The blowback from the conflict in Ukraine has solely simply began to rock the worldwide financial system, however the early clues for the US stay encouraging. There’s an extended highway forward and it’s too early to make high-confidence forecasts, however preliminary knowledge for March counsel that development nonetheless has the higher hand.

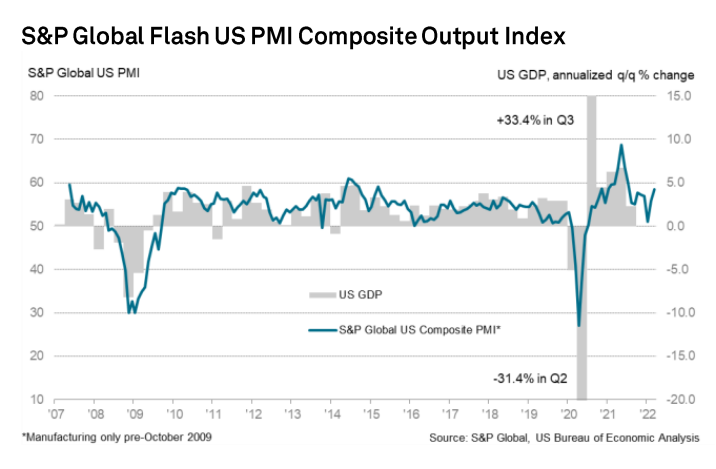

Let’s begin with yesterday’s survey knowledge, which paints an upbeat profile for the US macro development this month. The preliminary estimate of the US Composite Index, a survey-based GDP proxy, accelerated to an eight-month in March. The 58.5 print is effectively above the impartial 50 mark and alerts a stable growth development.

“Producers and repair suppliers registered stronger upturns in exercise, largely supported by pent-up demand the easing of Covid-19 restrictions,” Markit Economics experiences. “Corporations additionally famous that much less extreme provide disruption and job creation allowed companies to step up manufacturing.”

The most recent weekly replace on US helps the upbeat PMI knowledge. Certainly, new filings for unemployment advantages final week fell to the bottom stage since 1969.

“US companies will not be shedding staff as a result of they know the big challenges they’re dealing with in filling open positions,” says Ryan Candy, a senior economist at Moody’s Analytics.

A analysis observe from economists at Jefferies, an funding financial institution, advises that the labor market “is extraordinarily sturdy and [jobless claims] knowledge is precisely the kind of proof that has given the Fed confidence that they’ll elevate charges extra shortly to battle inflation.” General, “demand for labor is powerful and there are not any causes to imagine that this may change any time quickly, barring one other wave of a brand new Covid variant.”

Regardless of these upbeat numbers, it’s untimely to imagine that the financial system has dodged a business-cycle bullet. That evaluation, or rejecting it, will take a number of months. In the meantime, as CapitalSpectator.com outlined earlier this week, recession danger has risen not too long ago, largely because of the confluence of surging inflation and varied world shocks unleashed by the conflict in Ukraine.

However greater recession danger has but to succeed in the tipping level. Though the potential for hassle has absolutely elevated relative to a month in the past, there’s nonetheless room for debate about what comes subsequent. For now, utilizing numbers revealed so far, exhibits a low chance {that a} new NBER-defined financial contraction has began, or is about to start out within the quick future. The problem is that financial circumstances are topic to radical and maybe dramatic adjustments within the weeks forward, because of the blowback from Russia’s invasion of Ukraine and elevated inflation.

An added issue of uncertainty, some economists advise, are adjustments within the forces of development and contraction. “The lengthy period of low inflation, suppressed volatility and straightforward monetary circumstances is ending,” says Mark Carney, a former head of the Financial institution of England. “It’s being changed by tougher macro dynamics wherein provide shocks are as essential as demand shocks.”

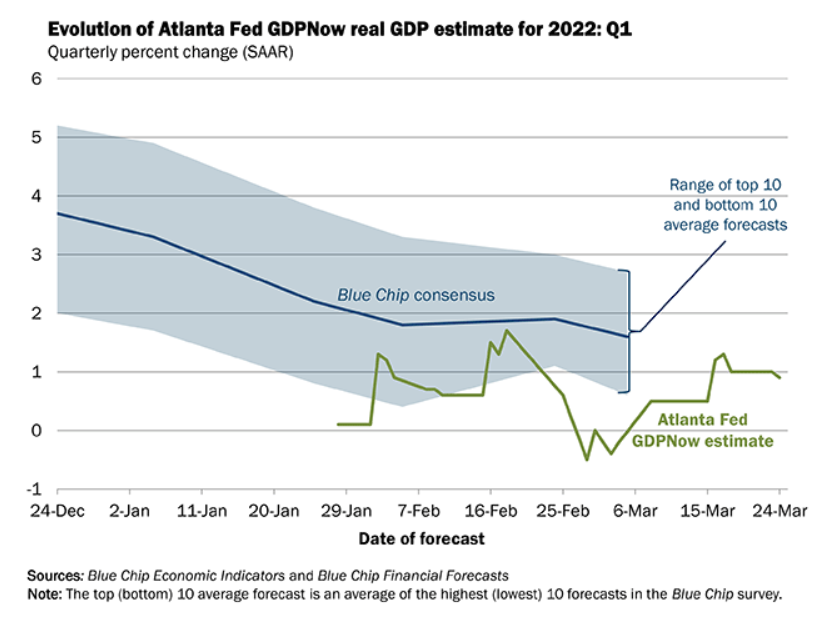

One other complication is that the US financial system is heading right into a interval of elevated macro dangers with a decelerating development fee. Some present nowcasts for first-quarter GDP exercise anticipate a pointy slowdown in output that counsel financial exercise will come to a digital cease. The Atlanta Fed’s GDPNow mannequin is projecting that Q1 GDP will improve by a tepid 0.9% within the first three months of 2022 (primarily based on the Mar. 24 estimate) – a dramatic slowdown from This autumn’s red-hot 7.0% surge (annualized fee).

