MARKET RECAP

The U.S. greenback, as measured by the DXY index, retreated on Wednesday, dragged decrease by falling charges within the wake of disappointing financial numbers. U.S. Treasury yields have begun to retrench in latest days, as softer-than-expected macro-related statistics have lowered the chance of extra financial tightening by the Federal Reserve.

Earlier this week, U.S. job openings and client confidence introduced forth adverse surprises. Immediately, personal payroll figures (ADP) for August adopted the sample of lackluster information, clocking in at 177,000 versus a forecast of 195,000. The second estimate of Q2 GDP additionally fell in need of predictions, recording a development charge of two.1% annualized, in distinction to the projected 2.4%.

US ECONOMIC DATA

Supply: DailyFX Financial Knowledge

Though the outlook is fluid and topic to vary, rising indicators that the financial system is slowing somewhat than reaccelerating might drive the Fed to undertake a extra cautious stance at upcoming conferences, deterring officers from pursuing additional coverage firming. This might create a bearish setting for the U.S. greenback, however merchants ought to stay attentive to the August NFP report and the ISM survey to validate this evaluation.

Commerce the U.S. greenback like a professional. Obtain the third-quarter USD buying and selling information for key insights and methods

Really useful by Diego Colman

Get Your Free USD Forecast

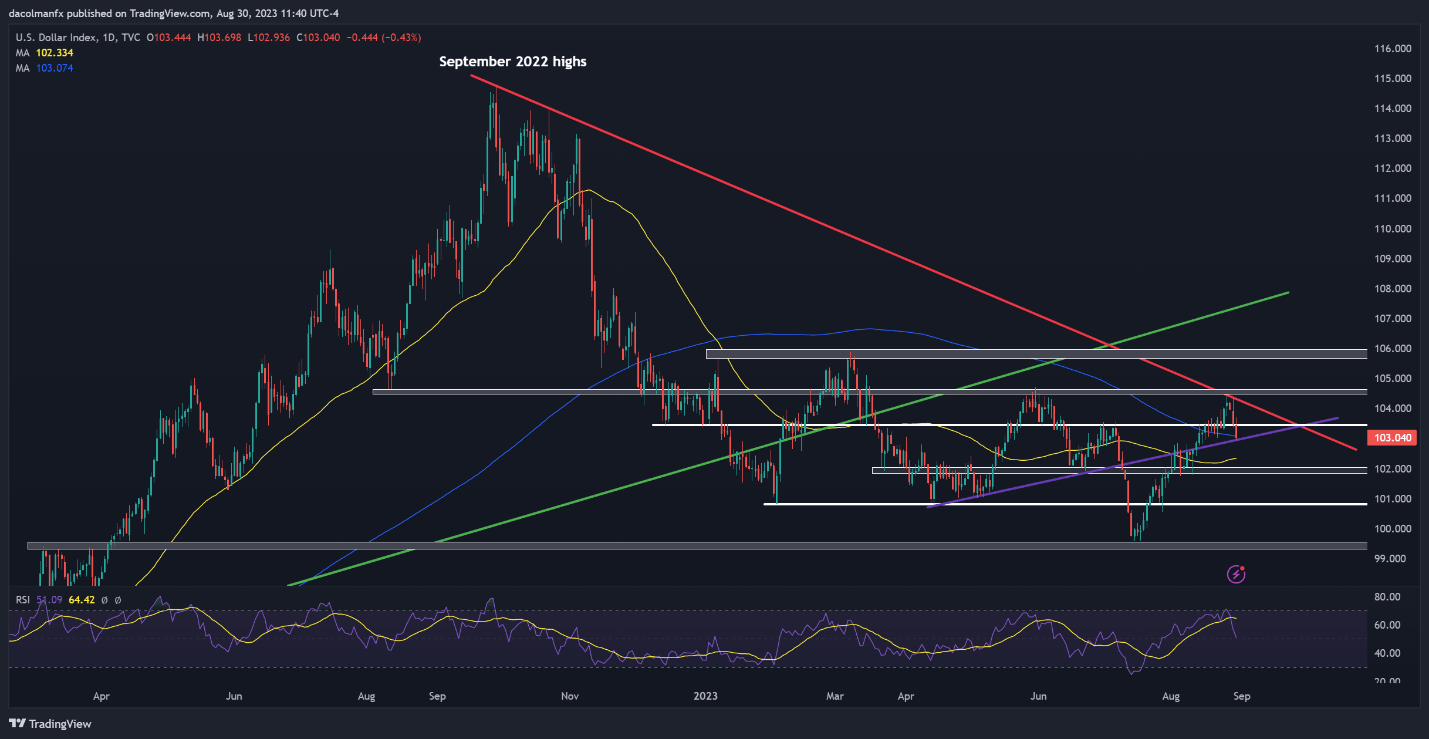

US DOLLAR (DXY) TECHNICAL ANALYSIS

Specializing in technical evaluation, the U.S. greenback rallied from mid-July by late August to multi-month highs, however didn’t clear trendline resistance close to 104.50. As soon as the DXY index reached this threshold, sellers regained management of the market, triggering a reasonable pullback in subsequent periods, with costs threatening to interrupt under the 200-day easy shifting common at 103.00 the time of writing.

