Capuski

Funding Thesis

The United States Pure Fuel Fund, LP ETF (NYSEARCA:UNG) is commonly the go-to exchange-traded fund (“ETF”) for traders which can be bullish on pure fuel. And whereas I’m very bullish on pure fuel, I clarify right here why investing in UNG is probably not one of the best ways to precise one’s bullish view of pure fuel.

Pure Fuel’ Thrilling Prospects

The way forward for pure fuel holds thrilling prospects within the world effort to decrease internet carbon emissions. Also known as a “bridge gasoline,” pure fuel has already performed an important function in lowering greenhouse fuel emissions by changing coal in electrical energy era. Nevertheless it’s essential to acknowledge that pure fuel is greater than only a transitional power supply; it may be a vacation spot gasoline within the broader context of the power transition. It’s because pure fuel gives vital benefits by way of decrease emissions in comparison with coal and oil, making it a cleaner and extra environment friendly power supply.

As we transfer in direction of a sustainable power future, it’s clear that a mixture of power sources might be important. Pure fuel, alongside nuclear energy, can function a dependable complement to intermittent renewable power sources like photo voltaic and wind.

Whereas renewables are important for lowering emissions, they’re additionally topic to weather-dependent fluctuations, which might result in power provide challenges.

Certainly, I imagine that traders are already coming round to this concept, in terms of nuclear energy, with uranium costs hovering in 2023.

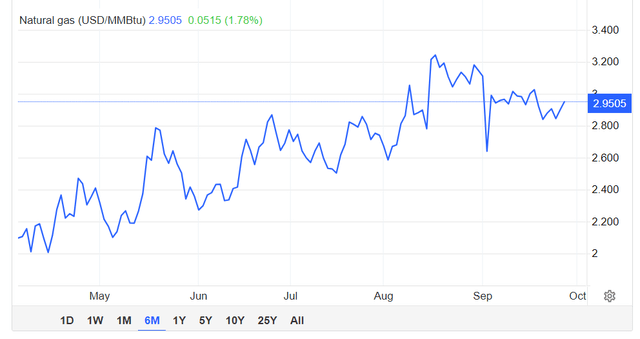

Buying and selling Economics

By the way, I’ve already mentioned about investing in uranium right here.

What’s extra, pure fuel energy crops can present a secure and versatile power supply that may rapidly ramp up or down to fulfill power calls for, making them a super companion for intermittent renewables. Moreover, developments in carbon seize maintain the promise of lowering emissions from pure fuel even additional, making it an important element of our future power panorama.

The fast adoption of electrical autos, or EVs, and the rising affect of synthetic intelligence (“AI”) are poised to drive a large surge in electrical energy demand. Nonetheless, the present electrical grid infrastructure is ill-prepared for the challenges posed by this elevated load.

Moreover, the variability of power provide, particularly from renewable sources like wind and photo voltaic, signifies that our grid should adapt to deal with fluctuations in electrical energy era and consumption effectively. Upgrading and modernizing our grid to accommodate these adjustments, whereas essential, are costly and can take years to make sure a secure and sustainable power provide as we transition in direction of a cleaner and extra electrified future.

I argue that this standpoint is now not farfetched, however really beginning to be mirrored proper now within the pure fuel market.

Buying and selling Economics

Give it some thought like this, pure fuel costs have moved greater than 30% larger up to now 6 months. Sure, chances are you’ll retort that it’s pushed again from a 30-year low worth, as soon as adjusted for inflation.

Whereas I acknowledge that consideration, certainly, I’d already written about that precise state of affairs again in February after I argued this re-pricing of pure fuel would occur in an evaluation titled, The Treatment For Low Costs.

Now, as I famous within the introduction, there are essential dangers of investing in UNG.

Dangers of Investing in UNG

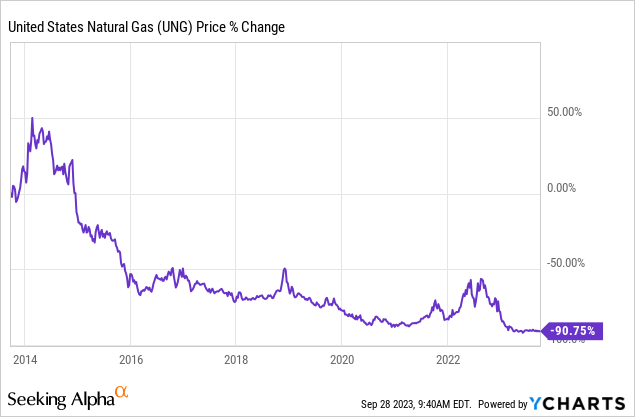

Investing in UNG entails a number of dangers that it’s best to perceive. UNG is designed to trace the value of pure fuel, but it surely doesn’t purchase and retailer precise fuel. As a substitute, it makes use of futures contracts, that are monetary agreements to purchase or promote fuel at a predetermined worth sooner or later. Which means if the futures marketplace for pure fuel doesn’t transfer within the course UNG anticipates, you may lose cash.

UNG’s mechanics are based mostly on rolling over its futures contracts. As every contract approaches its expiration date, UNG sells it and buys a brand new one for a later date. This course of known as “rolling,” and it could possibly result in a state of affairs the place UNG is shopping for excessive and promoting low if costs are rising or staying fixed.

This can lead to a loss over time, even when pure fuel costs rise general. Certainly, you may see UNG’s efficiency over the previous 10 years above.

So, whereas UNG can present publicity to pure fuel costs, it’s important to pay attention to these dangers and perceive how they work earlier than investing.

So, The place Ought to I Make investments?

I imagine one ought to spend money on the producers of pure fuel. Personally, I’m invested in Antero Assets (AR), as that enterprise is generally unhedged to pure fuel costs. However there are various different low-cost pure fuel producers within the Appalachian Basin that you could be additionally contemplate if you want. My solely recommendation is to spend 5 minutes wanting over their respective steadiness sheets earlier than you make investments.

The Backside Line

I’m bullish on pure fuel for its potential to cut back carbon emissions, however investing in america Pure Fuel Fund, LP ETF is probably not the only option. Pure fuel has a big function in our transition to cleaner power. However bear in mind, UNG depends on futures contracts and may be impacted by market actions, posing dangers for traders. As a substitute, readers might contemplate investing in pure fuel producers like Antero Assets or others within the Appalachian Basin for extra direct publicity to pure fuel costs, however do your analysis first!