Jack Andersen/DigitalVision by way of Getty Photographs

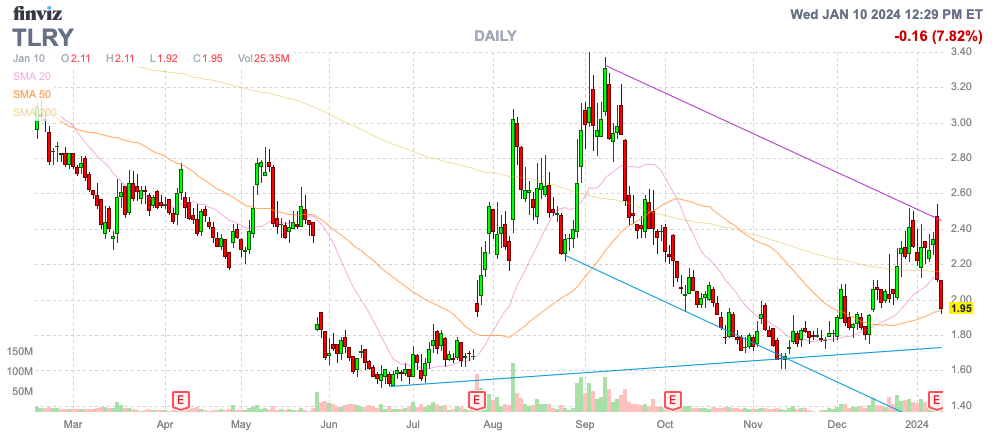

Tilray Manufacturers, Inc. (NASDAQ:TLRY) reported one other quarter the place development was all about acquisitions and never really rising the hashish enterprise. The corporate has lengthy struggled to report any constant development and the enterprise is now just about a non-cannabis operation with the brand new give attention to drinks. My funding thesis stays Impartial on the inventory following the fiscal FQ2 outcomes, with Tilray shares dipping again beneath $2.

Supply: Finviz

One other Complicated Quarter

One of many greatest issues with the Canadian hashish corporations has been the fixed circulation of acquisitions resulting in the corporate going nowhere. In actual fact, an organization like Tilray has at all times appeared to wrestle managing a far-flung enterprise with hashish operations in Canada, a wellness enterprise within the U.S., and international hashish operations, with none of them offering an anchor.

Throughout the simply reported quarter, Tilray acquired a number of craft beer manufacturers from Anheuser-Busch (BUD), together with Shock High and Breckenridge Brewery. The offers had been predicted so as to add $250 million in pro-forma gross sales yearly, and the quarter ended November 30 ought to embody roughly 2 months’ value of gross sales from the brand new beverage alcohol companies.

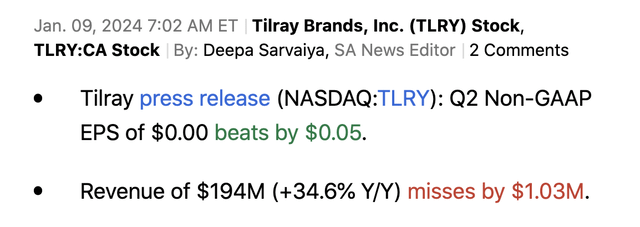

Tilray reported FQ2’24 revenues of $194 million, up 34% from final FQ2, as follows:

Supply: In search of Alpha

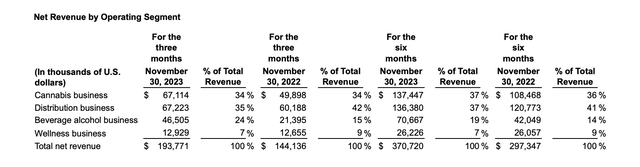

The reported numbers look spectacular, however Tilray acquired HEXO and Truss final 12 months. As well as, the FQ4 ’23 revenues had been $184 million earlier than dipping to $177 million the prior quarter.

Whereas the phase revenues how stable YoY development in all classes, the numbers really did not improve from the August quarter. Hashish income dipped from $71 million in FQ1 to $67 million within the final quarter and Wellness revenues had been down $0.5 million sequentially, whereas the Beverage alcohol enterprise grew from $24 million to $47 million.

Supply: Tilray Manufacturers FQ2’24 earnings launch

In essence, the Beverage alcohol enterprise grew by barely above $22 million within the quarter whereas Tilray revenues had been up simply $18 million. The whole revenues had been solely $12 million above the FQ4 numbers suggesting the non-beverage segments have misplaced $10 million in quarterly gross sales within the final 6 months.

The brand new Beverage alcohol enterprise wants a number of work when Tilray ought to be specializing in bettering the prime hashish enterprise. This beverage enterprise noticed the adjusted gross margin dip to 38% from a previous stage of 52% suggesting the acquired craft beer enterprise is struggling.

As well as, the income enhance does not seem to approximate wherever near the $62.5 million in quarterly pro-forma gross sales forecast when the deal closed with practically 2 months of craft beer gross sales solely boosting the Beverage alcohol enterprise by $22 million. The quantity ought to’ve topped $40 million, or extra, however Tilray suggests excessive seasonality within the craft beer phase. Apart from, the Beverage alcohol income enhance included natural development plus the Montauk deal final November.

No Worth

Tilray saved steerage for FY24 adjusted EBITDA of $68 to $78 million whereas the corporate solely produced $10 million in FQ2. The corporate has reached simply $21 million in adjusted EBITDA YTD requiring over $47 million in adjusted EBITDA within the 2H of the 12 months regardless of a previous lack of ability to develop and a a lot bigger enterprise to handle in 2024 with 8 new craft beer manufacturers on an already various enterprise.

The inventory is simply value $1.4 billion right here, and Tilray has internet debt of ~$184 million. If Tilray was to hit the EBITDA goal, the shares trades at practically 20x adjusted EBITDA.

The adjusted EBITDA targets seem far too aggressive, with Tilray unable to develop the underside line through the years and the quarterly quantities need to at the very least double beginning with FQ3.

Takeaway

The important thing investor takeaway is that Tilray Manufacturers, Inc. is not excessively costly, however buyers haven’t any cause to pile into the inventory at $2. The corporate now will get as a lot revenues from drinks and wellness merchandise as hashish, whereas the distribution enterprise continues to inflate revenues. Administration must refocus the enterprise and show synergies exist from these far-flung segments earlier than Tilray will ever grow to be a viable funding.