xxwp

TriplePoint Enterprise Progress (NYSE:TPVG) is a small-cap BDC that made waves in 2023 due to a surge in problematic loans the funding agency has in its portfolio. Though the funding firm nonetheless covers its dividend with NII, I consider a dividend lower is probably lurking within the shadows. Given the poor high quality of the BDC’s present mortgage portfolio, I additionally consider that the P/NAV ratio just isn’t enticing sufficient for buyers to danger their capital on this BDC. Contemplating that TriplePoint Enterprise had 4.7% of its loans marked as non-performing, I would wish at the very least a 20% low cost to NAV earlier than shopping for into this BDC at this level!

Earlier protection

I’ve not lined TriplePoint Enterprise Progress earlier than, however lined a rival, Hercules Capital (HTGC), only a few days in the past: A Magnificent 10% Yield For Lengthy-Time period Traders.

Hercules Capital primarily operates in the identical trade as TriplePoint Enterprise, however this BDC has earned a robust purchase ranking from me as a consequence of the truth that it has spectacular NII/dividend protection. Traders do pay for the premium, nevertheless, as Hercules Capital is buying and selling at a 40%+ premium to internet asset worth.

Poor mortgage high quality could also be an issue for dividend buyers…

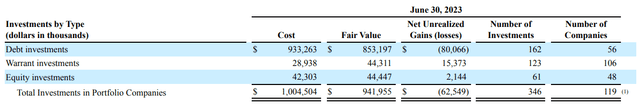

TriplePoint Enterprise is an externally-managed, closed-end BDC with a slim area of interest deal with expertise, life sciences, and different high-growth industries which were backed by the enterprise trade. The portfolio was comprised, on the finish of the June quarter mainly of debt investments: TriplePoint Enterprise’s debt investments totaled $853.2M and the BDC’s complete portfolio was valued at $941.5M.

Supply: TriplePoint Enterprise

The issue with TriplePoint Enterprise is that the BDC has seen an increase in drawback loans in its portfolio with the non-accrual share rising from 1.1% in This autumn’22 to 4.7% in Q2’23, displaying an enormous improve of three.6 PP.

Non-accrual investments as of June 30, 2023 totaled $40.1M and a complete of six portfolio corporations fell behind on funds. The overall greenback worth of non-accruals elevated by an element of 4.4X between the top of FY 2022 and the top of the second-quarter… which represents a surprising decline in mortgage high quality. For context, Hercules Capital’s Q2’23 earnings report confirmed a non-accrual share of 0.0% (Supply)… which is why I consider that Hercules Capital is by far the superior funding alternative.

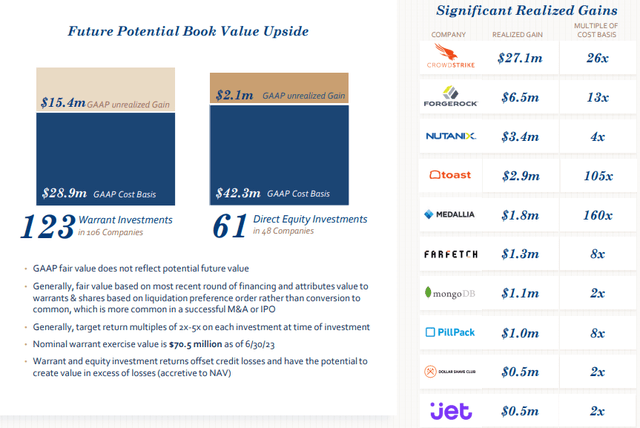

Along with debt investments, TriplePoint Enterprise takes fairness in corporations and makes use of warrant buildings that characterize out-sized return potential. Like Hercules Capital, TriplePoint Enterprise has struck some actual winners with its funding technique. Nevertheless, returns from fairness and warrant investments are inconceivable to venture.

Supply: TriplePoint Enterprise

To date the dividend has been lined with NII…

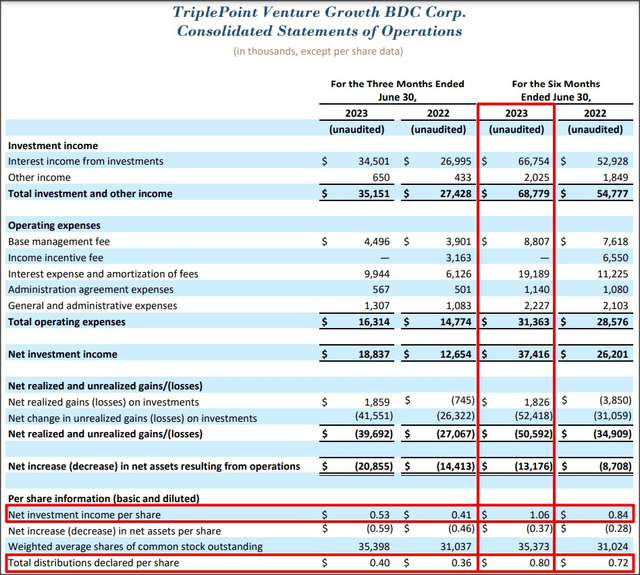

TriplePoint Enterprise’s dividend, at the very least to this point, is supported by NII, however a further uptick within the non-accrual share, because it pertains to the debt portion of the BDC’s portfolio, could ultimately set off a dividend lower.

