Printed on Might twenty eighth, 2025 by Bob Ciura

Canadian oil shares have confirmed over the previous decade that they’ll navigate downturns in commodity costs.

Canadian oil shares additionally are inclined to pay larger dividends than many U.S.-based oil shares, making them probably extra interesting for revenue traders.

Valuations have additionally remained fairly low just lately, boosting their respective whole return profiles because of this.

On this article, we’ll check out 7 main Canadian oil shares:

- Canadian Pure Assets (CNQ)

- Suncor Power (SU)

- Enbridge, Inc. (ENB)

- Whitecap Assets (SPGYF)

- Paramount Assets (PRMRF)

- Tamarack Valley Power (TNEYF)

- Freehold Royalties Ltd. (FRHLF)

On this article, we’ll rank them so as of highest anticipated annual returns over the following 5 years.

Observe: Canada imposes a 15% dividend withholding tax on U.S. traders. In lots of instances, investing in Canadian shares via a U.S. retirement account waives the dividend withholding tax from Canada, however test together with your tax preparer or accountant for extra on this challenge.

These prime 7 Large Oil shares in Canada are shareholder-friendly corporations, with enticing dividend payouts. With this in thoughts, we created a full record of practically 80 vitality shares.

You may obtain a free copy of the vitality shares record by clicking on the hyperlink under:

Extra info might be discovered within the Certain Evaluation Analysis Database, which ranks shares primarily based on their dividend yield, earnings-per-share progress potential, and modifications within the valuation a number of.

The shares are listed so as under, with #1 being essentially the most enticing for traders immediately.

Learn on to see which Canadian oil inventory is ranked highest in our Certain Evaluation Analysis Database.

Desk Of Contents

You need to use the next desk of contents to immediately leap to a selected inventory:

The highest 7 Canadian oil shares are ranked primarily based on whole anticipated returns over the following 5 years, from lowest to highest.

