Printed on March 4th, 2025 by Bob Ciura

Spreadsheet knowledge up to date day by day

We advocate long-term traders deal with high-quality dividend shares. To that finish, we view the Dividend Aristocrats as among the many greatest dividend shares to buy-and-hold for the long term.

The Dividend Aristocrats have a protracted historical past of outperforming the market relating to risk-adjusted returns. There are at the moment 69 Dividend Aristocrats.

You’ll be able to obtain an Excel spreadsheet of all 69 Dividend Aristocrats (with metrics that matter equivalent to dividend yields and price-to-earnings ratios) by clicking the hyperlink under:

Disclaimer: Certain Dividend just isn’t affiliated with S&P International in any method. S&P International owns and maintains The Dividend Aristocrats Index. The data on this article and downloadable spreadsheet relies on Certain Dividend’s personal evaluation, abstract, and evaluation of the S&P 500 Dividend Aristocrats ETF (NOBL) and different sources, and is supposed to assist particular person traders higher perceive this ETF and the index upon which it’s based mostly. Not one of the data on this article or spreadsheet is official knowledge from S&P International. Seek the advice of S&P International for official data.

This text begins with an outline of the Dividend Aristocrats record. Then, we record our high 10 excessive progress Dividend Aristocrats.

The record under is comprised of 10 Dividend Aristocrats, all of which have raised their dividends for over 25 years in a row, and are included within the S&P 500 Index.

This text will record the ten Dividend Aristocrats with the best returns anticipated to come back from earnings progress. This doesn’t analyze anticipated whole returns, however reasonably how a lot future earnings progress will issue into the anticipated whole returns.

These 10 Dividend Aristocrats wouldn’t have excessive dividend yields right this moment. However with their outsized dividend progress potential, these 10 Dividend Aristocrats are optimum dividend shares to purchase and maintain for the long term.

Desk of Contents

Dividend Aristocrats Overview

The necessities to be a Dividend Aristocrat are:

- Be within the S&P 500

- Have 25+ consecutive years of dividend will increase

- Meet sure minimal dimension & liquidity necessities

All Dividend Aristocrats are high-quality companies based mostly on their lengthy dividend histories. An organization can’t pay rising dividends for 25+ years with out having a powerful and sturdy aggressive benefit.

However not all Dividend Aristocrats make equally good investments right this moment. That’s the place the spreadsheet on this article comes into play. You should utilize the Dividend Aristocrats spreadsheet to rapidly discover high quality dividend funding concepts.

The record of all 69 Dividend Aristocrats is efficacious as a result of it offers you a concise record of all S&P 500 shares with 25+ consecutive years of dividend will increase (that additionally meet sure minimal dimension and liquidity necessities).

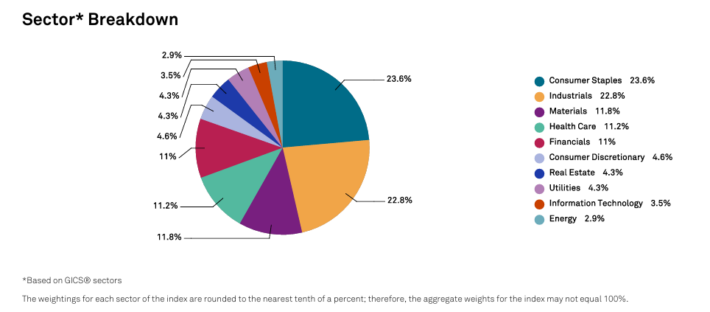

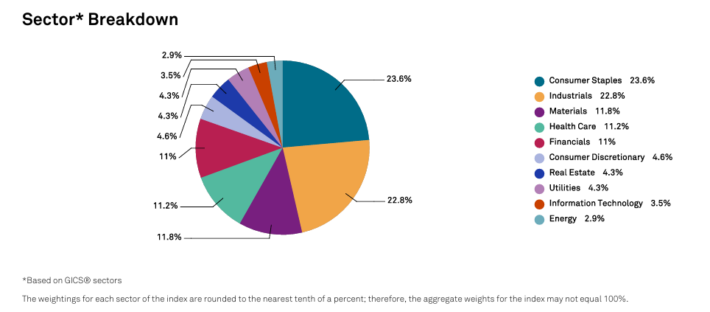

A sector breakdown of the Dividend Aristocrats Index is proven under:

The highest 2 sectors by weight within the Dividend Aristocrats are Industrials and Client Staples. The Dividend Aristocrats Index is tilted towards Client Staples and Industrials relative to the S&P 500.

These 2 sectors make up over 40% of the Dividend Aristocrats Index, however lower than 20% of the S&P 500.

The Dividend Aristocrats Index can be considerably underweight the Info Know-how sector, with a ~3.5% allocation in contrast with over 20% allocation throughout the S&P 500.

The next 10 Dividend Aristocrats have sturdy enterprise fashions, sturdy aggressive benefits, and long-term dividend progress potential.

Excessive Progress Dividend Aristocrat #10: Lowe’s Firms (LOW)

Lowe’s Firms is the second-largest house enchancment retailer within the US (after House Depot). It operates or providers greater than 1,700 house enchancment and {hardware} shops within the U.S.

Lowe’s reported fourth quarter 2024 outcomes on February twenty sixth, 2025. Complete gross sales got here in at $18.60 billion in comparison with $18.55 billion in the identical quarter a 12 months in the past.

Comparable gross sales elevated by 0.2%, whereas web earnings-per-share of $1.99 in comparison with $1.77 in fourth quarter 2023.

Adjusted EPS was decrease at $1.93. Lowe’s continues to be negatively impacted from a discount in DIY discretionary spending.

The corporate repurchased 5.5 million shares within the quarter for $1.4 billion. Moreover, it paid out $650 million in dividends.

Lowe’s initiated its fiscal 2025 outlook and expects to earn diluted EPS of $12.15 to $12.40 on whole gross sales of $83.5 to $84.5 billion.

Click on right here to obtain our most up-to-date Certain Evaluation report on LOW (preview of web page 1 of three proven under):

