Most Learn: GBP Replace – Hunt Decides on Nationwide Insurance coverage Discount Over Tax Cuts

The U.S. greenback trended decrease on Wednesday, pressured by falling U.S. Treasury charges. This occurred regardless of Federal Reserve Chair Jerome Powell indicating throughout his Semiannual financial coverage report back to Congress that policymakers are in no rush to begin reducing borrowing prices.

On this look earlier than the Home Monetary Providers Committee, the FOMC chief reiterated that the Fed doesn’t consider it might be applicable to chop charges till it has gained higher confidence that inflation is transferring sustainably towards 2.0%.

Though Powell’s remarks leaned in the direction of the hawkish aspect, they had been nothing new: they merely echoed the sentiment expressed within the earlier central financial institution assembly. On this context, merchants took at the moment’s developments as “no information is nice information”, giving little incentive to yields and dollar’s bulls to cost.

Curious in regards to the U.S. greenback’s near-term prospects? Discover all of the insights obtainable in our quarterly forecast. Request your complimentary information at the moment!

Advisable by Diego Colman

Get Your Free USD Forecast

With Powell’s testimony within the rearview mirror, the main target now shifts to Friday’s extremely anticipated U.S. jobs report. Expectations recommend that U.S. employers added 200,000 staff in February, however an upside shock shouldn’t be dominated out; in spite of everything, latest employment information have tended to beat estimates.

A surprisingly robust NFP report may set off a shift in market pricing, convincing skeptical merchants that the Fed will certainly wait longer earlier than eradicating coverage restriction. The potential of a delayed easing cycle may result in an upward transfer within the U.S. greenback and yields, reversing at the moment’s market path.

Need to keep forward of the yen’s subsequent main transfer? Entry our quarterly forecast for complete insights. Request your complimentary information now to remain knowledgeable on market traits!

Advisable by Diego Colman

Get Your Free JPY Forecast

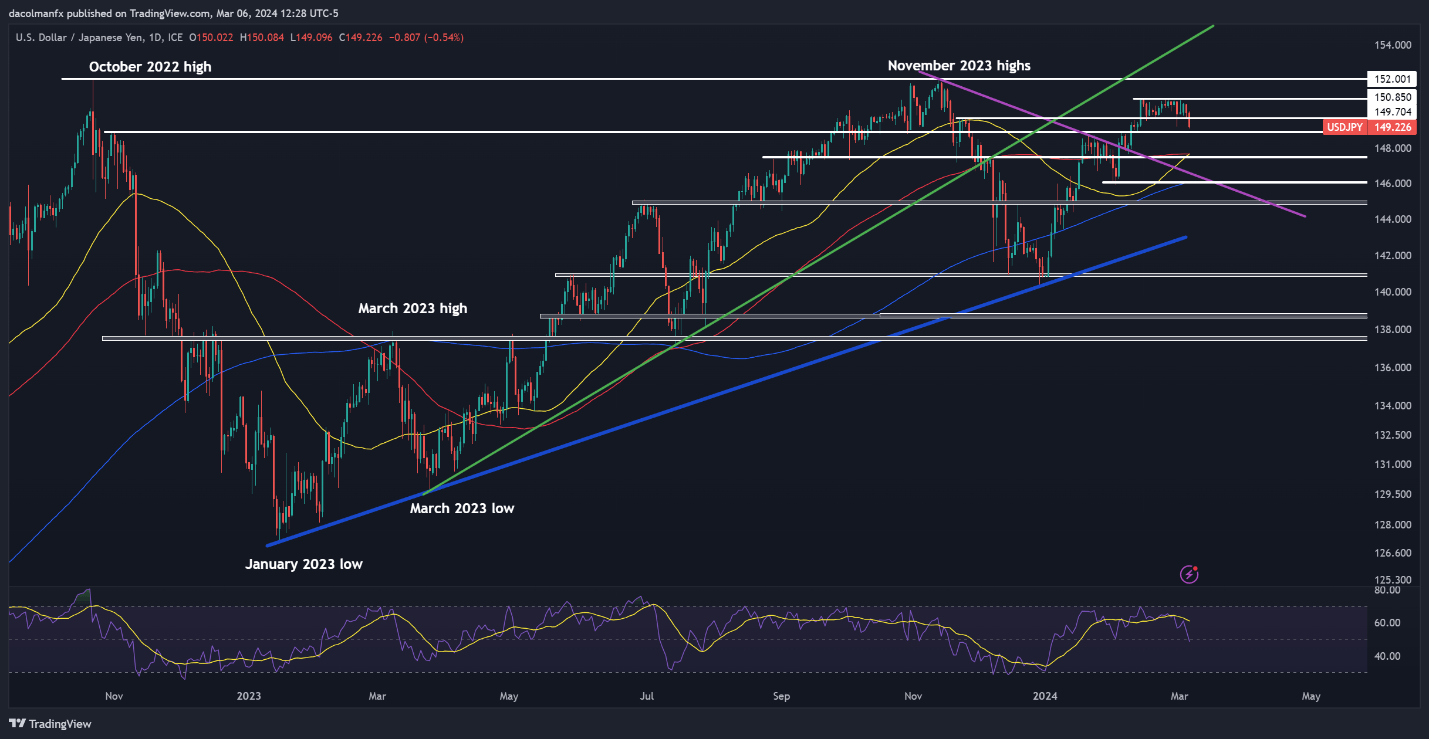

USD/JPY FORECAST – TECHNICAL ANALYSIS

Following a brief part of sideways consolidation, USD/JPY broke all the way down to the draw back, dipping beneath help at 149.70. Ought to this breakdown be validated by a every day candlestick, sellers are more likely to set their sights on 148.90. Additional weak point may draw consideration to 147.50.

