The report got here in hotter than anticipated for the headline and metrics. CPI swap pricing did a superb job of predicting the headline inflation price. Consequently, yesterday’s report has led the swaps market to cost increased CPI inflation charges for October and November.

The swaps market is now pricing the year-over-year enhance for October at 2.58%, November at 2.72%, and December at 2.8%. These are up from 2.46%, 2.55%, and a pair of.5%, respectively.

(BLOOMBERG)

Once more, this takes us again to the roles report and the 4% wage development determine, which, assuming a 1% productiveness price, suggests inflation is operating round 3%. The swaps market doesn’t appear far off from that view both.

got here in a lot increased than anticipated, rising by 258,000 in comparison with estimates of 230,000, which probably precipitated some confusion out there.

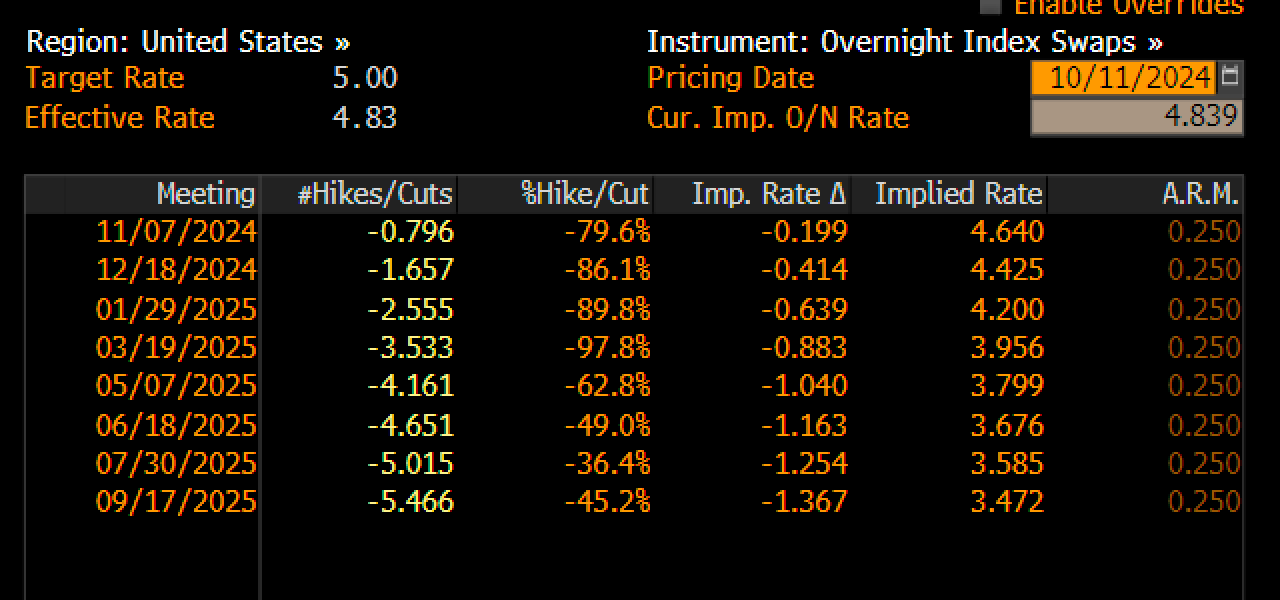

Regardless of the warmer CPI, Fund swaps are nonetheless pricing in about an 80% probability of a price reduce in November.

Right this moment’s report will assist us achieve a greater deal with on the PCE report, and that PPI report will probably present extra readability relating to the percentages of a November price reduce.

If the swaps market is correct and we’re solely going to see charges get down 3.5% on the Fed Funds, the might be at some extent the place we’re going to see a lot draw back from right here.

The actual threat is now on the again of the curve. As a result of if inflation nonetheless is a factor, then the again of the curve might rise rather a lot.

In truth, the usually peaks within the 200 to 300 bps vary and extra generally within the 250 to 300 bps vary, so a 2-year that settles out round 3.50% might imply a within the 5.5 to six.5% vary.