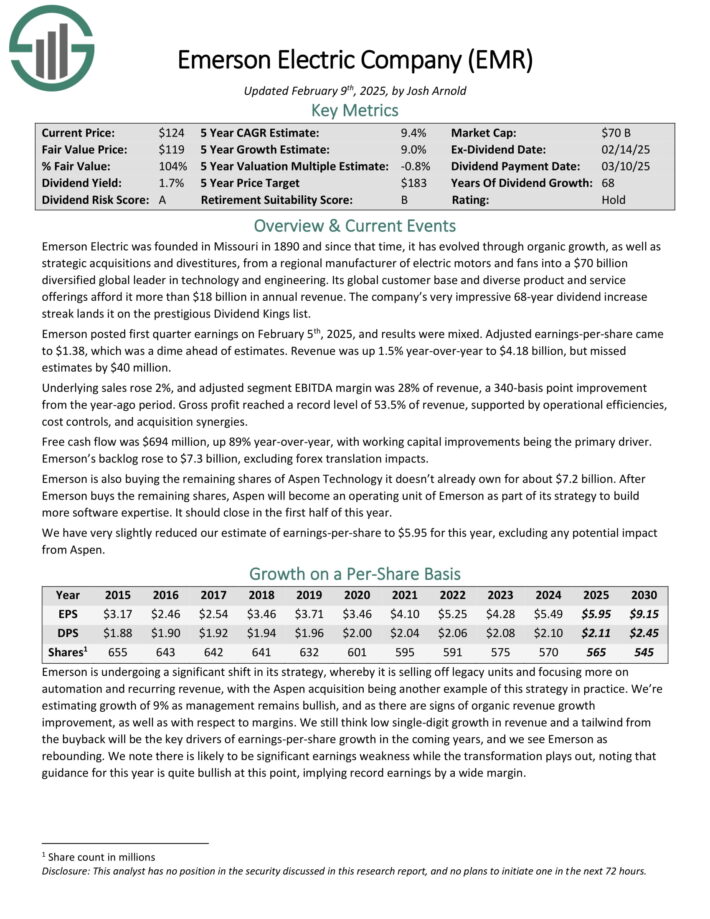

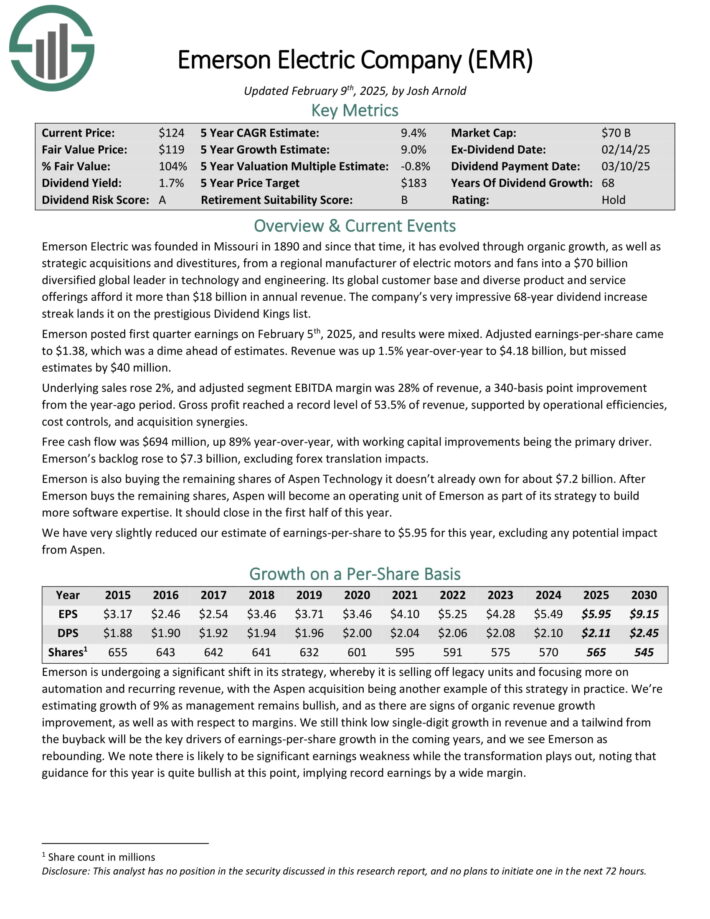

Excessive Progress Dividend Aristocrat #9: Emerson Electrical Co. (EMR)

Emerson Electrical is a diversified international chief in know-how and engineering. Its international buyer base and various product and repair choices afford it greater than $17 billion in annual income.

Emerson posted first quarter earnings on February fifth, 2025, and outcomes have been combined. Adjusted earnings-per-share got here to $1.38, which was a dime forward of estimates. Income was up 1.5% year-over-year to $4.18 billion, however missed estimates by $40 million.

Underlying gross sales rose 2%, and adjusted section EBITDA margin was 28% of income, a 340-basis level enchancment from the year-ago interval. Gross revenue reached a report stage of 53.5% of income, supported by operational efficiencies, price controls, and acquisition synergies.

Free money circulation was $694 million, up 89% year-over-year, with working capital enhancements being the first driver. Emerson’s backlog rose to $7.3 billion, excluding foreign exchange translation impacts.

Click on right here to obtain our most up-to-date Certain Evaluation report on EMR (preview of web page 1 of three proven under):

