J Studios/DigitalVision through Getty Pictures

Proper earlier than we entered February, the Fed delivered fairly hawkish message relative to what was baked into the cake by the market. Whereas it was not a shock that there won’t be any rate of interest cuts now, the commentary on future selections was not as accommodative because the market hoped for.

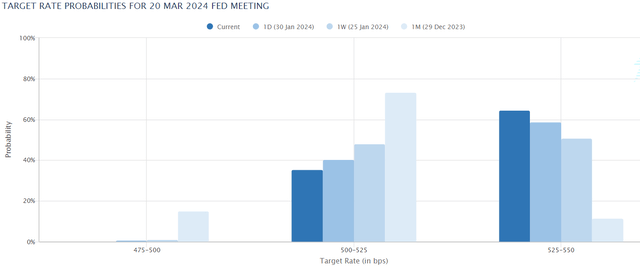

CME Group

The chart above captures the essence very nicely, the place we are able to see how the possibilities of an rate of interest reduce have steadily decreased, with one other calibration to the draw back occurring proper after the latest Fed assembly.

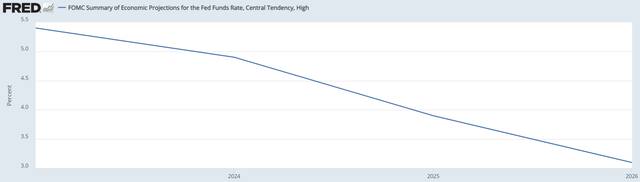

FOMC; St. Louis Fed

Having mentioned, the FOMC’s “dot plot” chart nonetheless signifies decrease rates of interest in 2024 which might be adopted with extra significant decreases in 2025 and 2026. Additionally, it was fairly evident in Jerome Powell’s speech that downward revisions of SOFR are clearly imminent this 12 months.

The important thing takeaways from this for yield-seeking buyers are the next:

- SOFR has peaked, which implies that there won’t be incremental upwards strain on the yields in a scientific vogue.

- As a substitute, the present yields are set to return down throughout the board because the underlying low cost charge shrinks.

Now, this would possibly set off extra aggressive dividend buyers to open positions in extraordinarily excessive yielding shares earlier than they’re repriced increased as a consequence of favorable actions in the price of financing.

Theoretically, such technique is smart as a result of overly depressed shares (which is implied by irregular yield ranges) are inherently extra delicate to any constructive charge of change in systematic components just like the rates of interest.

Nevertheless, this clearly comes with its dangers, the place buyers should pay very cautious consideration to the underlying fundamentals and money technology to keep away from moving into the “worth lure”.

On this article beneath, I spotlight two related examples, which from the floor appear enticing, but when we peeled again the onion a bit we’d discover the overly speculative nature – i.e., main indicators of yield unsustainability.

Lastly, the latest knowledge factors from the Fed suggest elevated danger for these two names since whereas the rates of interest are poised to go down, the truth that it’s more likely to occur in a extra back-end loaded vogue, render the monetary scenario far more troublesome.

#1 Medical Properties Belief (NYSE:MPW)

MPW is a healthcare REIT working in a comparatively steady and easy enterprise (i.e., devising a purchase and maintain technique of various kind of healthcare amenities). Though the underlying enterprise is characterised with steady and predictable financial dynamics, MPW’s precise efficiency has been utterly reverse.

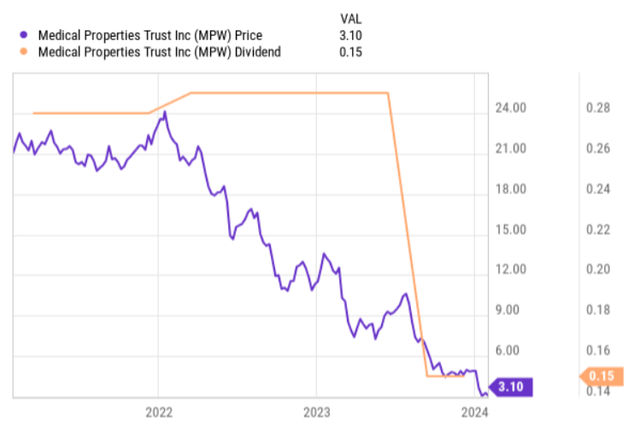

Within the chart beneath, we are able to see how MPW’s share value has plunged since early 2022 and the way large the dividend reduce was in mid 2023.

YCharts

Regardless of the dividend discount and a few constructive information on the steadiness sheet finish (e.g., profitable divestiture of Australian portfolio, a few smaller-scale asset gross sales), MPW nonetheless yields ~19% (on a TTM foundation).

Contemplating the truth that MPW will be capable of repay many of the debt maturities till 2025, it might sound that the monetary danger is well-managed. Plus, one would possibly assume that this offers ample time for MPW’s administration to divest further properties and accumulate a few of the undistributed money (stemming from FFO payout of 80%) that may finally strengthen the liquidity profile and permit to sort out the remaining maturities.

However, there are two elements, which render such thesis too optimistic and even unrealistic.

First is the tenant problem, which is nothing new for buyers, who’ve adopted MPW. As of Q3, 2023, Prospect Medical Holdings and Steward Well being Care accounted for greater than 25% of the full lease technology.

