Alexander Schmitz

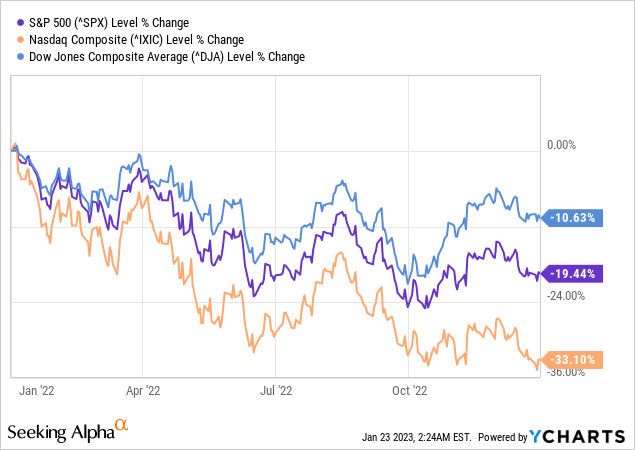

Much like the opposite December articles, I wish to use this chance to evaluation how the portfolio carried out towards the three main indexes for 2022. John’s evaluation may have similarities with the Taxable Account evaluation (hyperlink on the finish of the article) as a result of we’re going to add again the withdrawals that had been made to raised perceive how the portfolio would have carried out if no funds had been taken from the account.

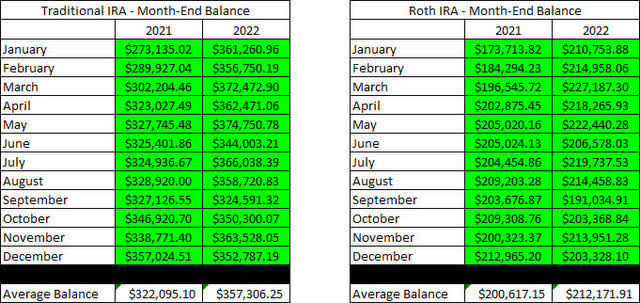

Conventional IRA – The stability of the account on December 31, 2022, was $352,787.19 which compares to the stability on the finish of December 31, 2021, of $357,024.51. The Conventional IRA had a complete of $12K of withdrawals ($1,000 per 30 days) which signifies that the ending stability would have been $364,787.19. Which means John’s Conventional IRA noticed optimistic progress in 2022 of two.13% progress when we add again the withdrawals taken throughout the 12 months.

Roth IRA – The stability of the account on December 31, 2022, was $203,328.10 which compares to the stability on the finish of December 31, 2021, of $212,965.20. The Roth IRA had no withdrawals in 2022 so we are going to use the $203,328.10 for the calculation. Which means John’s Roth IRA noticed destructive progress in 2022 of -4.53%.

The graph beneath exhibits how this compares to the efficiency of the three important indexes.

As soon as once more, John and Jane’s portfolio has withstood a harsh atmosphere in 2022 and his Conventional IRA carried out exceptionally properly after we take into account what the stability would seem like with the distributions added again.

Background

For many who are all in favour of John and Jane’s full background, please click on the next hyperlink right here for the final time I revealed their full story. The small print beneath are up to date for 2022.

- This can be a actual portfolio with precise shares being traded.

- I’m not a monetary advisor and merely present steerage based mostly on a relationship that goes again a number of years.

- John retired in January 2018 and now solely collects Social Safety revenue as his common supply of revenue.

- Jane formally retired initially of 2021, and he or she is gathering Social Safety as her solely common supply of revenue.

- John and Jane have determined to begin taking attracts from the Taxable Account and John’s Conventional IRA to the tune of $1,000/month every. These attracts are at present lined in full by the dividends generated in every account.

- John and Jane produce other investments outdoors of what I handle. These investments primarily include minimal-risk bonds and low-yield certificates.

- John and Jane don’t have any debt and no month-to-month funds aside from primary recurring payments reminiscent of water, energy, property taxes, and so forth.

The explanation why I began serving to John and Jane with their retirement accounts is that I used to be infuriated by the charges they had been being charged by their earlier monetary advisor. I don’t cost John and Jane for something that I do, and all I’ve requested of them is that they permit me to jot down about their portfolio anonymously as a way to assist unfold data and to make me a greater investor within the course of.

Producing a secure and rising dividend revenue is the first focus of this portfolio, and capital appreciation is the least necessary attribute. My main objective was to offer John and Jane as a lot certainty of their retirement as I presumably can as a result of this has been a relentless level of stress during the last decade.

