HJBC

Thesis

Like different oil majors, TotalEnergies (NYSE:TTE) reported an exceptionally sturdy FY 2022 efficiency. Nevertheless, whereas different power corporations – particularly US primarily based firms – have began to commerce at a considerably cheap valuation, TTE continues to be priced at a FWD EV/EBIT of about x4.5.

In 2022, supported by excessive power costs, paired with strong quantity, the European Oil Main generated $49.1 billion of working earnings. Anchored on distinctive profitability, TotalEnergies balances engaging shareholder returns with long-term investments in a robust renewables power portfolio.

On the backdrop of bettering macroeconomic fundamentals, together with China’s COVID reopening, I elevate my EPS expectations for TTE by means of 2025, and I now calculate a base case goal value of $91.17/share.

Robust This autumn And FY 2022

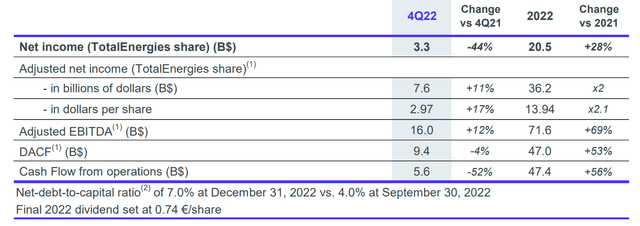

TotalEnergies ended 2022 with a formidable This autumn: From September to December, the corporate reported $63.95 billion in complete revenues, which displays an approximate 16% YoY progress in comparison with the identical interval within the earlier yr. The oil main’s working earnings for the interval got here in at $7.9 billion. Though working income decreased by 9% as in comparison with $8.7 billion in This autumn 2021, the outcome was about according to analyst expectations.

TotalEnergies’ full-year revenues for 2022 surged to $263.3 billion, versus $184.6 billion in 2021 (42% YoY progress). Supported by favorable power costs, TotalEnergies achieved its highest-ever FY adjusted profitability degree, propelled by strong top-line progress. In FY 2022, the European Oil Main generated working earnings of practically $49.1 billion, greater than double the $23.7 billion achieved in 2021.

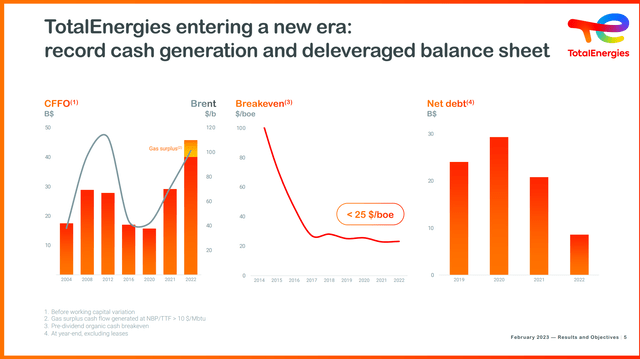

TotalEnergies 2022 Presentation

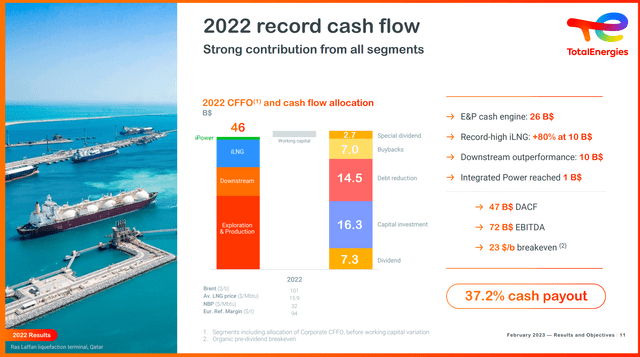

On the backdrop of an distinctive profitability, TotalEnergies allotted roughly $17 billion to shareholders, $7 billion within the type of share buybacks, $7.3 billion in type of dividends and $2.7 billion in type of a particular dividend. Notably, as in comparison with a market capitalization of about $160 billion, in 2022 TotalEnergies traders loved an fairness yield of near 11%.

TotalEnergies 2022 Presentation

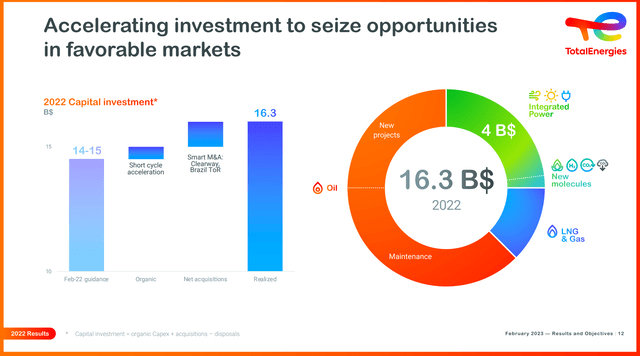

Along with $17 billion of shareholder distributions, TotalEnergies allotted about $14.5 billion to debt discount – bringing the corporate’s internet monetary debt to $19 billion — and TTE allotted $16.3 billion to enterprise investments. With that body of reference, TotalEnergies invested $4 billion to increase the corporate’s renewables energies enterprise and near $2 billion to develop the LNG & Gasoline phase.