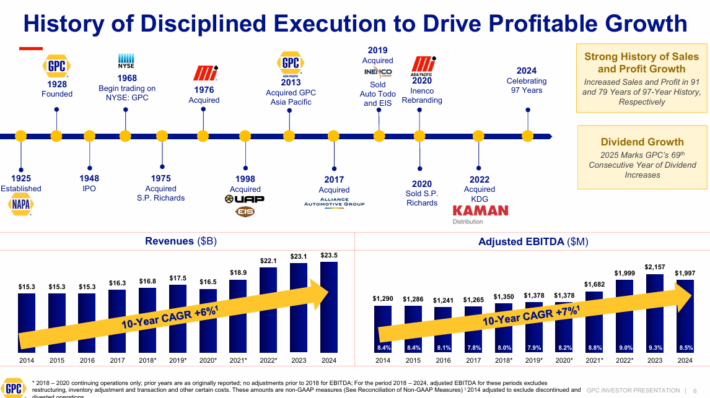

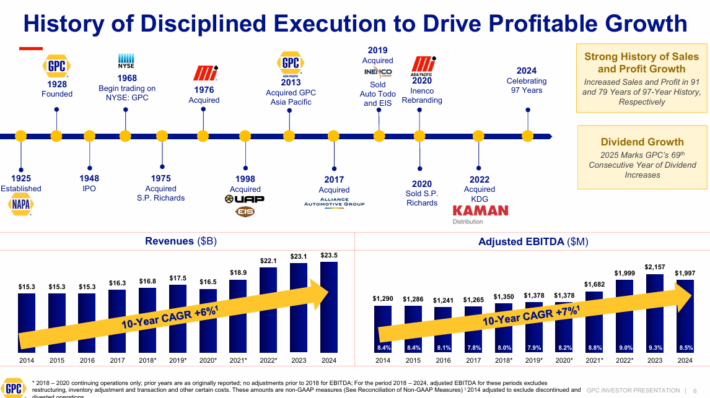

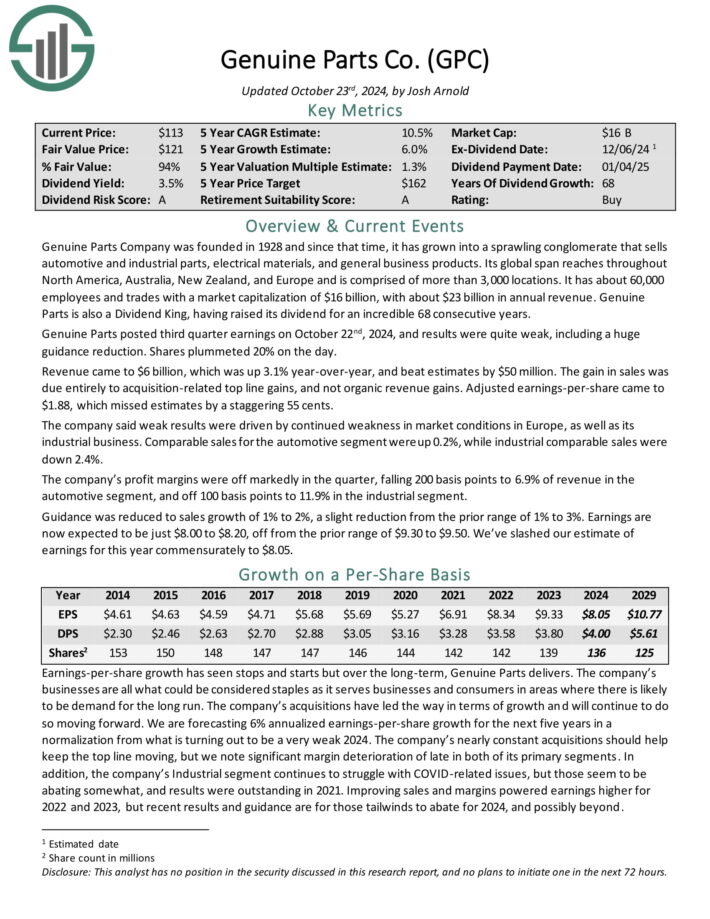

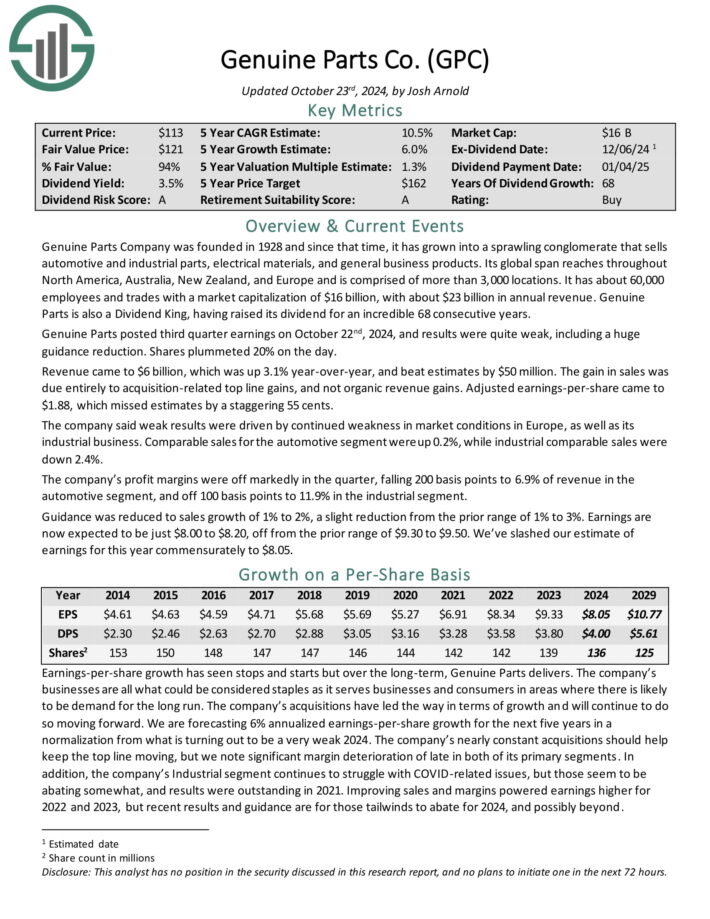

Excessive Progress Dividend Aristocrat #8: Real Components Co. (GPC)

Real Components has the world’s largest international auto elements community, with greater than 10,800 areas worldwide. As a serious distributor of automotive and industrial elements, Real Components generates annual income of practically $23 billion.

It operates two segments, that are automotive (consists of the NAPA model) and the commercial elements group which sells industrial alternative elements to MRO (upkeep, restore, and operations) and OEM (authentic tools producer) prospects.

Prospects are derived from a variety of segments, together with meals and beverage, metals and mining, oil and gasoline, and well being care.

Supply: Investor Presentation

The corporate reported its third-quarter 2024 outcomes, with gross sales reaching $6.0 billion, a 2.5% enhance from the earlier 12 months.

Web revenue fell to $227 million, or $1.62 per diluted share, down from $351 million in Q3 2023. Adjusted diluted earnings per share (EPS) additionally decreased to $1.88 in comparison with $2.49 final 12 months.

Click on right here to obtain our most up-to-date Certain Evaluation report on GPC (preview of web page 1 of three proven under):

Excessive Progress Dividend Aristocrat #7: Ecolab, Inc. (ECL)

