Pgiam/iStock via Getty Images

Investment Portfolio Discipline Summary

“Blockdesk’s Standard Performance Comparison fund invests in equities whenever Market-Maker hedging activity forecasts that 80% or more of the near-coming price range is expected to be to the upside and 10% or less may be to the downside. This is intended as a guide to use the provided expectations insights.

At the time of each purchase a GTC sell order for all of those just bought shares is placed with the broker where bought. His system will monitor and direct to you the sale confirmation when accomplished, probably with encouragement for reinvestment.

At the time of the buy, only on your own personal private calendar at 3 months after the purchase, make a note to review this holding. If not yet sold, but at a loss, sell and put the proceeds into the reinvestment stream. If at a gain, after considering alternatives, decide to sell or move the calendar note a month further forward.”

source: blockdesk.com

Description of the Primary Investment Candidate

“Fair Isaac Corporation (NYSE:FICO) develops analytic, software, and data management products and services that enable businesses to automate, enhance, and connect decisions in the Americas, Europe, the Middle East, Africa, and the Asia Pacific. It operates through two segments, Scores and Software. The Software segment offers pre-configured decision management solution designed for various business problems or processes. The Scores segment provides business-to-business scoring solutions and services for consumers. Fair Isaac Corporation markets its products and services primarily through its direct sales organization and indirect channels, as well as online. The company was formerly known as Fair Isaac & Company, Inc. and changed its name to Fair Isaac Corporation in July 1992. Fair Isaac Corporation was founded in 1956 and is headquartered in Bozeman, Montana.”

source: Yahoo Finance

Yahoo Finance

Alternative Investments Compared

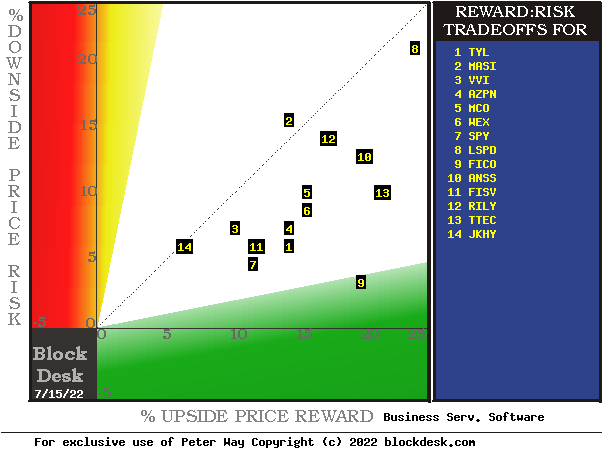

Here are several business software services similar to Fair Isaac Corporation. Following the same analysis as with FICO, historic sampling of today’s Risk~Reward balances were taken for each of the alternative investments. They are mapped out in Figure 1.

Figure 1

blockdesk.com

(used with permission).

Expected rewards for these securities are the greatest gains from current closing market price seen worth protecting short positions. Their measure is on the horizontal green scale.

The risk dimension is of actual price drawdowns at their most extreme point while being held in previous pursuit of upside rewards similar to the ones currently being seen. They are measured on the red vertical scale.

Both scales are of percent change from zero to 25%. Any stock or ETF whose present risk exposure exceeds its reward prospect will be above the dotted diagonal line. Capital-gain attractive to-buy issues are in the directions down and to the right.

Our principal interest is in FICO at location [9], at the edge of the green area marking 5 to 1 reward-to-risk ratio candidates.. A “market index” norm of reward~risk tradeoffs is offered by SPY at [7]. Most appealing (to own) by this Figure 1 view is FICO.

Comparing features of Alternative Investment Stocks

The Figure 1 map provides a good visual comparison of the two most important aspects of every equity investment in the short term. There are other aspects of comparison which this map sometimes does not communicate well, particularly when general market perspectives like those of SPY are involved. Where questions of “how likely’ are present other comparative tables, like Figure 2, may be useful.

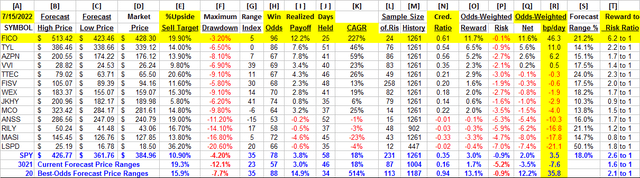

Yellow highlighting of the table’s cells emphasize factors important to securities valuations and the security CURE, most promising of near capital gain as ranked in column [R].

Figure 2

blockdesk.com

(used with permission)

Why do all this math?

Figure 2’s purpose is to attempt universally comparable answers, stock by stock, of a) How BIG the prospective price gain payoff may be, b) how LIKELY the payoff will be a profitable experience, c) how SOON it may happen, and d) what price drawdown RISK may be encountered during its holding period.

Readers familiar with our analysis methods after quick examination of Figure 2 may wish to skip to the next section viewing Price range forecast trends for FICO.

Column headers for Figure 2 define investment-choice preference elements for each row stock whose symbol appears at the left in column [A]. The elements are derived or calculated separately for each stock, based on the specifics of its situation and current-day MM price-range forecasts. Data in red numerals are negative, usually undesirable to “long” holding positions. Table cells with yellow fills are of data for the stocks of principal interest and of all issues at the ranking column, [R].

