SlavkoSereda/iStock by way of Getty Photographs

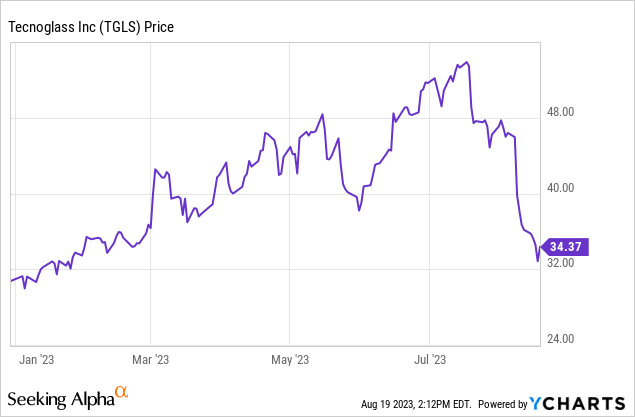

It is wonderful how shortly issues can change within the monetary markets. Only a month in the past, I cautioned that shares of Colombian glass and window producer Tecnoglass (NYSE:TGLS) gave the impression to be absolutely valued forward of a possible slowdown within the development business. Shares have since gotten walloped, with the inventory dropping a fast 35%. Certainly, the corporate has now given up virtually all of its 2023 year-to-date positive aspects:

Whereas I believe the market was too optimistic when the inventory was within the $50s, this can be turning into an overreaction within the different course. This is why I am transferring again to a purchase score for Tecnoglass inventory.

Q2 Earnings Have been Sturdy

On August eighth, Tecnoglass reported its Q2 earnings. These got here in higher than anticipated. Non-GAAP EPS of $1.12 beat by 5 cents. Revenues of $225 million have been method forward of the expectation for $209 million of revenues; the $225 million determine additionally represented 33% year-over-year progress.

That mentioned, we must always take these outcomes with a grain of salt. There was by no means all that a lot doubt that Tecnoglass would have robust leads to 2023, as there may be already a big backlog of orders in place. The query is extra round the place 2024 and 2025 outcomes will find yourself as greater rates of interest and a probably flagging South Florida economic system begin to hit new development demand.

Regardless, the Q2 numbers have been effectively forward of expectations and confirmed that the enterprise nonetheless has robust momentum behind it. So, why did the inventory unload double digits on the seemingly favorable earnings outcomes?

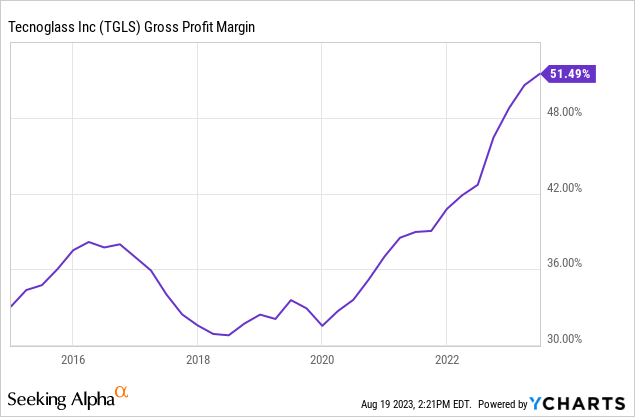

I consider the reply has to do with gross margins. Right here is Tecnoglass’ gross margin evolution since being a publicly-traded firm (notice that that is annual not quarterly figures):

As you’ll be able to see, the agency has loved an incredible surge in margins since 2020, with a virtually 2,000 foundation level enchancment in outcomes. That is the basic cause why Tecnoglass went from being a single-digit to $50 inventory. It is nice promoting extra merchandise — folks all the time like top-line progress — however the place you actually get the exponential earnings progress comes from promoting extra merchandise at greater margins.

Nevertheless, I do not consider this gross revenue margin enlargement might be a everlasting function. Tecnoglass does have some proprietary know-how and patents which insulate it from commodity pricing results. Nonetheless, for a lot of prospects, shopping for choices might be made totally on value. An enormous transfer up in margins probably opens the door for extra manufacturing at rival companies to attempt to steal again a few of that margin.

As well as, the roaring scorching housing market of the previous few years and shortages of inputs, together with home windows, gave companies like Tecnoglass an excessive amount of pricing energy. I think in a extra regular economic system, not to mention a recession, gross margins settle again towards 40% as a substitute of the latest 50%+ figures Tecnoglass was producing.

To that time, we noticed the primary indicators of this within the Q2 earnings launch. Tecnoglass’ gross margin was 48.7% This was up from 43.5% in the identical quarter of 2022. Be aware, nonetheless, that it was down sharply from Q1 of 2023, the place Tecnoglass earned a report excessive revenue margin of 53.2%.

Right here is quarterly gross margin knowledge for Tecnoglass:

- Q1 2022: 44.8%

- Q2 2022: 43.5%

- Q3 2022: 52.2%

- This fall 2022: 52.2%

- Q1 2023: 53.2%

- Q2 2023: 48.7%

This quarter’s 48.7% gross margin continues to be large, and much above what Tecnoglass was incomes previous to the pandemic. Nevertheless, it’s a sharp break from the previous 9 months of outcomes, suggesting that Tecnoglass is beginning to see the pricing image flip a bit much less favorable. That is totally to be anticipated as rates of interest proceed to push greater and the Miami economic system’s power continues to taper off.

