got here in barely above expectations, however a bounce in shifted the main target to the necessity for additional coverage easing, dampening hypothesis that the might not minimize charges in November.

rose 0.2% m/m in September, the identical because the earlier month, whereas annual inflation slowed from 2.5% to 2.4%, above expectations of two.3%. Housing and meals had been vital drivers, accounting for three-quarters of the entire worth improve.

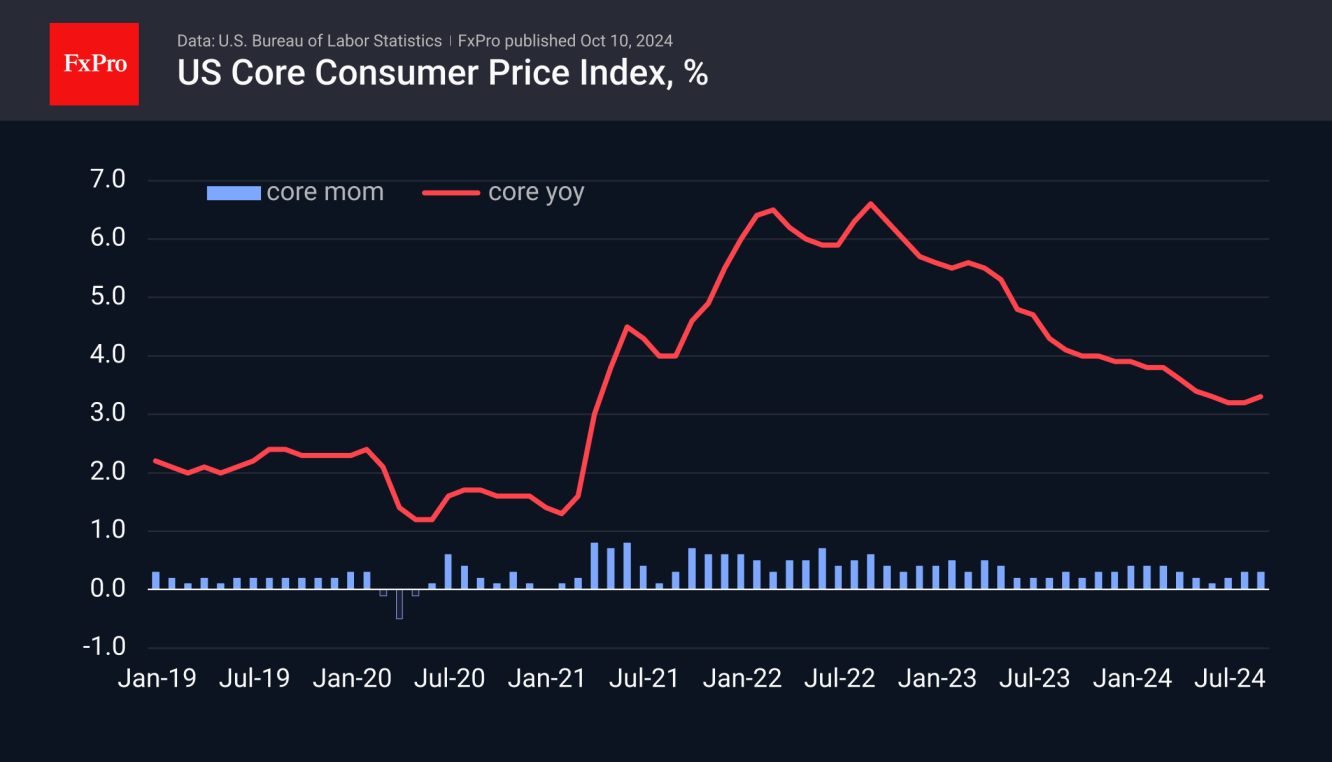

The , which excludes vitality and meals costs, accelerated its annual development price from 3.2% to three.3%, the primary acceleration in a yr and a half. This proves that slowing inflation is not any simple process within the context of full employment and is mediated by low oil and gasoline costs.

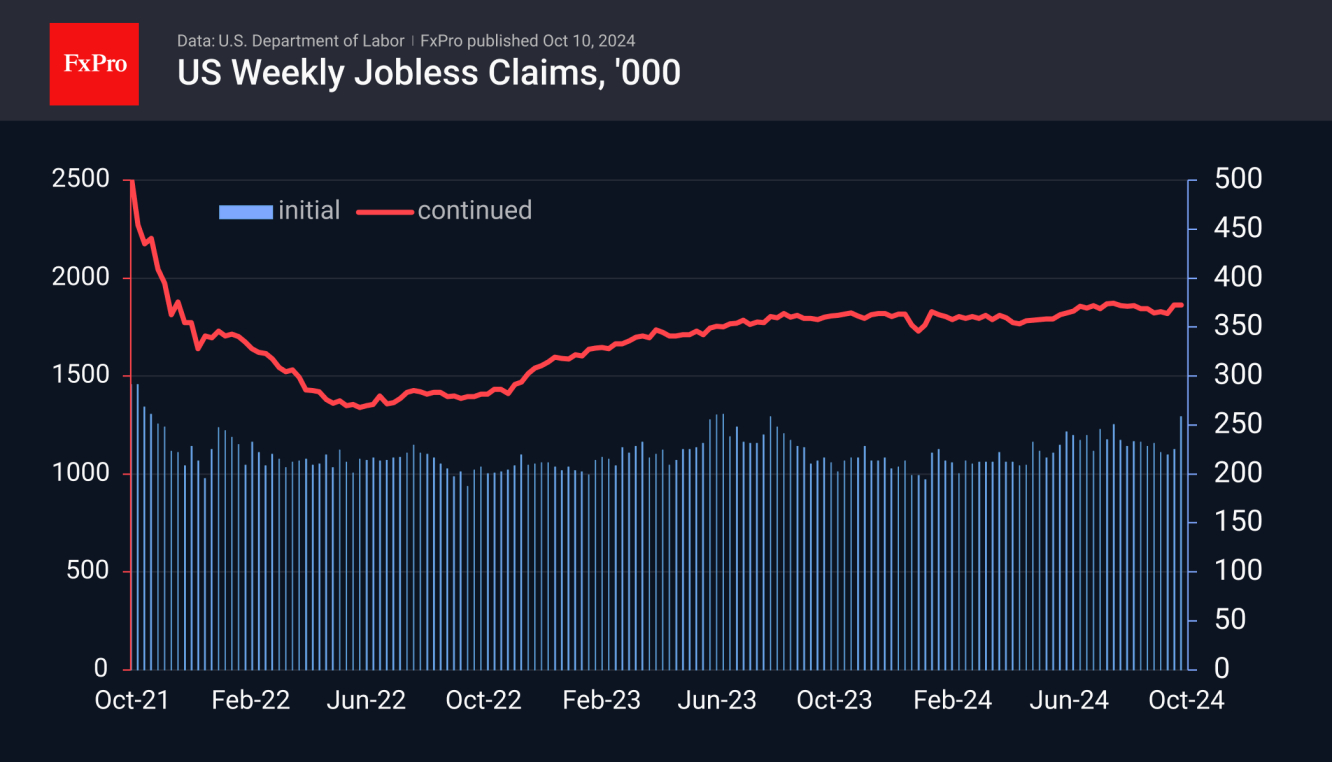

The influence of accelerating core inflation—often a bullish issue for the —was overwhelmed this time by an surprising bounce in jobless claims final week. Preliminary claims had been reported to have risen to 258K from 225K the earlier week and an anticipated 231 Okay. The present stage is the very best since final August and the fourth highest in virtually three years because the US labor market recovered from the shutdown shock.

About two months in the past, monetary markets reacted nervously to employment indicators, however the return of weekly claims to regular ranges reassured traders that we had been seeing a short-term spike fairly than a development reversal. Now, the state of affairs is reversed: robust versus the alarm from the weekly numbers.

The greenback fluctuated between 0.4% and 0.1% within the first moments after the information was launched however has solely misplaced 0.1% on the time of writing on such conflicting knowledge. Maybe traders will now eagerly search for indicators from Fed members to be taught their evaluation of the state of affairs, which the market will comply with.

The FxPro Analyst Workforce