Do you battle to guess the place costs will go in foreign currency trading? Many merchants do. The ups and downs of forex pairs can result in missed possibilities and massive losses. However, there’s a option to know extra: assist and resistance ranges.

These key spots available in the market give us clues about when costs may change or maintain going. By studying about assist and resistance, merchants can discover one of the best instances to purchase or promote. They’ll additionally handle dangers higher and make smarter decisions. Let’s discover how these ideas can change your buying and selling sport.

Key Takeaways

- Assist and resistance ranges are basic to foreign exchange technical evaluation

- These ranges point out potential shopping for and promoting possibilities

- Value motion close to these ranges can present when developments may change or maintain going

- Assist can flip into resistance and vice versa after a breakout

- Understanding these ranges helps in planning when to enter or exit trades

- Utilizing completely different time frames makes assist and resistance extra dependable

Assist and Resistance Ranges in Foreign exchange

Assist and resistance ranges are key in foreign currency trading. They assist us perceive worth actions and make sensible buying and selling decisions. Let’s dive into what these essential ideas are all about.

Definition and Primary Ideas

Assist ranges act as a flooring, stopping costs from dropping too low. Resistance ranges, alternatively, act as a ceiling, making it onerous for costs to go up. These ranges are important in technical evaluation, with over 70% of merchants utilizing them to plan their strikes.

Function in Technical Evaluation

In technical evaluation, assist and resistance ranges predict future worth actions. Main ranges are adopted by the market 60-80% of the time. Minor ranges are revered 40-50% of the time. Sturdy assist ranges, examined greater than 3 times, are seen as extra dependable.

Market Psychology Behind Value Ranges

Buying and selling psychology is essential in forming assist and resistance ranges. Worry, greed, and herd conduct form market actions. Psychological ranges, typically at rounded numbers, are key areas of assist and resistance due to dealer conduct. Understanding these emotional components can improve buying and selling methods and enhance worth prediction.

| Stage Kind | Market Respect Fee | Psychological Impression |

|---|---|---|

| Main Assist/Resistance | 60-80% | Excessive |

| Minor Assist/Resistance | 40-50% | Reasonable |

| Psychological Ranges | Varies | Very Excessive |

What Makes Assist Ranges in Buying and selling

Assist ranges in buying and selling are like worth flooring. They occur when extra folks wish to purchase at decrease costs. From 2019 to 2022, the bottom worth was 6375, displaying how these ranges final.

Merchants discover assist ranges in numerous methods. They have a look at previous costs to see the place demand was robust. These ranges typically match spherical numbers, like $50 or $100, which have an effect on the market.

The power of a assist stage is determined by how typically it’s hit. A stage touched 4 instances is seen as robust. Trendlines, needing at the very least three touches, additionally present assist zones. These pattern reversals could be seen in lots of time frames, from every day to five-minute charts.

Understanding about assist ranges helps predict market strikes. Merchants use them to make sensible decisions. This exercise exhibits robust beliefs in an asset’s worth, hinting at future worth adjustments and possibilities to commerce.

Understanding Resistance Zones and Their Formation

Resistance zones are key in foreign currency trading. They’re worth ceilings that cease costs from going up. Understanding how they kind may also help merchants succeed.

How Resistance Ranges Type

Resistance ranges kind when costs cease going up after which go down. This occurs when sellers assume the value is simply too excessive. Numbers like 1.5000 for EUR/USD typically act as limitations.

Key Traits of Sturdy Resistance

Sturdy resistance zones have a number of essential traits. They kind after costs have been examined at the very least 3 times. This exhibits robust vendor sentiment.

Value reversals up to now can even point out future resistance. The extra a worth stage is examined, the extra it impacts the market.

Psychology Behind Resistance Zones

The psychology of resistance zones is fascinating. Greed in rising markets helps create resistance. When costs close to historic resistance, about 65% of merchants assume a reversal will occur.

