Printed on March nineteenth, 2025 by Bob Ciura

Spreadsheet information up to date each day

Benjamin Graham is broadly thought of to be the “founding father of worth investing”.

In truth, lots of the finest worth buyers over time, reminiscent of Warren Buffett, used Graham’s teachings to spend money on worth shares.

Graham popularized the time period intrinsic worth, which refers to a inventory’s underlying honest worth. On this method, buyers can decide whether or not a inventory is undervalued, pretty valued, or overvalued.

One of many core ideas of Graham’s funding philosophy is the Graham Quantity.

Traders can apply the Graham Quantity to seek out undervalued dividend progress shares, such because the Dividend Kings.

The Dividend Kings are the best-of-the-best in dividend longevity.

What’s a Dividend King? A inventory with 50 or extra consecutive years of dividend will increase.

We’ve compiled a listing that features each Dividend King.

You’ll be able to see the total downloadable spreadsheet of all 54 Dividend Kings (together with essential monetary metrics reminiscent of dividend yields, payout ratios, and price-to-earnings ratios) by clicking on the hyperlink under:

The Dividend Kings listing contains a number of mega-cap shares which have monumental companies, reminiscent of Walmart Inc. (WMT) and Coca-Cola (KO).

The next listing represents the ten Dividend Kings within the Positive Evaluation Analysis Database with the bottom Graham Quantity.

Desk of Contents

Graham Quantity Overview

The Graham Quantity is pretty easy: buyers can merely a number of the price-to-book ratio (P/B) by the price-to-earnings ratio (P/E).

Traders need to deal with shares with a Graham Quantity under 22.5, and the decrease, the higher.

To compile the display screen, we took the P/E ratios within the Positive Evaluation Analysis Database, together with P/B ratios taken from Ycharts.

We then ranked the listing of Dividend Kings by their corresponding Graham Quantity. The ten most undervalued Dividend Kings, in keeping with the Graham Quantity, are listed under.

Prime Graham Quantity Dividend King: Stanley Black & Decker (SWK)

