Markets have been up on the broader index however blended general, with 319 names decrease within the and 180 increased. The day was uneventful from an fairness market standpoint, however we noticed large strikes in FX, with the standing out.

The French known as for a no-confidence vote for his or her newly appointed Prime Minister, Michel Barnier, and this despatched the EUR/USD down by round 80 bps on the day.

The EUR/USD doesn’t look nice at this level and possibly might fall additional. Certainly, when wanting on the technicals, a drop beneath 1.04 and probably beneath 1.03 seems attainable. Momentum is bearish and never displaying a lot in the best way of a transparent backside but.

French 5-year credit score default swaps have traded to their highest degree since 2020.

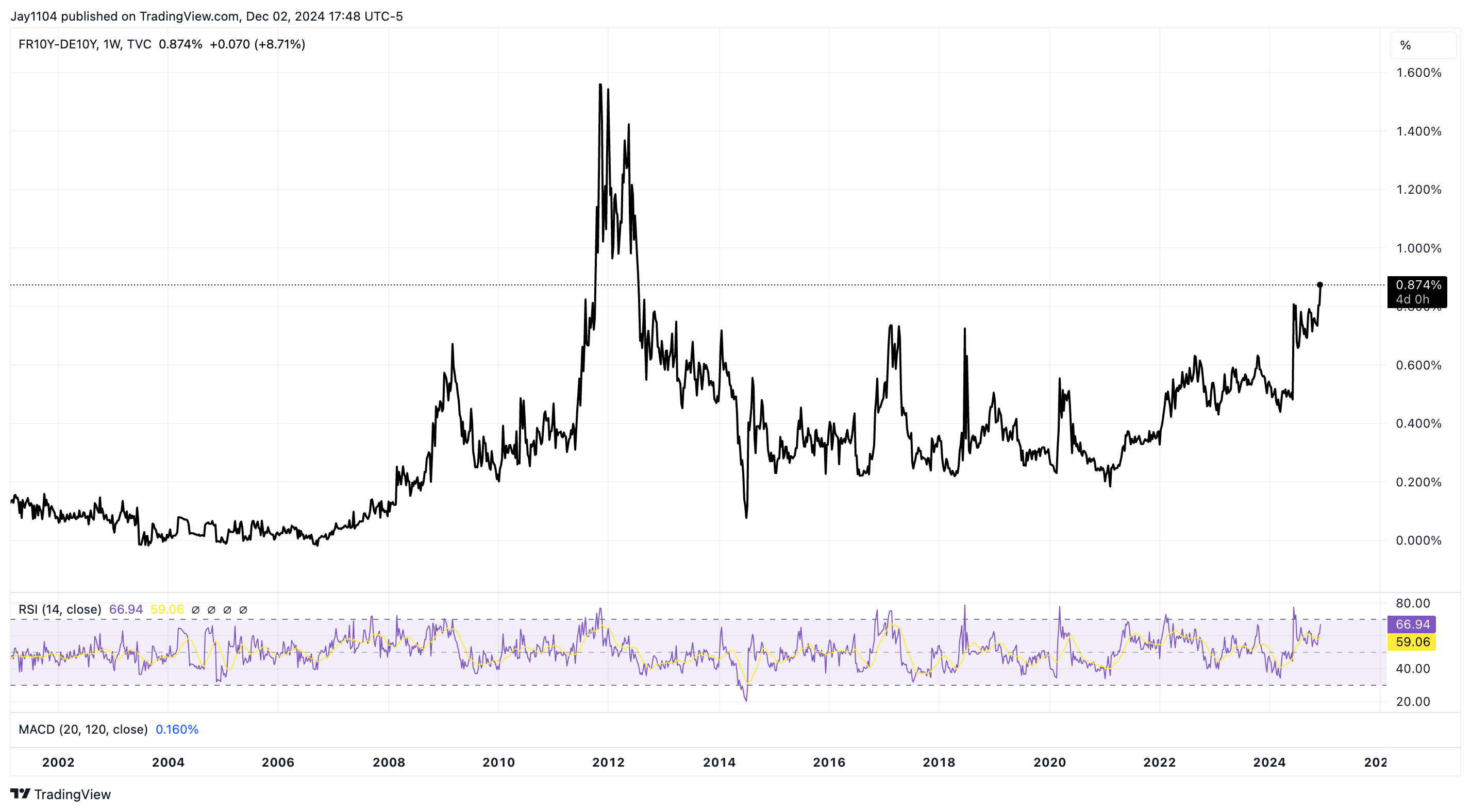

In the meantime, the French/German 10-year unfold rose to its highest since 2012. So, so long as the French funds points persist, the euro dangers additional struggles.