Sadly, early this 12 months extra destructive information had been circulated to the general public indicating that MPW’s largest tenant (Steward) has did not service the pre-agreed funds that had been a part of the comparatively latest restructuring plan. Even worse, to keep away from a catastrophe MPW was compelled to step in as soon as once more and inject recent liquidity within the tenant’s books, thereby inflating additional the efficient publicity (lease funds, debt funds, fairness stake).

Second facet, is de facto the mix of main restructuring and unfavorable rate of interest atmosphere, which as outlined above is ready to stay at this restrictive territory for some whereas.

So, finish of January this 12 months, Steward introduced that it has assigned restructuring consultants that may dig deep in Steward’s financials to reach at an answer that will maximize shareholder worth given the entire transferring items. Normally, it takes a number of weeks to evaluate and decide the optimum route, what’s then adopted by virtually speedy execution to halt the money drain and protect any worth that’s left.

Right here there are not less than two points (dangers) with the present restructuring agenda:

- Any asset disposals, spin-offs, fairness financings and different comparable capital sourcing maneuvers are inherently much less doable and dearer throughout a restrictive rate of interest atmosphere.

- Restructuring advisers deal with the shareholder worth perseveration (or maximization), which could not essentially find yourself in one of the best curiosity of MPW, which is nowhere near being the most important shareholder.

Therefore, my base case is that MPW should reduce its dividend additional to protect its steadiness sheet and shut the potential money movement gaps that might stem from non-paying Steward.

#2 PIMCO Company and Revenue Alternative Fund (NYSE:PTY)

PTY is a ~10% yielding CEF that’s managed by PIMCO. The general focus of PTY is within the excessive yielding fastened earnings house, the place along with a big load of exterior leverage, the Administration goals to maintain the dividend at a pretty and steady stage.

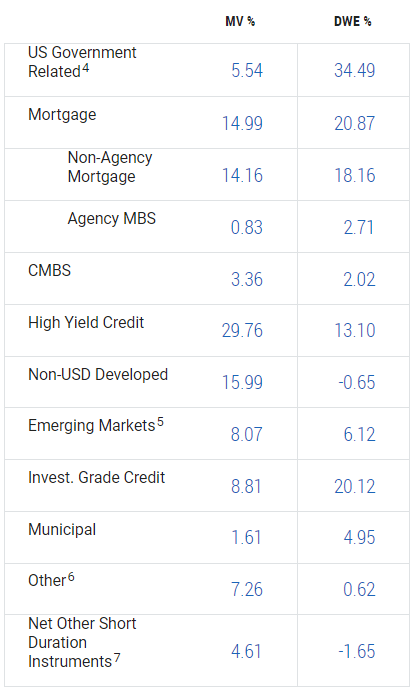

If we have a look at the underlying sector combine, it should turn out to be clear why PTY is ready to facilitate comparatively excessive yielding dividends.

PIMCO Investments LLC

For instance, excessive yield credit score, non-agency mortgages and rising markets represent greater than half of complete PTY’s publicity. All of those fastened earnings segments present relatively enticing present earnings streams due to the inherent danger profile.

A essential facet within the context of PTY’s yield is the notion of exterior leverage, which as of now explains ~27% of the full AuM. This manner, PTY is ready to enlarge the core yield that’s generated by the underlying investments (i.e., capturing the distinction between price of debt and funding yield).

However, in my view, PTY can be on the trail in the direction of lowering its dividend.

There are three causes for this.

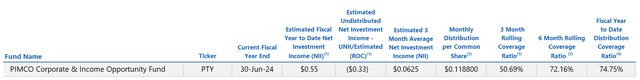

First, the 3-month rolling dividend protection of PTY is clearly in an unsustainable territory, the place the Fund has to faucet into its present NAV base to maintain the present dividend stage intact.

PIMCO Investments LLC

Second, given the latest knowledge factors from the Fed (i.e., SOFR staying this excessive for longer), we are able to suggest that PTY should carry the dividend funding shortfall for fairly a while. In different phrases, the price of financing ranges will proceed to stay excessive, sustaining destructive established order from the exterior leverage (yield-enhancement) perspective.

Third, elevated SOFR will proceed to set a strain on the asset valuations, which is extraordinarily unfavorable within the present case of PTY when the Administration has to divest elements of its asset base to cowl the shortfall.

In a nutshell, I’d not be stunned if PTY decides to revisit the prevailing dividend stage to protect its present NAV base till the rates of interest normalize.

The underside line

Whereas the rates of interest are poised to go down, it appears that it’s going to take a bit longer time for that to occur. The implied certainty about rate of interest peak stage and downward trajectory in future SOFR, would possibly set off yield-seeking buyers to enter double-digit dividend yielders earlier than decrease rates of interest kick in and convey up the valuations.

Nevertheless, allocating in double-digit devices with out a cautious evaluation of the underlying fundamentals would possibly end in relatively unfavorable outcomes even towards the backdrop of normalizing rates of interest.

MPW and PTY are clear examples of this, which at the moment present attractive dividend yields that embody significant possibilities of dividend reductions, the place the truth that rate of interest cuts shall be extra back-end loaded have simply elevated the possibilities of such an occasion occurring.