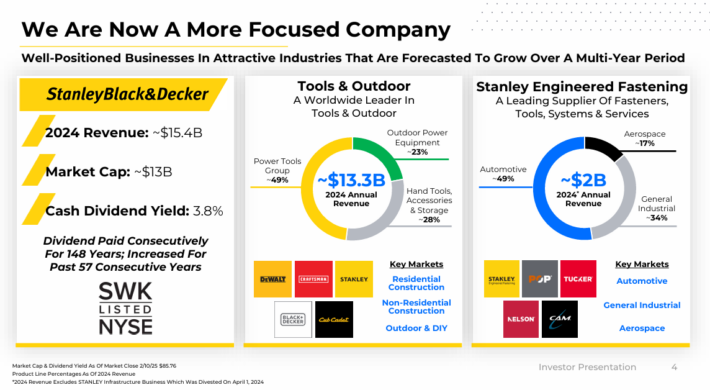

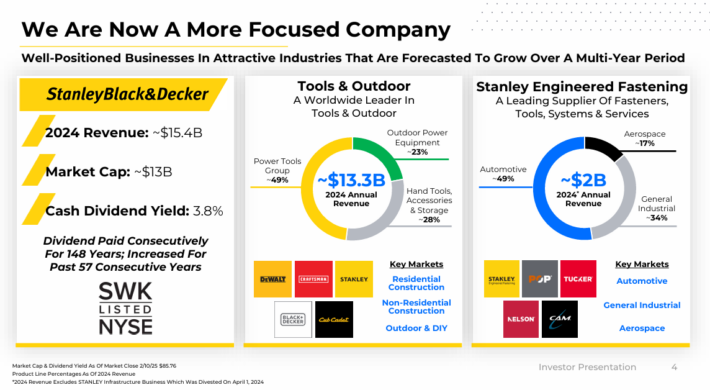

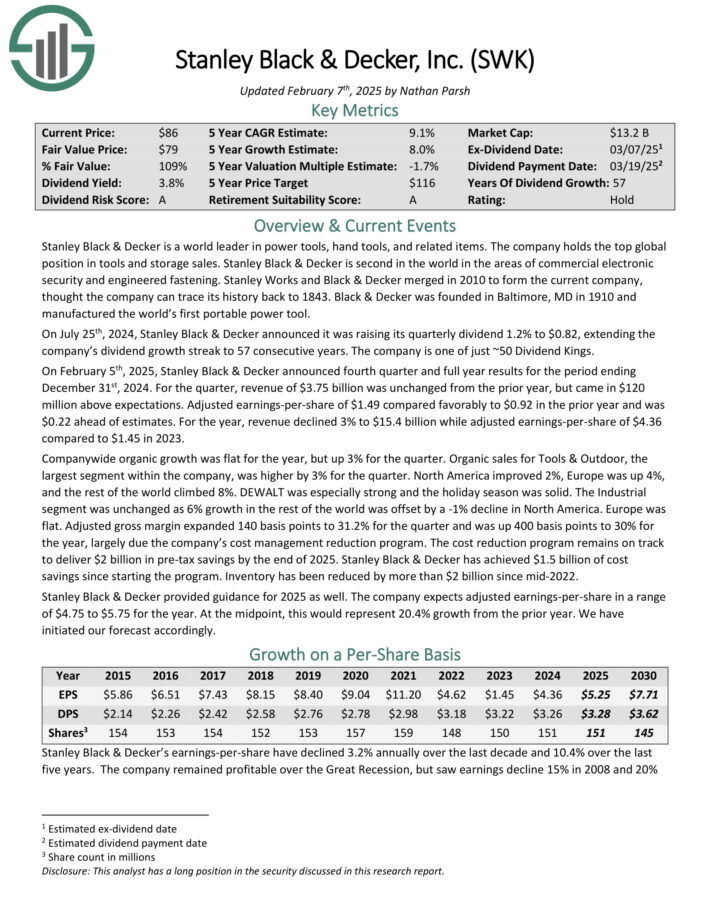

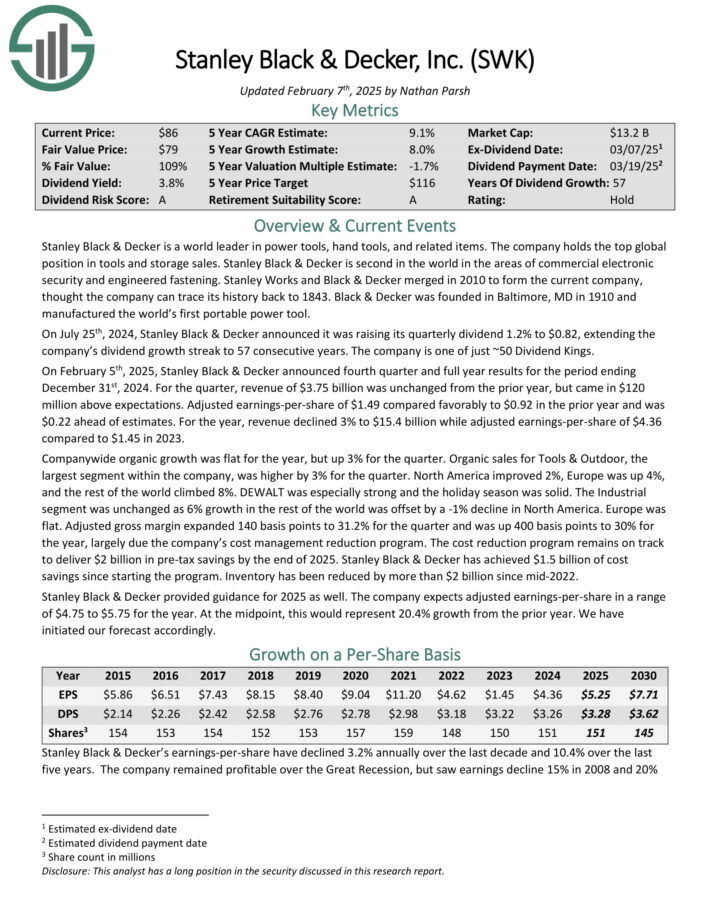

Stanley Black & Decker is a world chief in energy instruments, hand instruments, and associated gadgets. The corporate holds the highest world place in instruments and storage gross sales.

Stanley Black & Decker is second on the earth within the areas of business digital safety and engineered fastening. The corporate consists of three segments: instruments & out of doors, and industrial.

Supply: Investor Presentation

On February fifth, 2025, Stanley Black & Decker introduced fourth quarter and full-year outcomes. For the quarter, income of $3.75 billion was unchanged from the prior yr, however got here in $120 million above expectations.

Adjusted earnings-per-share of $1.49 in contrast favorably to $0.92 within the prior yr and was $0.22 forward of estimates. For the yr, income declined 3% to $15.4 billion whereas adjusted earnings-per-share of $4.36 in comparison with $1.45 in 2023.

Natural progress was flat for the yr, however up 3% for the quarter. Natural gross sales for Instruments & Outside, the biggest section throughout the firm, was greater by 3% for the quarter.

Click on right here to obtain our most up-to-date Positive Evaluation report on SWK (preview of web page 1 of three proven under):

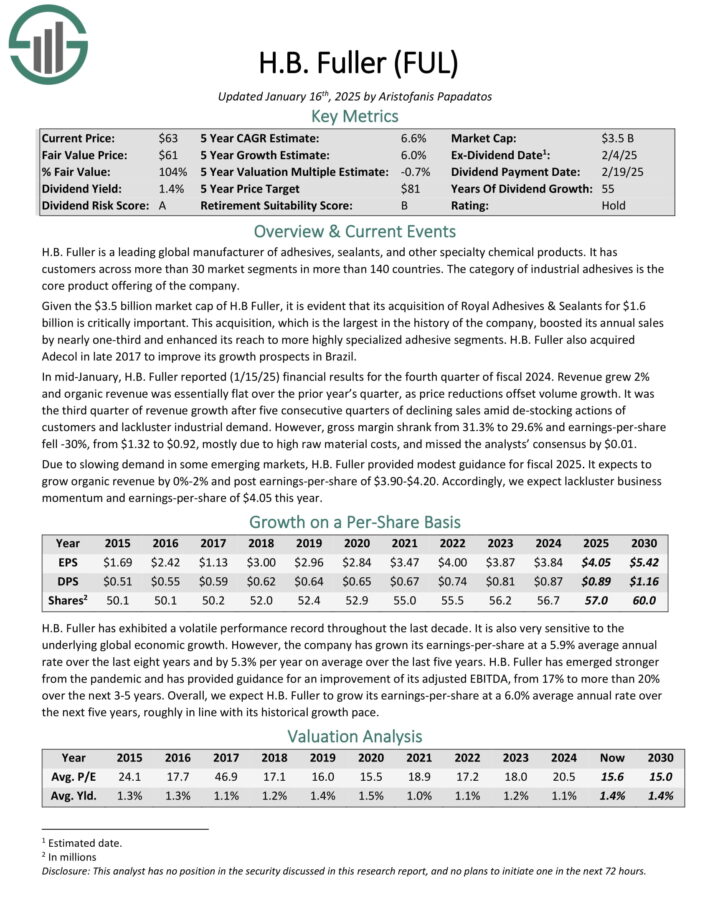

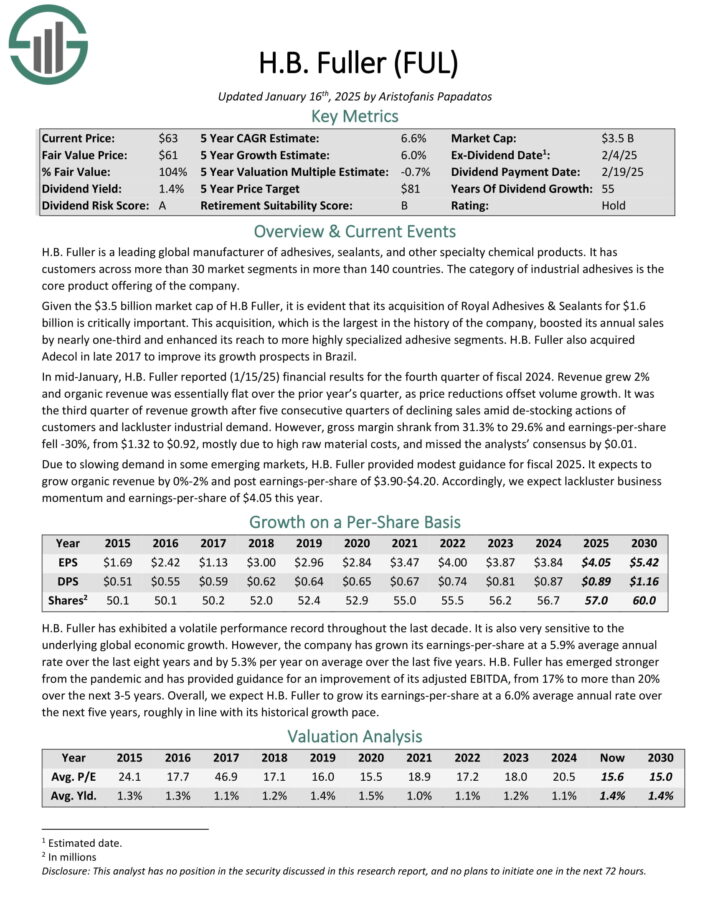

Prime Graham Quantity Dividend King: H.B. Fuller Corporations (FUL)

H.B. Fuller is a number one world producer of adhesives, sealants, and different specialty chemical merchandise.

