The elemental backdrop for gold as we head into Q2 of 2023 could also be shifting by means of a much less hawkish Federal Reserve. That being stated, calling a dovish Fed could also be too early to name with different financial components making a push/pull impact for the US central again, thus making their job that a lot more durable to attain value stability.

Commerce Smarter – Join the DailyFX Publication

Obtain well timed and compelling market commentary from the DailyFX staff

Subscribe to Publication

XAU/USD TECHNICAL ANALYSIS

SPOT GOLD WEEKLY CHART

Chart ready by Warren Venketas, IG

Trying on the longer-term weekly chart for gold, the 1950.00 resistance deal with (now assist) has been breached for the second time this yr. With extra conviction this tie spherical, a rally up in the direction of the 2070 2075 zone (inexperienced) is just not unlikely. If we have a look at the Relative Power Index (RSI), there are indicators of bearish divergence and will point out a potential transfer decrease as value motion and the RSI lengthen their opposing travels. Though an preliminary transfer increased is on the playing cards, by the top of Q2 there could be a pullback in the direction of 1950 and past. The 50-day (yellow) and 200-day (blue) transferring averages are quietly converging and should type a loss of life cross in the end, as soon as once more exposing XAU/USD to additional draw back.

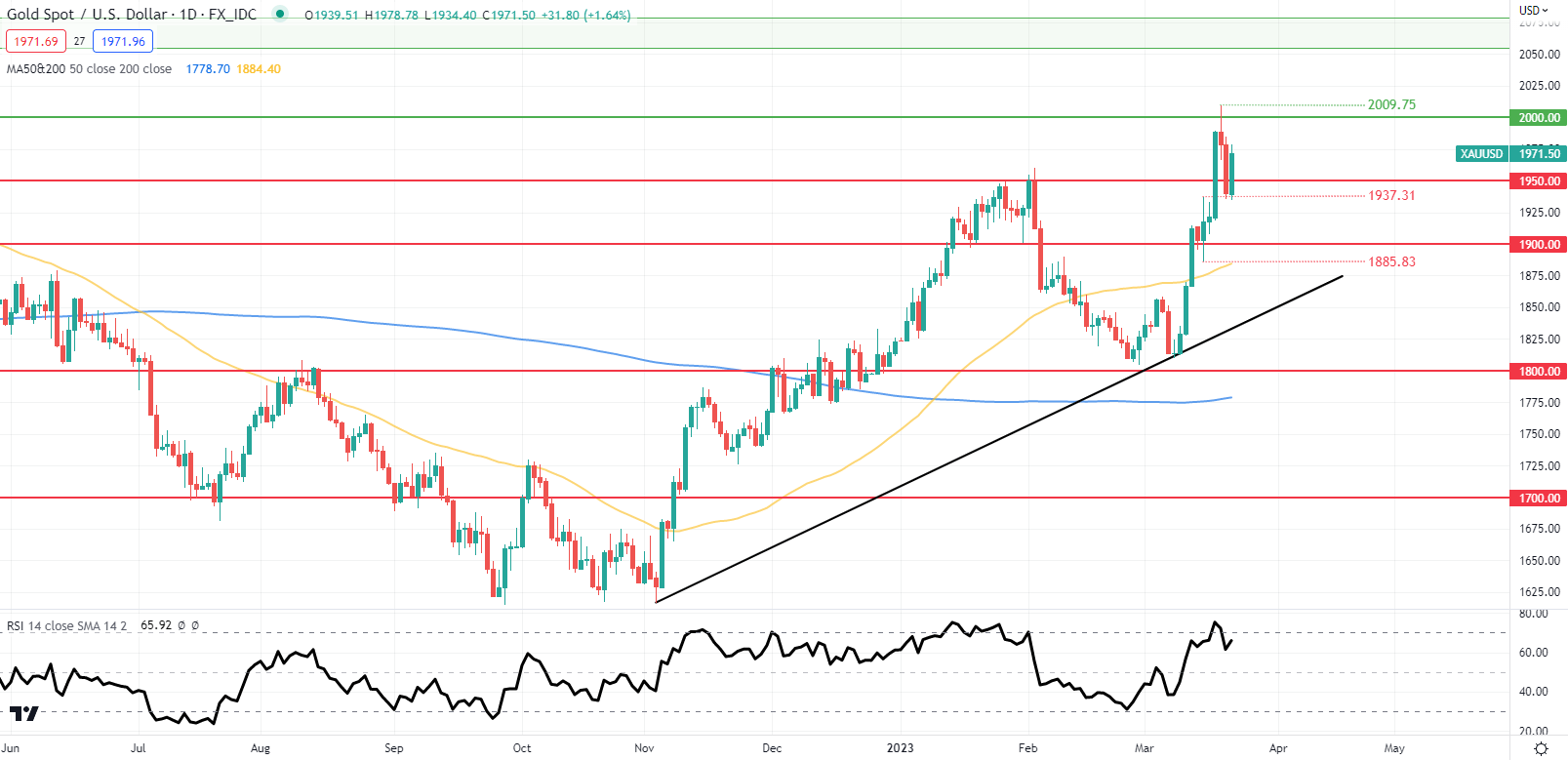

SPOT GOLD DAILY CHART

Chart ready by Warren Venketas, IG

Focusing in on the every day chart above, the short-term bias stays firmly in favor of gold bears with the RSI in overbought territory. The problem lies in forecasting over a 3 month interval and with a lot impactful financial knowledge to return, the long-term outlook will be blurry. Revising the technical evaluation above periodically will guarantee a contemporary look as and when new knowledge hits the market, giving a extra correct viewpoint. My private view ought to see gold persist between the 1900 – 2100 zones leaving Q3 with the potential to maneuver the needle in a extra important method.

Key resistance ranges:

-2070.00 – 2075.00

-2009.75

-2000.00

Key assist ranges:

-1950.00

-1937.31

-1900.00

-1885.83/50-day SMA

-Trendline assist

Contact and comply with Warren on Twitter @Wvenketas