UK JOBS DATA KEY POINTS:

- UK Employment Change (FEB) Precise 182k Vs Forecast 160k.

- UK Unemployment Price (MAR) Precise 3.9% Vs Forecast 3.8%.

- Common Earnings incl. Bonus (3Mo/Yr) (MAR) Precise 5.8% Vs Forecast 5.8%.

- In Actual Phrases (adjusted for inflation) Wages Dropped by 3% for Complete Pay and by 2.0% for Common Pay.

- To Study Extra About Worth Motion, Chart Patterns and Shifting Averages, Take a look at the DailyFX Schooling Part.

Commerce Smarter – Join the DailyFX Publication

Obtain well timed and compelling market commentary from the DailyFX staff

Subscribe to Publication

READ MORE: Australian Greenback Dips on Mushy China Knowledge. Will AUD/USD Check Vary Lows?

The most recent labor market information out from the UK got here in blended as we had each indicators of resilience and early indicators of colling because the variety of individuals working within the UK grew by 182k (3-month interval to finish of March 23) above the forecasted determine of 160k. The rise was largely pushed by part-time workers and self-employed employees.

Customise and filter stay financial information through our DailyFX financial calendar

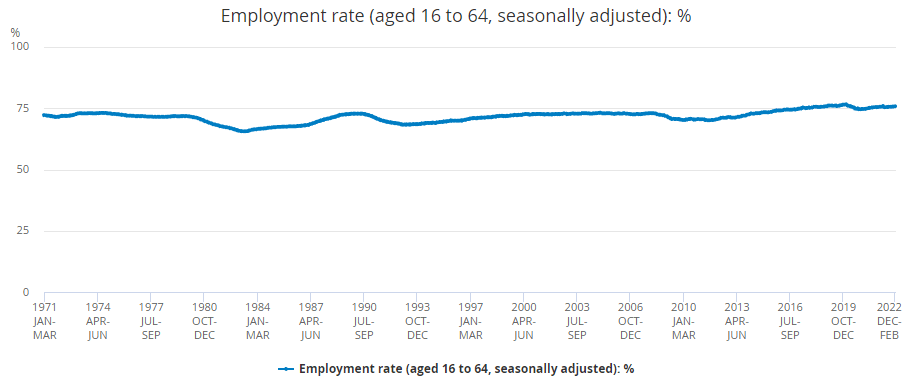

The unemployment fee elevated 0.1% on the quarter to three.9% which was largely attributable to individuals unemployed for over 12 months. That is the very best degree because the November 2021 to January 2022 interval. February to April 2023, the estimated variety of vacancies fell by 55,000 on the quarter to 1,083,000. Vacancies fell on the quarter for the tenth consecutive interval and mirror uncertainty throughout industries, as survey respondents proceed to quote financial pressures as a think about holding again on recruitment. The report by the ONS went additional stating that the UK misplaced 556,000 working days to strikes in March.

Common Earnings Incl. Bonus within the UK got here in at 5.8% and in step with estimates. In the meantime common development for the general public sector got here in at 5.6% in January to March 2023, such development for the general public sector was final seen in August to October 2003 (5.7%).

Supply: Workplace for Nationwide Statistics

UK OUTLOOK MOVING FORWARD

Wanting we’ve had a bunch of excessive impression UK information over the previous two weeks which have painted a quite blended image of the economic system. Inflation stays uncomfortably excessive whereas the not too long ago revised development forecast from the BoE has seen some upward revisions made. Nevertheless, this week’s GDP development information confirmed an intriguing slowdown and contraction in GDP development for the month of February and March respectively.

There is no such thing as a denying the UK economic system has remained resilience for the massive half, nevertheless the current GDP information could also be trigger for concern. Now we have seen retail gross sales additionally dip of late, an indication that that customers proceed to tighten their belts as price of residing continues to be a difficulty. I for one will likely be holding a detailed eye on GDP information because it begins filtering by in Q2 and naturally UK inflation.

The Financial institution of England (BoE) did go away the door open to additional rate of interest hikes. One other hike is feasible however given the banks personal inflation expectations it may be time for a wait and see strategy. As the consequences of the current mountain climbing cycle start to take maintain Central banks will need to make sure that overtightening doesn’t change into prevalent throughout the globe with the BoE no exception.