It has clients throughout greater than 30 market segments in additional than 140 international locations. The class of commercial adhesives is the core product providing.

In mid-January, H.B. Fuller reported (1/15/25) monetary outcomes for the fourth quarter of fiscal 2024. Income grew 2% and natural income was basically flat year-over-year, as worth reductions offset quantity progress.

Highlights for the total yr might be seen within the picture under:

Supply: Investor Presentation

It was the third quarter of income progress after 5 consecutive quarters of declining gross sales amid de-stocking actions of shoppers and lackluster industrial demand.

Nonetheless, gross margin shrank from 31.3% to 29.6% and earnings-per-share fell -30%, from $1.32 to $0.92, principally because of excessive uncooked materials prices, and missed the analysts’ consensus by $0.01.

As a result of slowing demand in some rising markets, H.B. Fuller supplied modest steering for fiscal 2025. It expects to develop natural income by 0%-2% and submit earnings-per-share of $3.90-$4.20.

Click on right here to obtain our most up-to-date Positive Evaluation report on FUL (preview of web page 1 of three proven under):

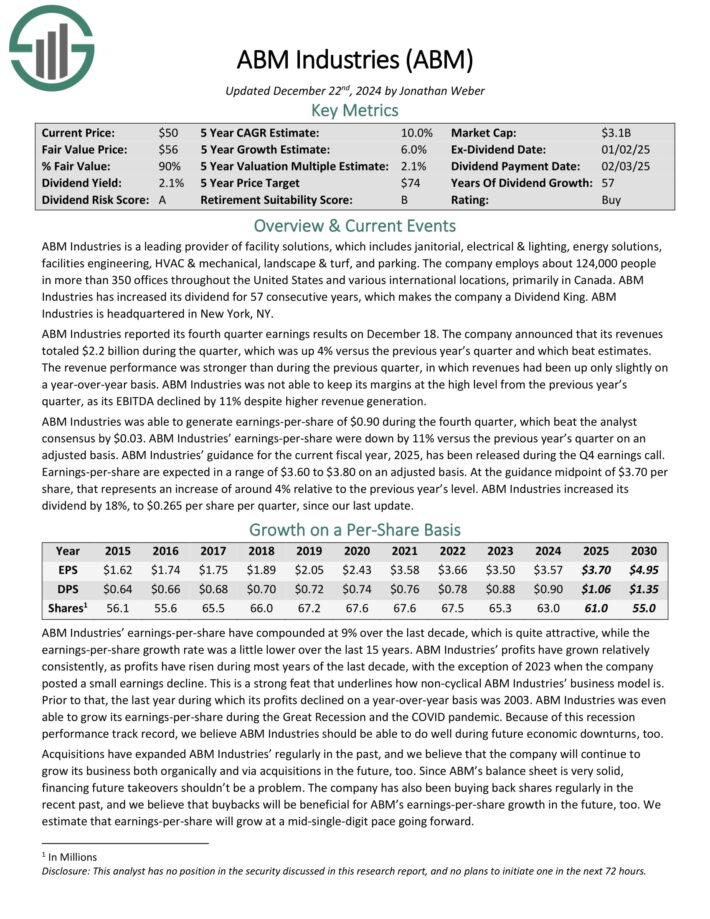

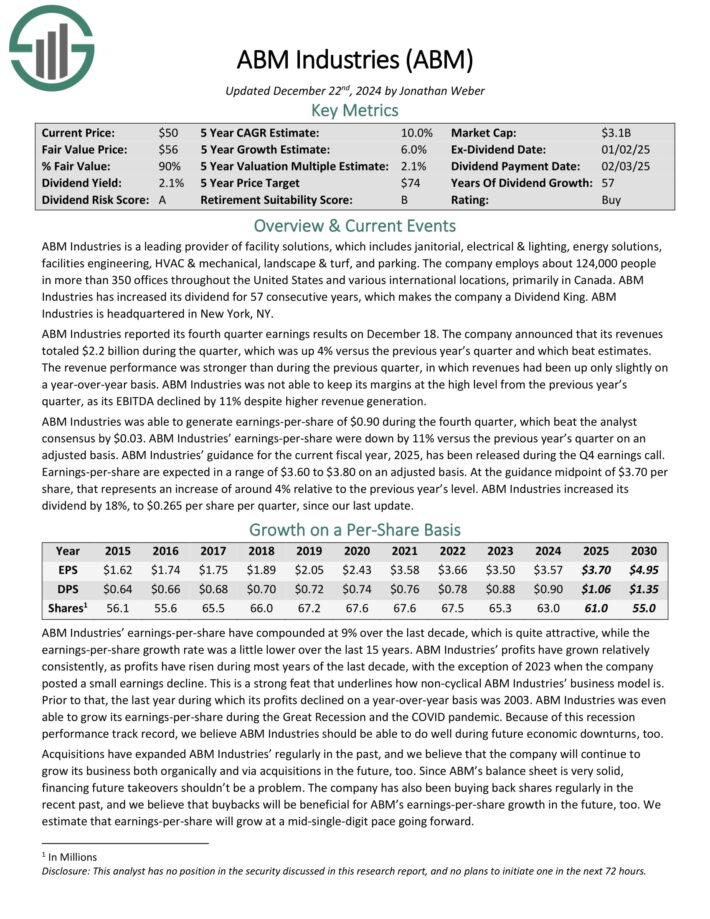

Prime Graham Quantity Dividend King: ABM Industries (ABM)

ABM Industries is a number one supplier of facility options, which incorporates janitorial, electrical & lighting, vitality options, amenities engineering, HVAC & mechanical, panorama & turf, and parking.

The corporate employs about 124,000 individuals in additional than 350 places of work all through the USA and varied worldwide areas, primarily in Canada.

Supply: Investor Presentation

ABM Industries reported its fourth quarter earnings outcomes on December 18. Revenues totaled $2.2 billion throughout the quarter, which was up 4% year-over-year. EBITDA declined by 11% regardless of greater income era.

Earnings-per-share of $0.90 throughout the fourth quarter beat the analyst consensus by $0.03. EPS declined by 11% on an adjusted foundation, year-over-year.

Earnings-per-share are anticipated in a spread of $3.60 to $3.80 on an adjusted foundation. On the steering midpoint of $3.70 per share, that represents a rise of round 4% relative to 2024.

