arild lilleboe

Observe:

I’ve coated Transocean Ltd. (NYSE:RIG) beforehand, so buyers ought to view this as an replace to my earlier articles on the corporate.

Final week, main offshore driller Transocean Ltd. or “Transocean” reported a powerful contract win for the harsh-environment semi-submersible rig Transocean Equinox:

Transocean Ltd. (…) right this moment introduced a 16-well binding award for the Transocean Equinox in Australia for a consortium of 4 operators. The estimated 380-day marketing campaign contributes roughly $184 million in backlog, excluding full compensation for mobilization and demobilization. The engagement additionally consists of choices that, if totally exercised, might hold the Transocean Equinox working in Australia into 2028.

This new award is predicted to start within the first quarter of 2025 in direct continuation of the rig’s beforehand introduced five-well, 300-day dedication in Australia with a serious operator, at present anticipated to start out within the first quarter of 2024.

Together with mobilization and demobilization charges, the estimated dayrate needs to be nicely above $500,000, a quantity not witnessed for nearly a decade within the harsh atmosphere of floater area:

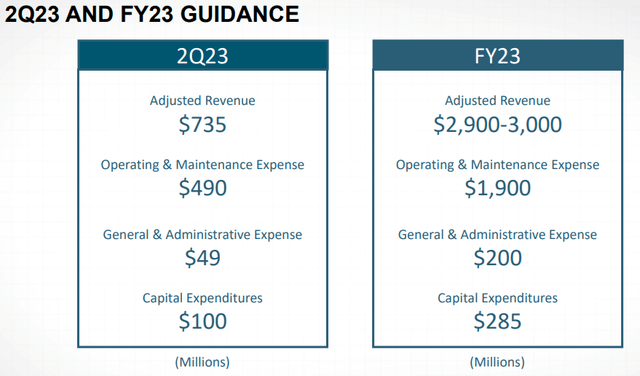

Firm Presentation

In response to Esgian Rig Analytics (“Esgian”), the operator for the contract is known to be nicely administration firm Zenith Vitality, representing Seashore Vitality (OTCPK:BEPTF, OTCPK:BCHEY), Cooper Vitality (OTCPK:COPJF), Woodside Vitality Group (WDS, OTC:WOPEF), and ConocoPhillips (COP).

Bear in mind, Transocean Equinox has been sitting idle since October 2022 after Equinor (EQNR) surprisingly terminated the rig’s long-term contract forward of time.

Whereas the rig is more likely to stay warm-stacked for the rest of the yr, Transocean not too long ago secured new work for the unit offshore Australia with the 300-day contract anticipated to start within the first quarter of 2024.

Assuming the train of all choices for the rig, Transocean Equinox received’t be obtainable for brand spanking new employment till 2028.

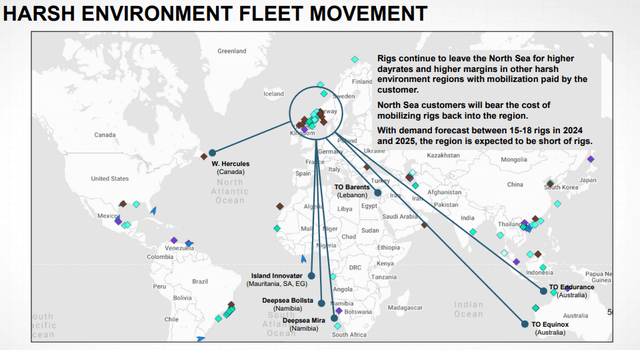

With sister rig Transocean Endurance and several other different harsh atmosphere floaters additionally scheduled to go away the at present weak North Sea markets, the area may very nicely find yourself being in need of rigs as soon as demand is returning:

Firm Presentation

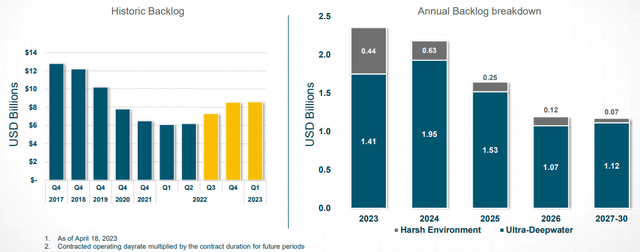

Whereas the most recent contract award is actually nice information, buyers will probably have to arrange for a sequentially decrease backlog quantity in Transocean’s subsequent fleet standing report later this month.

Firm Presentation

In actual fact, the corporate has not disclosed a single drillship award in current months which isn’t precisely comforting given the truth that the ultra-deepwater drillship Discoverer Inspiration has been sitting idle within the U.S. Gulf of Mexico for a while now.