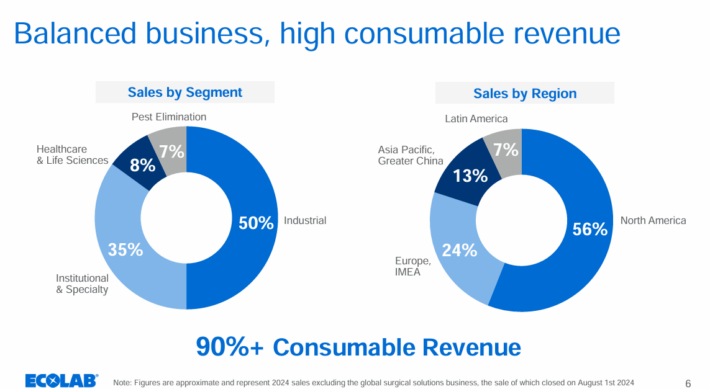

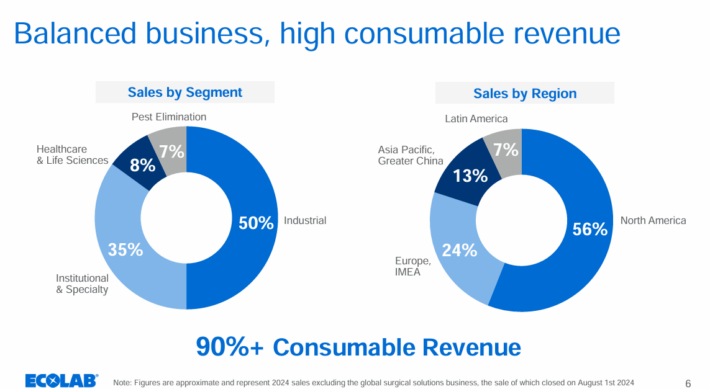

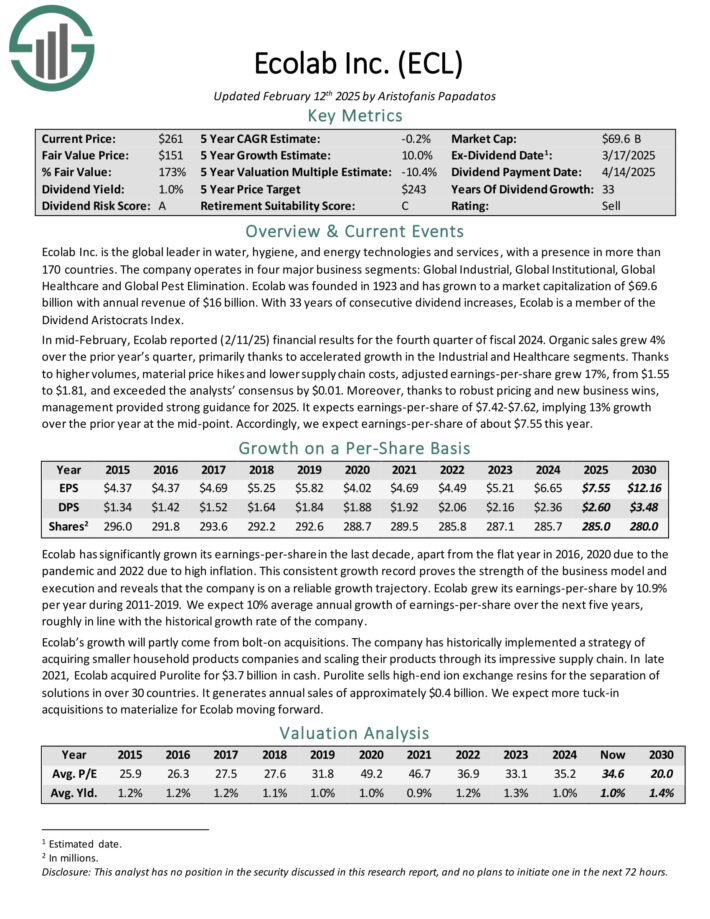

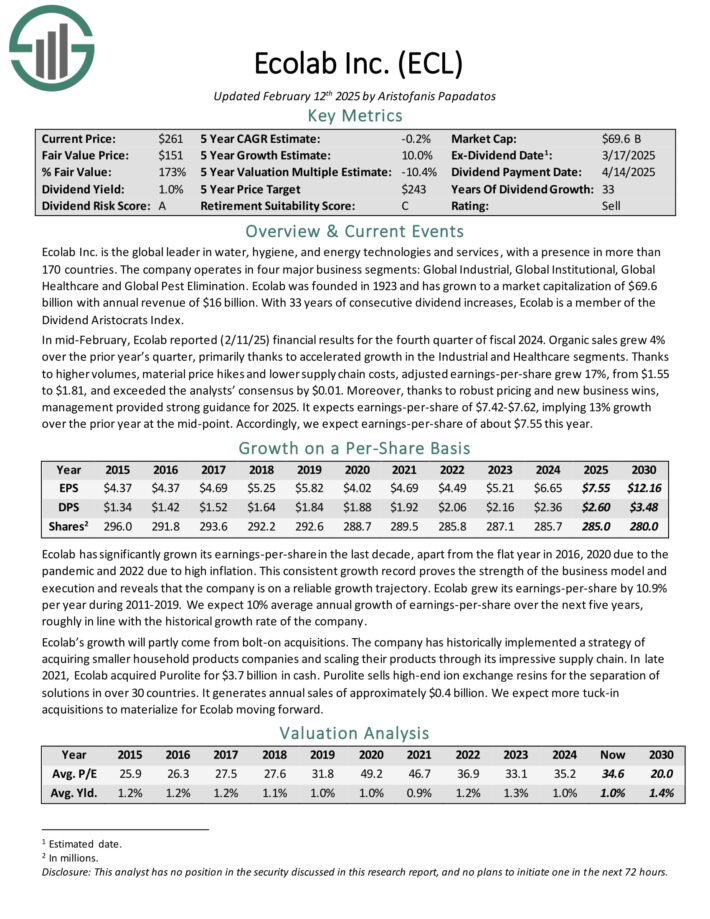

Ecolab Inc. is the worldwide chief in water, hygiene, and power applied sciences and providers, with a presence in additional than 170 international locations.

The corporate operates in 4 main enterprise segments: International Industrial, International Institutional, International Healthcare and International Pest Elimination.

Supply: Investor Presentation

In mid-February, Ecolab reported (2/11/25) monetary outcomes for the fourth quarter of fiscal 2024. Natural gross sales grew 4% over the prior 12 months’s quarter, primarily due to accelerated progress within the Industrial and Healthcare segments.

Due to increased volumes, materials value hikes and decrease provide chain prices, adjusted earnings-per-share grew 17%, from $1.55 to $1.81, and exceeded the analysts’ consensus by $0.01.

Furthermore, due to sturdy pricing and new enterprise wins, administration supplied sturdy steering for 2025. It expects earnings-per-share of $7.42-$7.62, implying 13% progress over the prior 12 months on the mid-point.

Click on right here to obtain our most up-to-date Certain Evaluation report on ECL (preview of web page 1 of three proven under):