The BLS information has been so inconsistent not too long ago that it’s laborious to have faith in any view. Heading into the September jobs report, the confirmed indicators of accelerating, and non-farm payrolls seemed weak.

However then the September report got here with all these sudden revisions, and all of a sudden, every part modified.

Given the current rise within the 10-year yield, it’s beginning to seem like the subsequent transfer may very well be increased. Any such yield curve shift known as a bear steepener, which occurs when the again of the yield curve rises away from the entrance.

The vital factor to recollect is that the Fed has no management over the again of the curve until it’s conducting QE.

So, whereas the Fed can reduce charges, the lengthy finish of the yield curve can transfer independently. If the market believes the Fed isn’t dealing with coverage appropriately, the again of the curve might rise considerably from right here.

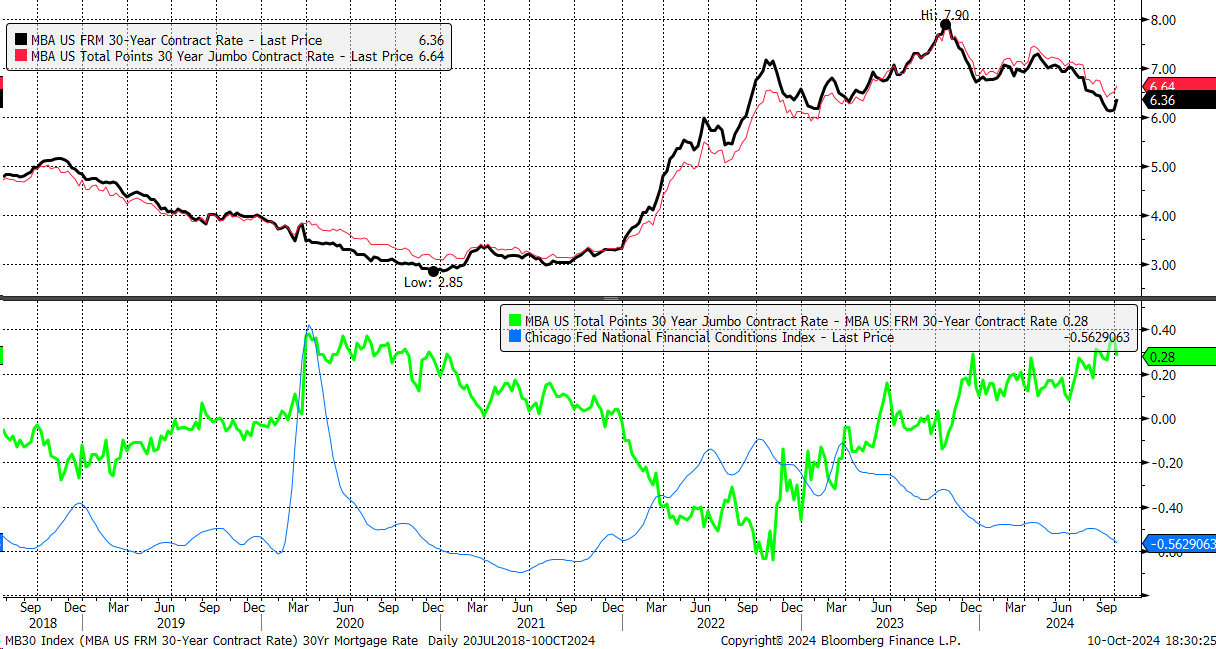

If the Fed made a coverage error and long-term charges transfer increased, mortgage charges may even enhance, as they’re largely tied to 10-year Treasury yields. Because of this mortgage charges have risen even after the Fed reduce charges.

That is additionally why the has declined by virtually 5% because the center of September.

This ought to be bullish for the , and the has managed to bounce off the 100 degree.

This probably received’t be good for small caps or high-yield dividend shares. Normally, we consider utilities and staples, however the has been appearing surprisingly, probably as a result of ‘AI’ mania. The XLU has damaged its uptrend.

The appears to have already shaped a head and shoulders sample and is now sitting just under the neckline after a retest.

is one other sector with some higher-yield shares, and we’ve clearly seen it roll over as nicely. It’s now nearing its uptrend.

Unique Submit