Click on right here to obtain our most up-to-date Positive Evaluation report on ABM (preview of web page 1 of three proven under):

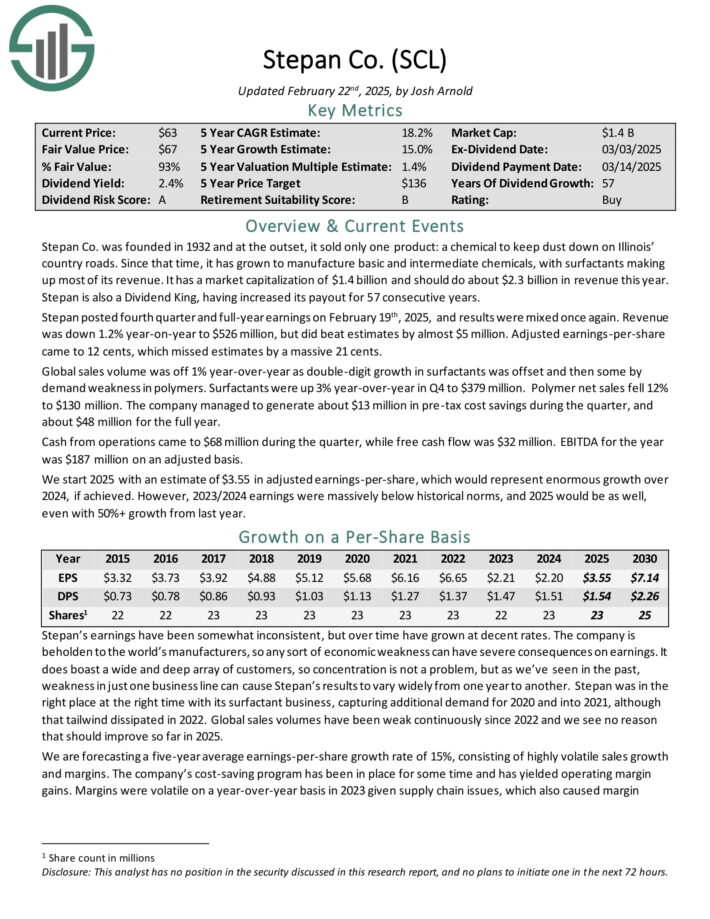

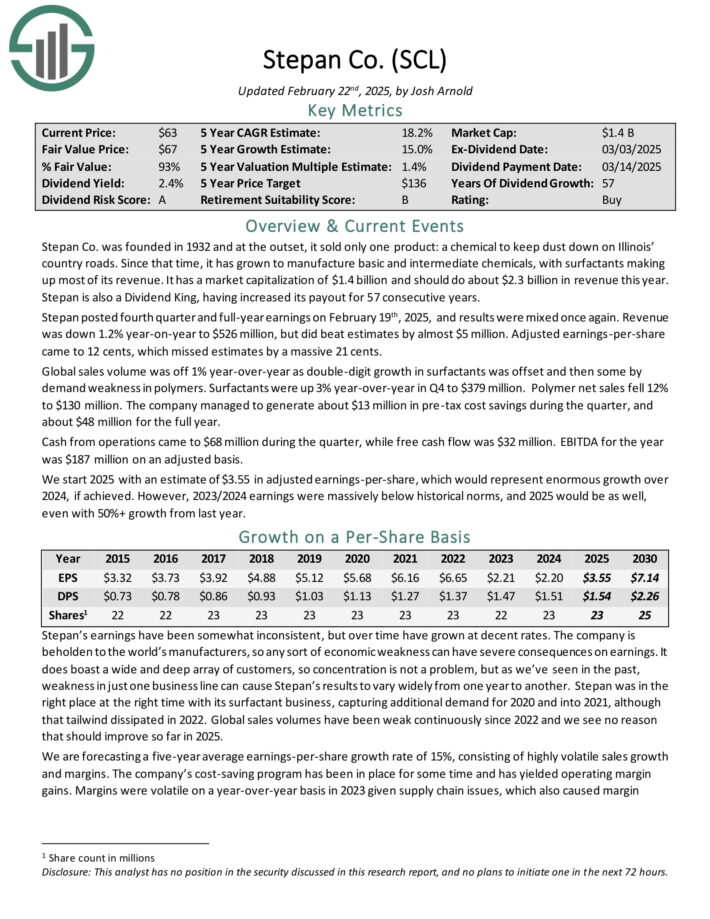

Prime Graham Quantity Dividend King: Stepan Co. (SCL)

Stepan manufactures fundamental and intermediate chemical substances, together with surfactants, specialty merchandise, germicidal and material softening quaternaries, phthalic anhydride, polyurethane polyols and particular components for the meals, complement, and pharmaceutical markets.

It’s organized into three distinct enterprise traces: surfactants, polymers, and specialty merchandise. These companies serve all kinds of finish markets, which means that Stepan just isn’t beholden to only a handful of industries.

Supply: Investor presentation

The surfactants enterprise is Stepan’s largest by income, accounting for ~68% of complete gross sales in the latest quarter. A surfactant is an natural compound that comprises each water-soluble and water-insoluble parts.

Stepan posted fourth quarter and full-year earnings on February nineteenth, 2025, and outcomes had been combined as soon as once more. Income was down 1.2% year-on-year to $526 million, however did beat estimates by virtually $5 million. Adjusted earnings-per-share got here to 12 cents, which missed estimates by 21 cents.

International gross sales quantity was off 1% year-over-year as double-digit progress in surfactants was offset after which some by demand weak spot in polymers. Surfactants had been up 3% year-over-year in This fall to $379 million. Polymer web gross sales fell 12% to $130 million.

The corporate managed to generate about $13 million in pre-tax value financial savings throughout the quarter, and about $48 million for the total yr.

Click on right here to obtain our most up-to-date Positive Evaluation report on SCL (preview of web page 1 of three proven under):