Dividend Decreases

No shares in John’s Conventional or Roth IRA put/decreased dividends throughout the month of December.

Dividend And Distribution Will increase

Three corporations paid elevated dividends/distributions or a particular dividend throughout the month of December within the Conventional and Roth IRAs.

- Crown Fort Worldwide (CCI)

- Predominant Avenue Capital (MAIN)

- Pinnacle West (PNW)

CCI and MAIN had been lined in Jane’s Retirement Account replace, so I’ll solely embody details about the dividend will increase. These all in favour of studying the abstract of those two corporations can test the hyperlink included on the finish of the article.

Crown Fort Worldwide – The dividend was elevated from $1.47/share per quarter to $1.565/share per quarter. This represents a rise of 6.5% and a brand new full-year payout of $6.26/share in contrast with the earlier $5.88/share. This leads to a present yield of 4.23% based mostly on the present share worth of $148.12.

Predominant Avenue Capital – The dividend was elevated from $.220/share per 30 days to $.225/share per 30 days. This represents a rise of two.3% and a brand new full-year payout of $2.70/share in contrast with the earlier $2.64/share. This leads to a present yield of 6.90% based mostly on the present share worth of $39.15.

MAIN additionally paid a particular supplemental dividend of $.10/share throughout the month of December.

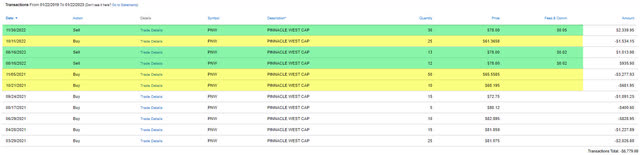

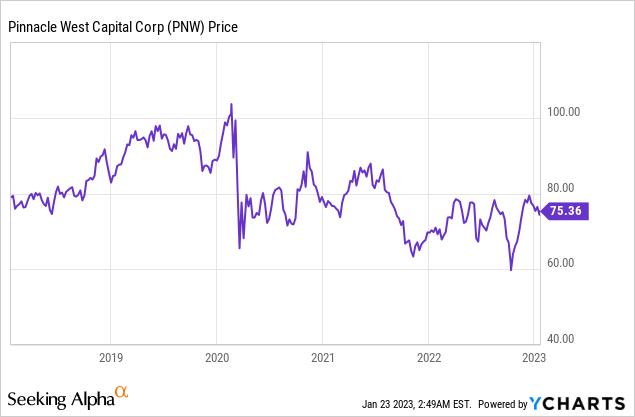

Pinnacle West – PNW’s latest worth volatility is essentially associated to the earlier charge case that went into impact on December 1st, 2021. This resolution meant that PNW is restricted relating to charge will increase that will have helped offset inflationary strain. This created a shopping for alternative in December 2021 and October 2022. We cannot be seeing PNW transfer again as much as $100/share anytime quickly however the dividend yield and upside are compelling when shares commerce underneath $70/share.

We used these shopping for alternatives so as to add shares after which unload the high-cost portion of the place. The picture beneath exhibits the entire trades made with PNW and you may see that the place was initially constructed on higher-cost shares. The price foundation after latest purchases and gross sales is now $65.85/share which is a good long-term place to be in.

PNW – Commerce Historical past (Charles Schwab)

The dividend was elevated from $.85/share per quarter to $.865/share per quarter. This represents a rise of 1.8% and a brand new full-year payout of $3.46/share in contrast with the earlier $3.40/share. This leads to a present yield of 4.59% based mostly on the present share worth of $75.36.

Retirement Account Positions

There are at present 38 completely different positions in John’s Conventional IRA and 23 completely different positions in his Roth IRA. Whereas this will look like quite a bit, you will need to keep in mind that many of those shares cross over in each accounts and are additionally held within the Taxable Portfolio.

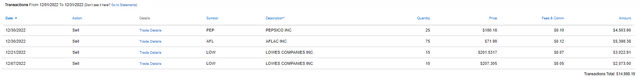

Under is an inventory of the trades that befell within the Conventional IRA throughout the month of December.

Conventional IRA – December Trades (Charles Schwab)

Under is an inventory of the trades that befell within the Roth IRA throughout the month of December.

Roth IRA – December Trades (Charles Schwab)

For extra particulars/perception into these trades and the rationale please see my trades abstract articles (I can be engaged on that article subsequent to cowl December and January Trades).

