A few weeks in the past we checked out US Tech vs non-tech earnings… this time we’re taking a look at US vs non-US earnings — the outcomes are surprisingly unsurprising, however essential for world buyers to take be aware.

The very first thing that stands out is the traits: US earnings have been trending greater all through the final 30-years, however rest-of-world earnings have been touring by way of a extremely cyclical vary over the previous 15-years.

Extra not too long ago, world earnings have been declining (is smart given the financial slowdown and difficult financial situations in China/EM and Europe).

This stands in distinction to the US which has seen a powerful, albeit slender (tech-driven) cyclical upturn in earnings off the 2022 lows.

A pure query could be: will the hole between them shut or slender?

Right here’s a few factors to ponder:

-

Trump: tax cuts if broad and quickly applied would raise the blue line, tariffs would have combined results however doubtless current extra of a headwind to the black line.

-

Cycle: Europe has been extra aggressive with charge cuts and China is ramping up stimulus, if these main economies can reaccelerate out of slowdown it is going to enhance the black line.

-

AI Hype Cycle: the AI growth if it follows the traditional Gartner (NYSE:) Hype Cycle will finally make a journey by way of the trough of disillusionment, it will take some steam out of US/Tech earnings.

General I’d say consensus is (based mostly on relative valuations) that the blue line continues to the sky, whereas the black line will languish in everlasting stagnation. To me that claims the market as an entire doesn’t even ponder the prospect of any narrowing of the hole or modifications on this chart — and to me that claims threat (US) + alternative (world) [check out the bonus chart below for another angle on this].

Key level: US company earnings have strongly outperformed vs world.

Cycles of Relative Efficiency

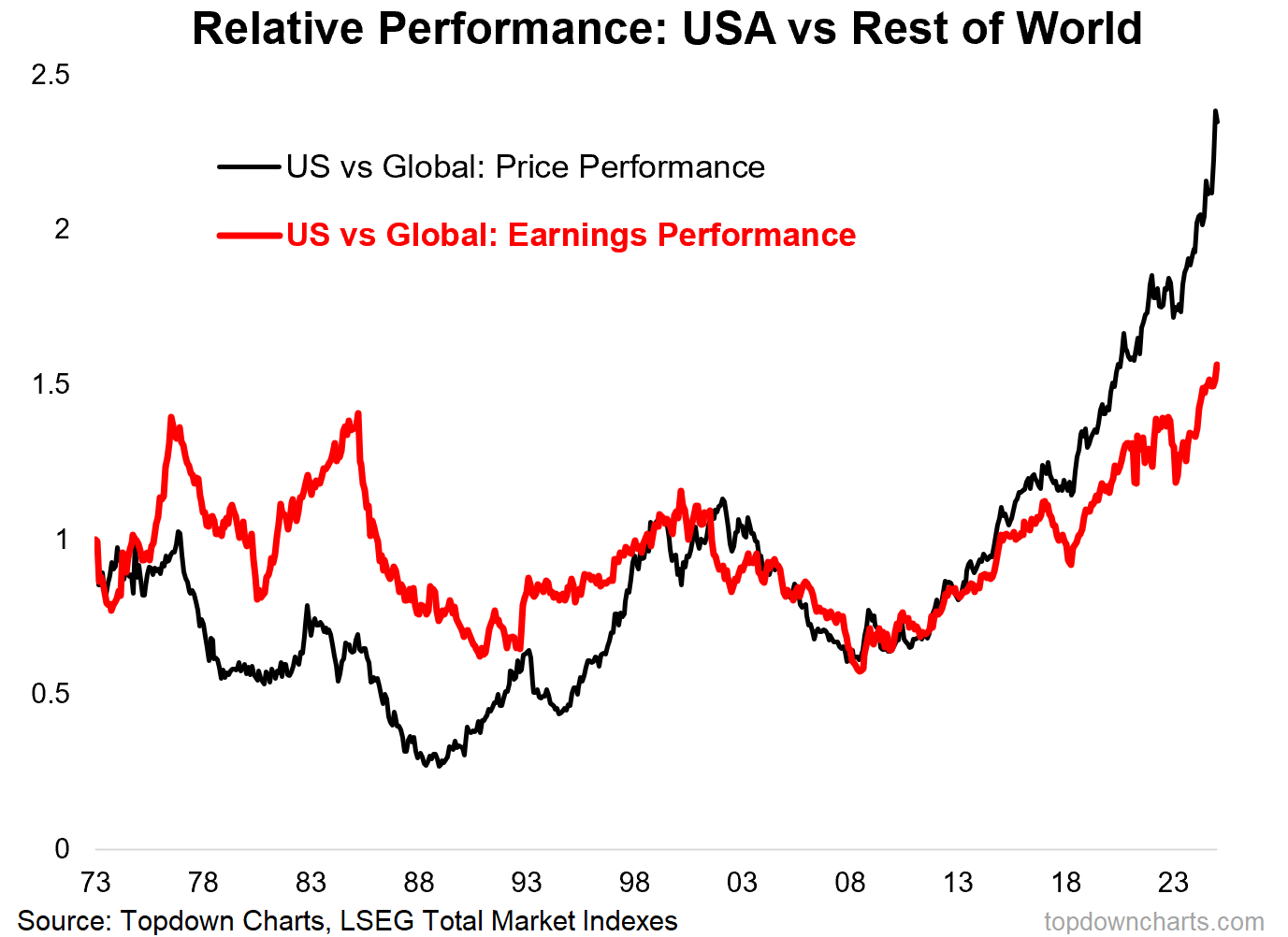

You may need seen these charts of US vs world relative value efficiency (i.e. the black line within the chart beneath), displaying how excessive it has turn out to be. However the crimson line exhibits that there’s a basic motive for the course of journey within the black line.

Sure US inventory costs have considerably outperformed vs world shares, however US earnings have additionally considerably outperformed vs world (the crimson line).

There are 2 key takeaways on this chart: first, the black line whereas appropriate in course of journey given fundamentals, has considerably overshot (because of this once you take a look at nearly each measure of valuations, it’s clear that US shares commerce at a significant premium vs world shares).

Second, for world shares to show the nook and begin outperforming vs US, you want extra than simply low-cost relative worth (and it is extremely low-cost), you want the basic development to vary — the crimson line to go down. As mentioned above there are a couple of methods this might occur, however I’ll say once more: the typical investor will not be ready for it (and even considering it).

Unique Submit