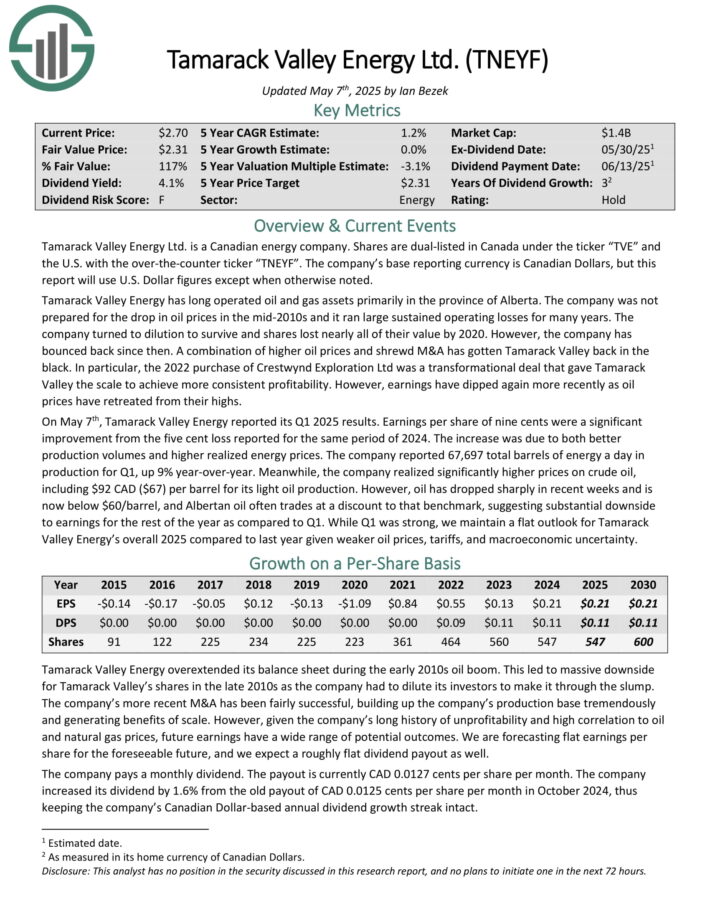

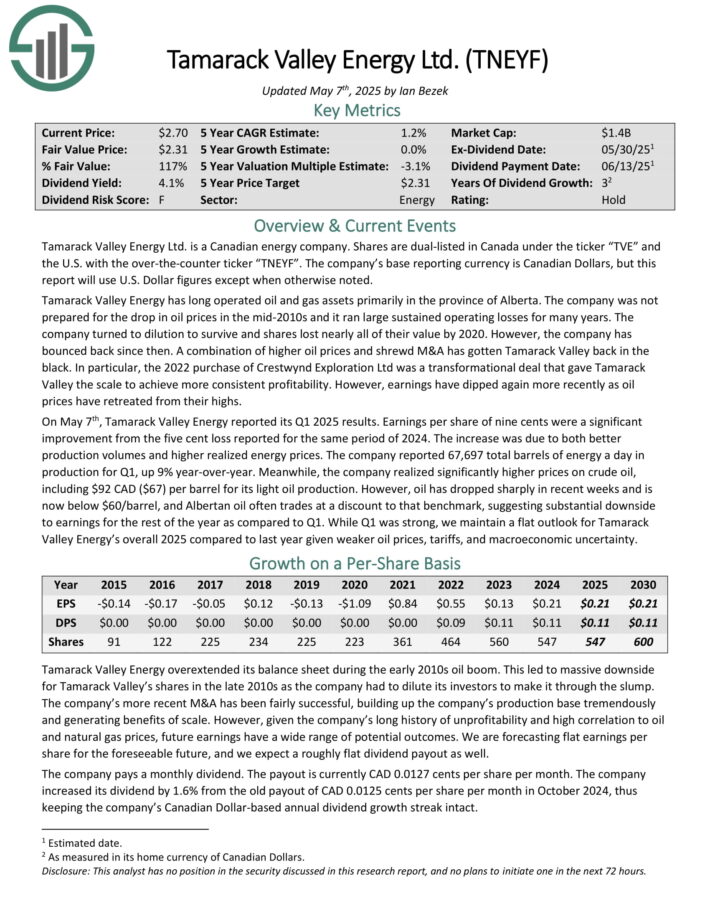

Canadian Oil Inventory #7: Tamarack Valley Power (TNEYF)

- 5-year anticipated returns: -2.5%

Tamarack Valley Power Ltd. is a Canadian vitality firm. Shares are dual-listed in Canada underneath the ticker “TVE” and the U.S. with the over-the-counter ticker “TNEYF”.

The corporate’s base reporting forex is Canadian {Dollars}, however this report will use U.S. Greenback figures besides when in any other case famous. Tamarack Valley Power has lengthy operated oil and gasoline property primarily within the province of Alberta.

On Might seventh, Tamarack Valley Power reported its Q1 2025 outcomes. Earnings per share of 9 cents have been a major enchancment from the 5 cent loss reported for a similar interval of 2024. The rise was resulting from each higher manufacturing volumes and better realized vitality costs.

The corporate reported 67,697 whole barrels of vitality a day in manufacturing for Q1, up 9% year-over-year. In the meantime, the corporate realized considerably larger costs on crude oil, together with $92 CAD ($67) per barrel for its gentle oil manufacturing.

Nevertheless, oil has dropped sharply in current weeks and is now under $60/barrel, and Albertan oil typically trades at a reduction to that benchmark, suggesting substantial draw back to earnings for the remainder of the yr as in comparison with Q1.

Click on right here to obtain our most up-to-date Certain Evaluation report on TNEYF (preview of web page 1 of three proven under):

Canadian Oil Inventory #6: Paramount Assets (PRMRF)

- 5-year anticipated returns: -2.4%

Paramount Assets is a Canadian vitality firm. Paramount Assets has a protracted historical past. The corporate was based in 1976 and has been publicly-traded since 1978.

Paramount Assets now owns a much smaller oil and gasoline manufacturing base centered on the Kaybob area of Alberta together with the Willesden Inexperienced Duvernay space additionally positioned in Alberta.