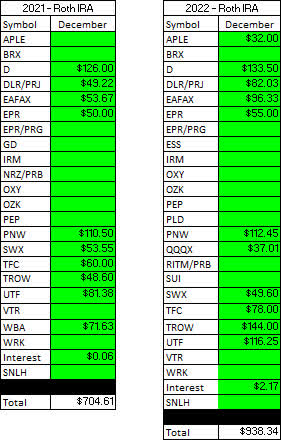

December Revenue Tracker – 2021 Vs. 2022

December’s revenue for the Conventional IRA and Roth IRA had been up significantly year-over-year.

- The common month-to-month revenue for the Conventional IRA in 2022 (in comparison with 2021) was up 35.3% YoY.

- The common month-to-month revenue for the Roth IRA in 2022 (in comparison with 2021) was up 25.9% YoY.

This implies the Conventional IRA would generate a mean month-to-month revenue of $1,485.63/month and the Roth IRA would generate a mean revenue of $710.57/month. This compares with 2021 figures that had been $1,098.38 and $564.25 per 30 days, respectively. John’s Retirement Accounts had been capable of generate a complete of $6,402.89 extra in dividend revenue than what was acquired in 2021.

It ought to be famous that a considerable amount of the rise in dividend revenue within the Conventional IRA can largely be attributed to the numerous particular dividend paid by Healthcare Realty (HR). For extra info please reference the July replace.

SNLH = Shares No Longer Held – Dividends on this row signify the dividends collected on shares which are now not held in that portfolio. We nonetheless rely the dividend revenue that comes from shares now not held within the portfolio regardless that it’s non-recurring.

All photos beneath come from Constant Dividend Investor, LLC. (Abbreviated to CDI).

Conventional IRA – December – 2021 V 2022 Dividend Breakdown (CDI) Roth IRA – December – 2021 V 2022 Dividend Breakdown (CDI)

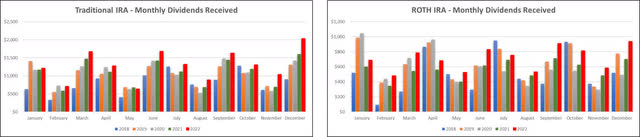

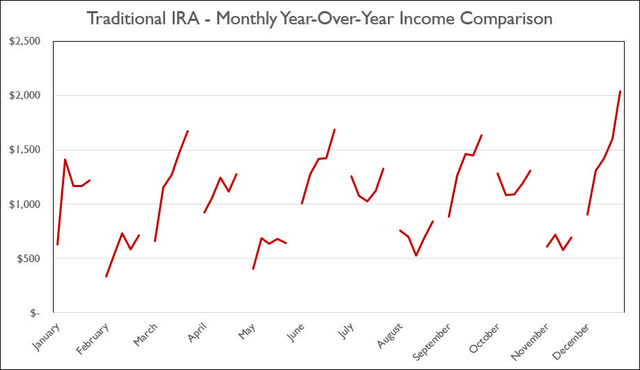

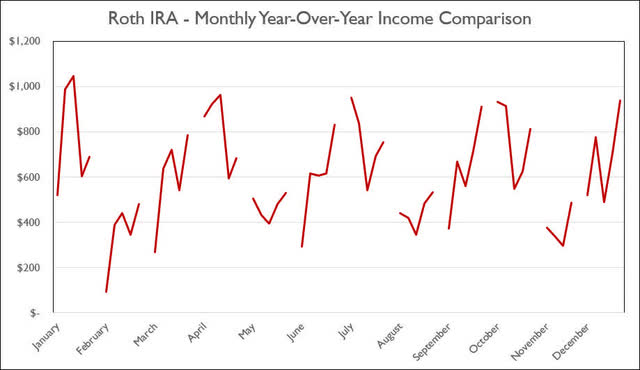

Here’s a graphical illustration of the dividends acquired on a month-to-month foundation for the Conventional and Roth IRAs.