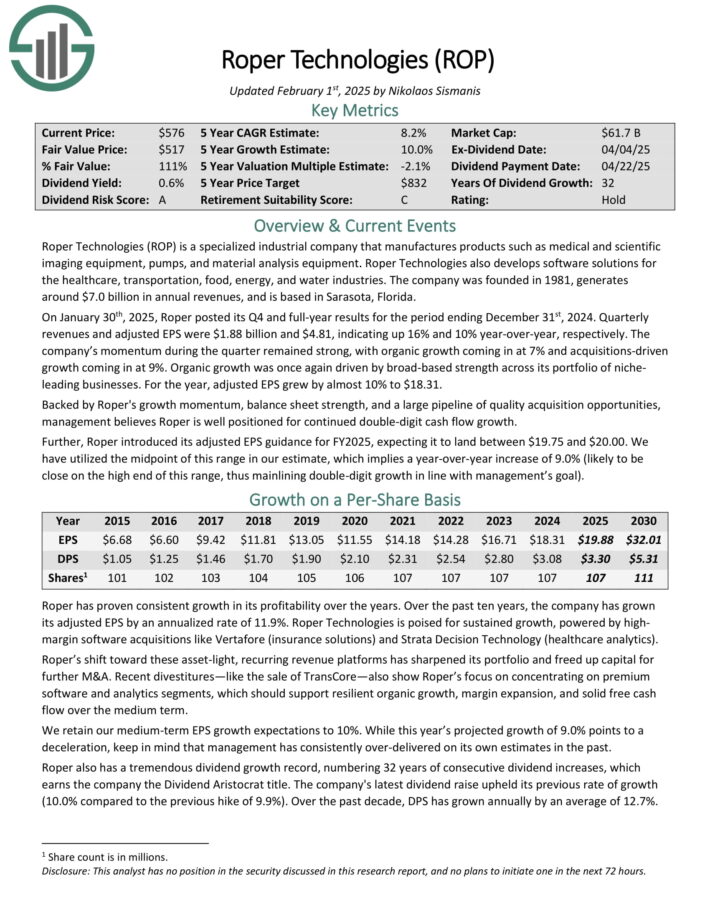

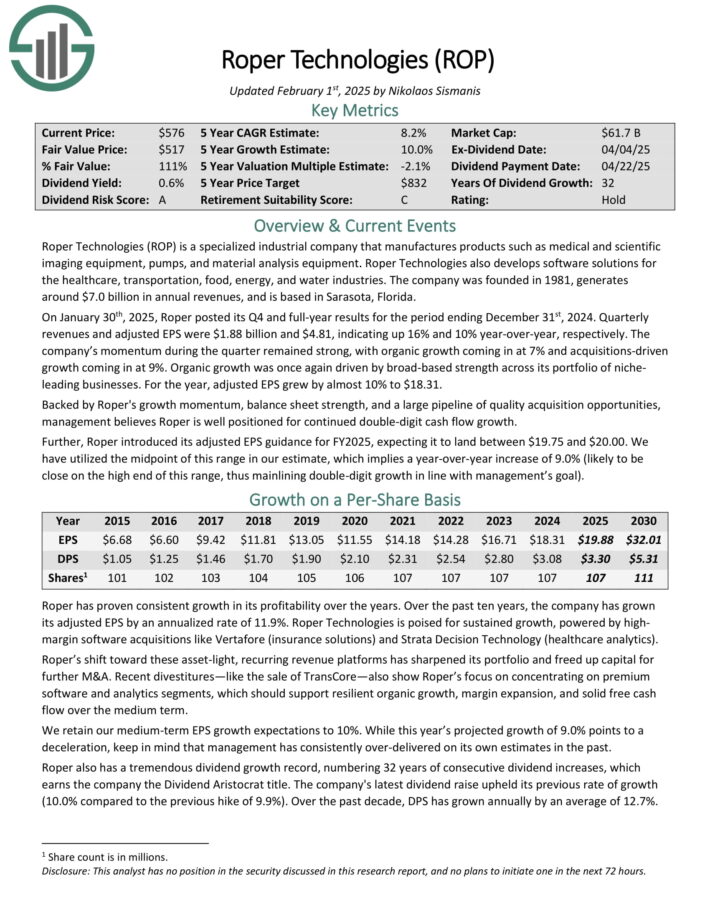

Excessive Progress Dividend Aristocrat #6: Roper Applied sciences Inc. (ROP)

Roper Applied sciences is a specialised industrial firm that manufactures merchandise equivalent to medical and scientific imaging tools, pumps, and materials evaluation tools.

Roper Applied sciences additionally develops software program options for the healthcare, transportation, meals, power, and water industries. The corporate was based in 1981, generates round $5.4 billion in annual revenues, and relies in Sarasota, Florida.

On January thirtieth, 2025, Roper posted its This fall and full-year outcomes for the interval ending December thirty first, 2024. Quarterly revenues and adjusted EPS have been $1.88 billion and $4.81, indicating up 16% and 10% year-over-year, respectively.

Supply: Investor Presentation

The corporate’s momentum throughout the quarter remained sturdy, with natural progress coming in at 7% and acquisitions pushed progress coming in at 9%.

Natural progress was as soon as once more pushed by broad-based power throughout its portfolio of area of interest main companies. For the 12 months, adjusted EPS grew by virtually 10% to $18.31.

Backed by Roper’s progress momentum, stability sheet power, and a big pipeline of high quality acquisition alternatives, administration believes Roper is effectively positioned for continued double-digit money circulation progress.

Additional, Roper launched its adjusted EPS steering for FY2025, anticipating it to land between $19.75 and $20.00.

Click on right here to obtain our most up-to-date Certain Evaluation report on ROP (preview of web page 1 of three proven under):

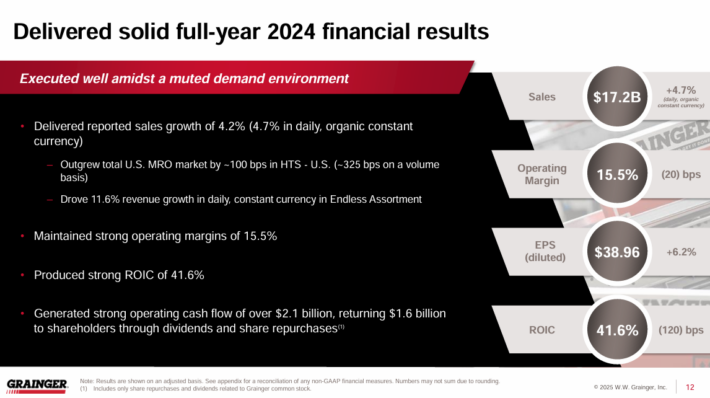

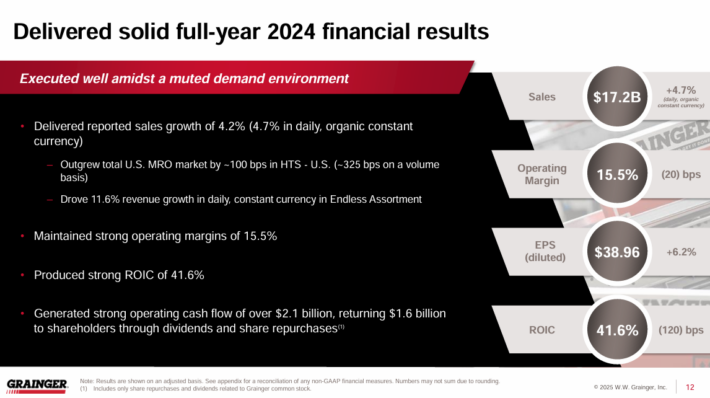

Excessive Progress Dividend Aristocrat #5: W.W. Grainger (GWW)

W.W. Grainger, headquartered in Lake Forest, IL, is among the world’s largest business-to-business distributors of upkeep, restore, and operations (“MRO”) provides.

Grainger has greater than 4.5 million lively prospects, with greater than 30 million merchandise supplied globally.

On January thirty first, 2025, W.W. Grainger posted its This fall and full-year outcomes. For the quarter, revenues have been $4.23 billion, up 5.9% on a reported foundation and up 4.7% on a day by day, fixed foreign money foundation in comparison with final 12 months.

Outcomes have been pushed by strong efficiency throughout the board. The Excessive-Contact Options section achieved gross sales progress of 4.0% on account of quantity progress in all geographies.

Supply: Investor Presentation

Within the Infinite Assortment section, gross sales have been up 15.1%. Income progress for the section was pushed by core B2B prospects throughout the section in addition to enterprise buyer progress at MonotaRO.

Web revenue equaled $475 million, up 20.2% in comparison with This fall-2023. Web revenue was boosted by a 110 foundation level enlargement within the working margin to fifteen.0%.

Earnings-per-share got here in at $9.74, 22.8% increased year-over-year, and have been additional aided by inventory buybacks. For the 12 months, EPS reached a report $38.71.