This collective pondering makes the resistance zone stronger. Breakout alternatives come up when market sentiment adjustments. This will result in increased buying and selling volumes and costs going past resistance.

Understanding these dynamics helps merchants make higher decisions. They’ll revenue from worth rejections at resistance or put together for breakouts.

Main vs Minor Assist and Resistance Ranges

In foreign currency trading, understanding key worth ranges is essential. It helps in understanding the market construction and buying and selling ranges. Assist and resistance ranges are main and minor. They each form worth actions and dealer selections.

Main ranges are large limitations available in the market. They’ll cease and even reverse developments. For instance, a serious assist stage as soon as led to a +9489 level surge in a short while. These ranges typically match psychological worth factors or long-term pattern strains.

Minor ranges, alternatively, trigger quick pauses in worth motion. They could briefly decelerate rising or falling costs in a pattern. Merchants use these ranges for fast trades or to regulate their entries and exits.

- Variety of instances examined

- The amount of trades at these factors

- The time-frame they seem on

Main ranges present up on longer time frames and have been examined many instances. Minor ranges are extra widespread in shorter time frames. They might solely be examined a number of instances earlier than breaking.

Understanding the distinction between main and minor ranges helps merchants. Main ranges provide large worth strikes and pattern reversals. Minor ranges present fast, short-term trades throughout the market construction.

How Assist Transforms into Resistance and Vice Versa

The foreign exchange market exhibits fascinating position reversals. Assist ranges can flip into resistance and vice versa. This alteration exhibits how the market is at all times shifting and provides merchants worthwhile insights.

Value Stage Flip Phenomenon

Assist and resistance ranges aren’t fastened. They’ll swap roles, opening up new possibilities for merchants. For instance, the DJIA fell 5% after breaking its assist on Could 17, 2006. This assist then grew to become a brand new resistance stage.

Buying and selling the Stage Transformation

Merchants can take advantage of these adjustments by looking ahead to key worth motion indicators. ExxonMobil’s inventory is an effective instance. Its resistance stage of $65 was examined twice in 2005-2006 earlier than turning into assist in mid-July 2006. This alteration introduced new buying and selling possibilities.

Figuring out Legitimate Stage Modifications

It’s essential to identify real-level adjustments for profitable buying and selling. Walmart’s inventory worth round $51 exhibits this. This stage was supported in 2004, then turned to resistance in early 2005. Such adjustments occur in about 60% of circumstances when a stage is damaged.

| Inventory | Stage | Preliminary Function | Reworked Function | Transformation Interval |

|---|---|---|---|---|

| DJIA | Unspecified | Assist | Resistance | Could 17, 2006 |

| ExxonMobil | $65 | Resistance | Assist | Mid-July 2006 |

| Walmart | $51 | Assist | Resistance | Early 2005 |

Buying and selling Methods Utilizing Assist and Resistance

Assist and resistance ranges are key in foreign currency trading. They assist merchants discover when to purchase and promote. Additionally they assist handle dangers. Let’s have a look at some good methods to make use of them.

Shopping for when costs bounce off assist and promoting after they hit resistance is a well-liked tactic. As an illustration, if a forex pair typically finds assist at 6375, a dealer may purchase when it will get near that stage.

Breakout buying and selling is one other methodology. When costs break by means of a resistance stage, it would imply they’re going up. A drop under assist might imply they’re taking place. Merchants typically enter trades simply after these ranges to catch the transfer.

It’s essential to handle dangers when buying and selling assist and resistance. Merchants set stop-loss orders under assist for lengthy positions and above resistance for brief positions. This limits losses if the value goes towards the commerce.

| Technique | Entry Level | Exit Technique | Danger Administration |

|---|---|---|---|

| Bounce Buying and selling | At assist or resistance | Goal reverse stage | Cease-loss past stage |

| Breakout Buying and selling | Past stage break | Trailing cease or goal | Cease-loss at damaged stage |

| Retest Technique | On stage retest | Set revenue goal | Tight stop-loss |

Bear in mind, assist and resistance ranges change. A damaged assist can develop into resistance, and vice versa. Merchants want to observe the market intently and modify their plans as wanted.