When it comes to attainable situations, if costs handle to breach the 103.00 ground, the bears might launch an assault on the psychological 102.00 degree, adopted by 100.80. On the flip facet, if the US greenback regains poise and turns increased, preliminary resistance seems at 103.50, and 104.25 thereafter.

US DOLLAR TECHNICAL CHART

US Greenback (DXY) Chart Created Utilizing TradingView

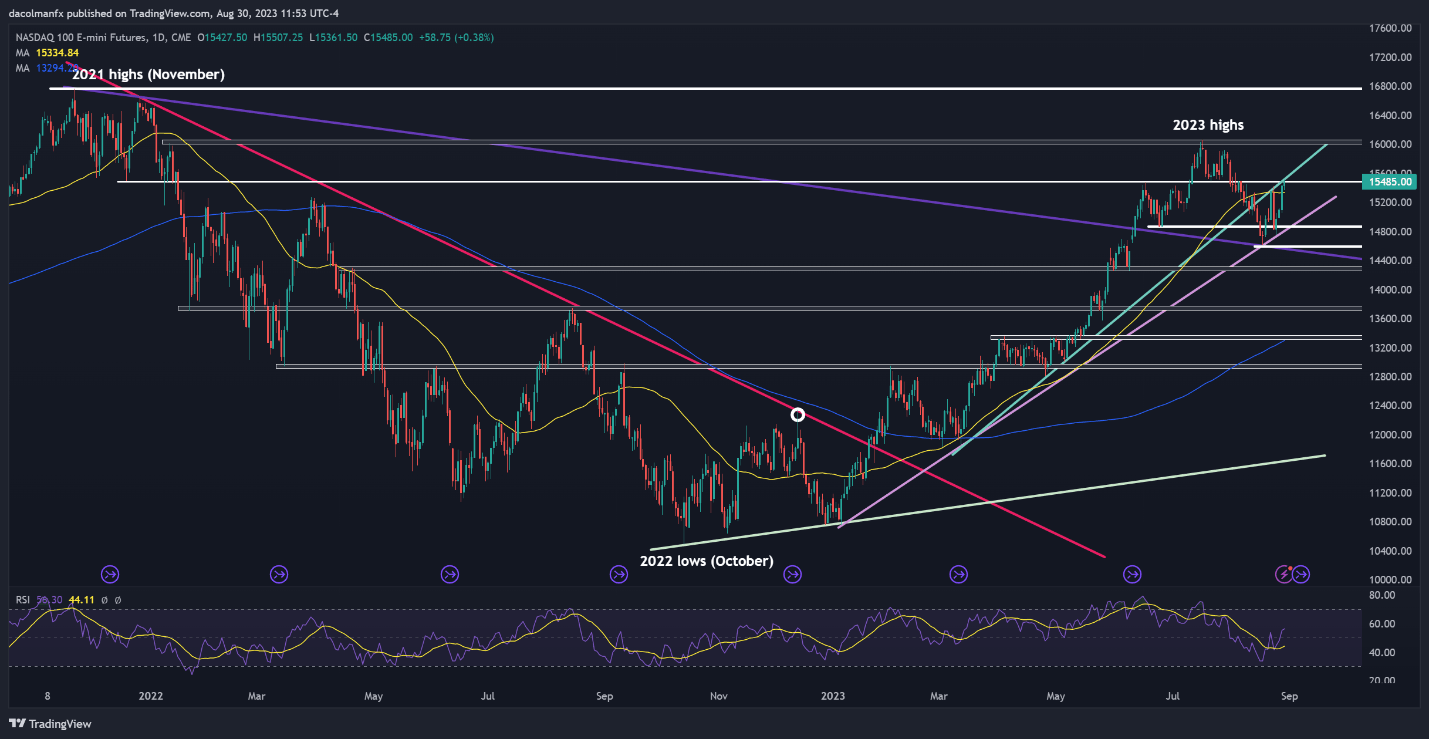

NASDAQ 100 TECHNICAL ANALYSIS

After some indecision on the market open on Wednesday, the Nasdaq 100 in the end leaned in the direction of positive aspects in afternoon buying and selling, rising for the fourth consecutive session to the doorstep of a serious technical resistance positioned close to 15,500. Whereas clearing this barrier may show difficult, a clear and decisive breakout might considerably bolster bullish momentum, paving the best way for a retest of the 2023 highs round 16,000.

Conversely, if upward impetus fades and sellers return, the tech index might slip under its 50-day shifting common, creating favorable circumstances for a stoop towards trendline assist at 14,850. Though the Nasdaq 100 might set up a base on this area on a pullback, a breakdown has the potential to amplify downward stress, doubtlessly resulting in a decline towards the 14,600 mark.

Keep forward of vital traits. Obtain your third-quarter Nasdaq 100 outlook and begin buying and selling with extra confidence

Really useful by Diego Colman

Get Your Free Equities Forecast

NASDAQ 100 TECHNICAL CHART

Nasdaq 100 Futures Chart Created Utilizing TradingView