Click on right here to obtain our most up-to-date Certain Evaluation report on GWW (preview of web page 1 of three proven under):

Excessive Progress Dividend Aristocrat #4: Nordson Corp. (NDSN)

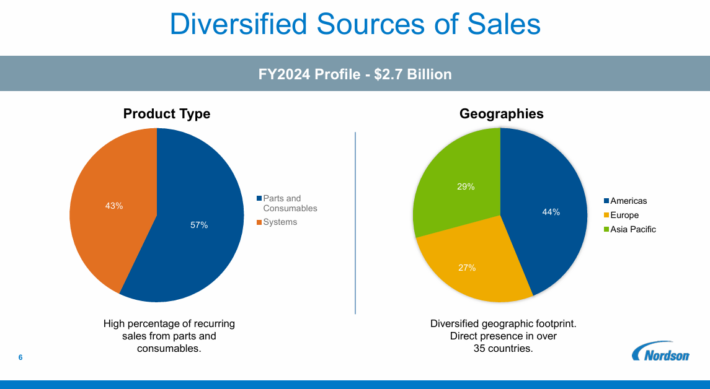

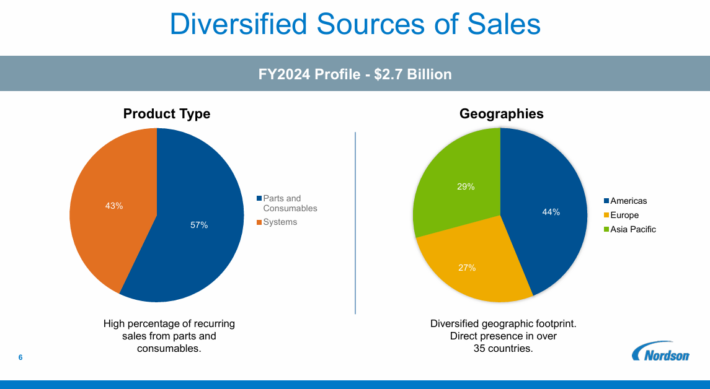

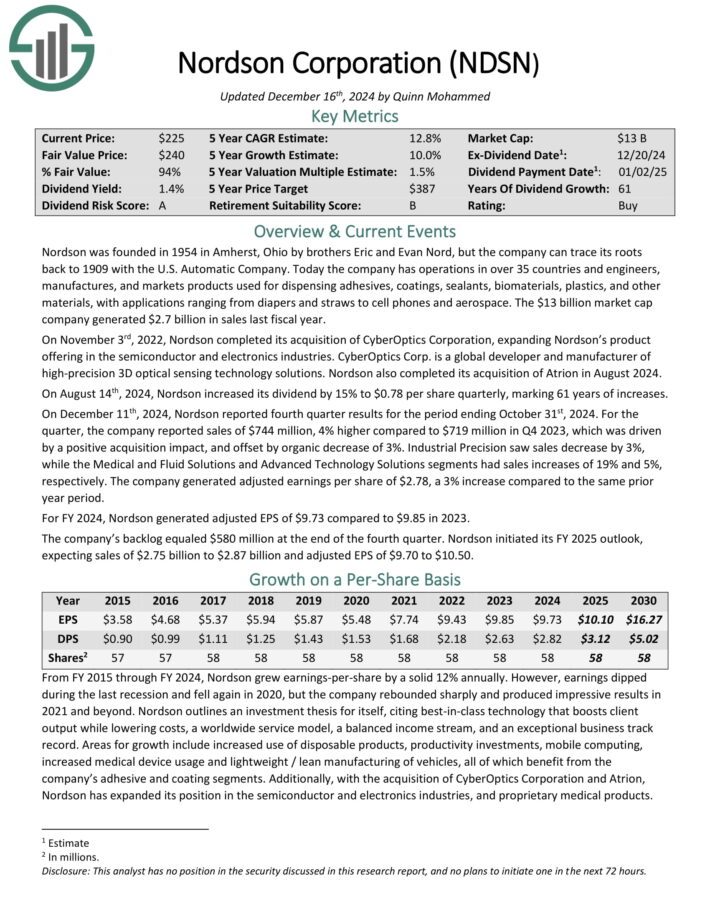

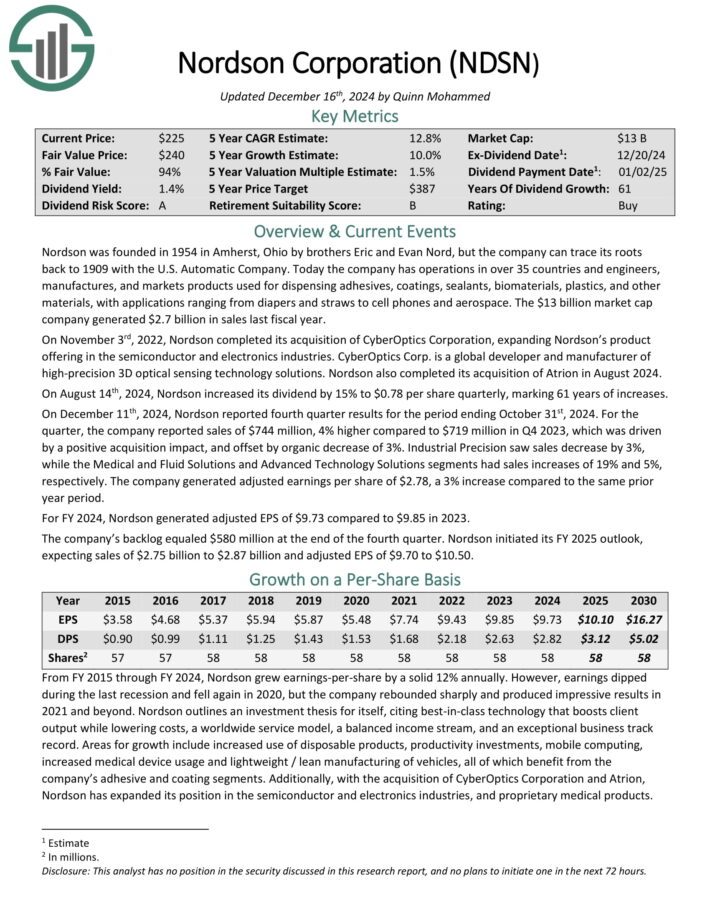

Nordson was based in 1954 in Amherst, Ohio by brothers Eric and Evan Nord, however the firm can hint its roots again to 1909 with the U.S. Computerized Firm.

Immediately the corporate has operations in over 35 international locations and engineers, manufactures, and markets merchandise used for allotting adhesives, coatings, sealants, biomaterials, plastics, and different supplies, with purposes starting from diapers and straws to cell telephones and aerospace.

Supply: Investor Presentation

On December eleventh, 2024, Nordson reported fourth quarter outcomes for the interval ending October thirty first, 2024. For the quarter, the corporate reported gross sales of $744 million, 4% increased in comparison with $719 million in This fall 2023, which was pushed by a optimistic acquisition impression, and offset by natural lower of three%.

Industrial Precision noticed gross sales lower by 3%, whereas the Medical and Fluid Options and Superior Know-how Options segments had gross sales will increase of 19% and 5%, respectively.

The corporate generated adjusted earnings per share of $2.78, a 3% enhance in comparison with the identical prior 12 months interval.