Technical Instruments for Figuring out Assist and Resistance

Merchants use many instruments to seek out assist and resistance in foreign exchange markets. These instruments assist them see the place costs may change course. This offers them a bonus in making buying and selling decisions.

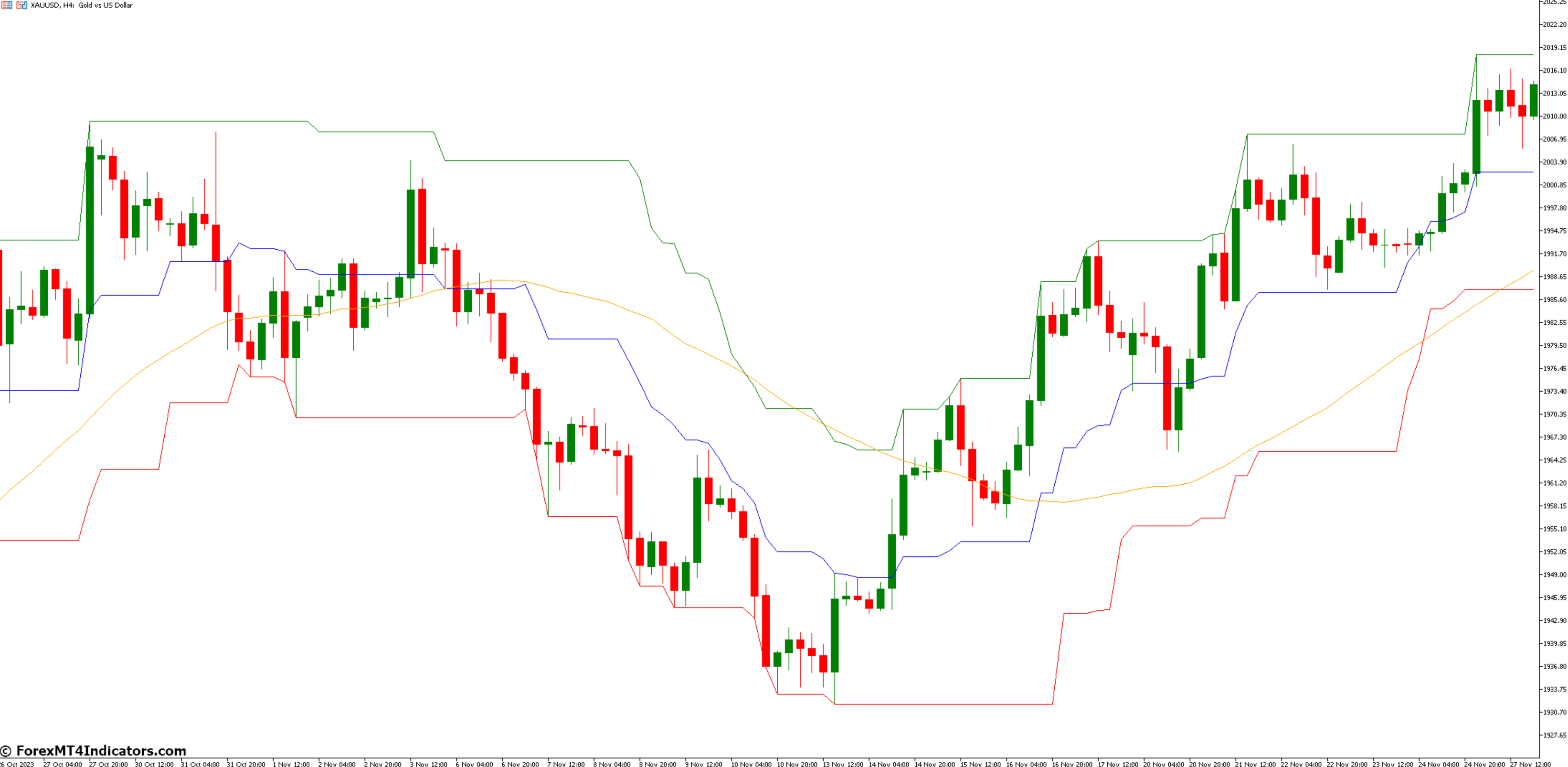

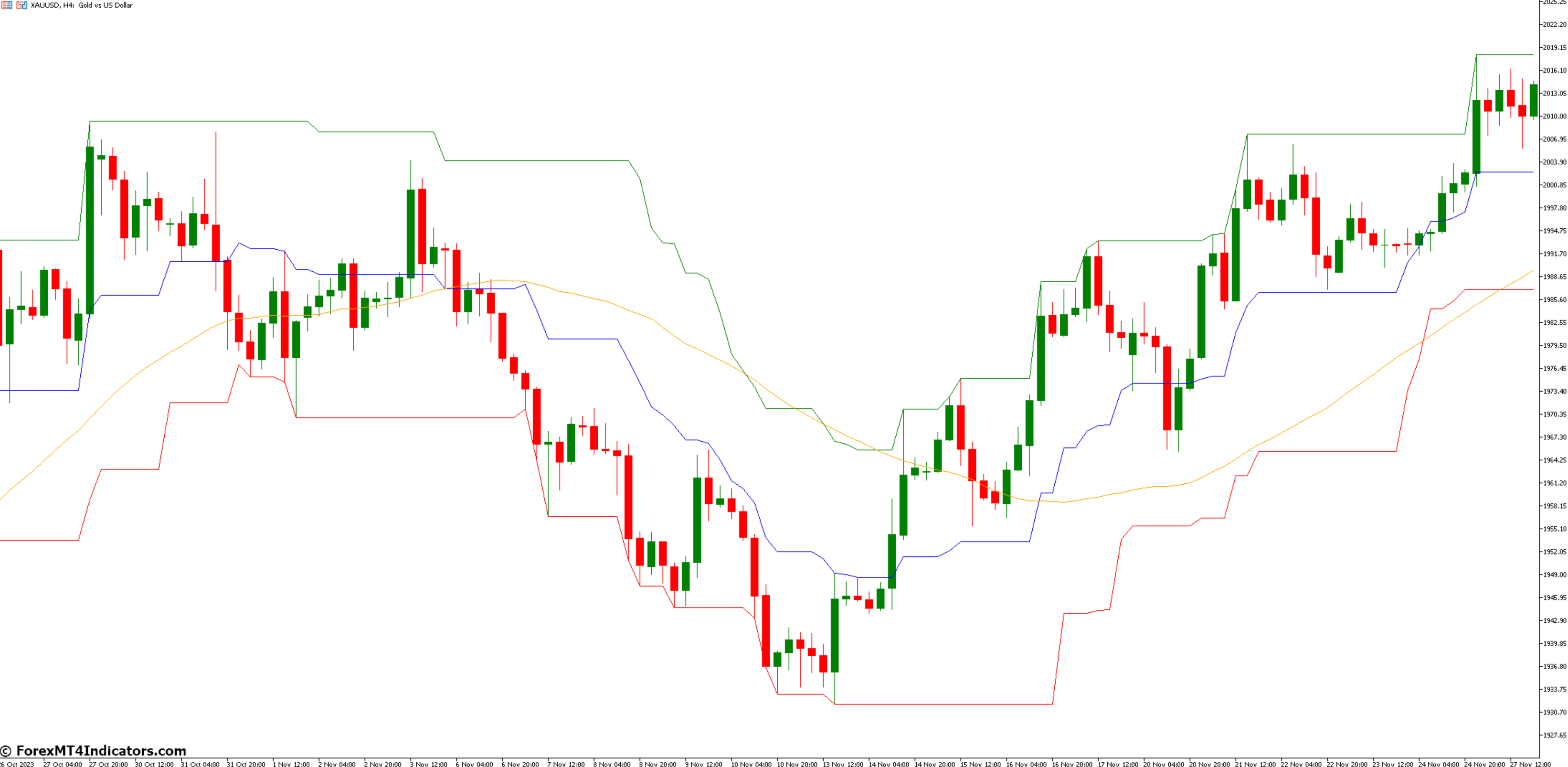

Transferring Averages as Dynamic Ranges

Transferring averages are key for recognizing assist and resistance. The 25-day, 50-day, and 200-day averages are favorites. When the value hits a shifting common, it typically bounces again, displaying assist. Then again, when the value meets a shifting common going up, it could possibly present resistance.

