onurdongel

Creator’s Notice: This text was revealed on iREIT on Alpha in early June 2023

Pricey subscribers,

The storage trade tends to be one of many most secure havens of progress and high quality in instances of business turmoil. All you want do is have a look at the 20-year averages of a market chief, or maybe higher stated “the” market chief Public Storage (NYSE:PSA), in an effort to see this.

Why?

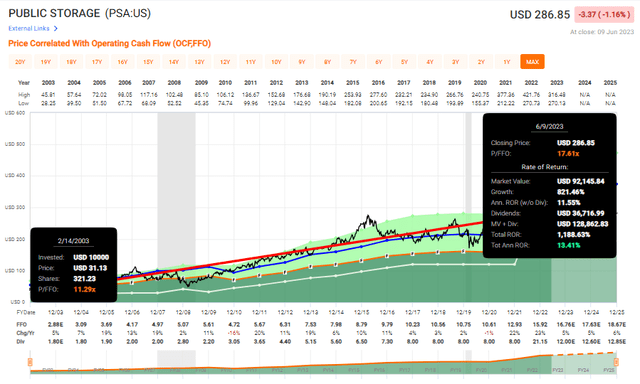

As a result of out of the final 20 years – the corporate had two years of adverse FFO progress. One again in 2010, when it dropped 16%. The opposite in COVID-19 and 2020, when it dropped a whopping one p.c. Apart from that, it has been progress, and even inclusive of these drops, PSA has averaged annual FFO progress of virtually 9% per 12 months which has rewarded traders with a market-beating 20-year RoR of 1,188% even after the decline from its premium over the previous few years.

PSA RoR (F.A.S.T graphs)

That is why I think about it a little bit of a “PSA” to inform you that Public storage, or PSA, is definitely at present undervalued.

Let’s dive in.

Public Storage – A category-leading REIT

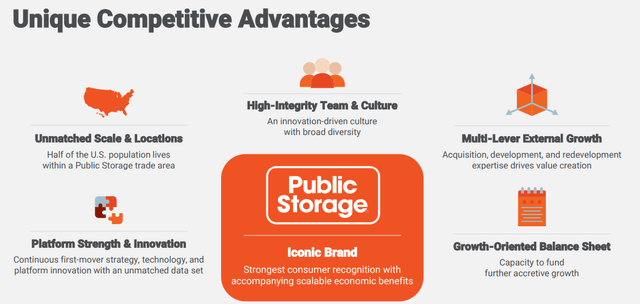

Whereas I’ve written about different firms within the house comparable to Nationwide Storage Associates (NSA), between NSA and PSA, PSA is the clear market chief. With 2,800 properties throughout the width of the nation, the enterprise is giant. Over 1,800,000 prospects use the corporate’s companies and properties, and the corporate provides over 200M sq. ft of house in whole.

The corporate has the type of operational historical past you as a conservative investor actually need to see. 50 years of operational security, a REIT with an A-rating – not many REITs on the planet can come to the desk with an A-rating when it comes to credit score.

PSA IR (PSA IR)

PSA is a “higher breed” than most REITs. Its profitability metrics are off-the-chart. It has a really low debt for a REIT, and if we have a look at the corporate with even remotely conventional fiscal metrics, a few of these qualities shine by like by glass.

ROIC goes to be good for many self-storage REITs however the firm has constantly, over the past 10 years managed to retain huge profitability in its investments and use of invested capital. Throughout ZIRP, this went above double digits web of the price of capital, and even now it is above 5%. That is spectacular.

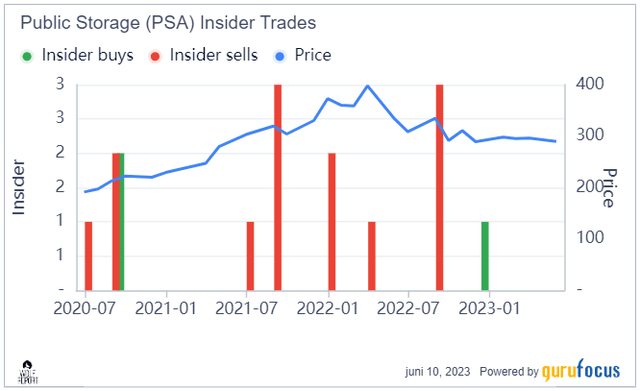

What’s extra and telling, because the firm dropped again in early 2023, it is the primary time in over 2-3 years that insiders have been including shares. They didn’t add shares throughout all of 2021-2022, however they’ve been including once more now. In actual fact, insiders have been promoting vital quantities of shares in the course of the 2021-2022 overvaluation – as I personally would have performed, if I held shares of the corporate on the time.

The entire “Make investments-and-hold-forever” strategy does work, and I do not need to bad-mouth it, but it surely’s much more environment friendly and worthwhile, to remain valuation-conscious.