Click on right here to obtain our most up-to-date Certain Evaluation report on NDSN (preview of web page 1 of three proven under):

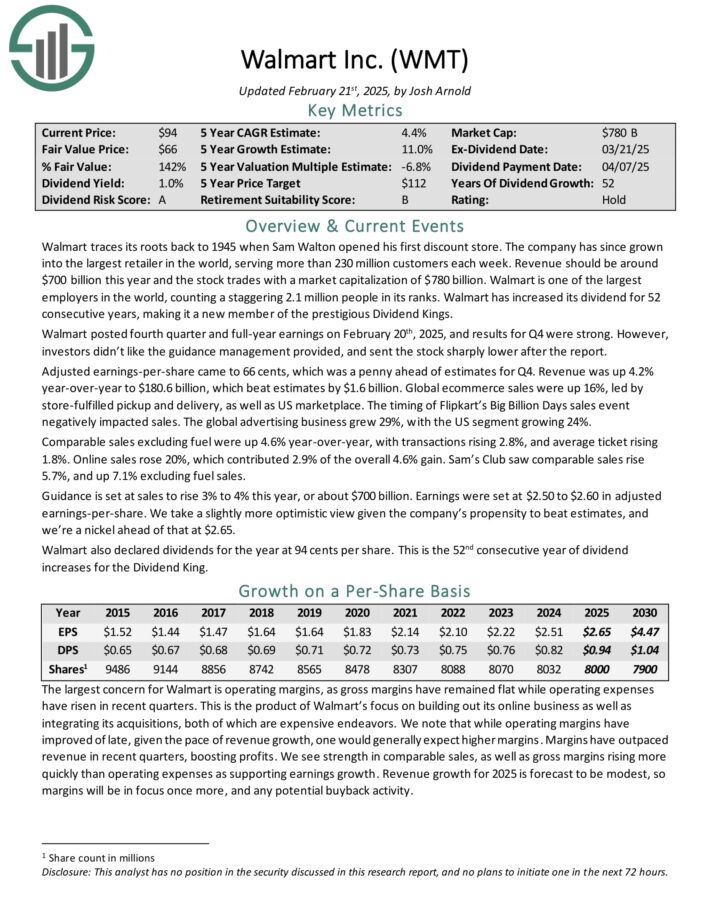

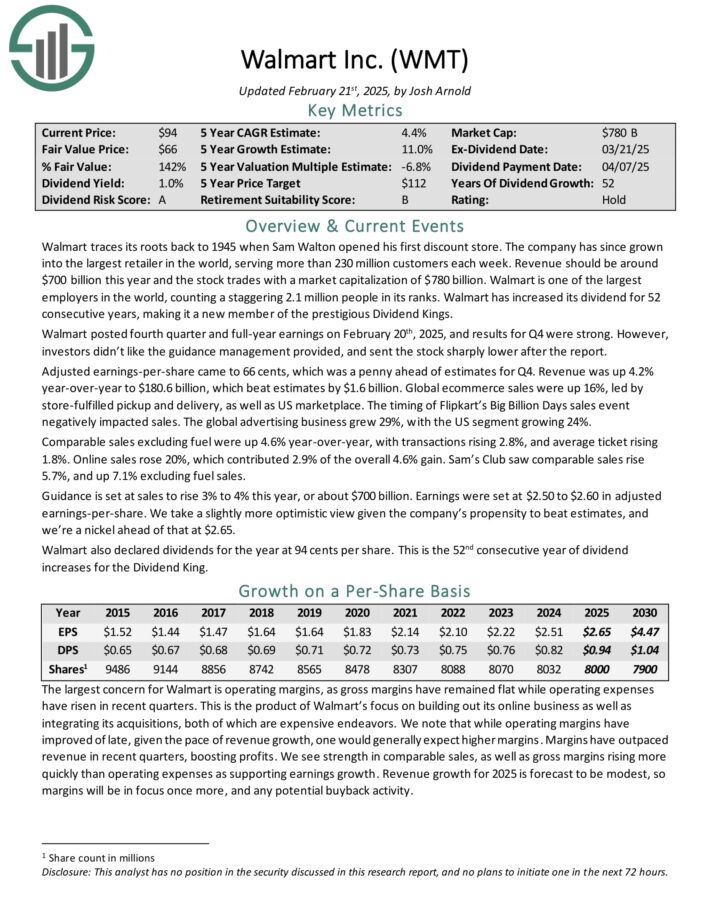

Excessive Progress Dividend Aristocrat #3: Walmart Inc. (WMT)

Walmart traces its roots again to 1945 when Sam Walton opened his first low cost retailer. The corporate has since grown into one of many largest retailers on the planet, serving over 230 million prospects every week.

Income will doubtless be round $600 billion this 12 months.

Walmart posted fourth quarter and full-year earnings on February twentieth, 2025, and outcomes for This fall have been sturdy. Adjusted earnings-per-share got here to 66 cents, which was a penny forward of estimates for This fall.

Income was up 4.2% year-over-year to $180.6 billion, which beat estimates by $1.6 billion. International ecommerce gross sales have been up 16%, led by store-fulfilled pickup and supply, in addition to US market.

The timing of Flipkart’s Huge Billion Days gross sales occasion negatively impacted gross sales. The worldwide promoting enterprise grew 29%, with the US section rising 24%.

Comparable gross sales excluding gas have been up 4.6% year-over-year, with transactions rising 2.8%, and common ticket rising 1.8%.

On-line gross sales rose 20%, which contributed 2.9% of the general 4.6% achieve. Sam’s Membership noticed comparable gross sales rise 5.7%, and up 7.1% excluding gas gross sales.

Click on right here to obtain our most up-to-date Certain Evaluation report on Walmart (preview of web page 1 of three proven under):

Excessive Progress Dividend Aristocrat #2: S&P International Inc. (SPGI)

S&P International is a worldwide supplier of monetary providers and enterprise data and income of over $13 billion.

By means of its numerous segments, it gives credit score scores, benchmarks and indices, analytics, and different knowledge to commodity market contributors, capital markets, and automotive markets.

S&P International has paid dividends constantly since 1937 and has elevated its payout for 51 consecutive years.

S&P posted fourth quarter and full-year earnings on February eleventh, 2025, and outcomes have been a lot better than anticipated on each the highest and backside traces.

Adjusted earnings-per-share got here to $3.77, which was a staggering 30 cents forward of estimates. Earnings rose from $3.13 a 12 months in the past.

Income was up 14% year-over-year to $3.59 billion, beating estimates by $90 million. The corporate posted income progress in all of its working segments, along with sturdy working margin enlargement.

Working bills rose barely from $2.26 billion to $2.33 billion year-over-year. That led to working revenue of $1.68 billion, sharply increased from $1.39 billion a 12 months in the past.

With dividend progress above 10%, SPGI is among the rock strong dividend shares.

Click on right here to obtain our most up-to-date Certain Evaluation report on SPGI (preview of web page 1 of three proven under):