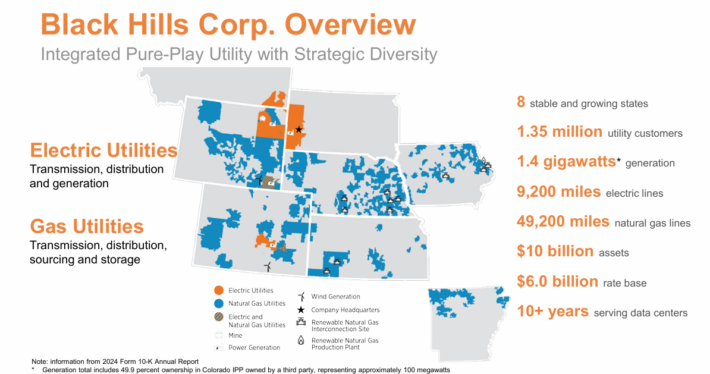

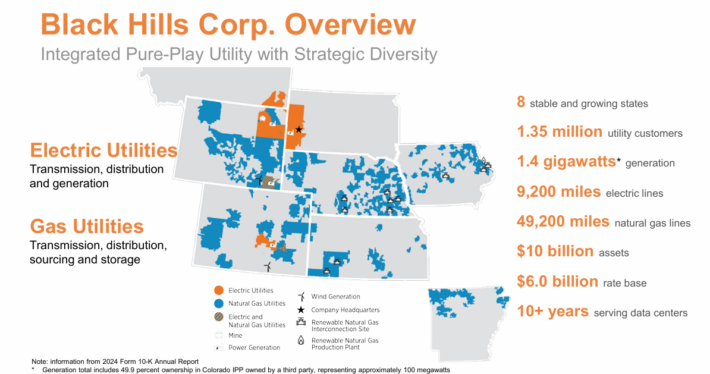

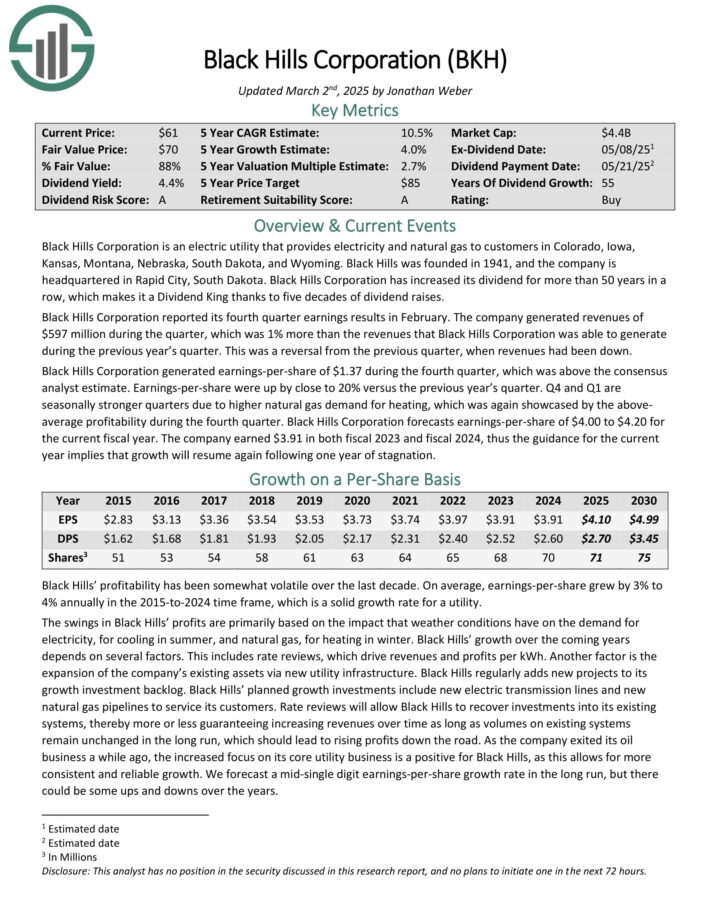

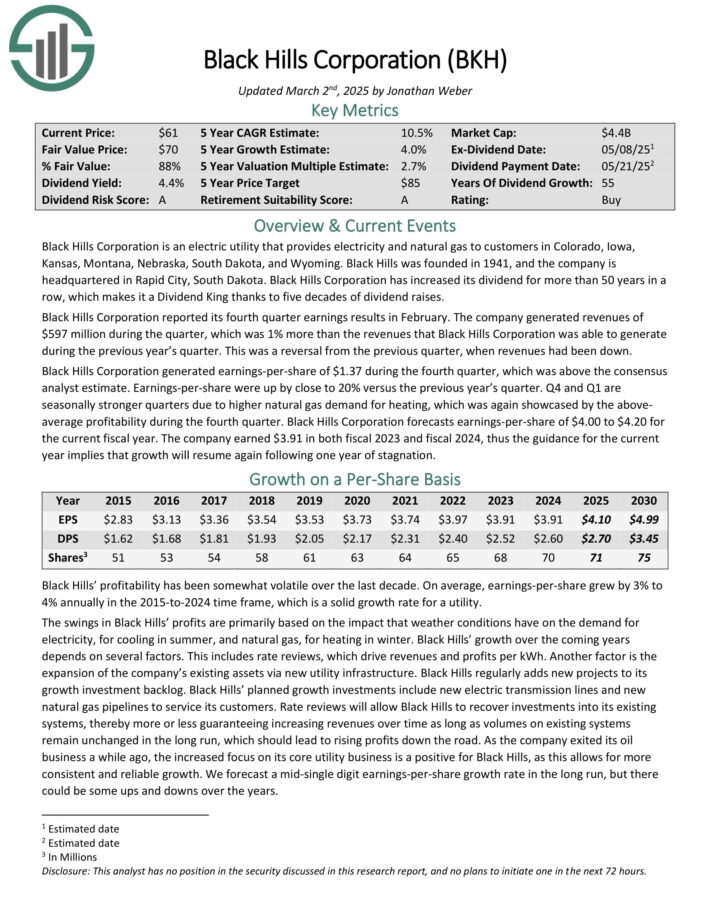

Prime Graham Quantity Dividend King: Black Hills Corp. (BKH)

Black Hills Company is an electrical utility that gives electrical energy and pure gasoline to clients in Colorado, Iowa, Kansas, Montana, Nebraska, South Dakota, and Wyoming.

The corporate has 1.35 million utility clients in eight states. Its pure gasoline property embrace 49,200 miles of pure gasoline traces. Individually, it has ~9,200 miles of electrical traces and 1.4 gigawatts of electrical era capability.

Supply: Investor Presentation

Black Hills Company reported its fourth quarter earnings leads to February. The corporate generated revenues of $597 million throughout the quarter, which was up 1% year-over-year.

Earnings-per-share of $1.37 throughout the fourth quarter was above the consensus analyst estimate. Earnings-per-share had been up by shut to twenty% versus the earlier yr’s quarter. This fall and Q1 are seasonally stronger quarters because of greater pure gasoline demand for heating, which was once more showcased by the above-average profitability throughout the fourth quarter.

Black Hills Company forecasts earnings-per-share of $4.00 to $4.20 for the present fiscal yr.