The price-range forecast limits of columns [B] and [C] get defined by MM hedging actions to protect firm capital required to be put at risk of price changes from volume trade orders placed by big-$ “institutional” clients.

[E] measures potential upside risks for MM short positions created to fill such orders, and reward potentials for the buy-side positions so created. Prior forecasts like the present provide a history of relevant price draw-down risks for buyers. The most severe ones actually encountered are in [F], during holding periods in effort to reach [E] gains. Those are where buyers are emotionally most likely to accept losses.

The Range Index [G] tells where today’s price lies relative to the MM community’s forecast of upper and lower limits of coming prices. Its numeric is the percentage proportion of the full low to high forecast seen below the current market price.

[H] tells what proportion of the [L] sample of prior like-balance forecasts have earned gains by either having price reach its [B] target or be above its [D] entry cost at the end of a 3-month max-patience holding period limit. [ I ] gives the net gains-losses of those [L] experiences.

What makes FICO most attractive in the group at this point in time is its basic strength of reward to risk ratio of 6.2 to 1 in [T].

Further Reward~Risk tradeoffs involve using the [H] odds for gains with the 100 – H loss odds as weights for N-conditioned [E] and for [F], for a combined-return score [Q]. The typical position holding period [J] on [Q] provides a figure of merit [fom] ranking measure [R] useful in portfolio position preferencing. Figure 2 is row-ranked on [R] among alternative candidate securities, with FICO in top rank.

Along with the candidate-specific stocks these selection considerations are provided for the averages of some 3000+ stocks for which MM price-range forecasts are available today, and 20 of the best-ranked (by fom) of those forecasts, as well as the forecast for S&P500 Index ETF as an equity-market proxy.

Current-market index SPY is not competitive as an investment alternative with its Range Index of 35 indicates 2/3rds of its forecast range is to the upside, but little more than 3/4ths of previous SPY forecasts at this range index produced profitable outcomes, with enough losers to put its average in single-digit positive result.

As shown in column [T] of figure 2, those levels vary significantly between stocks. What matters is the net profit between investment gains and losses actually achieved following the forecasts, shown in column [I]. The Win Odds of [H] tells what proportion of the Sample RIs of each stock were profitable. Odds below 80% often have proven to lack reliability.

Price range forecast trends for FICO

Figure 3

blockdesk.com

(used with permission)

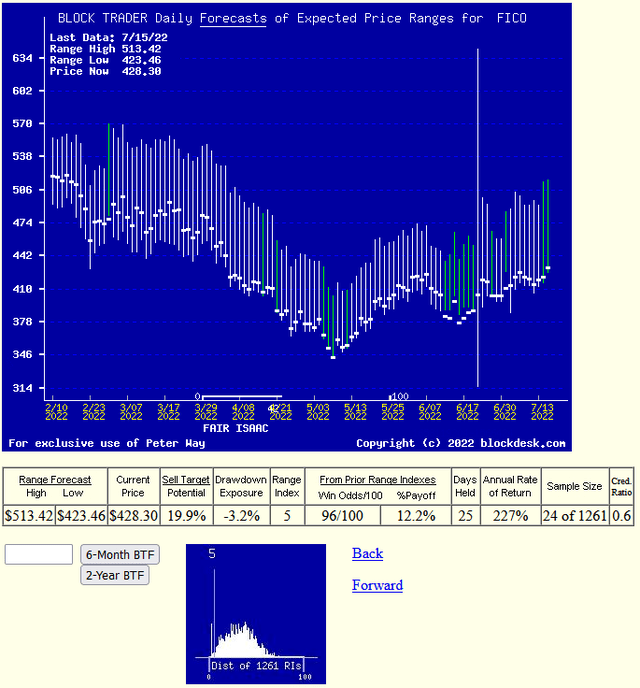

No, this is not a “technical analysis chart”. I’m showing only historical data. It is a Behavioral Analysis picture of the Market-Making community’s actions in hedging investments of the subject. Those actions define expected price change limits shown as vertical bars with a heavy dot at the closing price on the date of the forecast.

It is an actual picture of experienced market professionals expected future prices, not a simple hope of a recurrence of the past. These are expectations backed up by significant bets of investment capital made to protect market-makers required positions or to earn a proprietary profit from risk-taking.

The special value of such pictures is their ability to immediately communicate the balance of expectation attitudes between optimism and pessimism. We quantify that balance by calculating what proportion of the price-range uncertainty lies to the downside, between the current market price and the lower expected limit, labeled the Range Index [RI].

Here a RI at zero indicates no further price decline is likely, but not guaranteed. The odds of 3 months passing without either reaching or exceeding the upper forecast limit or being at that time below the expected lower price (today’s) are quite slight.

The probability function of price changes for FICO are pictured by the (thumbnail) lower Figure 3 frequency distribution of the past 5 years of RI values with the today value indicated.

Conclusion

The multi-path valuations explored by the analysis covered in Figure 2 is rich testimony to the near-future value prospect advantage of a current investment in Fair Isaac Corporation over and above the other compared alternative investment candidates.