TotalEnergies 2022 Presentation

Going Into 2023 With Confidence

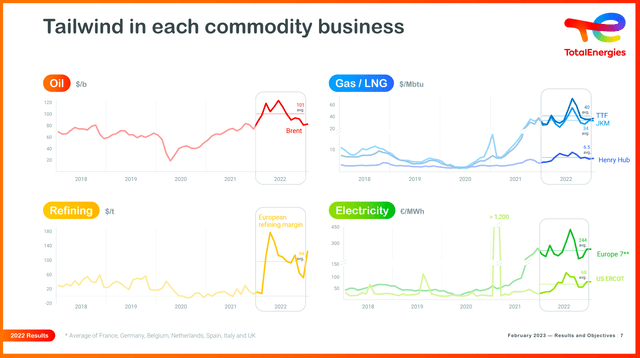

TotalEnergies’ administration anticipates that oil costs will stay favorable in 2023 Q1, because of a rebound in Chinese language demand, uncertainty round Russian exports, and depleted oil inventories worldwide. That mentioned, traders ought to think about that the power market was already stretched in 2022, however the year-long COVID lockdown in China. Now, as China lifts COVID restrictions and Europe’s economic system begins to get well, the primary half of 2023 is predicted to expertise a robust demand restoration.

TotalEnergies 2022 Presentation

Notably, TotalEnergies’ administration expects the brent benchmark to development round $80 per barrel, whereas the corporate forecasts refining margins in Europe–specifically for fuels reminiscent of diesel–to be boosted by the European embargo on Russian oil merchandise. That mentioned, if oil costs would certainly development round $80 in 2023, TotalEnergies is poised for one more yr of remarkable profitability.

Our oil value sensitivity is usually underestimated. However clearly, in 2022, we benefited strongly from the rise in oil costs, because of our low breakeven and low-cost portfolio, which allowed us to seize this value improve.

Anchored on administration commentary and sensitivity assumptions, I estimate that TotalEnergies is more likely to accumulate about $35 – $45 billion of working earnings in 2023. And given the corporate’s steadiness sheet power, I assume that TotalEnergies might probably afford to distribute one other $15 – $20 billion to shareholders in 2023.

For reference, TotalEnergies’ breakeven $/boe is under $25.

TotalEnergies 2022 Presentation

Valuation Replace: Nonetheless Too Low cost To Ignore

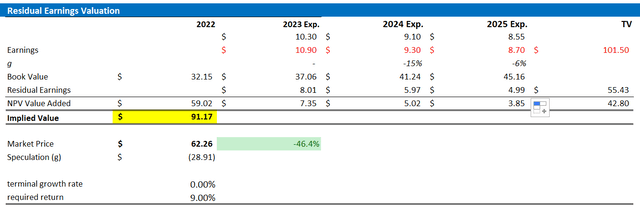

Anticipating a pointy financial rebound in China, which is able to probably assist elevated power costs, I now estimate that TTE’s EPS in 2023 will probably increase to someplace between $10.7 and $11.0 (according to consensus estimates). I additionally replace my EPS expectations for 2024 and 2025 to $9.30 and $8.70, respectively.

I proceed to anchor on a 0% terminal progress price, in addition to on a 9% value of fairness.

Given the EPS upgrades as highlighted under, I now calculate a good implied share value of $91.17.

Creator’s EPS Estimates; Creator’s Calculations

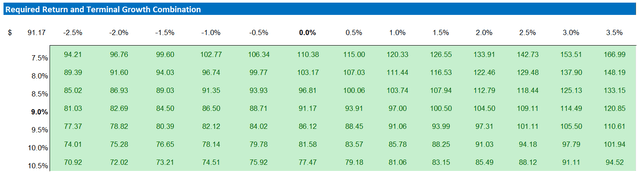

Under is the up to date sensitivity desk.

Creator’s EPS Estimates; Creator’s Calculations

Conclusion

TotalEnergies’ profitability continues to be supported by a robust power market. And reflecting on a cautiously optimistic outlook for 2023, paired with a robust demand tailwind coming from the China COVID reopening, I’m assured to mannequin sturdy EPS although 2025.

With that body of reference, I argue TotalEnergies inventory ought to commerce near $91.17/share (TTE reference) with a purpose to be pretty priced. TTE stays a “Purchase.”