Click on right here to obtain our most up-to-date Positive Evaluation report on BKH (preview of web page 1 of three proven under):

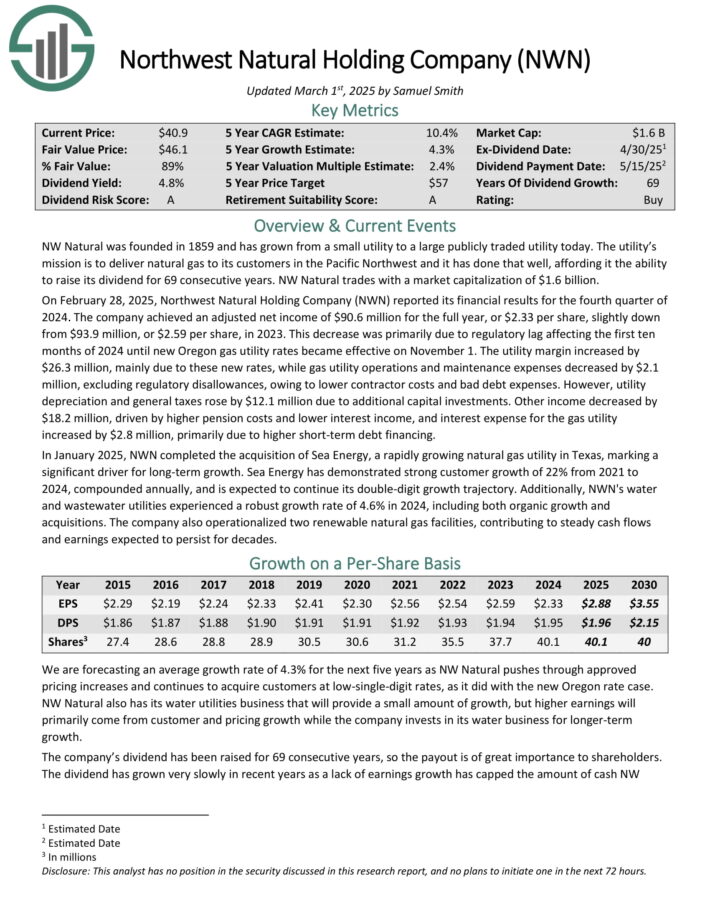

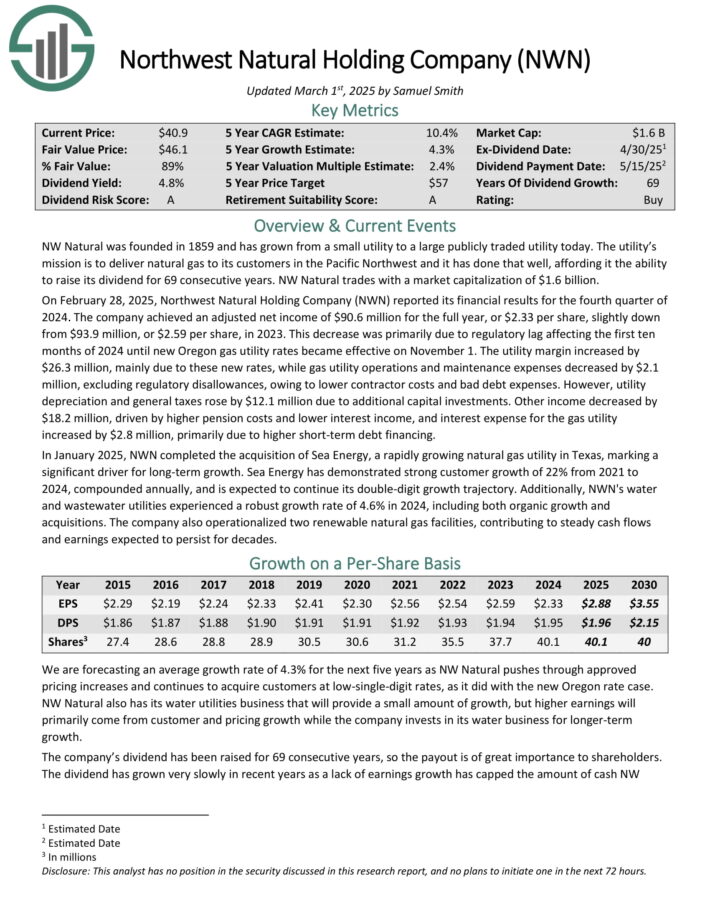

Prime Graham Quantity Dividend King: Northwest Pure Holding (NWN)

Northwest was based over 160 years in the past as a pure gasoline utility in Portland, Oregon.

It has grown from a really small, native utility that supplied gasoline service to a handful of shoppers to a really profitable regional utility with pursuits that now embrace water and wastewater, which had been bought in current acquisitions.

Supply: Investor Presentation

Northwest supplies gasoline service to 2.5 million clients in ~140 communities in Oregon and Washington, serving greater than 795,000 connections. It additionally owns and operates ~35 billion cubic ft of underground gasoline storage capability.

On February 28, 2025, Northwest Pure Holding Firm (NWN) reported its monetary outcomes for the fourth quarter of 2024. The corporate achieved an adjusted web earnings of $90.6 million for the total yr, or $2.33 per share, barely down from $93.9 million, or $2.59 per share, in 2023.

This lower was primarily because of regulatory lag affecting the primary ten months of 2024 till new Oregon gasoline utility charges turned efficient on November 1. The utility margin elevated by $26.3 million, primarily because of these new charges.

Click on right here to obtain our most up-to-date Positive Evaluation report on NWN (preview of web page 1 of three proven under):