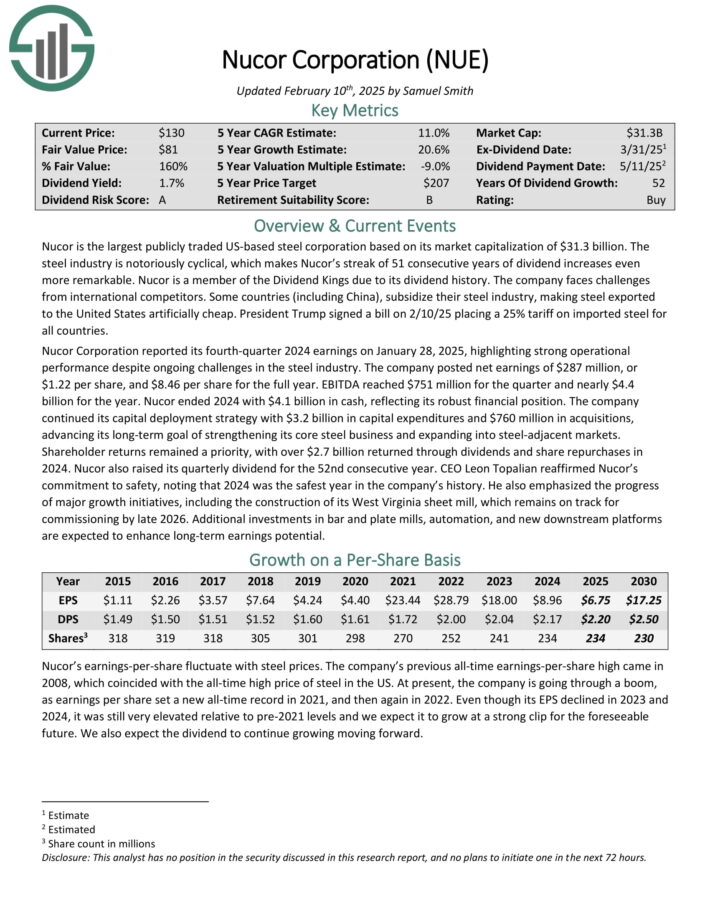

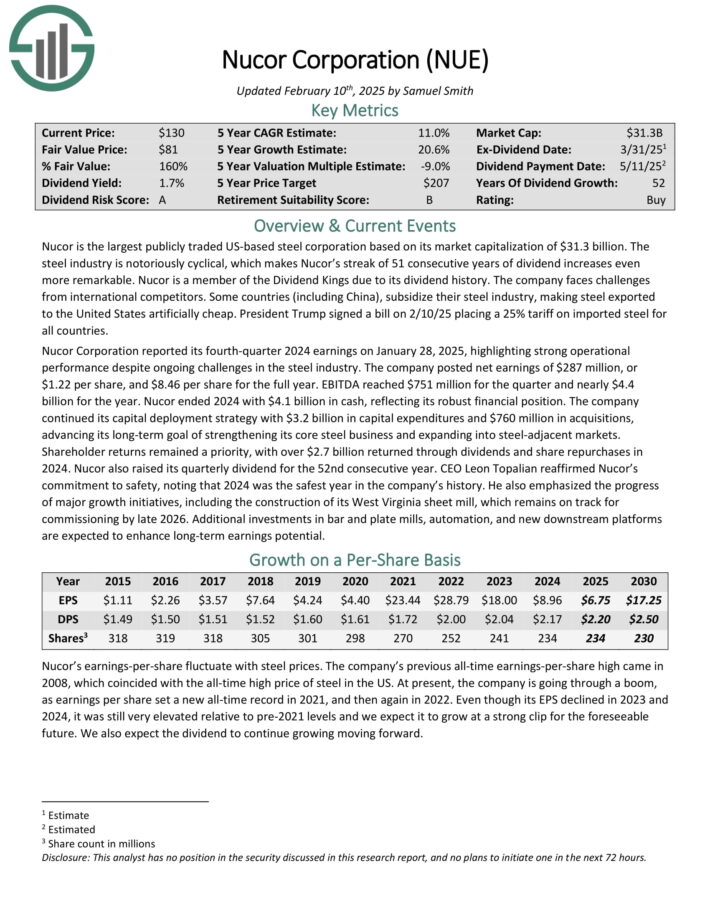

Excessive Progress Dividend Aristocrat #1: Nucor Corp. (NUE)

Nucor is the most important publicly traded US-based metal company based mostly on its market capitalization. The metal trade is notoriously cyclical, which makes Nucor’s streak of 52 consecutive years of dividend will increase much more exceptional.

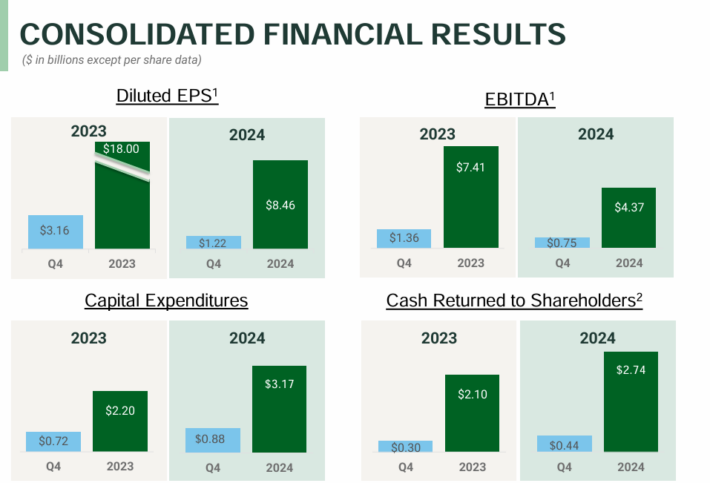

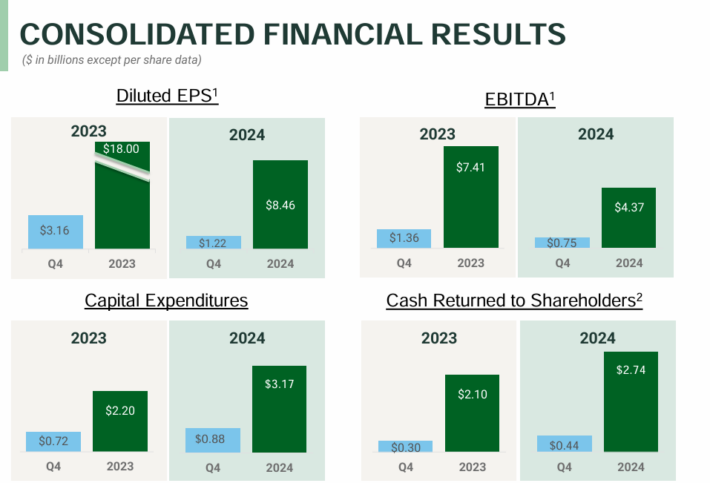

Nucor Company reported its fourth-quarter 2024 earnings on January 28, 2025, highlighting sturdy operational efficiency regardless of ongoing challenges within the metal trade.

The corporate posted web earnings of $287 million, or $1.22 per share, and $8.46 per share for the total 12 months. EBITDA reached $751 million for the quarter and practically $4.4 billion for the 12 months.

Supply: Investor Presentation

Nucor ended 2024 with $4.1 billion in money, reflecting its sturdy monetary place.

As a commodity producer, Nucor is susceptible to fluctuations within the value of metal. Metal demand is tied to building and the general financial system.

Traders ought to pay attention to the numerous draw back threat of Nucor as it’s more likely to carry out poorly in a protracted recession.

That mentioned, Nucor has raised its base dividend for 52 straight years. This means the power of its enterprise mannequin and administration workforce.

Click on right here to obtain our most up-to-date Certain Evaluation report on NUE (preview of web page 1 of three proven under):

Extra Studying

The Dividend Aristocrats are among the many greatest dividend progress shares to purchase and maintain for the long term. However the Dividend Aristocrats record just isn’t the one option to rapidly display screen for shares that repeatedly pay rising dividends.

We now have compiled a studying record for extra dividend progress inventory investing concepts:

Thanks for studying this text. Please ship any suggestions, corrections, or inquiries to [email protected].