By Graham Summers, MBA

I’m getting sick of the lies.

I maintain listening to from supposed gurus and commentators (to not point out the White Home) that inflation is on the decline… however at any time when I’m going to the grocery retailer or attempt to rent somebody to repair one thing at my home or do absolutely anything aside from pay for gasoline… the worth is UP.

Who am I to imagine? The institution or my very own eyes and pockets?

It is a MAJOR concern at present in America… we’re advised on a regular basis that one thing is a sure approach… solely to search out out that it’s not like that in any respect. And the concept inflation goes away is one MAJOR lie that hits near residence because it impacts our incomes and our lives every day.

I’ve been one of many few folks stating that inflation will not be declining for months now. In reality, the one purpose the info even rolled over in any respect was as a result of vitality costs fell as a result of the Biden administration dumped 250 MILLION barrels of oil on the markets.

All that completed was about three months of declining vitality costs. As a result of the bond market simply referred to as “BS” on the concept inflation is below management.

To whit… the yield on the 2-Yr U.S. Treasury… which the Fed tracks to find out the place charges must go… is SPIKING once more and about to take out its former highs! This tells us pint clean that inflation is again and if something the Fed will have to be MUCH MORE aggressive to cease it.

And regardless of this… and the economic system rolling over… and inflation NOT being on the decline… buyers poured $1.5 BILLION per day into shares final month. In reality, from what I can inform, buyers are MORE bullish at present than they had been a 12 months in the past! These people BELIEVE the lies they’re being advised!

That is the type of setting by which crashes can occur.

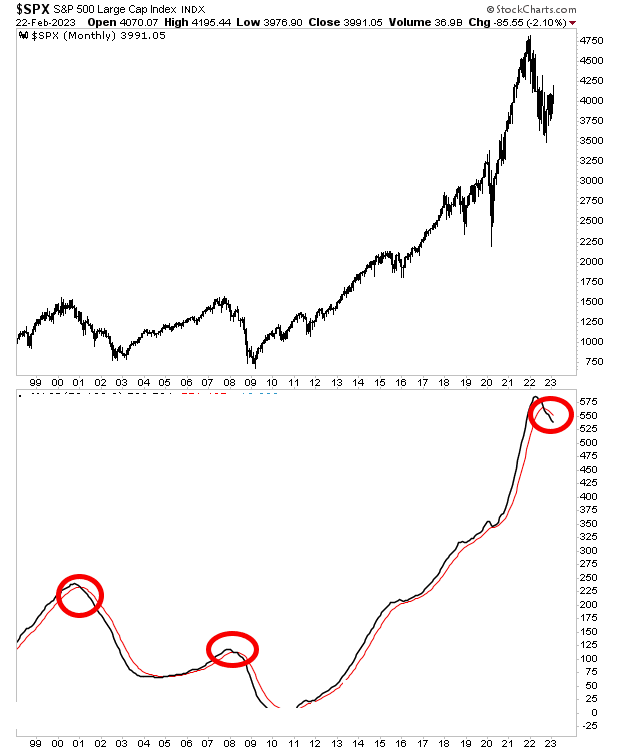

Certainly, my proprietary Crash Set off is now on the primary confirmed “Promote” sign since 2008.

This sign has solely registered THREE instances within the final 25 years: in 2000, 2008 and at present. I’ve illustrated them within the chart under.

The clock is ticking on the markets at present… identical to it was in 2000 and 2008. Many buyers will lose the whole lot… however you don’t need to be one in all them.