Lari Bat

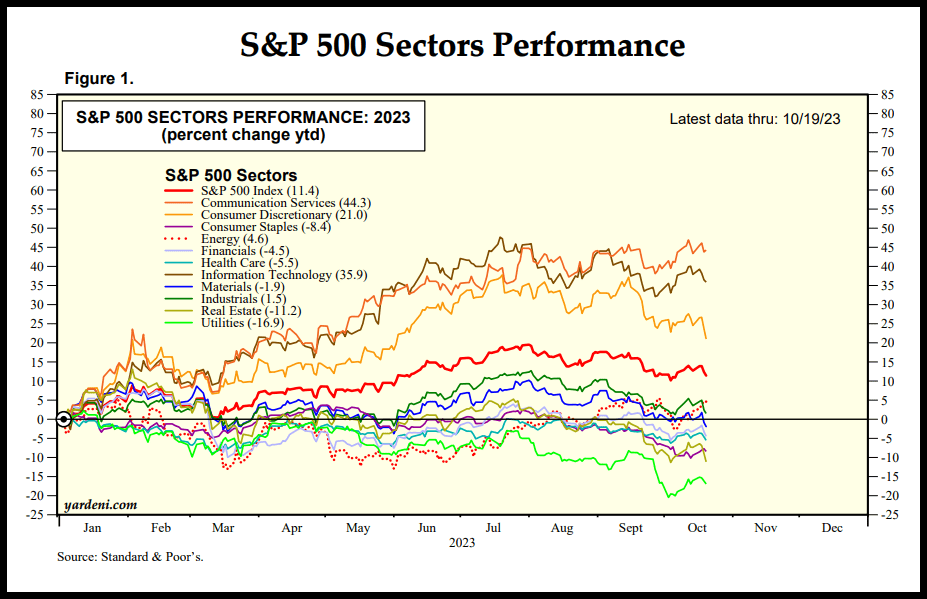

Actual property (XLRE) continues to be one of many worst-performing sectors, -10.86% YTD, amid traditionally excessive charges, tight provides, and customers’ reluctance to buy after locking in traditionally low charges in the course of the pandemic.

S&P 500 Sectors Efficiency (Yardeni Analysis, S&P)

Mortgage charges are effectively above 7%, dampening gross sales, which is why Firstam deputy chief economist Odeta Kushi acknowledged, “Right now’s housing market is not something just like the housing market of the mid-2000s – the housing market right now just isn’t overbuilt, neither is it pushed by free lending requirements, sub-prime mortgages, or householders who’re extremely leveraged.” Regardless of tight provides and the slowdown within the housing market, costs proceed to climb, posing alternatives for traders desirous about construction-related shares.

Quite than interact in bidding wars, some homebuyers wish to construct from the bottom up. The iShares U.S. House Building ETF (ITB) is +18% YTD and up practically 44% during the last 12 months. Along with the uptick in U.S. house building, the SPDR® S&P Homebuilders ETF (XHB) is +16.95% YTD. Though provide chain constraints and financial uncertainty are potential dangers, particularly given the present geopolitical and macroeconomic considerations for industrials, among the fall in building shares might show to be nice buy-the-dip alternatives. Sterling Infrastructure (NASDAQ:STRL) fell as a lot as 15% intraday on October thirteenth amid promoting pressures but gives glorious fundamentals and a robust outlook. Tripling its share worth during the last 12 months amid an increase in infrastructure tasks, take into account this prime inventory for a portfolio.

Sterling Infrastructure, Inc. (STRL)

-

Market Capitalization: $2.21B

-

Quant Score: Sturdy Purchase

-

Quant Sector Rating (as of 10/20/23): 6 out of 654

-

Quant Business Rating (as of 10/20/23): 3 out of 34

Providing a buy-the-dip alternative after its decline in latest weeks, Sterling Infrastructure is an business chief in E-infrastructure, large-scale web site improvement for knowledge facilities, transportation, and constructing options. Delivering large top-line development and increasing margins, Sterling’s observe report of differentiated, higher-margin freeway building and engineering permits STRL to boast of constructing, creating, and facilitating change and that “Our individuals work smarter, not tougher” to provide excessive outcomes for the group. After the Utah Division of Transportation awarded a big freeway mission and a $216M UDOT contract with its three way partnership associate, W.W. Clyde & Co., Sterling is an undervalued firm that provides sturdy development and profitability via strategic execution.

STRL Inventory Valuation and Momentum

Regardless of Sterling Infrastructure’s bullish momentum, with a YTD value efficiency of +109% and +183% during the last 12 months, STRL maintains a reduced valuation.