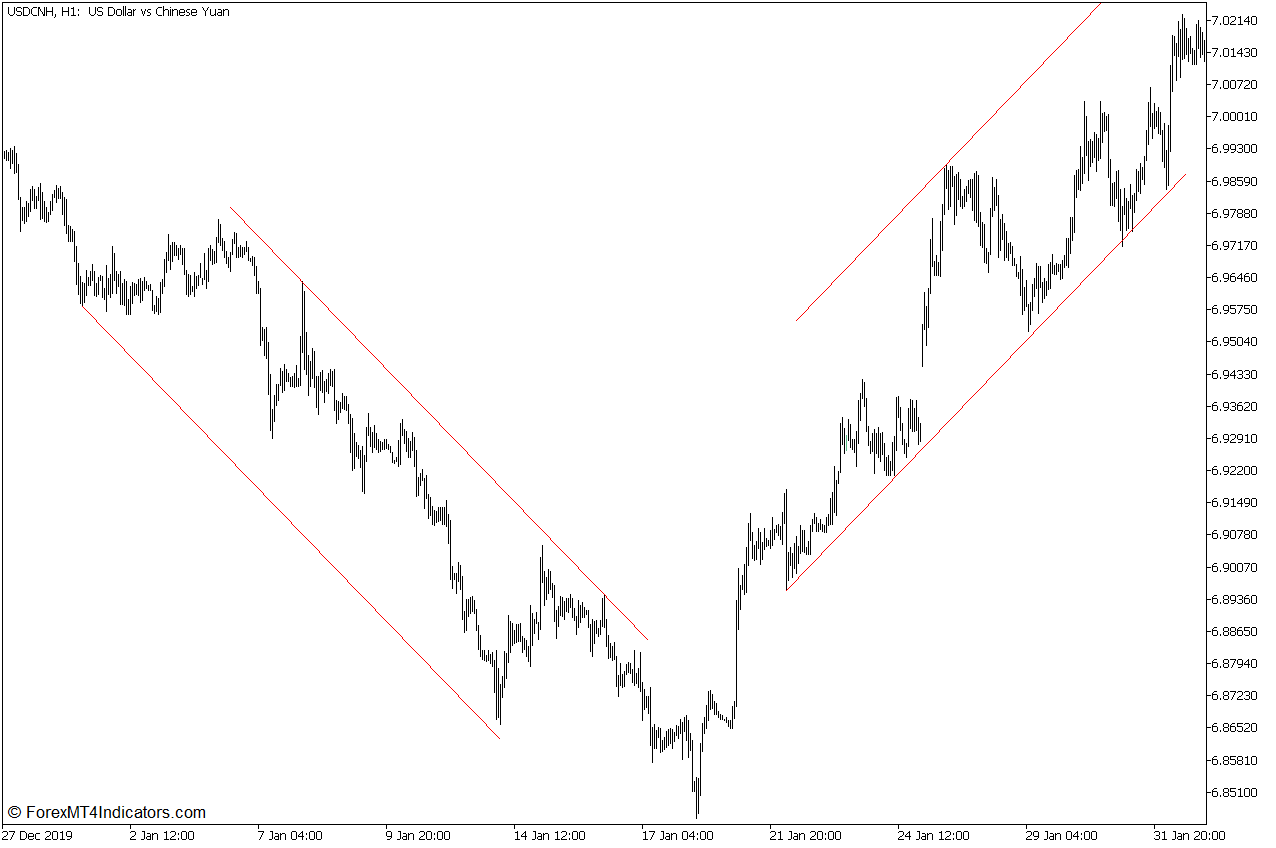

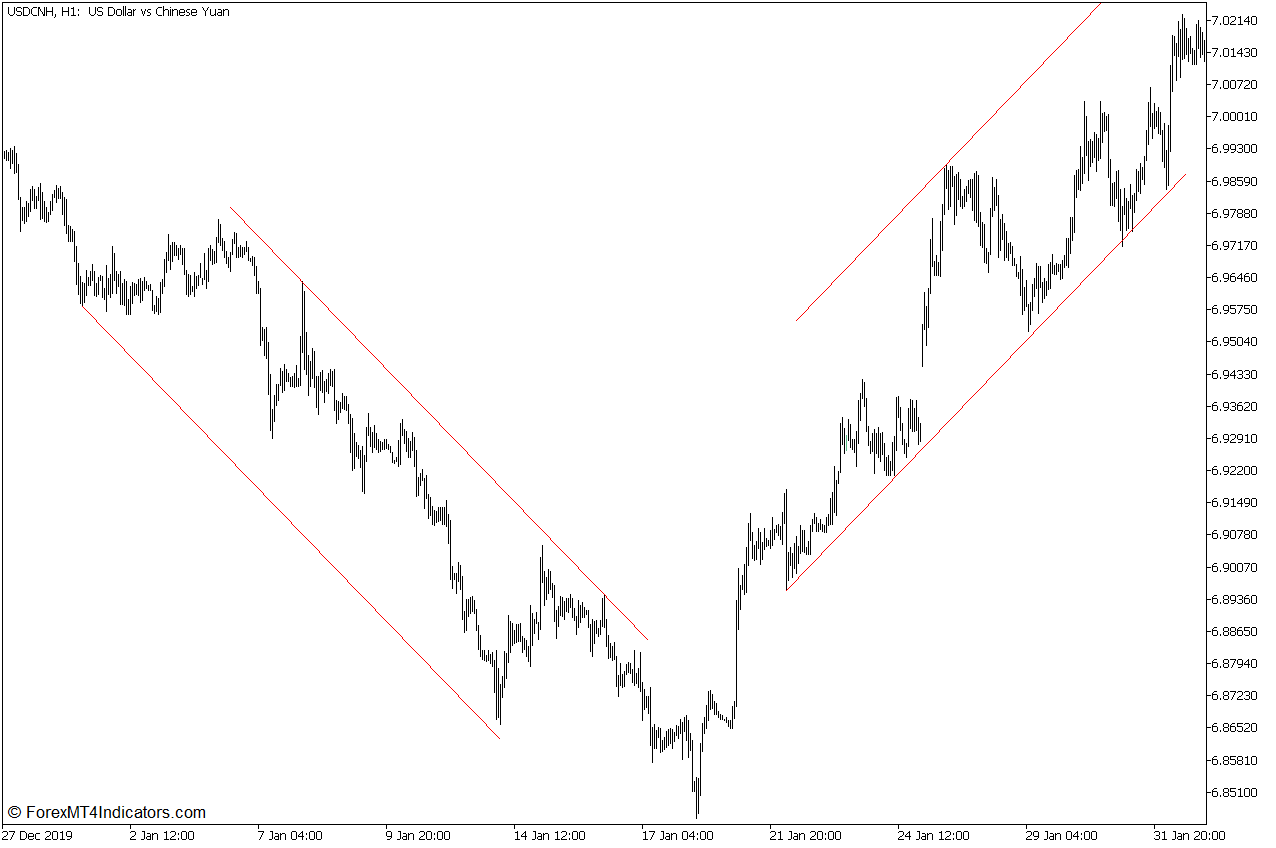

Pattern Strains and Their Software

Pattern strains are very important for locating assist and resistance. To make pattern line, join at the very least two worth factors. The extra instances the value touches a pattern line, the stronger it’s as assist or resistance. Merchants search for breakouts or bounce off these strains.

