POUND STERLING TALKING POINTS

- Record unemployment figures for UK economy.

- U.S. CPI in focus later today.

GBP/USD FUNDAMENTAL BACKDROP

Recommended by Warren Venketas

Get Your Free GBP Forecast

The pound extended its rally this morning on the back of a weaker USD as well as an unemployment rate at 3.6% (last seen in 1974) for the month of July – see economic calendar below. In addition, wages both including and excluding bonuses have beat estimates adding to inflationary pressures which could then lead to a more aggressive Bank of England (BoE).

Later today, U.S. inflation dominates the calendar with the headline figure projected to come in at 8.1% which would be the lowest print in the prior 5 months due to depressed energy prices. The has led to a weaker dollar this week but any slight beat on the headline read may resume dollar upside.

GBP/USD ECONOMIC CALENDAR

Source: DailyFX Economic Calendar

Recommended by Warren Venketas

Trading Forex News: The Strategy

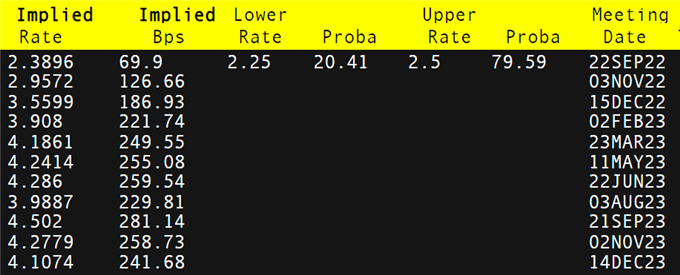

Looking at money market pricing for the upcoming BoE interest rate decision (which was pushed back from the 15th to the 22nd of September due to the Queens passing), expectations are around a 70bps rate hike at 80% probability, which may creep higher to the 75bps mark as upcoming UK inflation data suggests another increase month-on-month for August.

BOE INTEREST RATE PROBABILITIES

Source: Refinitiv

TECHNICAL ANALYSIS

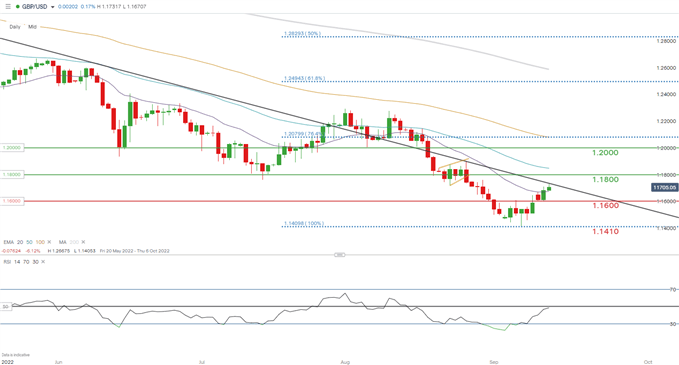

GBP/USD DAILY CHART

Chart prepared by Warren Venketas, IG

GBP/USD price action seems to be findings resistance along the longer-term trendline (black). I do anticipate markets adopting a cautious approach ahead of U.S. inflation which is supported by the Relative Strength Index (RSI) reading around the midpoint 50 level.

Key resistance levels:

- 1.1800

- Trendline resistance

Key support levels:

- 20-day EMA (purple)

- 1.1600

BULLISH IG CLIENT SENTIMENT

IG Client Sentiment Data (IGCS) shows retail traders are currently LONG on GBP/USD, with 75% of traders currently holding long positions (as of this writing). At DailyFX we typically take a contrarian view to crowd sentiment however, recent changes in long and short positioning result in a short-term upside bias.

| Change in | Longs | Shorts | OI |

| Daily | -3% | 10% | 0% |

| Weekly | -5% | 9% | -2% |

Contact and follow Warren on Twitter: @WVenketas