Conversely, ought to consumers stage a comeback and reclaim the 149.70 area, upward momentum may decide up traction, paving the best way for an advance in the direction of the horizontal resistance at 150.85. Though overcoming this barrier would possibly pose a problem for bulls, a breakout may sign a rally in the direction of 152.00.

USD/JPY PRICE ACTION CHART

USD/JPY Chart Created Utilizing TradingView

Enthusiastic about understanding how FX retail positioning could affect USD/CAD value actions? Uncover key insights in our sentiment information. Obtain it now!

| Change in | Longs | Shorts | OI |

| Each day | 25% | -26% | -5% |

| Weekly | 41% | -32% | -4% |

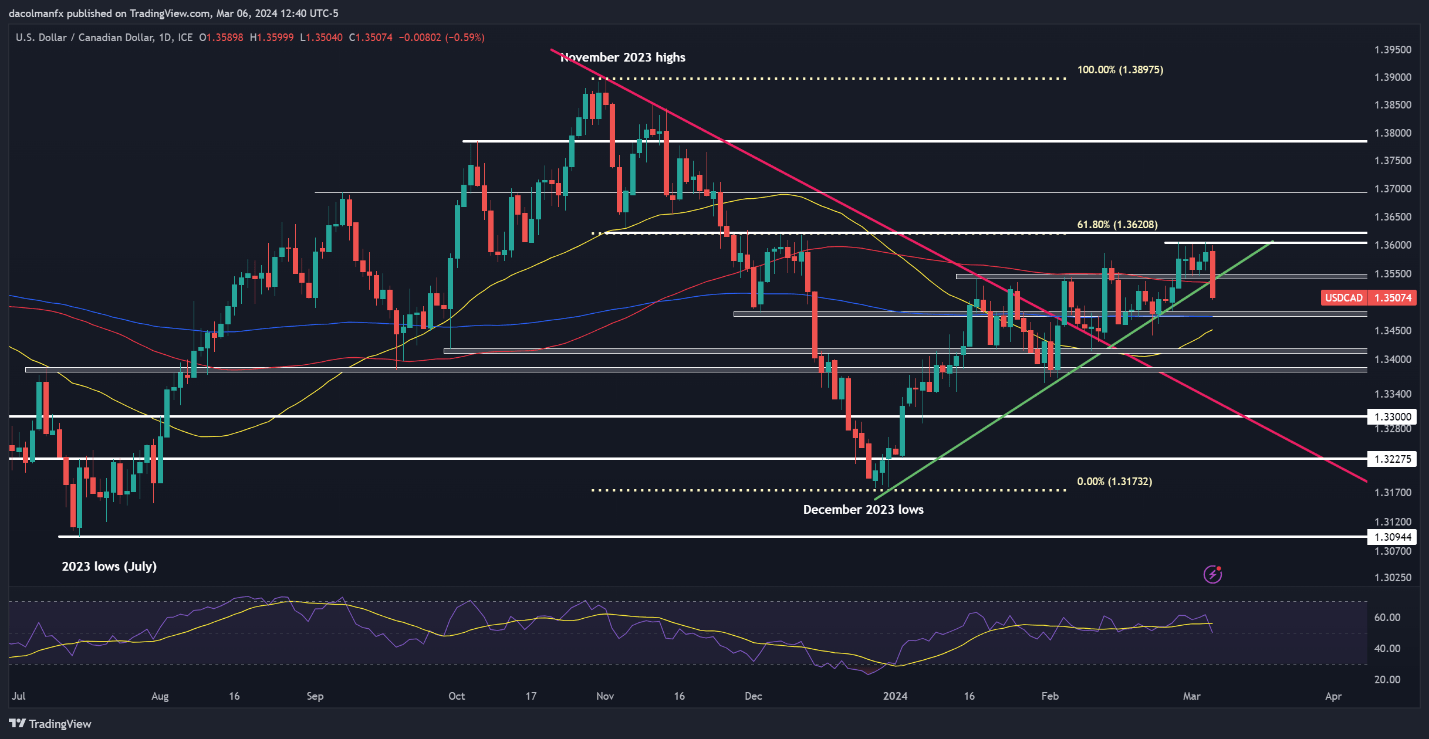

USD/CAD FORECAST – TECHNICAL ANALYSIS

USD/CAD suffered an essential setback, plunging sharply on Wednesday and breaching a crucial help zone extending from 1.3545 to 1.3535. If costs end the week beneath this vary, a possible transfer in the direction of the 200-day SMA at 1.3475 could also be in retailer, with a spotlight thereafter on the 1.3450 degree.

On the flip aspect, if costs unexpectedly reverse course and push previous the 1.3535/1.3555 space, heightened shopping for curiosity could reemerge, laying the groundwork for a attainable rally in the direction of 1.3600. Additional good points may convey 1.3620 into play, the 61.8% Fibonacci retracement of the November/December 2023 stoop.

USD/CAD PRICE ACTION CHART

USD/CAD Chart Created Utilizing TradingView