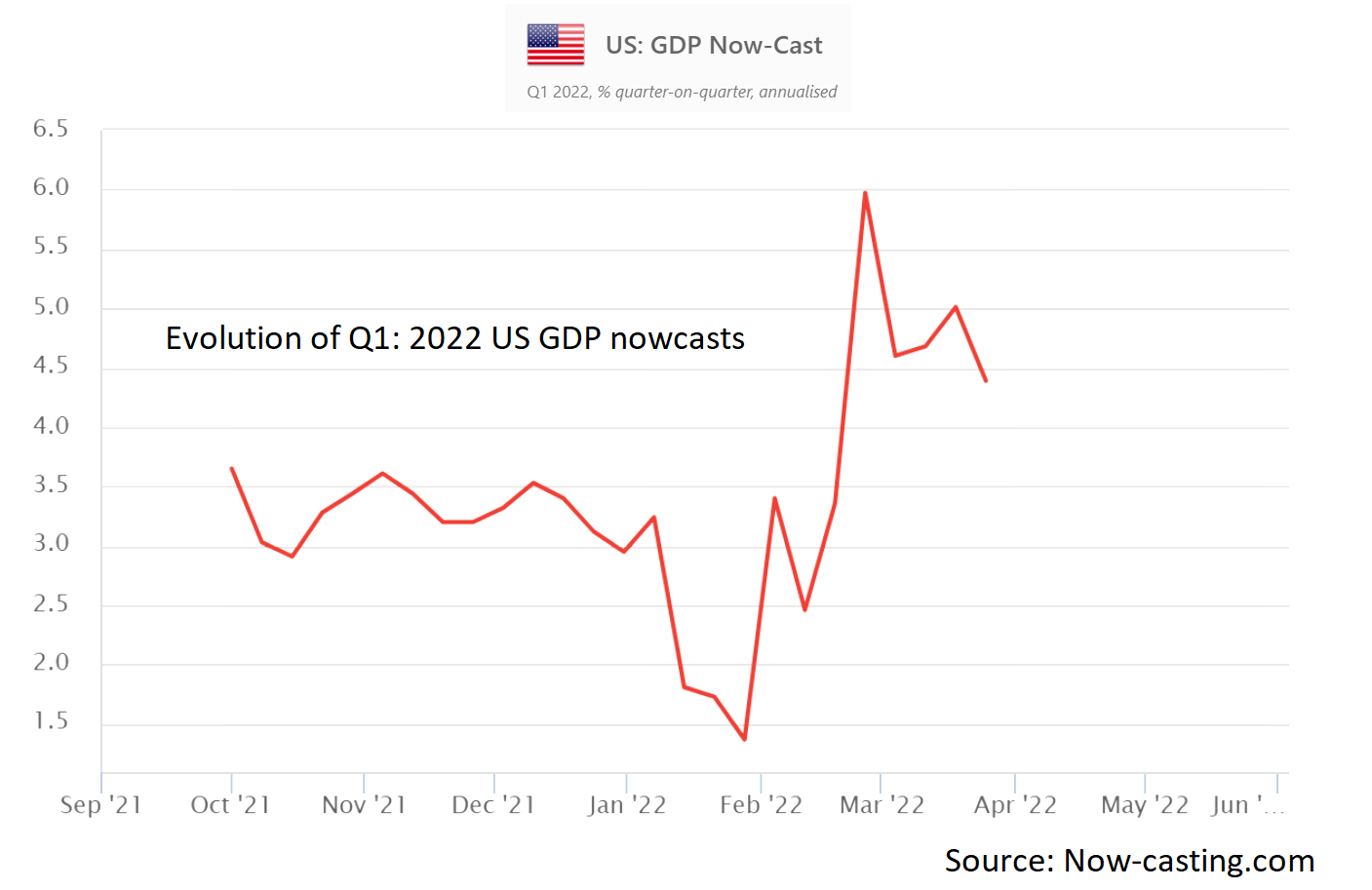

However different nowcasting fashions counsel in any other case. Notably, Now-casting.com is presently estimating a a lot stronger US growth north of 4.0% for upcoming Q1 numbers, primarily based on the agency’s Mar. 25 evaluation.

Nonetheless, with a worldwide shock simply beginning to roil economies, together with the uncertainty of how the Ukraine conflict might evolve within the days and weeks forward, a hearty dose of humility is required for assessing the trail of US financial exercise within the close to time period. To date, nonetheless, there are causes to assume that the present growth will proceed in some extent for the foreseeable future. The problem is watching the incoming knowledge and deciding how, or if, to alter the cautiously optimistic outlook.