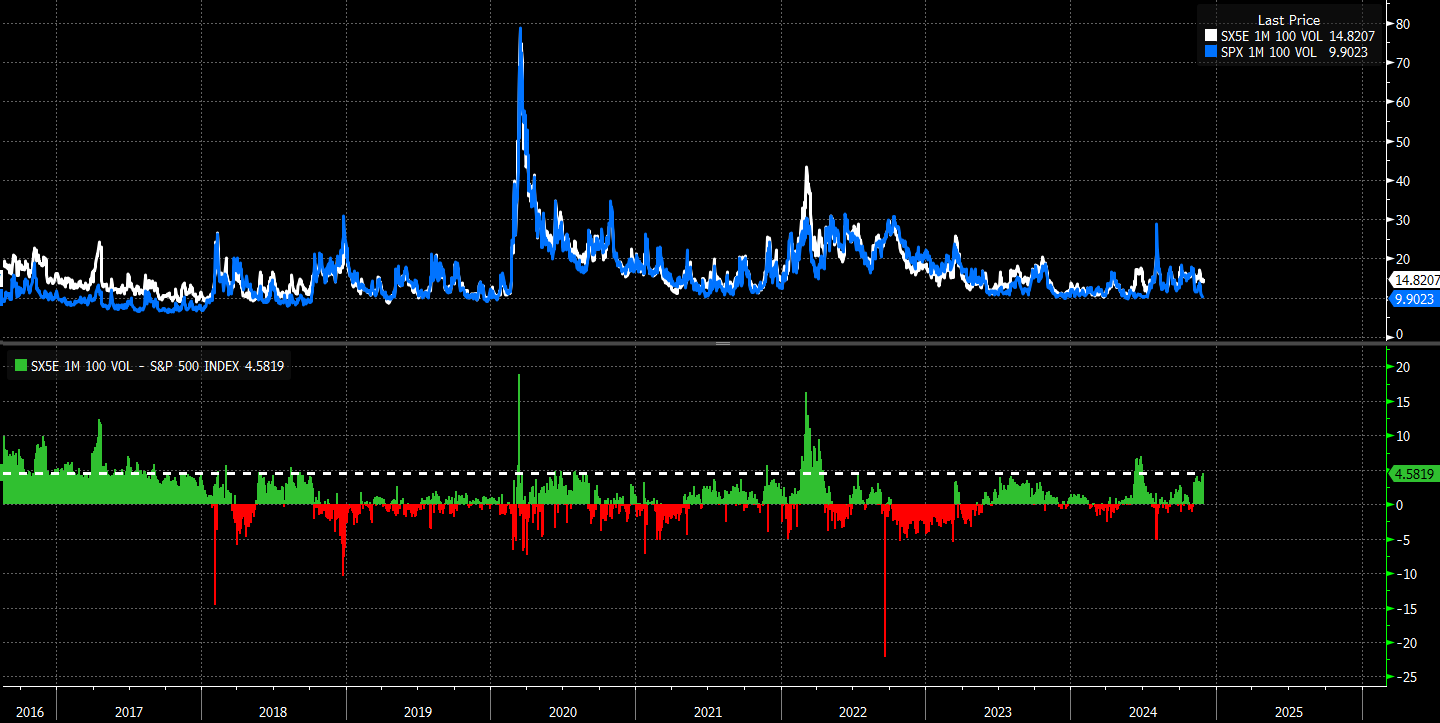

Moreover, yesterday, we noticed the S&P 500 ATM 1-month IV and ATM 1-month IV unfold widen out to 4.5 vols, which is a fairly decent-sized unfold.

