According to the latest data from Redfin, the housing market is slowing down in several major U.S. metros. The report included the top 20 U.S. hotspots and ranked them according to the number of home sales, home prices, supply and demand ratio, and the time it took for a listing to go to pending sale status.

After two years of record-breaking data, the newest report shows a stark change of direction for many major U.S. housing markets. Notably, the cities that led the pandemic-fueled homebuying frenzy are increasingly less attractive to homebuyers put off by the high home prices that are now coupled with rapidly rising mortgage rates.

The latest data and news coverage swirling around the housing correction has caused a lot of concern amongst real estate investors, and rightfully so. The question is: how should you react to this?

The West Coast Is Slowing Down The Fastest

The most obvious takeaway is the cool-off in popular west coast housing markets. Seattle, in particular, is experiencing the most dramatic downturn, with home sales down 34% year-over-year as of August. It’s a marked contrast with the 23% increase in the number of home sales in the city, which came as recently as February 2022, going to show how quickly things have changed.

Seattle is not an isolated example, either. Several major cities in California are experiencing a similar drop-off in buyer demand and, thus, home prices. Sacramento, San Jose, San Francisco, and San Diego are all seeing double-digit percentage decreases in home prices. Below are the 20 markets that are experiencing the fastest cool-offs, according to Redfin.

The west coast has had a problem with increasing unaffordability for a long time, and the pandemic merely exacerbated an existing trend. It’s unsurprising that buyers are already feeling the squeeze from high home prices and are now reconsidering buying in these areas, especially since the typical mortgage interest rate is almost double what it was at the beginning of the year.

According to Redfin Chief Economist Daryl Fairweather, “These are all places where homebuyers are feeling the sting of rising home prices, higher mortgage rates, and inflation very sharply. They’re slowing down partly because so many people have been priced out and partly because last year’s record-low rates made them unsustainably hot.”