Spherical Numbers in Stage Evaluation

Spherical numbers are essential in foreign currency trading. Numbers like 1.3000 in EUR/USD typically act as assist or resistance. Merchants typically place orders at these ranges, making pure limitations. Look ahead to worth motion round these numbers to seek out potential reversals or breakouts.

| Software | Software | Key Characteristic |

|---|---|---|

| Transferring Averages | Dynamic S/R | Adapts to cost adjustments |

| Pattern Strains | Static S/R | Connects worth factors |

| Spherical Numbers | Psychological S/R | Entire quantity ranges |

Through the use of these technical instruments collectively, merchants can discover robust assist and resistance ranges. This helps them make higher buying and selling decisions within the foreign exchange market.

Widespread Errors in Buying and selling Assist and Resistance

Buying and selling assist and resistance ranges could be difficult. Many merchants fall into widespread traps that harm their efficiency. Let’s have a look at a few of these errors and tips on how to keep away from them.

False breakouts are an enormous drawback. Merchants typically soar in too shortly when the value strikes previous a stage. This will result in losses if the breakout isn’t actual. It’s higher to attend for affirmation earlier than getting into a commerce.

Overtrading is one other difficulty. Some merchants attempt to catch each transfer at assist or resistance. This will eat into income and enhance danger. It’s smarter to be selective and solely commerce one of the best setups.

Danger administration errors could be expensive. Inserting cease losses too near assist or resistance typically results in pointless losses. Utilizing the Common True Vary (ATR) may also help set higher cease losses. For instance, with a 20-period ATR of 60 pips, you may set your cease loss on the recognized excessive plus this buffer.

Many merchants mark too many ranges on their charts. This creates confusion and makes evaluation more durable. Concentrate on only one or two key ranges, particularly on increased timeframes like every day or weekly charts. This retains issues clear and helps spot essential worth motion.

| Widespread Mistake | Impression | Answer |

|---|---|---|

| False breakouts | Pointless losses | Await affirmation |

| Overtrading | Diminished income, elevated danger | Be selective with trades |

| Poor stop-loss placement | Getting stopped out too typically | Use ATR for stop-loss setting |

| Marking too many ranges | Complicated evaluation | Concentrate on key ranges solely |

By avoiding these errors, merchants can enhance their success fee and make higher selections within the foreign exchange market.

Value Motion Round Assist and Resistance Zones

Understanding worth motion close to assist and resistance zones is essential to buying and selling success. These areas typically result in large market strikes. They’re essential for merchants to regulate.

Breakout Patterns

Breakout patterns occur when the value goes by means of a assist or resistance stage. They present a potential pattern change or continuation. Merchants use quantity to examine if it’s an actual breakout.

An enormous enhance in buying and selling quantity means a powerful breakout. This exhibits the market’s robust emotions.

Rejection Indicators

Rejection indicators occur when the value assessments a stage however can’t break by means of. Patterns like pin bars or doji candles present these rejections. They imply the extent is robust and may result in a worth flip.

False Breakouts

False breakouts happen when the value briefly crosses a stage however then shortly goes again. They’ll trick merchants into appearing too quickly. To identify false breakouts, search for low quantity and quick worth adjustments.