Beneficial by Zain Vawda

Get Your Free GBP Forecast

MARKET REACTION

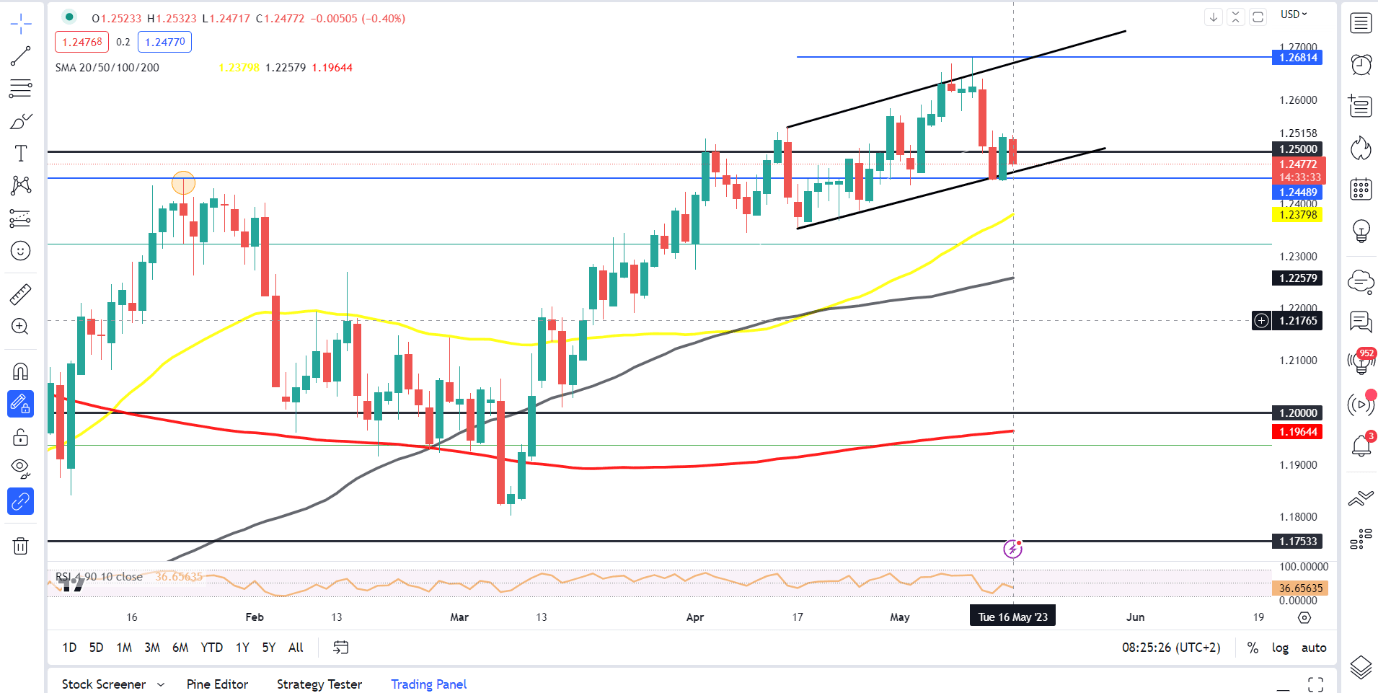

The preliminary market response following the information has seen GBPUSD decline round 50 pips, which is stunning given the restoration we noticed yesterday. The power of the slide put up information launch has additionally been helped by a barely stronger USD this morning.

Nevertheless, GBPUSD on a each day timeframe is making an attempt to interrupt beneath the ascending channel which might open up a deeper retracement towards the assist areas offered by the 50 and 100-day MAs at 1.2380 and 1.2260 respectively. Preserve a detailed eye on developments across the US debt ceiling as that would have a major bearing on the USD and thus GBPUSD.

GBPUSD Every day Chart, Might 16, 2023

Supply: TradingView, ready by Zain Vawda

— Written by Zain Vawda for DailyFX.com

Contact and comply with Zain on Twitter: @zvawda