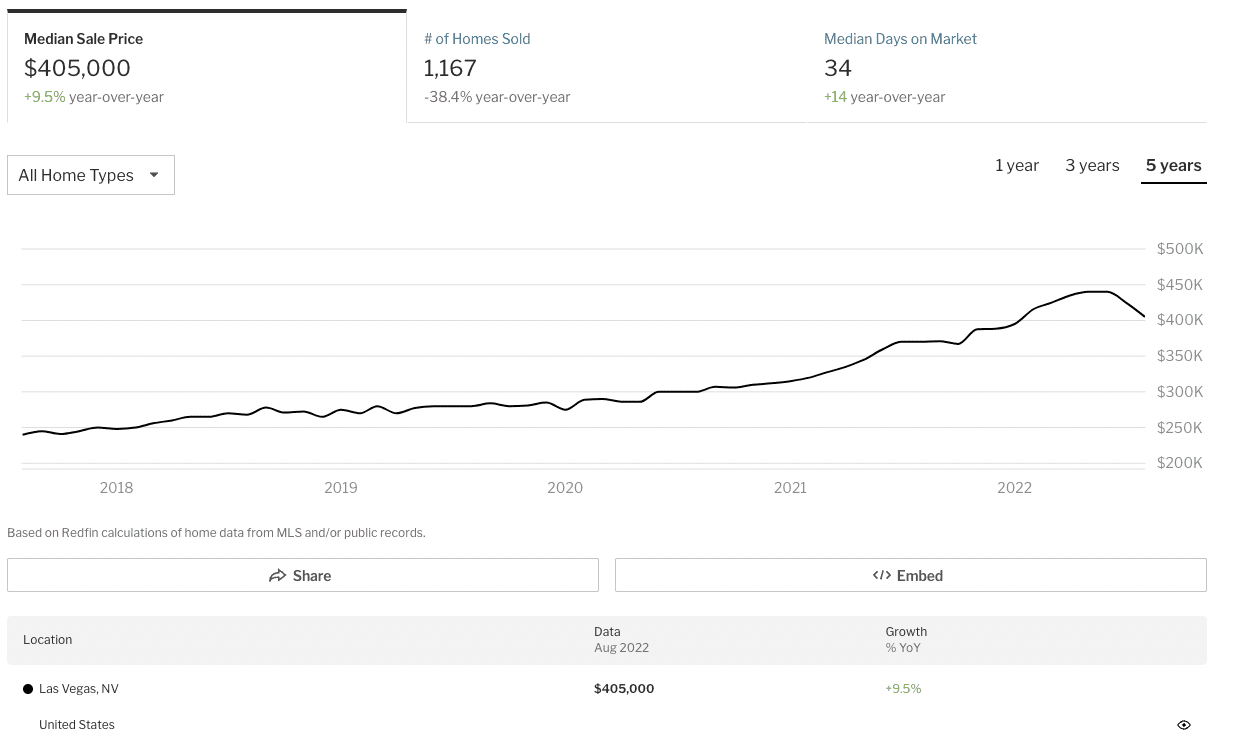

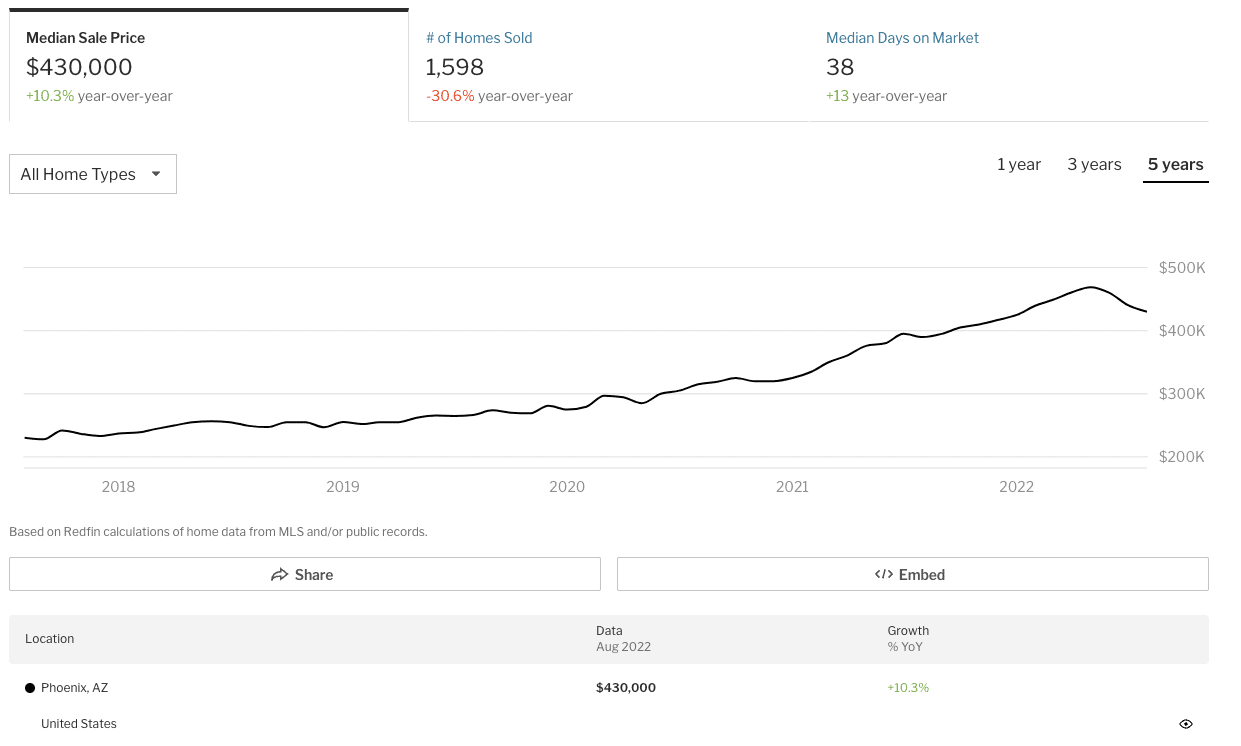

Similar effects are observable in areas that became popular pandemic relocation hotspots, notably Las Vegas, Nevada, and Phoenix, Arizona. These markets consistently made headlines over the last few years as the best cities for professionals migrating from the expensive markets of California. This year, however, they are experiencing the same issues. Housing markets in these metros became overpriced fast, and there are plenty of indications that buyers no longer see these destinations as attractive alternatives to overheated, overpriced coastal markets.

Las Vegas, for instance, peaked at $440,000 in median home prices this summer, up from $289,000 in February 2020. The median home price has since fallen sharply to $405,000.

On the other hand, Phoenix peaked at $469,000 in May and has since fallen to $430,000. In February 2020, the median home price was $279,000.

Does It Make Sense To Invest Right Now?

There’s no denying that with the housing market cooling off, investing requires a more cautious and calculated approach. According to Bloomberg, the first reaction to a market slow-down from investors is always an instinctive pull-back, with landlords canceling contracts and house flippers selling off their stock to clear inventories.

Does this have to be you? Not necessarily. One thing to remember about this housing market is that it’s not poised to crash, but instead, correct. With the right approach, you can still turn a profit, whether you invest in long-term rental properties, short-term rentals, develop, etc.

In a buyer’s market, it becomes necessary to consider buyer needs and seller perks that will entice buyers who may be hesitant, given our higher interest rates.

If you flip homes, which is of course one of the more challenging strategies in a receding market, seeking out cash buyers is the wise thing to do right now. According to Redfin CEO Glenn Kelman, accepting lower offers is the better strategy in a slower market over ‘’accruing interest expenses and other carrying costs as listings linger.’’

If you’re an institutional landlord, then you may choose to hold back on expanding your inventory just now. It’s all about waiting for the right moment when home prices come down even more. As Mark Zandi, chief economist for Moody’s Analytics, explained to Bloomberg, “Institutional buyers are opportunistic. I’m sure they’re waiting, thinking they’ll get a much better price for these properties in the not-so-distant future.”

While it’s easy to run the wait-and-see strategy going into 2023, there are still plenty of opportunities to find in this housing market. That’s why it’s more important now than ever to become a BiggerPockets Pro Member to stay on top of the latest news and proven approaches to real estate investing.

On The Market is presented by Fundrise

Fundrise is revolutionizing how you invest in real estate.

With direct-access to high-quality real estate investments, Fundrise allows you to build, manage, and grow a portfolio at the touch of a button. Combining innovation with expertise, Fundrise maximizes your long-term return potential and has quickly become America’s largest direct-to-investor real estate investing platform.

Learn more about Fundrise

Note By BiggerPockets: These are opinions written by the author and do not necessarily represent the opinions of BiggerPockets.