Insider exercise often does not say all that a lot, however on this case, I do imagine it says quite a bit and it is price having a look at.

PSA IA (GuruFocus)

The actual fact is, PSA isn’t beneath its typical premium of 20-22x to FFO. Every time it’s, it is one thing you need to take note of, as a result of traditionally, investing right now has been one thing that has almost all the time resulted in eventual revenue.

PSA has outperformed the general broader common of the Actual property sector for the previous 18-20 years, averaging a CAGR NOI progress of 5.2% listed to 2004, and round 146% cumulative. That is greater than twice the cumulative NOI progress within the broader actual property sector – and I see no signal that that is altering on a ahead foundation, provided that PSA is forecasting additional progress.

The corporate’s largest market is Los Angeles – and right here is probably one of many challenges. in case you’re not a fan of the west coast and California, you could need to know that PSA has appreciable publicity right here – although the corporate has been rising considerably right here as effectively, going in opposition to the grain when it comes to how the sector of REITs has fared within the geography total.

The newest outcomes from PSA we now have are the 1Q23 outcomes, and this quarter roughly simply confirmed the general optimistic view we will have on PSA. The corporate’s move-in volumes had been up 13%, same-store NOI greater than 11%, and acquisition and improvement NOI up 30%. The corporate is encountering little or no headwind, specializing in the digital transformation of the working mannequin, and its measurement and over $50B price of market cap provides it a novel place to execute the place smaller firms could have extra issue.

Any dangers to the corporate are minor in scope – no less than as I see it. Dangers and concerns must do with pricing sensitivity. On this market – as in lots of others – it is all the time about pricing, and seeing the primary indicators of softness each on a macro stage and in sure geographies as effectively. The move-in quantity power the corporate at present sees dispels the notion of any huge softness in pricing. The corporate has additionally confirmed that this move-in power has moved into 2Q23 as effectively, and the literal reply from administration was that PSA has not seen something regarding, at present, as regards to pricing softness or sensitivity.

The largest subject right now is how the macro uncertainty and the potential of a recession indicate the event of 3Q and 4Q of this 12 months, which in flip makes the full-year forecast considerably unsure nonetheless. I don’t anticipate double-digit FFO progress on this setting, akin to the 2022 developments of over 20% in FFO progress. I do anticipate the corporate to handle 4-6% although, and the present FactSet forecast can be at round 5%.

The corporate stays in a powerful place when it comes to its steadiness sheet. The present debt is round 61%, with a mean price of prefs/debt of two.8%, which means there’s a just-above 3x leverage. That is low – for REITs and for the sector, which signifies that the corporate can transfer ahead on alternatives it considers enticing.

What I see right here is that the near-term future implications usually are not tilted towards adverse in any respect. The corporate is kind of the opposite, strengthening its aggressive benefits and holding on to a income and revenue stream that is effectively above the protection and high quality of many different REITs. Present developments seen in 1Q don’t recommend there shall be any vital near-term draw back to the corporate, and on the idea of this, I’d say that there’s a lot to love about this firm at any type of conservative valuation.

Let’s take a look at the place this valuation at present places us.

Public Storage – The valuation is enticing, even when it is not triple digits

Public Storage will not generate triple digits in 3 years, like some firms that I’ve just lately written about. That is not why we purchase it, or the expectation we should always have, until we see huge overvaluation, which we now have earlier than.

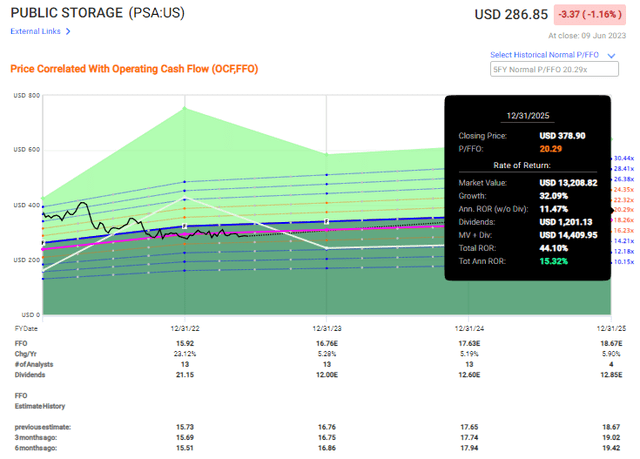

Present valuation developments put PSA at round 17.6x P/FFO, which is effectively beneath its historic common of about 20-22x P/FFO. Progress charges going ahead are going to be extra muted – anticipate 4-6%, with perhaps 5% on common per 12 months.