As well as, ultra-deepwater drillship Deepwater Invictus is scheduled to roll off the contract later this month.

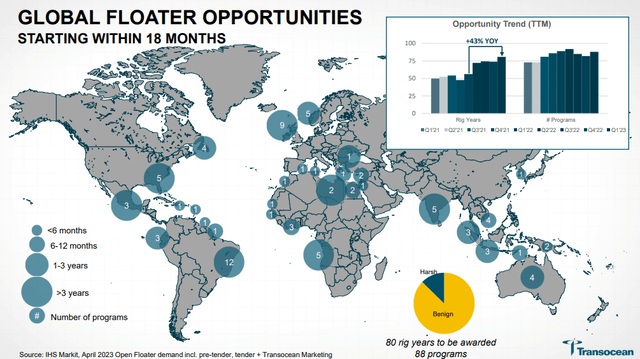

That stated, even with drillship demand within the U.S. Gulf of Mexico apparently not as robust as beforehand anticipated, there are nonetheless alternatives in different areas, notably Brazil and West Africa.

In response to Esgian, Petrobras (PBR) has invited plenty of rigs to maneuver into section two for the Buzios tender:

This follows the retendering of the chance in March to replace the goal begin window and supply an prolonged mobilization interval with a view to accommodate newbuilds or reactivations. Petrobras is known to have requested new pricing, with the brand new gives believed due by 14 July.

Furthermore, Esgian signifies that Azule Vitality is near awarding a brand new drillship contract for work offshore Angola.

Assuming no additional materials contract awards till the discharge of Transocean’s subsequent fleet standing report, I’d estimate mixture gross backlog addition to be under $400 million.

With projected Q2 contract drilling revenues of $735 million, I’d count on the reported backlog to be down by as much as 5% sequentially to between $8.2 billion and $8.3 billion.

Firm Presentation

As well as, Transocean is unlikely to announce cold-stacked drillship reactivations within the firm’s upcoming Q2 report which is likely to be thought-about disappointing by some buyers.

That stated, general market situations stay robust, and I’d be very shocked to see Deepwater Inspiration and Deepwater Invictus sitting idle for an prolonged time period.

Firm Presentation

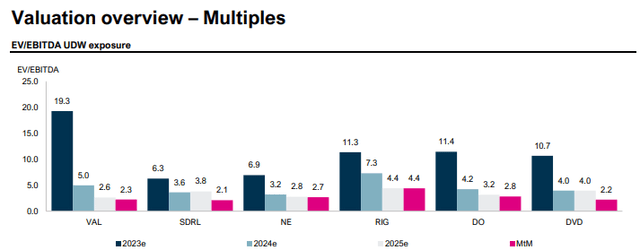

Valuation-wise, Transocean stays costly relative to friends based mostly on 2024 profitability expectations:

Pareto Securities

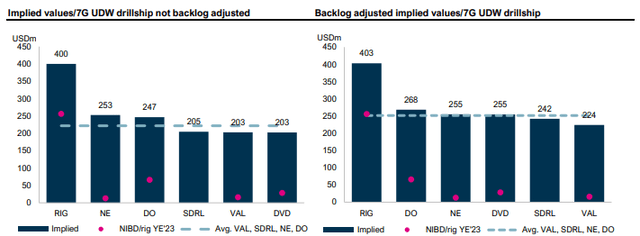

The identical goes for implied seventh era drillship values:

Pareto Securities

Given this situation, buyers also needs to contemplate different U.S. exchange-listed opponents like Noble Corp. (NE), Valaris (VAL), Seadrill (SDRL), and Diamond Offshore (DO) in addition to jack-up pure play Borr Drilling (BORR).

Backside Line

Transocean reported a powerful contract win offshore Australia which could hold the tough atmosphere semi-submersible rig Transocean Equinox within the area nicely into 2028.

Whereas the corporate has demonstrated substantial progress on the semi-submersible entrance in current months, Transocean has not reported a single drillship award because the firm’s final fleet standing report in mid-April.

In consequence, internet backlog addition within the upcoming July fleet standing report is more likely to be unfavorable.

Furthermore, some buyers is likely to be upset by the continued lack of cold-stacked drillship reactivation bulletins, however I wouldn’t be shocked to see an award offshore Brazil later this yr for one of many cold-stacked seventh era drillships inherited from Ocean Rig.

Whereas shares stay costly based mostly on plenty of key metrics when in comparison with U.S. exchange-listed opponents, I’d use any main weak spot to provoke or add to current positions because the trade outlook stays robust.