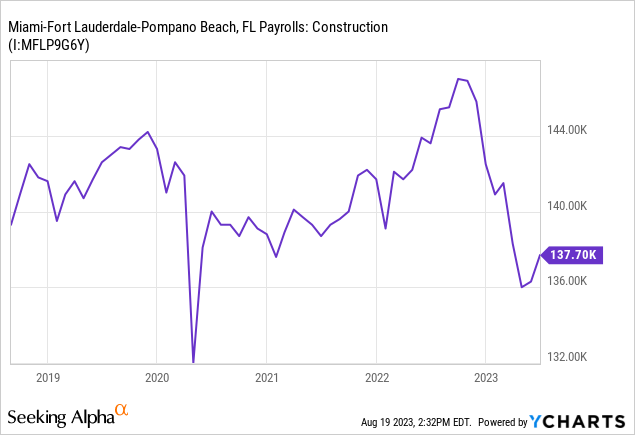

There was some pushback on my prior article round whether or not Miami — a key Tecnoglass market — is definitely slowing down or not. I would level to issues resembling development employment as exhibiting that the momentum is waning:

I would level out that there have been media experiences that development loans have gotten harder to acquire available in the market as effectively. As a Monetary Occasions article notes:

“[T]he torrid progress in Miami property costs has slowed. Costs are nonetheless inching up, though the quantity of gross sales has fallen and brokers say it’s now taking longer to shut offers.”

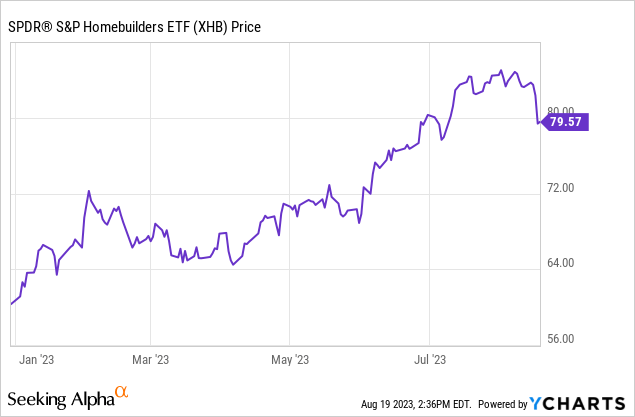

All this to say that I consider Tecnoglass inventory was priced at peak cyclical bullishness a month in the past, and shares have bought off in August as buyers digest the slowing market and the renewed rise in rates of interest. Additional to that time, after rallying all yr, homebuilding shares moved considerably decrease final week as mortgage charges rattled sentiment:

What’s Tecnoglass Price In A Slowing Market?

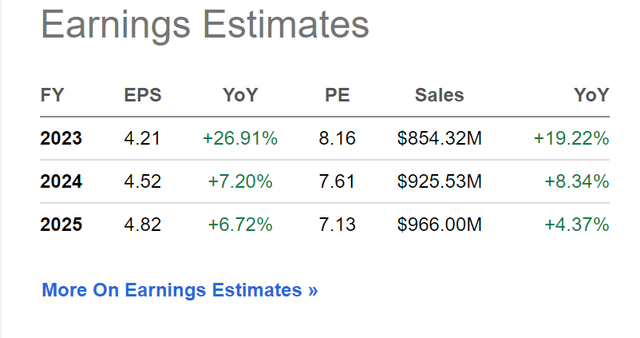

Listed here are the present analyst earnings projections for TGLS inventory:

TGLS earnings estimates (In search of Alpha)

I personally would assume barely decrease income progress in 2024 — backlog continues to be robust however I anticipate it to quickly lose steam given greater rates of interest and the softening South Florida economic system. So, for instance $900 million of income in 2024, up a bit from this yr however effectively off the latest progress fee. And I assume a gross margin of 44%, which continues to be far above the place it was previous to 2020 however displays a extra mid-cycle fairly than growth interval form of pricing atmosphere.

As per my calculations, this could lead to Tecnoglass producing about $170 million of internet revenue subsequent yr, which might be a modest dip from the $202 million earned over the previous 12 months, although nonetheless forward of the $156 million it earned in fiscal yr 2022. This could lead to a 2024 earnings per share determine of roughly $3.54.

With the inventory at $34 as of this writing, this could put Tecnoglass at just below 10x my estimate of 2024 earnings. And I consider my estimate bakes in a way more prudent and conservative financial outlook than what the consensus is at the moment modeling.

There’s threat to the draw back; maybe gross margins go plunging again into the 30s in a full-on recession state of affairs. And top-line revenues would possibly fail to develop in any respect subsequent yr if an even bigger credit score crunch emerges. That mentioned, utilizing pretty cautious numbers on my half — effectively under present avenue estimates — nonetheless will get Tecnoglass to being a contact underneath 10x ahead earnings.

I believe that is an inexpensive value to pay for an organization that has proven robust historic progress and whose administration staff has earned rising respect within the market albeit in a cyclical business and with a possible Colombian political threat low cost. Tecnoglass has a sturdy aggressive benefit from its favorable location, transport charges, and low-cost manufacturing capabilities. I anticipate the corporate to be considerably bigger in 5 and ten years than it’s at this time, and that ought to give ample room for important share value appreciation from right here.

That mentioned, the agency’s large dip in gross margin this quarter was a stark reminder that the corporate had beforehand been benefitting from a development growth, and that growth interval now seems to be ending. Buyers might want to put together for extra regular financial circumstances and maybe even a bust relying on the place rates of interest find yourself. Anticipate Tecnoglass shares to stay unstable in coming months as buyers digest the altering financial cycle. However for buyers with a a number of yr time horizon, I now see TGLS inventory as providing a lovely threat/reward profile as soon as once more.