UK GDP This fall ’22 (PRELIM) KEY POINTS:

Really useful by Zain Vawda

Get Your Free GBP Forecast

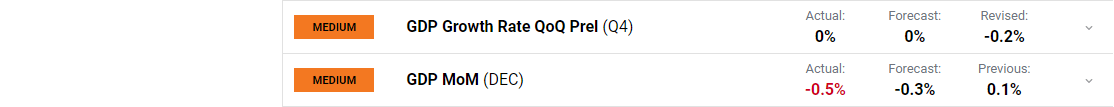

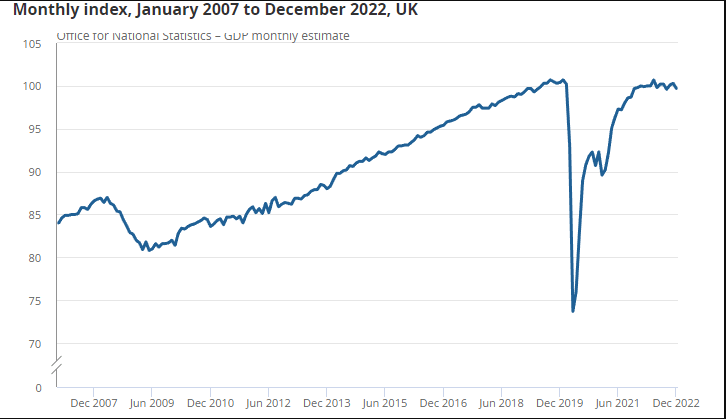

UK GDP preliminary knowledge for This fall 2022 indicated a particular slowdown regardless of matching estimates. Month-to-month actual gross home product (GDP) is estimated to have fallen by 0.5% in December 2022 whereas the larger image confirmed that GDP was flat within the 3 months to finish December 2022. As a complete 2022 GDP got here in at 4.1%.

Customise and filter dwell financial knowledge through our DailyFX financial calendar

The companies sector fell by 0.8% in December 2022, after unrevised development of 0.2% in November 2022; the biggest contributions to this fall got here from human well being actions, schooling, arts, leisure and recreation actions, and transport and storage. Output in consumer-facing companies fell by 1.2% in December 2022 whereas manufacturing output grew by 0.3% in December 2022 in comparison with 0.1% in November. The primary contributor to this development was electrical energy, fuel, steam and air-con provide.

Supply: Workplace for Nationwide Statistics

UK GDP GROWTH PROSPECTS FOR 2023

The Worldwide Financial Fund (IMF) just lately upgraded its world GDP Forecasts for 2023 with the UK financial system seen rising at -0.6% for the yr. This may characterize a pointy downturn following a largely resilient 2022 with the UK financial system dealing with vital headwinds in 2023. The continuing employee’s strikes, Authorities debt and ongoing points round Brexit are all set to weigh on any tried restoration in 2023.

Commerce Smarter – Join the DailyFX Publication

Obtain well timed and compelling market commentary from the DailyFX staff

Subscribe to Publication

The IMF emphasised that amongst its considerations for the UK financial system transferring ahead is vitality costs, employment ranges and financial coverage with additional tightening anticipated to combat inflation. Power costs have since fallen sharply including a ray of hope, nonetheless employment is but to recuperate to pre-pandemic ranges because the labor market stays tight however has not absorbed as many individuals again into employment because it had earlier than. That is prone to lead to much less output and manufacturing in 2023.

MARKET REACTION

The preliminary market response following the information has seen GBPUSD decline 15 pips. Wanting on the larger image from a technical perspective, GBPUSD value has bounced off the 200-day MA following it selloff towards the tip of final week. Yesterday we noticed resistance come into play across the 50-day MA at 1.21920 with the value hovering between the 2 MAs. Additional draw back stays extra interesting over the medium time period, nonetheless a break above the 50-day MA and retest of the vary or the psychological 1.2500 space can’t be dominated out earlier than the subsequent leg to the draw back unfolds.

GBPUSD Day by day Chart, February 10, 2022

Supply: TradingView, ready by Zain Vawda

— Written by Zain Vawda for DailyFX.com

Contact and comply with Zain on Twitter: @zvawda