The corporate introduced its Q1 2025 outcomes on Might thirteenth, 2025. EPS of C$8.74 skyrocketed from C$0.46 within the prior yr however outcomes aren’t comparable. The overwhelming majority of that revenue was from features on current asset gross sales together with receiving insurance coverage claims tied to wildfire harm.

For the reason that firm just lately bought off the vast majority of its manufacturing base, ahead earnings can be far decrease. Certainly, money stream from operations slipped from C$1.52 to C$1.01 per share year-over-year.

Analysts are forecasting simply 12 cents of earnings for Q2, which supplies a a lot more true reflection of the corporate’s earnings energy post-asset sale.

Click on right here to obtain our most up-to-date Certain Evaluation report on PRMRF (preview of web page 1 of three proven under):

Canadian Oil Inventory #5: Whitecap Assets (SPGYF)

- 5-year anticipated returns: 3.9%

Whitecap Assets is a Canadian vitality firm engaged within the acquisition, improvement, and manufacturing of oil and pure gasoline throughout Western Canada. Whitecap operates via 4 core areas: Northern Alberta & British Columbia, Central Alberta, Japanese Saskatchewan, and Western Saskatchewan.

It markets its manufacturing domestically and into the U.S., with publicity to benchmark pricing via numerous gross sales channels. It pays dividends on a month-to-month foundation. It studies its financials in CAD. All figures on this report have been transformed to USD except in any other case famous.

On April twenty third, 2025, Whitecap Assets reported its first-quarter outcomes for the interval ending March thirty first, 2025. For the quarter, income was about $678 million, a rise from $625 million in Q1 2024. Internet income after royalties got here in at $564 million.

The change was influenced by modest commodity worth dynamics and realized features of $9.86 million on commodity contracts, though unrealized losses weren’t detailed within the quarterly launch. Working revenue earlier than taxes was about $397 million, up from $347 million final yr.

Click on right here to obtain our most up-to-date Certain Evaluation report on SPGYF (preview of web page 1 of three proven under):

Canadian Oil Inventory #4: Canadian Pure Assets (CNQ)

- 5-year anticipated returns: 5.5%

Canadian Pure Assets is an vitality firm that operates within the acquisition, exploration, improvement, manufacturing, advertising and marketing, and sale of crude oil, pure gasoline liquids (NGLs), and pure gasoline.

It’s headquartered in Calgary, Alberta. All of the figures on this report are in U.S. {dollars}. Along with buying and selling on the New York Inventory Trade, CNQ inventory trades on the Toronto Inventory Trade.

You may obtain a full record of all TSX 60 shares under:

In early Might, Canadian Pure Assets reported (5/8/25) monetary outcomes for the primary quarter of fiscal 2025. The corporate grew its manufacturing 19% over the prior yr’s quarter, to a brand new all-time excessive. As well as, the worth of pure gasoline considerably elevated. Consequently, the earnings-per-share of Canadian Pure Assets surged 70%.

Canadian Pure Assets has raised its quarterly dividend by 4% this yr and thus it has grown its dividend (in CAD) for 26 consecutive years, at a compound annual progress charge of 20%.

That is an admirable accomplishment for a corporation that belongs to the extremely cyclical vitality sector. The corporate reiterated that its dividend is roofed by money flows due to its low-cost reserves. Administration expects 12% manufacturing progress this yr.

Click on right here to obtain our most up-to-date Certain Evaluation report on CNQ (preview of web page 1 of three proven under):

Canadian Oil Inventory #3: Suncor Power (SU)

- 5-year anticipated annual returns: 6.4%

Suncor Power is likely one of the largest built-in vitality producers in Canada. The corporate is concerned in all of the facets of the vitality worth chain, working in three segments: Exploration & Manufacturing, Refining & Advertising, and Different.

Suncor is headquartered in Calgary, Alberta, Canada and is cross listed on each the Toronto Inventory Trade and the New York Inventory Trade. Suncor studies monetary leads to Canadian {dollars}. Nevertheless, the figures listed on this analysis report are in USD.