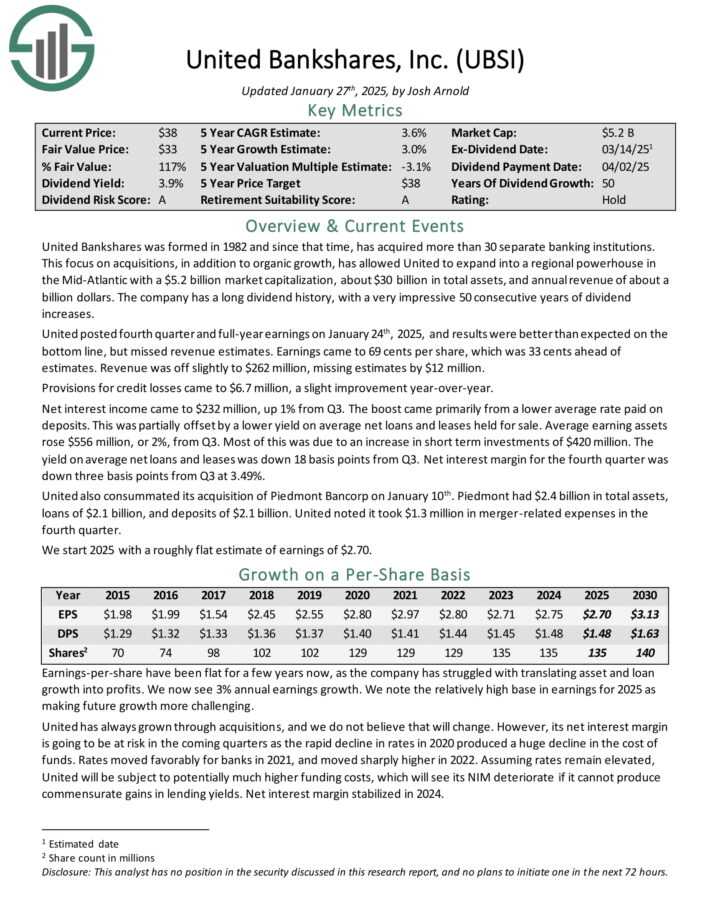

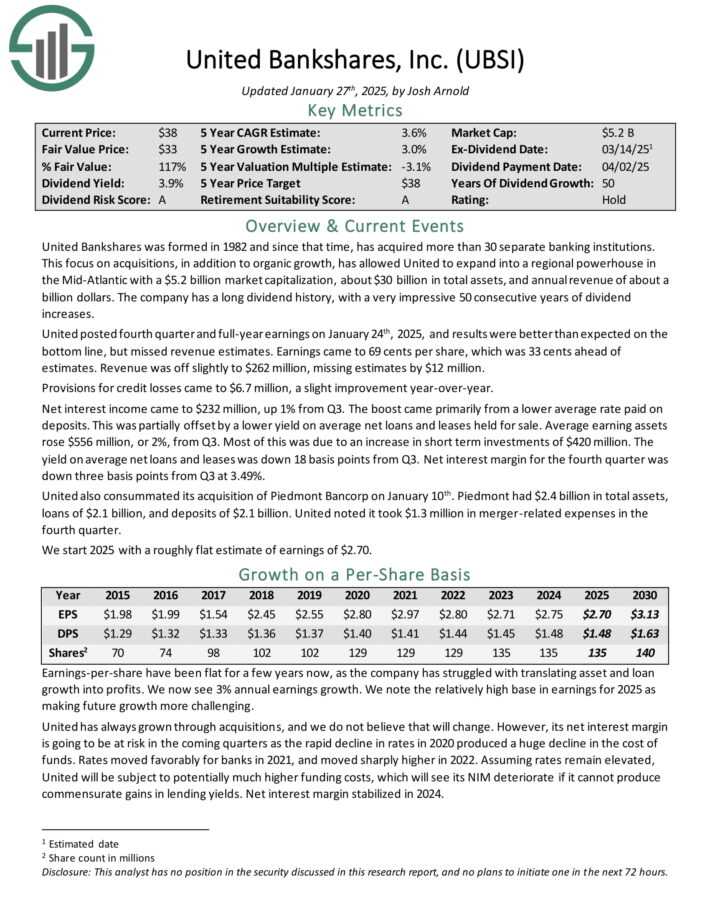

Prime Graham Quantity Dividend King: United Bankshares (UBSI)

United Bankshares was fashioned in 1982 and since that point, has acquired greater than 30 separate banking establishments.

This deal with acquisitions, along with natural progress, has allowed United to develop within the Mid-Atlantic with about $30 billion in complete property, and annual income of about $1 billion.

United posted fourth quarter and full-year earnings on January twenty fourth, 2025, and outcomes had been higher than anticipated on the underside line, however missed income estimates.

Earnings got here to 69 cents per share, which was 33 cents forward of estimates. Income was off barely to $262 million, lacking estimates by $12 million.

Provisions for credit score losses got here to $6.7 million, a slight enchancment year-over-year. Web curiosity earnings got here to $232 million, up 1% from Q3. The increase got here primarily from a decrease common price paid on deposits.

This was partially offset by a decrease yield on common web loans and leases held on the market. Common incomes property rose $556 million, or 2%, from Q3. Most of this was because of a rise in brief time period investments of $420 million.

The yield on common web loans and leases was down 18 foundation factors from Q3. Web curiosity margin for the fourth quarter was down three foundation factors from Q3 at 3.49%.

Click on right here to obtain our most up-to-date Positive Evaluation report on UBSI (preview of web page 1 of three proven under):

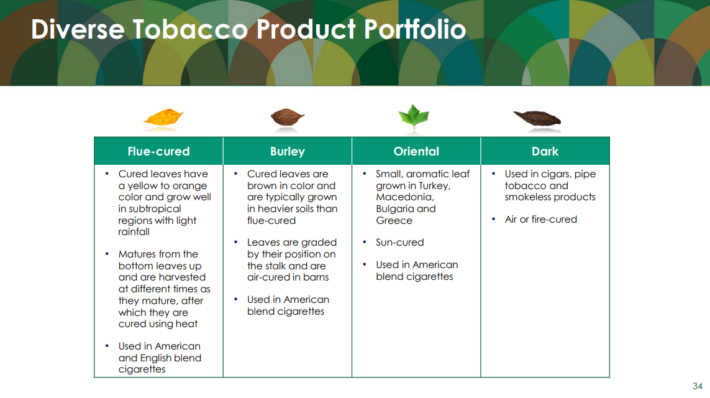

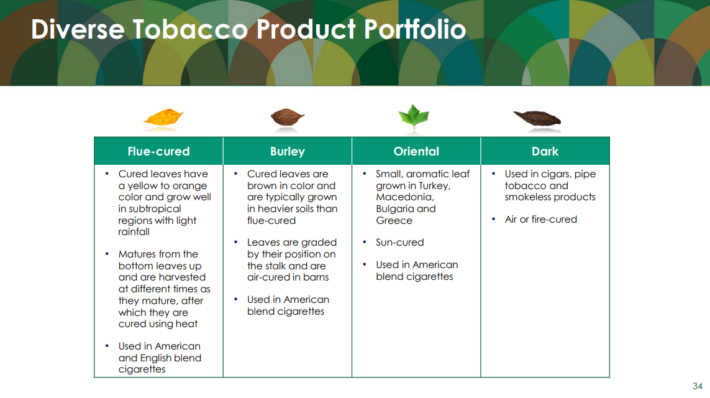

Prime Graham Quantity Dividend King: Common Corp. (UVV)

Common Company is a market chief in supplying leaf tobacco and different plant-based inputs to shopper product producers.

The Tobacco Operations section buys and sells tobacco used to make cigarettes, cigars, pipe tobacco, and smokeless merchandise.

Common buys tobacco from its suppliers, processes it, and sells it to massive tobacco corporations within the US and internationally.

Supply: Investor Presentation

The Ingredient Operations deal primarily with greens and fruits however is considerably smaller than the tobacco operations.

Common Company reported its third quarter earnings leads to February. The corporate generated revenues of $937 million throughout the quarter, which was greater than the revenues that Common Company generated throughout the earlier interval.

Revenues had been positively impacted by product combine modifications, whereas bigger and better-yielding crops additionally had a optimistic impression on the corporate’s top-line. Common Company’s revenues additionally rose on a year-over-year foundation, exhibiting a 14% enhance.

