- Tensions rise within the Center East as three US Troopers are killed in a base close to the Syrian-Jordan border after being attacked by Iran-backed militants. Crude Oil worth opens 1.15% increased.

- Gold rose 0.63% on Monday resulting from rising stress within the Center east. Merchants are evaluating whether or not the market will witness a “risk-off” sentiment this week.

- All eyes on the Federal Reserve’s press convention on Wednesday. Analysts count on the Federal Fund Charge to stay unchanged, however the Press Convention will sign the Fed’s future path.

- The US financial system grew 3.3% within the newest quarter, beating expectations of two.0%. Along with this, Pending House Gross sales rose 8.3% and the Core PCE Index rose from 0.1% to 0.2%.

XAUUSD – Geo-Political Pressure Once more on The Rise

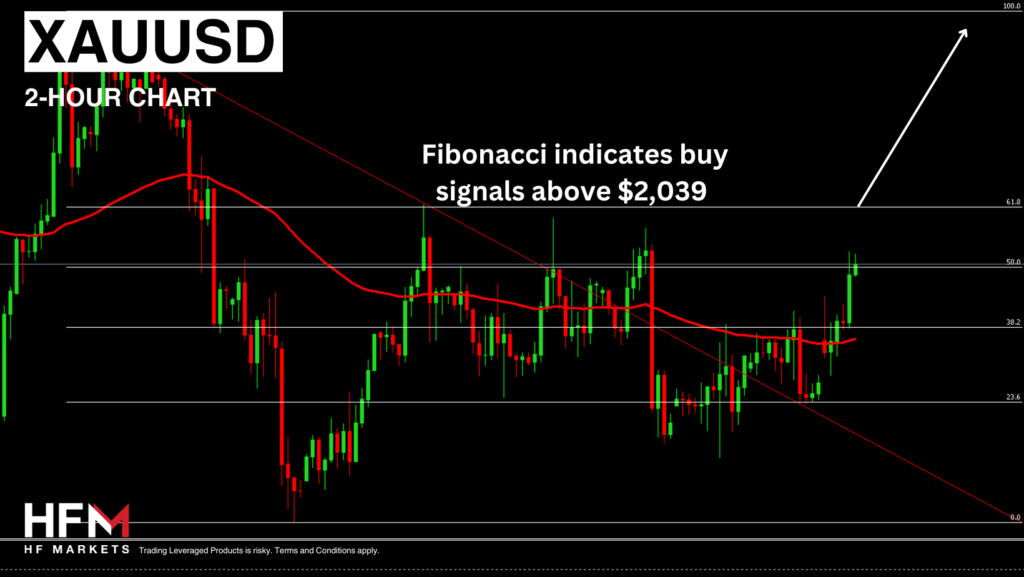

The US Greenback Index did open Monday’s buying and selling barely increased, nonetheless, has fallen 0.10% over the previous 2 hours as of the time of writing. As a substitute, buyers are rising publicity to Gold. Gold costs are buying and selling 0.63% increased throughout this morning’s Asian Session and have risen above the latest resistance ranges. When evaluating technical evaluation, the value of the commodity is buying and selling above worth sentiment indicators, above the impartial on most oscillators and above the day’s VWAP. Right here we are able to see potential “purchase” alerts, nonetheless, buyers additionally ought to be aware important resistance factors at $2,037.80. This stage has triggered declines on eight events over the previous month. If the value maintains momentum and crosses this stage, Gold will transfer into the “purchase” area of the Fibonacci ranges.

The worth is essentially being pushed by two components: the decline within the Greenback and decrease investor sentiment resulting from rising Center East tensions. The group which performed the assault just isn’t but identified, nonetheless, President Biden has already suggested the US will retaliate. In response to the White Home, the group is most probably an Iranian-backed militant group which is the principle concern for buyers. Although buyers ought to be aware that it will solely have a short-term impact if the scenario doesn’t escalate.

The following worth drive would be the Federal Reserve’s Press Convention and the central financial institution’s ahead steerage on rates of interest. It will decide if establishments determine to additional expose their funds to the Greenback or search for options. The principle options might be Gold and US Bonds. If buyers are unconvinced the Fed will hold charges excessive, Gold may benefit from a weaker Greenback. Tomorrow’s JOLTS Job Openings might additionally create additional volatility.

USA100 – Traders Eye Earnings and Fed Press Convention

US buyers are involved concerning the developments over the weekend and consequently the rising oil worth. One other concern for buyers can be if the Fed provides an ultra-hawkish sign on Wednesday after sturdy financial knowledge final week. Final week, the US PMI rose increased than expectations as did the financial system’s Gross Home Product. Although shares and shareholders will equally be monitoring this week’s quarterly earnings stories from main firms.

Tuesday Quarterly Earnings Report

Microsoft – +1.01% over the previous week.

Alphabet – +3.30% over the previous week.

AMD – +1.58% over the previous week.

Wednesday Quarterly Earnings Report

Apple – Unchanged over the previous week.

Amazon – +1.35% over the previous week.

Meta – +1.61% over the previous week.

The efficiency of the USA100 will largely rely upon whether or not the above earnings are increased than Wall Avenue’s expectations and on the Fed’s Press Convention. If the Fed is considered as “ultra-hawkish”, shares are more likely to expertise important strain if earnings don’t exceed expectations.

Michalis Efthymiou

Market Analyst

Disclaimer: This materials is supplied as a basic advertising communication for data functions solely and doesn’t represent an unbiased funding analysis. Nothing on this communication incorporates, or ought to be thought-about as containing, an funding recommendation or an funding suggestion or a solicitation for the aim of shopping for or promoting of any monetary instrument. All data supplied is gathered from respected sources and any data containing a sign of previous efficiency just isn’t a assure or dependable indicator of future efficiency. Customers acknowledge that any funding in Leveraged Merchandise is characterised by a sure diploma of uncertainty and that any funding of this nature includes a excessive stage of danger for which the customers are solely accountable and liable. We assume no legal responsibility for any loss arising from any funding made based mostly on the knowledge supplied on this communication. This communication should not be reproduced or additional distributed with out our prior written permission.