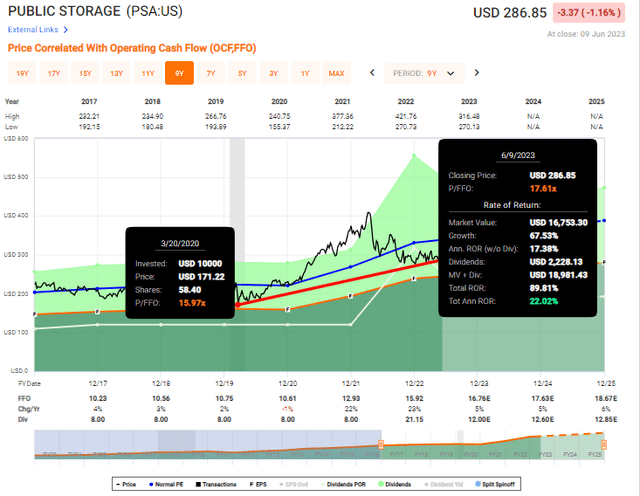

The present upside to Public Storage is excessive – particularly contemplating that the corporate has been what I’d think about extremely valued for a number of years. To place it very frankly, PSA has not been this interesting since 2019-2020. That was the final time, and just for a short while when the corporate traded beneath 20x P/FFO. Anybody who invested throughout COVID-19 is now nonetheless within the optimistic to the tune of twenty-two% annualized, even in case you didn’t promote, or nearly 90% whole ROR. This reveals the facility of investing during times of undervaluation.

PSA RoR (F.A.S.T graphs)

Do I think about it seemingly for the corporate to say no to this stage once more? We’d see 15x, or we’d not – however in any case, 17.6x continues to be an excellent worth, and it is adequate for me to take a position.

The common S&P World analyst targets come to a variety of $294 on the low aspect and $370 on the excessive aspect, with a present common of $341. It is near my goal as a result of I think about PSA to be a “BUY” at a worth of round $340/share or decrease. The upside right here is excessive sufficient – outperformance to premium will imply spectacular RoR atop of that. 11 Analysts observe the enterprise, and out of 11, 9 are at a “BUY” – the sign right here may be very clear, and I are likely to agree with it.

At 17.6x, we’re not at 1x to NAV – we’re nonetheless beneath 0.9x. Downward potential is clearly doable, however I’ve a tough time past geographic weak point or buyer pricing softness being a catalyst for that type of transfer – and that’s not one thing that the corporate at present sees. As a result of that’s not one thing we see, then I do not see a lot downward potential as a result of the corporate’s route is, as forecasted, within the optimistic.

PSA Upside (F.A.S.T graphs)

With that in thoughts, my stance on PSA is optimistic, and I am slowly beginning to add to my place within the firm. At this specific time, I’ve round 0.6% of my portfolio within the firm, and my goal is effectively past 1% finally. Whereas this firm will not make you wealthy – no less than until you are already wealthy, the corporate can pay you dividend, ought to shield your capital, and provides you the benefit of a few of the most recession-resistant money flows on the market.

There’s a lot to love about PSA, and a part of what I like is that it’s not all that thrilling. It is simply “boring storage” – and that’s, as I see it, a bonus on this setting.

For all of those causes, I think about Public Storage to be a “BUY” right here.

Thesis

- Public Storage is a sector outperformer. It is a stable enterprise in a really stable sector, the self-storage sector. The corporate is essentially protected, A-rated, the most important in its complete sector, which is a fragmented sector, to start with and comes with to me plain upside on the appropriate valuation.

- I view the corporate as an absolute “BUY” on the proper valuation, as a result of security of its money flows and the resiliency, the confirmed resiliency, of its enterprise mannequin.

- Based mostly upon this, I give the corporate a transparent PT of round $340/share, permitting for PSA to commerce at a premium which I imagine that the corporate deserves.

- Due to this, PSA is a “BUY” right here and I imagine it warrants your consideration.

Keep in mind, I am all about:

1. Shopping for undervalued – even when that undervaluation is slight, and never mind-numbingly huge – firms at a reduction, permitting them to normalize over time and harvesting capital good points and dividends within the meantime.

2. If the corporate goes effectively past normalization and goes into overvaluation, I harvest good points and rotate my place into different undervalued shares, repeating #1.

3. If the corporate does not go into overvaluation, however hovers inside a good worth, or goes again right down to undervaluation, I purchase extra as time permits.

4. I reinvest proceeds from dividends, financial savings from work, or different money inflows as laid out in #1.

Listed here are my standards and the way the corporate fulfills them (italicized).

- This firm is total qualitative.

- This firm is essentially protected/conservative & well-run.

- This firm pays a well-covered dividend.

- This firm is at present low-cost.

- This firm has a sensible upside based mostly on earnings progress or a number of enlargement/reversion.

Which means the corporate fulfills each single one in all my standards besides it being at present low-cost – I will not name it low-cost at 17x P/FFO – making it comparatively clear why I view it as a “BUY” right here.

Thanks for studying.