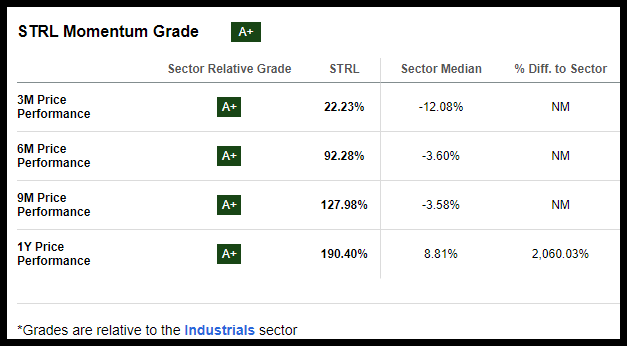

STRL Inventory Momentum Grades (SA Premium)

Sterling’s quarterly value efficiency considerably outperforms the sector median and its B- Valuation Grade is supported by a ahead PEG of 0.88x versus the sector median of 1.61x. Sterling’s ahead Value/Gross sales is a 13% low cost to the sector, and the corporate has a robust 6.17x Value/Money Stream (TTM) in comparison with the sector’s 12.33x. Contemplating its step by step rising quarterly value efficiency and A+ momentum, I imagine this inventory is primed for potential upside.

STRL Inventory Progress and Profitability

Because the pattern for car electrification grows, Sterling Infrastructure has regarded to capitalize. Nabbing an EV battery facility mission for Hyundai and a $45M web site improvement contract for Rivian’s Georgia EV facility, it needs to be no shock why STRL was chosen as certainly one of my High 10 Shares for the second half of 2023 and was chosen by one of the best of one of the best quant shares for Alpha Picks.

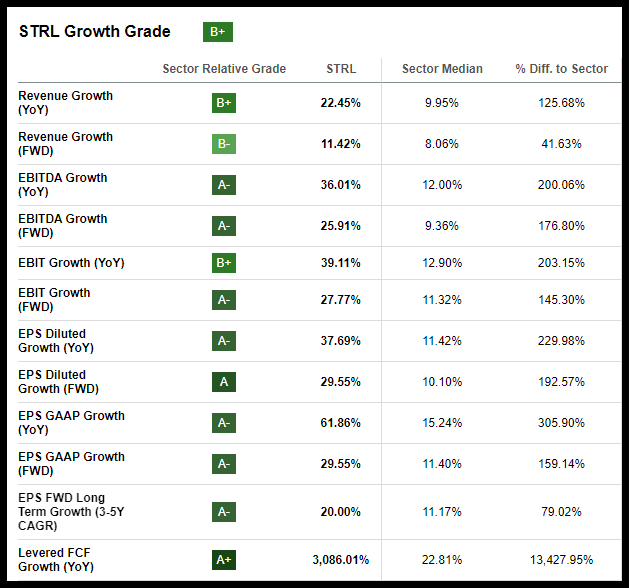

STRL Inventory Progress Grades (SA Premium)

Sterling Infrastructure’s development is powerful on the heels of 9 back-to-back earnings beats. Exceptionally sturdy money flows for its newest earnings beats and 42% development in its backlog from year-end 2022 have allowed its stability sheet to be in nice form. Sterling’s Q2 2023 EPS of $1.27 beat by $0.35, and income of $522.33M beat by and margin producing segments. STRL delivered 22% natural top-line development. Highlighted by its President and CEO, Joseph Cutillo, in the course of the Q2 earnings name,