TriplePoint Enterprise disclosed $37.4M in NII for the primary six months which calculated to $1.06 per-share in NII. The BDC set a quarterly dividend fee of $0.40 within the first-quarter of FY 2023 and has since distributed $0.80 per-share. The NII/dividend protection ratio has been 133%. Nevertheless, the BDC’s portfolio high quality is a important subject that buyers ought to rigorously take note of. A rising quantity of loans for which the payer has stopped making funds finally signifies a dividend lower… and I consider that is what the near-16% yield already alerts to the market.

Supply: TriplePoint Enterprise

TriplePoint Enterprise Progress in contrast towards Hercules Capital

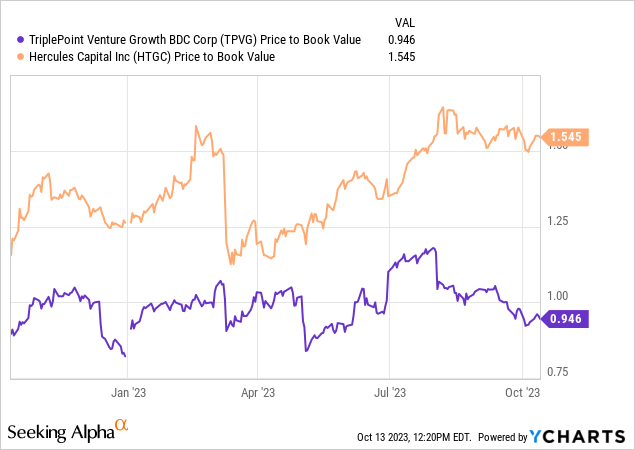

Dividend buyers virtually have two selections right here: They may purchase a high-quality BDC like Hercules Capital… which sustainably earns its dividend with NII and trades at an admittedly excessive premium to NAV. Or they’ll purchase a lower-quality BDC like TriplePoint Enterprise… which has considerably greater NII and dividend dangers… and that sells at a reduction to NAV. Which one to decide on is dependent upon buyers’ danger acceptance: if safe dividend revenue issues to you greater than the rest, then HTGC often is the better option. When you have the next danger acceptance and also you consider that TPVG is a play on recovering portfolio high quality, then an in funding in TPVG could repay.

Apart from the distinction in portfolio high quality mentioned above, the valuation hole between HTGC and TPVG reveals that dividend buyers worth the previous way more extremely whereas the market seems to anticipate that the dividend might be lower for TriplePoint Enterprise: TPVG at the moment trades at a P/NAV ratio of 0.95X… implying a 5% NAV low cost. HTGC, as indicated by its P/NAV, is a very costly BDC funding. TPVG’s poor asset high quality in addition to rising dividend dangers are possible the explanations for the big relative valuation discrepancy between these two BDCs.

I would wish at the very least a 20% low cost (0.8X P/NAV) ratio to really feel enticed sufficient to put money into TriplePoint Enterprise as the chance profile appears to be like really unattractive. The BDC’s third-quarter earnings report will present what path the TriplePoint’s non-accrual share has taken.

Dangers with TPVG

The dangers clearly heart across the BDC’s funding portfolio and the standard of the loans contained therein. TriplePoint Enterprise’s surge within the non-accrual share signifies that the corporate is going through severe high quality points and this will finally be mirrored in a dividend lower.

Ultimate ideas

TriplePoint Enterprise just isn’t a high-quality BDC and loses in a direct comparability to HTGC, in my view. Hercules Capital has no credit score points whereas TriplePoint Enterprise has a whole lot of them. TriplePoint Enterprise Progress sells at a a lot decrease P/NAV ratio than Hercules Capital (at a 5% low cost to NAV really), however the low cost just isn’t massive sufficient to compensate me for the excessive quantity of NII and dividend dangers which can be related to an under-performing debt portfolio. Subsequently, I consider there’s a excessive likelihood that TriplePoint Enterprise Progress will see a down-trend in its NII within the coming quarters they usually dividend may be placed on the chopping block. Traders that desire high quality, ought to take into account shopping for Hercules Capital as an alternative, in my view!