US Greenback Worth, Evaluation, and Charts

Really helpful by Nick Cawley

Constructing Confidence in Buying and selling

The newest US PPI report confirmed that wholesale inflation stays sticky, denting the latest disinflation story. US y/y inflation rose 1.6% in February, above market expectations of 0.9% and a previous month’s revised 1.0%. In line with the US Bureau of Labor Statistics,

‘On an unadjusted foundation, the ultimate demand index superior 1.6 p.c for the 12 months resulted in February, the most important rise since transferring up 1.8 p.c for the 12 months ended September 2023. In February, almost two-thirds of the rise in ultimate demand costs may be traced to the index for ultimate demand items, which superior 1.2 p.c. Costs for ultimate demand providers moved up 0.3 p.c. The index for ultimate demand much less meals, power, and commerce providers elevated 0.4 p.c in February after rising 0.6 p.c in January. For the 12 months resulted in February, costs for ultimate demand much less meals, power, and commerce providers moved up 2.8 p.c.’

These numbers could have been famous by the Fed forward of subsequent Wednesday’s FOMC coverage assembly and charge choice. The Fed is totally anticipated to maintain charges unchanged subsequent week however any nod to increased inflation by Fed Chair Jerome Powell will preserve merchants consideration. After yesterday’s information, the possibilities for a June charge fell additional with the market now seeing a tough 60% probability of a 35bp charge on the finish of H1.

For all financial information releases and occasions see the DailyFX Financial Calendar

The US greenback index rallied after Thursday’s information, paring latest losses. The index now nears a zone of resistance made up of the 50% Fibonacci retracement at 103.41 and all three easy transferring averages that presently sit between 103.57 and 103.71. This zone of resistance ought to maintain forward of the FOMC choice.

Really helpful by Nick Cawley

Get Your Free USD Forecast

US Greenback Index Day by day Worth Chart

The Financial institution of England (BoE) may also announce its newest coverage choice subsequent week and the UK central financial institution is totally anticipated to go away all coverage settings untouched. The primary focal point on the assembly would be the rate of interest vote break up. On the final assembly, six out of the 9 members voted for charges to be left unchanged, two members voted for a hike, and one member voted for a charge minimize. If this break up is modified, markets will seemingly re-price Sterling within the quick time period.

For all main central financial institution assembly dates, see the DailyFX Central Financial institution Calendar

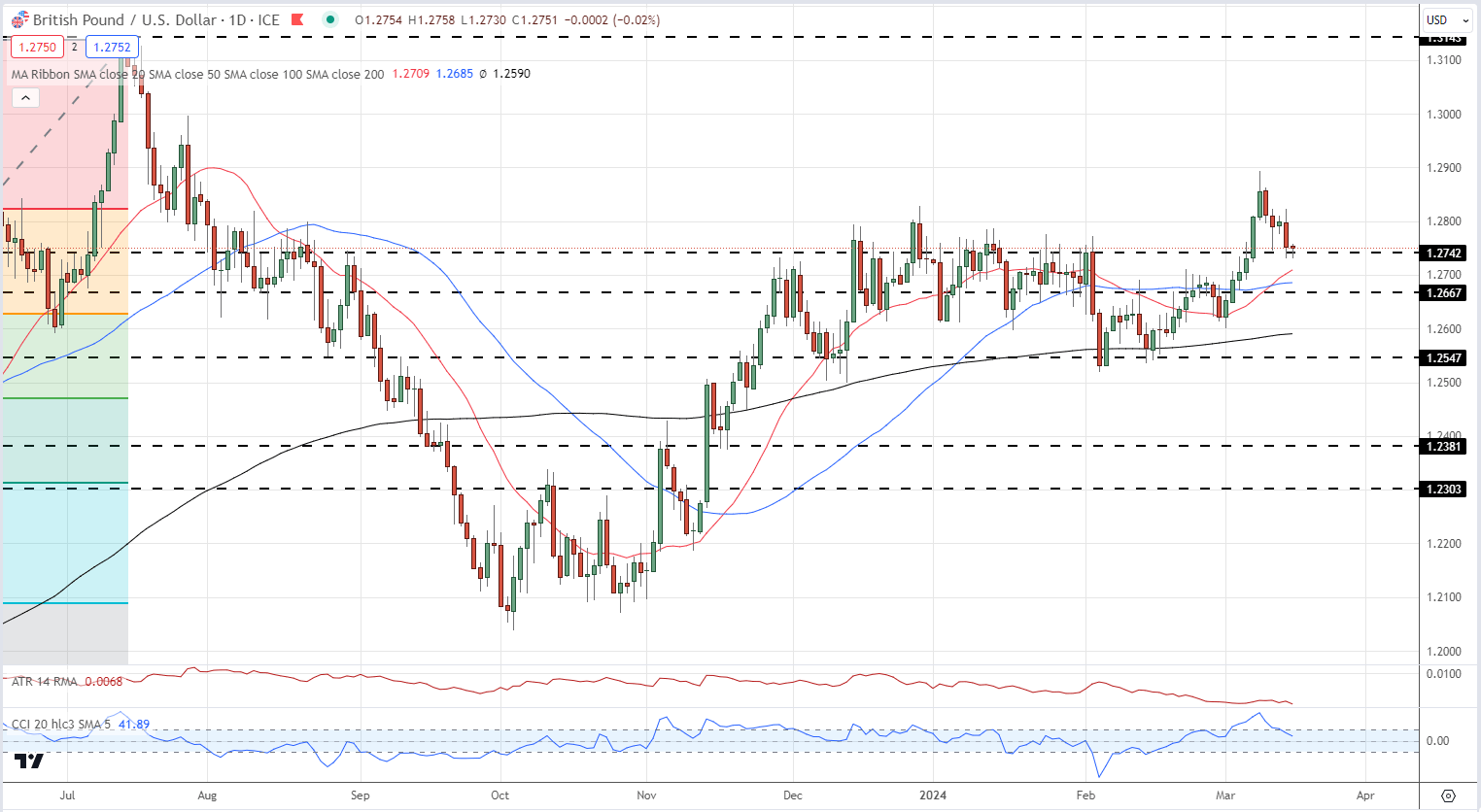

GBP/USD is presently buying and selling on both aspect of 1.2742, a previous degree of resistance. A block of prior day by day candles and the 20- and 50-day easy transferring averages guard the subsequent degree of assist at 1.2667. That is more likely to maintain till subsequent week’s central financial institution conferences. If not, 1.2600 and 1.2547 come into focus.

GBP/USD Day by day Worth Chart

All Charts by way of TradingView

What are your views on the US Greenback and the British Pound – bullish or bearish?? You’ll be able to tell us by way of the shape on the finish of this piece or you may contact the creator by way of Twitter @nickcawley1.