Extra lately, it has solely been increased as soon as, and that was when the entire French parliamentary subject began again in late Might and June.

Whether or not these points spill over into US markets stays to be seen. I suppose it’s going to come all the way down to how lengthy and the way extreme the issues develop into.

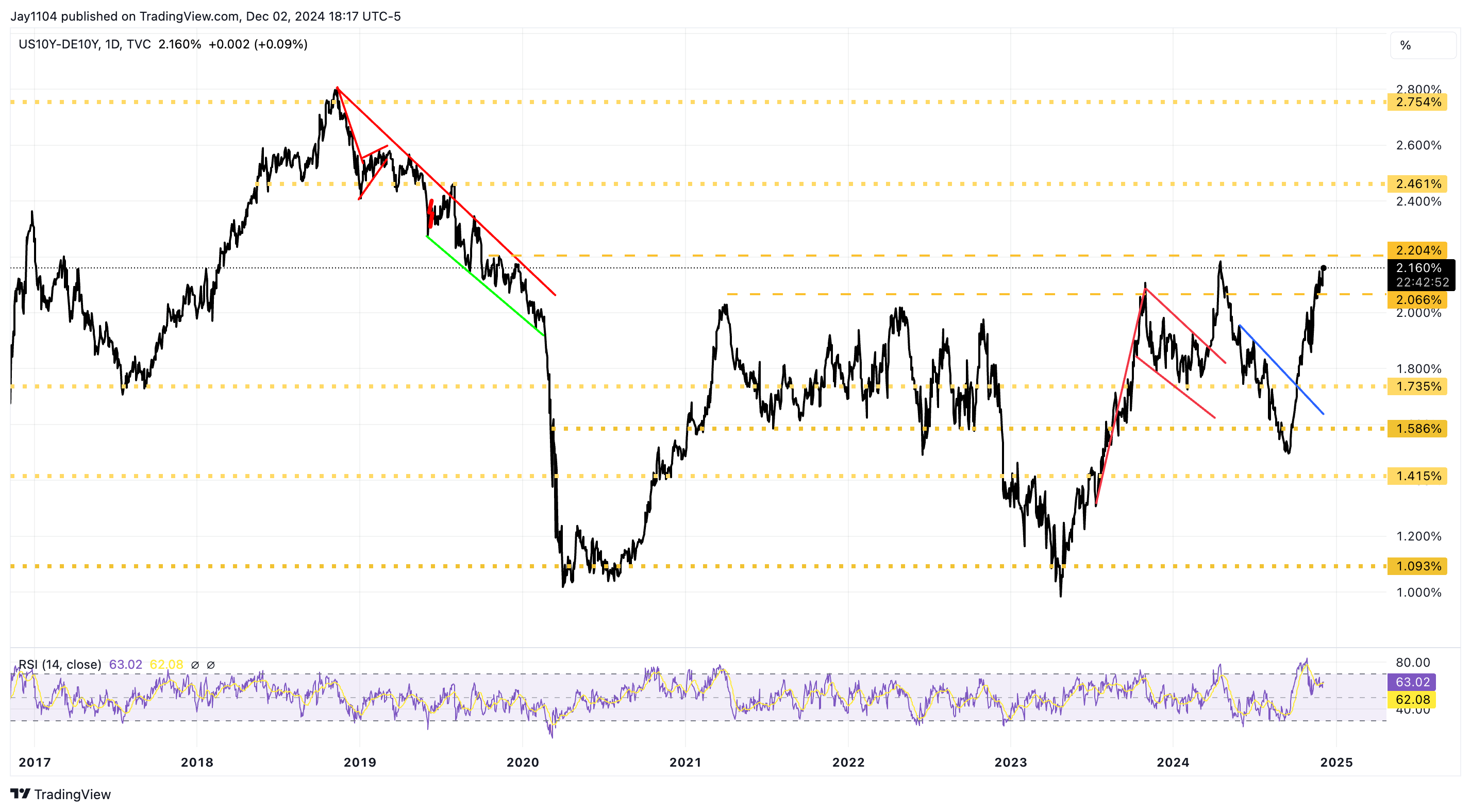

The and German 10-year spreads are at an essential spot, at 2.16%. If the unfold rises above 2.2%, it might result in a fairly sharp breakdown within the euro.