Retirement Account – Month-to-month Dividends Obtained – December 2022 (CDI)

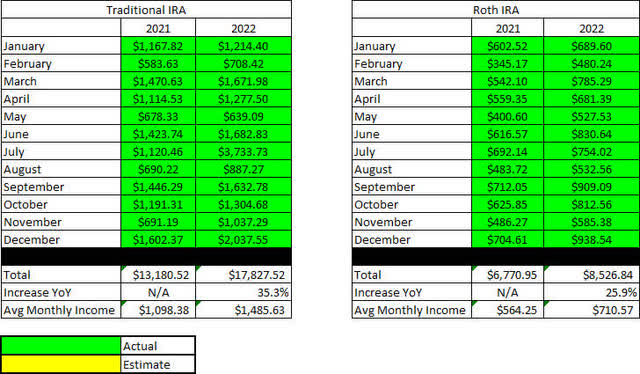

Primarily based on the present data I’ve concerning dividend funds and share rely, the next tables are a primary prediction of the revenue we anticipate the Conventional IRA and Roth IRA to generate in FY-2022 in contrast with the precise outcomes from 2021.

Retirement Projections – December 2022 (CDI)

Under is an expanded desk that exhibits the complete dividend historical past since inception for each the Conventional IRA and Roth IRA.

Retirement Projections – December 2022 – Full Dividend Historical past (CDI)

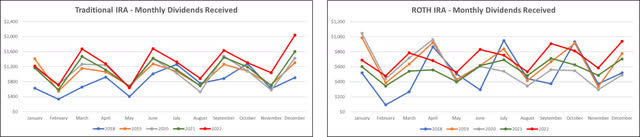

I’ve included line graphs that higher signify the tendencies related to John’s month-to-month dividend revenue generated by his retirement accounts. The pictures beneath signify the Conventional IRA and Roth IRA, respectively.

Retirement Account – Month-to-month Dividends – December 2022 (CDI)

Here’s a desk to indicate how the account balances stack up 12 months over 12 months (I beforehand used a graph however consider the desk is extra informative).

Retirement Account – Month Finish Balances – December 2022 (CDI)

The following photos are the brand new tables that point out how a lot money John had in his Conventional and Roth IRA Account on the finish of the month, as indicated on his Charles Schwab statements.

Retirement Accounts – December 2022 – Money Balances (CDI)

The next two tables present a historical past of the unrealized achieve/loss on the finish of every month within the Conventional and Roth IRAs, going again to the start of January 2018.

Retirement Accounts – December 2022 – Unrealized Acquire-Loss (CDI)

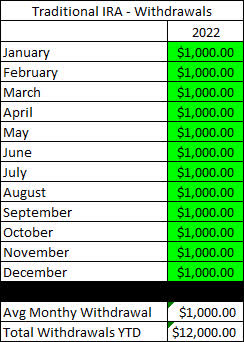

John has lastly begun taking disbursements from his Conventional IRA, and he has opted to obtain $1,000/month. Primarily based on the dividend revenue generated he might take as much as $1,400/month from the Conventional IRA earlier than his withdrawals would begin to negatively impression his principal. Our objective for John is to take care of withdrawals beneath the dividend revenue generated for so long as attainable.

Conventional IRA Withdrawals – December 2022 (CDI)