Understanding the market’s temper helps inform actual from pretend breakouts.

| Sample | Traits | Buying and selling Implications |

|---|---|---|

| Breakout | Sturdy worth transfer, excessive quantity | Potential pattern change or continuation |

| Rejection | Pin bars, doji candles | Doable worth reversal |

| False Breakout | Weak quantity, fast reversal | Keep away from untimely entries |

By studying these worth motion patterns and utilizing candlestick evaluation, merchants could make sensible decisions close to assist and resistance zones. Bear in mind, profitable buying and selling wants persistence and apply in studying these market indicators.

Utilizing A number of Timeframes for Stage Evaluation

Foreign exchange merchants use many timeframes to grasp market developments higher. This methodology helps affirm developments and makes buying and selling extra constant. By trying on the similar forex pair in numerous time frames, merchants could make higher decisions.

Good timeframe evaluation contains three intervals. The medium-term is the typical commerce size. Quick-term frames are 25% of the medium-term. Lengthy-term frames are at the very least 400% greater. This timeframe correlation boosts the possibilities of profitable trades.

Lengthy-term charts present gradual adjustments and basic influences. They result in lasting developments however provide much less short-term revenue. Medium-term trades can make more cash due to greater worth swings and fewer noise. Quick-term trades benefit from quick market adjustments however price extra to do.

| Timeframe | Traits | Advantages |

|---|---|---|

| Lengthy-term | Basic influences, gradual adjustments | Sustained developments, much less frequent buying and selling |

| Medium-term | Bigger worth actions, much less noise | Larger revenue, balanced method |

| Quick-term | Fast fluctuations, increased volatility | Frequent adjustments want energetic administration |

Utilizing completely different timeframes helps make higher selections and analyze charts. Swing merchants typically use weekly charts with every day or 4-hour charts. Intraday merchants may pair every day charts with 30-minute or 15-minute charts. This methodology improves the reward-to-risk ratio and finds key assist and resistance ranges.

Danger Administration at Assist and Resistance Ranges

Buying and selling foreign exchange wants grasp of danger administration. This ability is much more essential when utilizing assist and resistance ranges. Let’s have a look at tips on how to handle danger properly in these conditions.

Cease Loss Placement

Setting cease losses is an enormous a part of managing trades. For lengthy positions, put cease losses 1-2% under assist ranges. For brief positions, place them 1-2% above resistance ranges. This helps maintain your cash protected if the market goes towards you.

Place Sizing Issues

Getting the best place dimension is essential to maintaining your capital protected. Don’t danger greater than 1-2% of your account on one commerce. This manner, you may deal with a number of losses with out dropping all of your buying and selling cash.

Managing Breakout Trades

Breakout trades could be each worthwhile and dangerous. Enter lengthy positions when costs break above resistance, displaying a powerful uptrend. Use a trailing cease to safe income as the value strikes your method. This boosts your risk-reward ratio.

Bear in mind, assist and resistance ranges change with market circumstances. Regulate these ranges and modify your plans as wanted. Through the use of these danger administration suggestions and cautious evaluation, you may enhance your buying and selling success by 15-25%.

Conclusion

Assist and resistance ranges are key in foreign currency trading expertise. They’re the place demand and provide meet, shaping the market. At assist ranges, shopping for stops worth drops. At resistance, promoting stops the value rises.

Understanding these ranges is important for good market evaluation.

About 70% of merchants use assist and resistance of their plans. This exhibits how essential they’re. When a stage is damaged, it typically adjustments roles. This occurs about 80% of the time, displaying how markets change.

Studying by no means stops in foreign exchange. Whereas 90% of recent merchants simply have a look at worth ranges, winners do extra. They have a look at provide and demand, use technical and basic evaluation, and shifting averages to identify developments. Spherical numbers are robust limitations, good for getting into or leaving the market.

Briefly, mastering assist and resistance takes effort and time. By enhancing these expertise and at all times studying, merchants can higher analyze the market. Bear in mind, within the fast-changing world of foreign exchange, understanding quite a bit could be very highly effective.