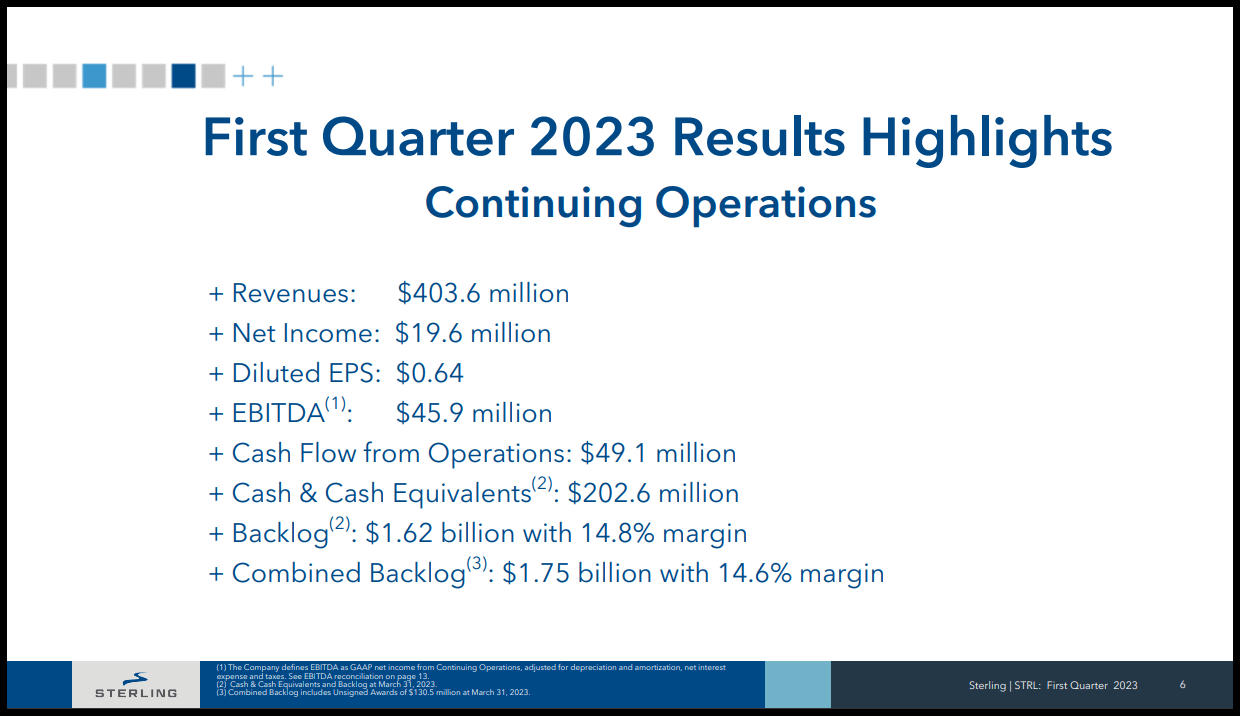

“Our individuals are out within the discipline every single day, utilizing their entrepreneurial spirit to win tasks, execute flawlessly, and push Sterling to the subsequent degree…Our sturdy backlog place offers us confidence in our beforehand issued steering ranges, which we’re reiterating right now. Primarily based on our first quarter outcomes, we imagine we’re monitoring in the direction of the excessive finish of our 2023 steering, which suggests a 13% enhance in income and a 14% development in web revenue.”

STRL Inventory Q1 Outcomes (STRL Inventory Q1 2023 Investor Presentation)

Sterling’s backlog totals $1,624B, up $210M from the start of the 12 months, and its, backlog gross margins have been practically 15%, its biggest backlog margin in historical past. Given the large development, two Wall Road analysts have revised their FY1 estimate up during the last 90 days with zero downward revisions. With plans to learn from the 2021 Infrastructure Invoice and a path towards sustainability, STRL hopes to increase its geographic footprint, income, and margins. With the easing of provide chains since COVID, Sterling has recaptured among the losses from inefficiencies that impacted their margins in the course of the pandemic and plans to ramp up its massive tasks.

Potential Dangers

Provide chain constraints and macroeconomic challenges can pose dangers to industrials, particularly amid larger charges and customers’ budgets. The surge in Rates of interest and price of uncooked supplies has prompted many corporations to really feel the results of elevated bills – an hostile impact on corporations. Greater leverage tends to create larger quantities of curiosity to be paid, which might show taxing for corporations struggling to repay loans. The costly price of capital for corporations unable to provide returns might discover it difficult to remain afloat financially ought to a market slowdown happen.

Labor shortages and well being and security hazards additionally have an effect on the development and engineering industries. Though security is a priority, STRL prides itself on reaching one of many business’s finest security data – the cornerstone of its operations.

Concluding Abstract

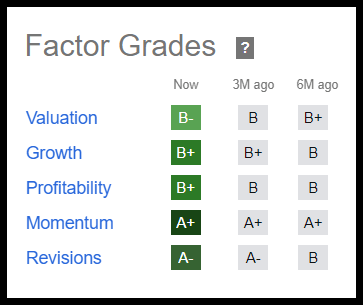

Industrials, particularly building, have skilled some volatility as financial slowdown, inflation, and geopolitical fears create headwinds. The place many corporations lack development or are buying and selling at poor valuations, STRL is powerful on every of the 5 core traits of valuation, development, profitability, momentum, and EPS revisions.

STRL Inventory Issue Grades

STRL Inventory Issue Grades (SA Premium)

In search of Alpha’s Issue Grades price funding traits on a sector-relative foundation, and STRL is among the best-performing building and engineering shares during the last 12 months. With a wholesome backlog of enterprise, high-margin tasks within the pipeline, and its innovation and diversified segments, STRL is in place financially and has sturdy momentum. Contemplate shopping for STRL long-term in a sector referred to as one of many industries driving the U.S. economic system.

Now we have many High Industrial shares to select from, or when you’re searching for a restricted variety of month-to-month concepts from the tons of of prime quant shares, take into account exploring Alpha Picks.