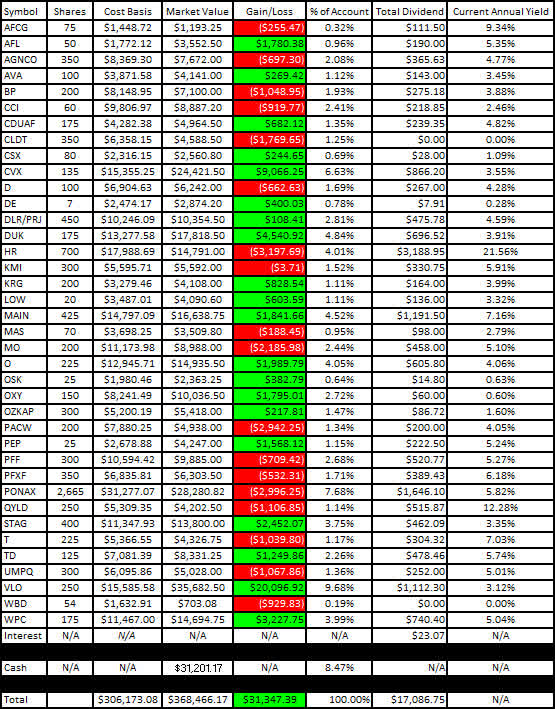

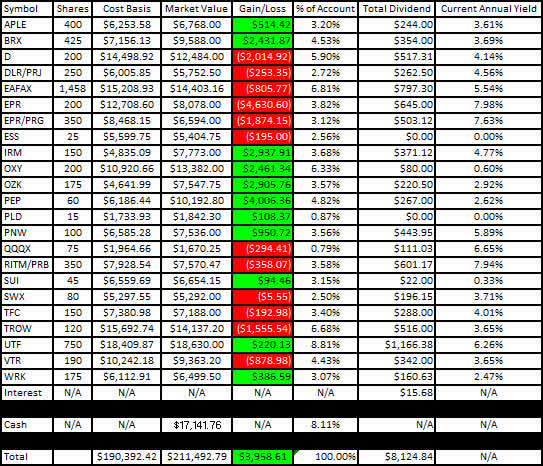

I like to indicate readers the precise unrealized achieve/loss related to every place within the portfolio as a result of you will need to take into account that, as a way to grow to be a correct dividend investor, it’s essential to learn to dwell with volatility. The market worth and price foundation beneath are correct as of the market shut on January 20, 2023.

Right here is the unrealized achieve/loss related to John’s Conventional and Roth IRAs.

Conventional IRA – December 2022 – Acquire-Loss (CDI) Roth IRA – December 2022 – Acquire-Loss (CDI)

It ought to be famous that Essex Property Belief (ESS) and Prologis (PLD) replicate an annual yield of 0% as a result of these had been just lately established positions and no dividends had been acquired in 2022.

The final two graphs present how dividend revenue has elevated, stayed the identical, or decreased in every respective month on an annualized foundation. Now that we’re in our fifth 12 months of monitoring, the development for every respective month of the 12 months has begun to indicate fascinating tendencies for when revenue will increase year-over-year.

Conventional IRA – December 2022 – Annual Month Comparability (CDI) Roth IRA – December 2022 – Annual Month Comparability (CDI)

Conclusion

John’s portfolio carried out even higher than Jane’s portfolio throughout this time and far of this was the results of having much less publicity to the tech sector which carried out the worst throughout this time. John has a major amount of money out there and we are going to probably look to deploy it into Certificates as a result of there is not quite a bit that we might be assured deploying money into at this time limit.

Certificates are additionally a wonderful different for the retirement portfolio as a result of curiosity is taxed on the revenue stage so Conventional and Roth IRAs are an incredible place to gather that revenue. We’ve a certificates within the Taxable Account so it is good to concentrate on the implications of how the revenue is taxed and what tax bracket applies.

December Articles

I’ve included the hyperlinks for John and Jane’s Taxable Account and Jane’s Retirement Account articles for the month of December beneath.

The Retirees’ Dividend Portfolio: John And Jane’s December Taxable Account Replace

The Retiree’s Dividend Portfolio, Jane’s December Replace: Index-Beating Yr-Finish Outcomes

Article Format: Let me know what you concentrate on the format (what you want or dislike) by commenting. I admire all types of criticism and would love to listen to what I can do to make the articles extra helpful for you!

In John’s Conventional and Roth IRAs, he’s at present lengthy the next talked about on this article: AFC Gamma (AFCG), Aflac (AFL), Apple Hospitality REIT (APLE), Avista (AVA), BP plc (BP), Brixmor Property Group (BRX), Crown Fort (CCI), Canadian Utilities (OTCPK:CDUAF), Chatham Lodging Belief (CLDT), Chevron (CVX), CSX (CSX), Dominion Vitality (D), Deere (DE), Digital Realty Most popular Collection J (DLR.PJ), Duke Vitality (DUK), Eaton Vance Floating-Fee Benefit Fund (EAFAX), EPR Properties (EPR), EPR Properties Most popular Collection G (EPR.PG), Healthcare Belief of America (HTIA), Iron Mountain (IRM), Kinder Morgan (KMI), Kite Realty Group (KRG), Lowe’s (LOW), Predominant Avenue Capital (MAIN), Masco (MAS), Altria (MO), New Residential Funding Corp. Most popular Collection B (NRZ.PB), Realty Revenue (O), Oshkosh (OSK), Occidental Petroleum Corp. (OXY), Financial institution OZK (OZK), Financial institution OZK Most popular Collection A (OZKAP), PacWest Bancorp (PACW), PepsiCo (PEP), iShares Most popular and Revenue Securities ETF (PFF), VanEck Vectors Most popular Securities ex Financials ETF (PFXF), Pinnacle West (PNW), PIMCO Revenue Fund Class A (PONAX), Nuveen Nasdaq 100 Dynamic Overwrite Fund (QQQX), World X Funds Nasdaq 100 Lined Name ETF (QYLD), STAG Industrial (STAG), Solar Communities (SUI), Southwest Fuel (SWX), AT&T (T), