US CPI Evaluation

- US CPI prints largely consistent with estimates, yearly CPI higher than anticipated

- Disinflation advances slowly however reveals little indicators of upward stress

- Market pricing round future charge cuts eased barely after the assembly

Really useful by Richard Snow

Get Your Free USD Forecast

US CPI Prints Largely in Line with Expectations, Yearly CPI Higher than Anticipated

US inflation stays in enormous focus because the Fed gears as much as reduce rates of interest in September. Most measures of inflation met expectations however the yearly measure of headline CPI dipped to 2.9% in opposition to the expectation of remaining unchanged at 3%.

Customise and filter reside financial information through our DailyFX financial calendar

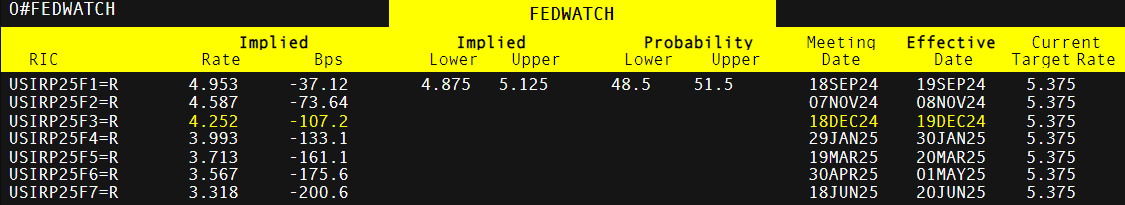

Market possibilities eased a tad after the assembly as considerations of a possible recession take maintain. Softer survey information tends to behave as a forward-looking gauge of the economic system which has added to considerations that decrease financial exercise is behind the current advances in inflation. The Fed’s GDPNow forecast foresees Q3 GDP progress of two.9% (annual charge) putting the US economic system roughly consistent with Q2 progress – which suggests the economic system is secure. Current market calm and a few Fed reassurance means the market is now cut up on climate the Fed will reduce by 25 foundation factors or 50.

Implied Market Possibilities

Supply: Refinitiv, ready by Richard Snow

Quick Market Response

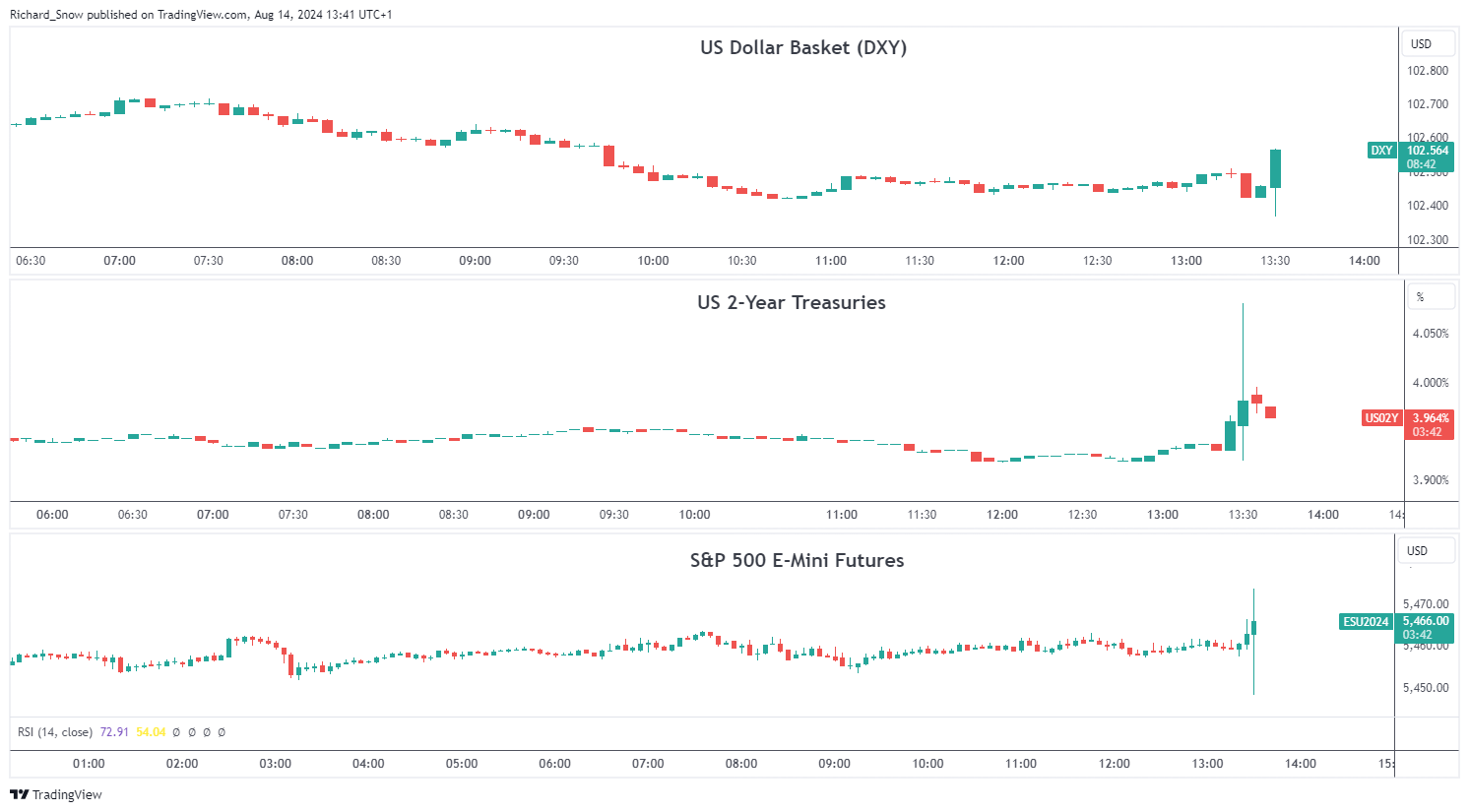

The greenback and US Treasuries haven’t moved too sharply in all actually which is to be anticipated given how intently inflation information matched estimates. It could appear counter-intuitive that the greenback and yields rose after optimistic (decrease) inflation numbers however the market is slowly unwinding closely bearish market sentiment after final week’s massively risky Monday transfer. Softer incoming information might strengthen the argument that the Fed has stored coverage too restrictive for too lengthy and result in additional greenback depreciation. The longer-term outlook for the US greenback stays bearish forward of he Feds charge reducing cycle.

US fairness indices have already mounted a bullish response to the short-lived selloff impressed by a shift out of dangerous property to fulfill the carry commerce unwind after the Financial institution of Japan shocked markets with a bigger than anticipated hike the final time the central financial institution met on the finish of July. The S&P 500 has already crammed in final Monday’s hole decrease as market circumstances seem to stabilise in the meanwhile.

Multi-asset Response (DXY, US 2-year Treasury Yields and S&P 500 E-Mini Futures)

Supply: TradingView, ready by Richard Snow

— Written by Richard Snow for DailyFX.com

Contact and comply with Richard on Twitter: @RichardSnowFX