In early Might, Suncor reported (5/6/25) outcomes for the primary quarter of 2025. It posted document first-quarter manufacturing and refining volumes. It grew its manufacturing 2% over final yr’s quarter and posted refinery utilization of 104%. Nevertheless, resulting from decrease costs of oil and gasoline, adjusted earnings-per-share dipped -7%.

Suncor reiterated its steering for primarily flat manufacturing this yr and a lower in refinery utilization from 100% to 93%-97% resulting from upkeep. Given additionally the current decline in oil costs, we’ve got lowered our forecast for earnings-per-share in 2025 from $3.20 to $3.00. .

Click on right here to obtain our most up-to-date Certain Evaluation report on SU (preview of web page 1 of three proven under):

Canadian Oil Inventory #2: Enbridge Inc. (ENB)

- 5-year anticipated annual returns: 7.0%

Enbridge is an oil & gasoline firm that operates the next segments: Liquids Pipelines, Fuel Distributions, Power Companies, Fuel Transmission & Midstream, and Inexperienced Energy & Transmission. Enbridge purchased Spectra Power for $28 billion in 2016 and has turn into one of many largest midstream corporations in North America.

Enbridge was based in 1949 and is headquartered in Calgary, Canada.

Enbridge reported its fourth quarter earnings outcomes on February 14. The corporate generated revenues of CAD$16.2 billion through the interval, which was up by 36% in comparison with the earlier yr’s quarter, and which pencils out to US$11.2 billion.

Throughout fiscal 2024, Enbridge grew its adjusted EBITDA by 13% yr over yr, to CAD$18.6 billion, up from CAD$16.5 billion through the earlier yr’s quarter.

Throughout fiscal 2024, Enbridge was capable of generate distributable money flows of CAD$12.0 billion, which equates to US$8.3 billion, or US$3.84 on a per-share foundation.

Enbridge is forecasting distributable money flows in a variety of CAD$5.50 – CAD$5.90 per share for the present yr. Utilizing present alternate charges, this equates to USD$3.95 on the midpoint of the steering vary, which might be up 3% versus 2024.

Click on right here to obtain our most up-to-date Certain Evaluation report on ENB (preview of web page 1 of three proven under):

Canadian Oil Inventory #1: Freehold Royalties Ltd. (FRHLF)

- 5-year anticipated annual returns: 9.2%

Freehold Royalties is a Canadian vitality firm. Shares are dual-listed in Canada underneath the ticker “FRU” and the U.S. with the over-the-counter ticker “FRHLF”. The corporate’s base reporting forex is Canadian {Dollars}, however this report will use U.S. Greenback figures besides when in any other case famous.

Freehold Royalties doesn’t personal upstream oil manufacturing amenities immediately. Reasonably it companions with operators, offering upfront money in return for a minimize of future oil and gasoline manufacturing volumes. Freehold at the moment has about 360 royalty companions and has publicity to greater than 7 million gross acres of land throughout the U.S. and Canada.

The corporate’s prime three manufacturing areas are the Midland and Eagle Ford basins within the U.S. together with Canadian heavy oil manufacturing within the province of Alberta.

On Might 14th, 2025, Freehold Royalties reported its Q1 2025 outcomes. The corporate’s top-line revenues elevated properly, rising to C$91 million from C$74 million in the identical quarter of 2024.

Because of the dilution and elevated curiosity prices, earnings per share of 23 cents per share CAD in Q1 2025 have been unchanged versus the identical interval of final yr regardless of the leap in revenues.

Click on right here to obtain our most up-to-date Certain Evaluation report on FRHLF (preview of web page 1 of three proven under):

Last Ideas

Canadian oil shares don’t get practically as a lot protection as the most important U.S. oil shares. Nevertheless, revenue and worth traders ought to take note of the massive 7 Canadian oil shares.

All 7 Canadian oil shares have cheap valuations, many with dividend yields which can be properly above the U.S. oil shares.

The next articles include shares with very lengthy dividend or company histories, ripe for choice for dividend progress traders:

Thanks for studying this text. Please ship any suggestions, corrections, or inquiries to help@suredividend.com.