POUND STERLING TALKING POINTS

- Stellar labor release unable to sway depressed pound.

- BoE to stop corporate bond sales this week while ramping up gilt purchases.

Trade Smarter – Sign up for the DailyFX Newsletter

Receive timely and compelling market commentary from the DailyFX team

Subscribe to Newsletter

GBP/USD FUNDAMENTAL BACKDROP

The pound has been on a slippery slope after the UK bond market sold off once again yesterday bringing into question pension funds’ ability to manage collateral calls. This morning, UK jobs statistics surprised to the upside (see calendar below) with little in the way of a positive reaction for the local currency, indicating the markets focus on the broader bond/gilt challenge.

Recommended by Warren Venketas

Get Your Free GBP Forecast

A closer look at the data shows the inflationary effect on earnings while better-than-expected employment and unemployment numbers reiterate the tight labor market in the UK.

GBP/USD ECONOMIC CALENDAR

Source: DailyFX Economic Calendar

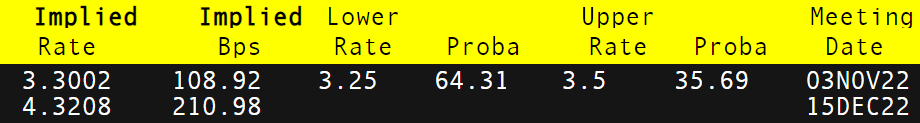

Solid labor numbers give some backing for the Bank of England (BoE) in their approach to tackle rampant inflation as well as settle the UK economy by hiking interest rates – currently money markets are pricing in a 100bps incremental hike for November. In conjunction with the job release, the BoE reiterated their willingness to purchase up to £10bn per day of government bonds in attempts to shore up the bond market. Broadening the scope of bond purchases has also been stated including the purchase of index-linked gilts while halting corporate bond sales this week.

BOE INTEREST RATE PROBABILITIES

Source: Refinitiv

TECHNICAL ANALYSIS

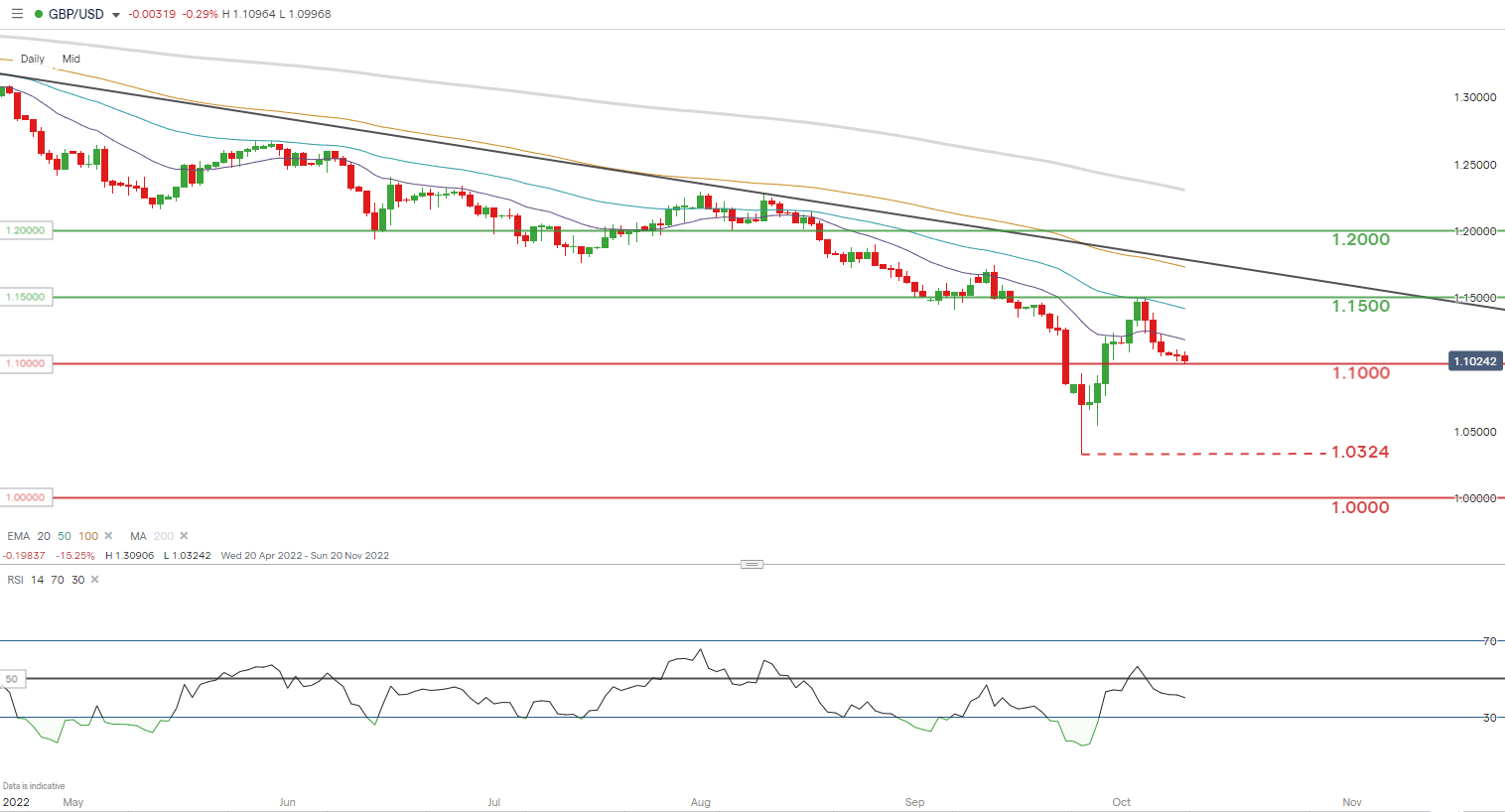

GBP/USD DAILY CHART

Chart prepared by Warren Venketas, IG

Sterling was unmoved by the jobs data while momentum remains skewed to the downside as indicated by the Relative Strength Index (RSI). The 1.1000 psychological support zone is under consideration today and is likely to break with fundamental headwinds mounting on the UK economy.

Key resistance levels:

- 1.1500

- 50-day EMA (blue)

- 20-day EMA (purple)

Key support levels:

BEARISH IG CLIENT SENTIMENT

IG Client Sentiment Data (IGCS) shows retail traders are currently 57% LONG on GBP/USD (as of this writing). At DailyFX we typically take a contrarian view to crowd sentiment resulting in a short-term downside bias.

Contact and followWarrenon Twitter:@WVenketas