Click on right here to obtain our most up-to-date Positive Evaluation report on Common (preview of web page 1 of three proven under):

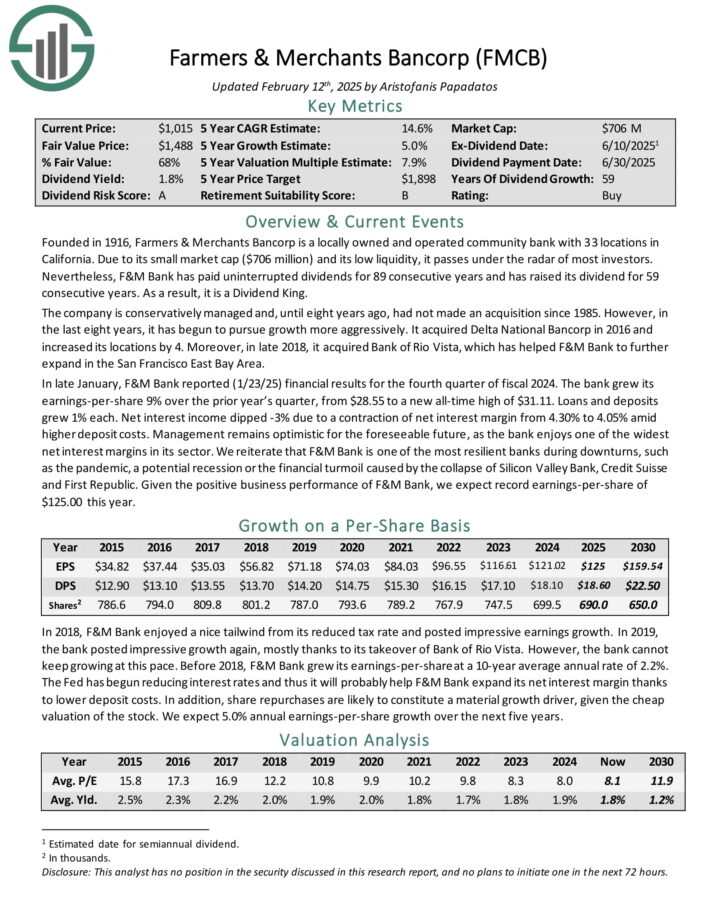

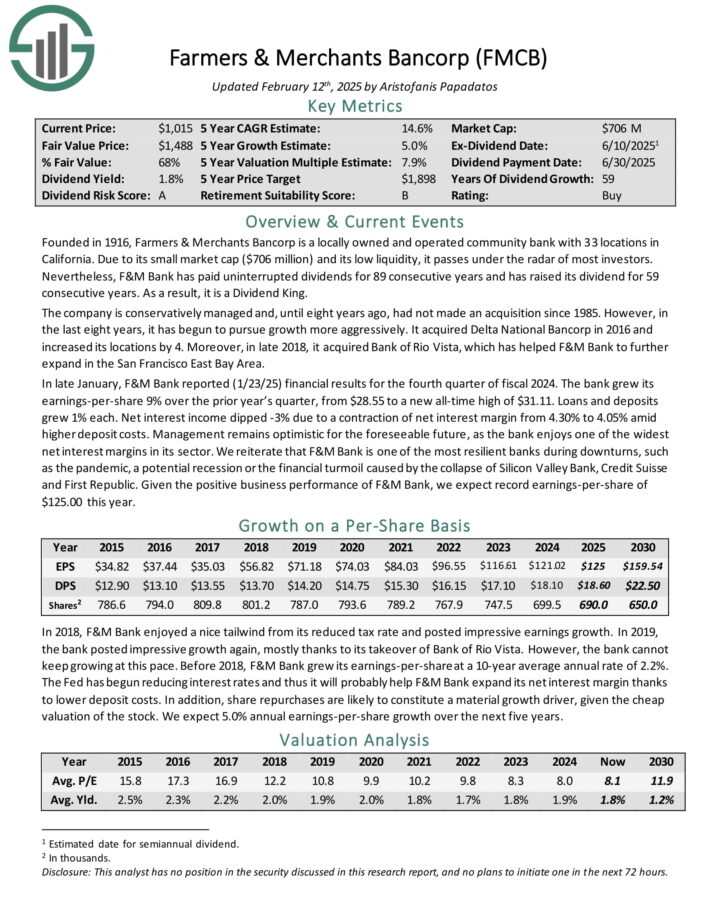

Prime Graham Quantity Dividend King: Farmers & Retailers Bancorp (FMCB)

Farmers & Retailers Bancorp is a regionally owned and operated neighborhood financial institution with 32 areas in California. As a result of its small market cap and its low liquidity, it passes below the radar of most buyers.

F&M Financial institution has paid uninterrupted dividends for 88 consecutive years and has raised its dividend for 59 consecutive years.

In late January, F&M Financial institution reported (1/23/25) monetary outcomes for the fourth quarter of fiscal 2024. The financial institution grew its earnings-per-share 9% over the prior yr’s quarter, from $28.55 to a brand new all-time excessive of $31.11. Loans and deposits grew 1% every.

Web curiosity earnings dipped -3% because of a contraction of web curiosity margin from 4.30% to 4.05% amid greater deposit prices. Administration stays optimistic for the foreseeable future, because the financial institution enjoys one of many widest web curiosity margins in its sector.

We reiterate that F&M Financial institution is likely one of the most resilient banks throughout downturns, such because the pandemic, a possible recession or the monetary turmoil attributable to the collapse of Silicon Valley Financial institution, Credit score Suisse and First Republic.

Click on right here to obtain our most up-to-date Positive Evaluation report on FMCB (preview of web page 1 of three proven under):

Prime Graham Quantity Dividend King: Archer Daniels Midland (ADM)

Archer-Daniels-Midland is the biggest publicly traded farmland product firm in the USA. Its companies embrace processing cereal grains, oilseeds, and agricultural storage and transportation.

Archer-Daniels-Midland reported its third-quarter outcomes for Fiscal Yr (FY) 2024 on November 18th, 2024.

The corporate reported adjusted web earnings of $530 million and adjusted EPS of $1.09, each down from the prior yr because of a $461 million non-cash cost associated to its Wilmar fairness funding.

Consolidated money flows year-to-date reached $2.34 billion, reflecting sturdy operations regardless of market challenges.

Click on right here to obtain our most up-to-date Positive Evaluation report on ADM (preview of web page 1 of three proven under):

Further Studying

Screening to seek out the most effective Dividend Kings just isn’t the one approach to discover high-quality dividend progress inventory concepts.

Positive Dividend maintains related databases on the next helpful universes of shares:

Thanks for studying this text. Please ship any suggestions, corrections, or inquiries to [email protected].