- Earnings studies are coming in thick and quick because the reporting season kicks off.

- This may current a unstable interval for shares but in addition create profitable alternatives for savvy buyers.

- On this article, we’ll have a look at three tech giants poised to exceed market expectations of their upcoming studies.

- Searching for actionable commerce concepts to navigate the present market volatility? Unlock entry to InvestingPro’s AI-selected inventory winners for underneath $9 a month!

Shares usually present elevated fluctuations, leaving buyers weak to volatility, particularly amid financial uncertainties and geopolitical tensions.

Nevertheless, whereas the dangers are higher, these huge strikes can current huge revenue alternatives for buyers.

Thus, it’s prudent to determine shares that, based mostly on their efficiency in latest months and analysts’ projections, are positioned to outperform consensus estimates.

3 Large Tech Able to Shock Markets

Narrowing our focus to megacap firms, a number of well-known corporations have constantly surpassed earnings and income forecasts over latest quarters. Based mostly on analysts’ forecasts, these corporations current important alternatives to shock once more.

These firms share traits of regular development and strong earnings forecasts, with all three working within the .

1. Nvidia

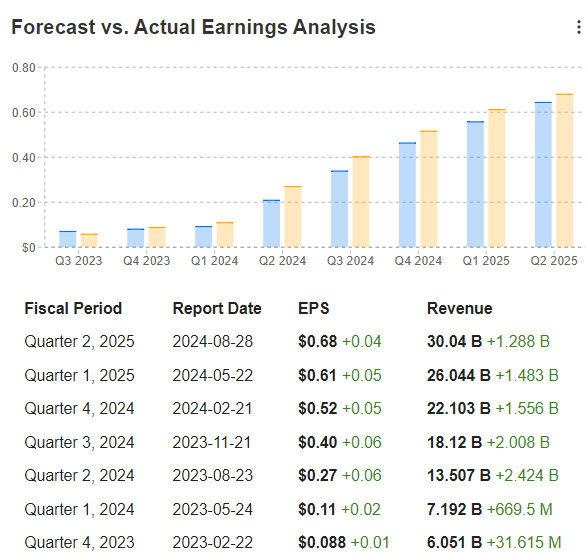

First is NVIDIA (NASDAQ:). After experiencing summer time volatility, the semiconductor inventory has regained its development trajectory, gaining over 18% within the inventory market since mid-September. Nvidia has a outstanding document, beating expectations for seven consecutive quarters.

Supply: InvestingPro

The query stays: Is there nonetheless potential for this optimistic streak to proceed?

In line with the newest analyst evaluations, the reply seems affirmative.

Supply: InvestingPro

Over the previous 12 months, brokers have elevated their expectations for the chip large’s earnings per share (EPS) for the upcoming quarter by 67.9%, rising from $0.44 to $0.74 per share. The corporate, led by Jensen Huang, will report its on November 14.

2. Meta Platforms

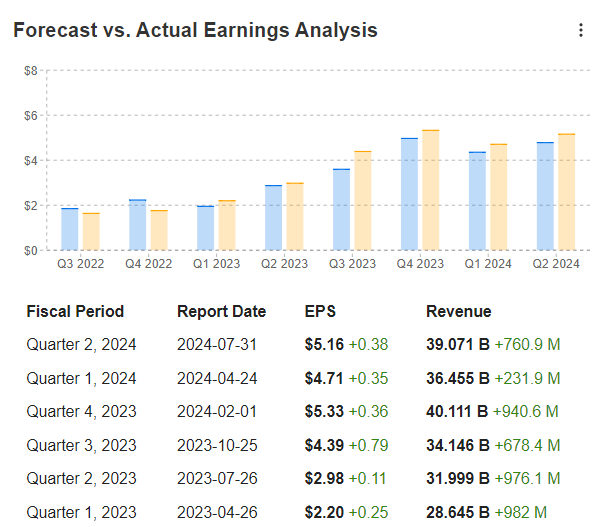

The second megacap to think about is Meta Platforms (NASDAQ:).

The chief in social networking has delivered six consecutive above-expected outcomes, enhancing the wealth of founder and first shareholder Mark Zuckerberg, who has climbed to second place among the many world’s richest people based on Forbes, surpassing Amazon’s (NASDAQ:) CEO Jeff Bezos.

Supply: InvestingPro

Meta’s inventory has appreciated over 80% up to now yr, and the upcoming quarterly report might additional bolster its efficiency.

Supply: InvestingPro

Within the final 12 months, brokers have raised EPS expectations for this quarter by 26.7%, from $4.17 to $5.28 per share. The corporate, which owns Fb and Instagram, will announce its on October 23.

3. Broadcom

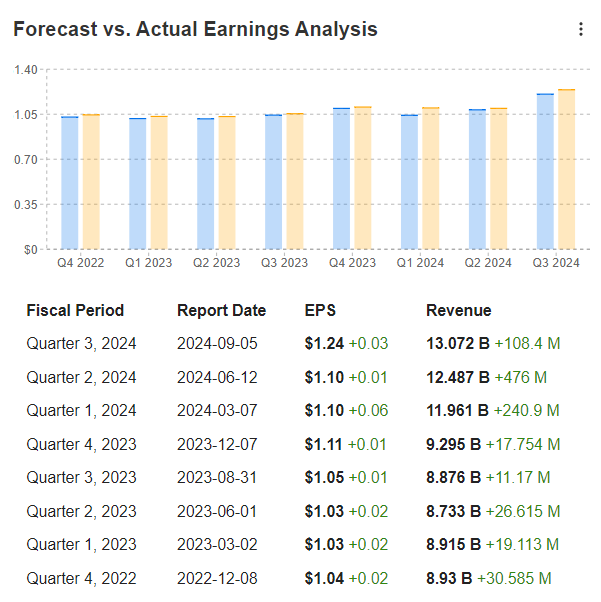

Lastly, Broadcom (NASDAQ:) stands out for its potential to outperform the market. Surging demand for AI has pushed this high business performer’s share value to greater than double in 12 months, with final quarter’s revenues hovering by 47% year-over-year.

Supply: InvestingPro

Analysts are optimistic that Broadcom will shock the markets as soon as extra, as indicated by 20 upward revisions to its third-quarter EPS over the previous 90 days.

Supply: InvestingPro

Since final yr, brokers have elevated EPS expectations for this quarter by 14.9%, from $1.21 to $1.39 per share. On this case, we must wait till December 5 to see if the outcomes certainly exceed expectations when the corporate publicizes its .

***

Disclaimer: This text is written for informational functions solely. It’s not meant to encourage the acquisition of property in any means, nor does it represent a solicitation, supply, suggestion or suggestion to speculate. I wish to remind you that each one property are evaluated from a number of views and are extremely dangerous, so any funding determination and the related danger rests with the investor. We additionally don’t present any funding advisory providers.