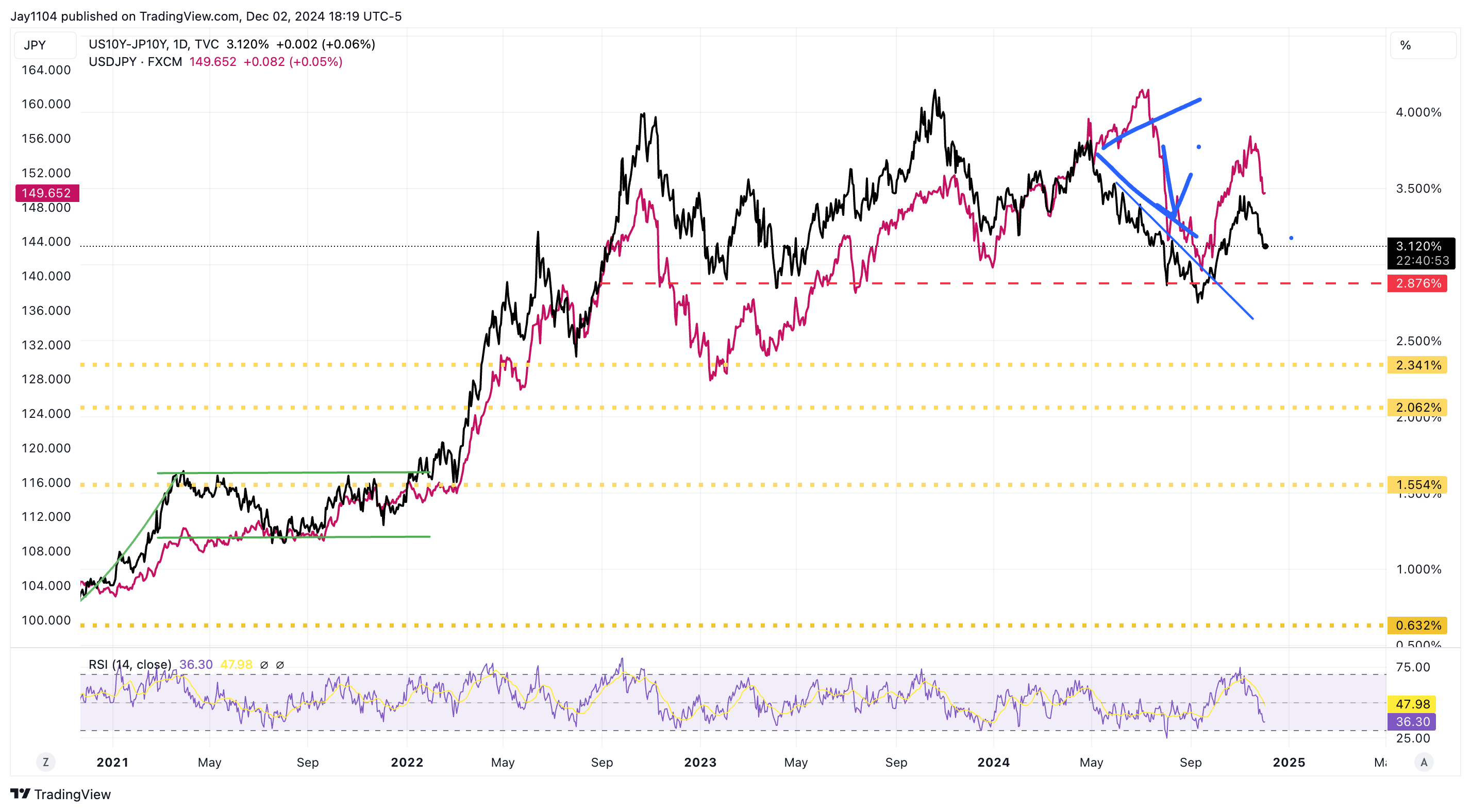

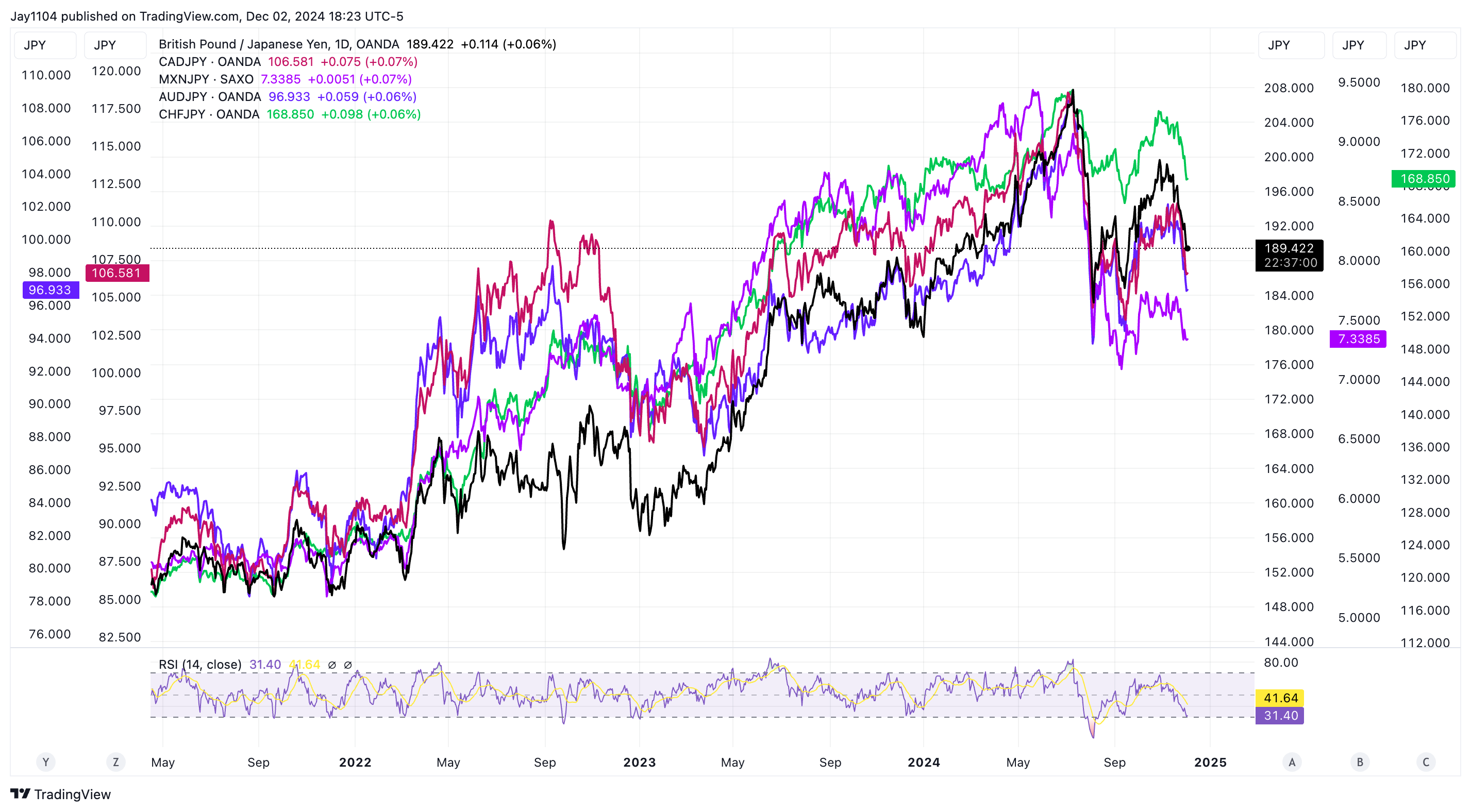

The alternative occurs in Japan, with 10-year spreads and US charges contracting. If the unfold continues to contract, it’s going to result in a stronger , which means the USD/JPY falls from its present degree.

In fact, you possibly can think about what which means if the strengthens throughout nearly each G10 foreign money aside from the yen, and it isn’t fairly. The will not be far off its August lows.

It’s the similar search for the , , , , and .

I suppose the larger query is when the US inventory market will care.

I suppose we are going to discover out quickly sufficient.

Unique Publish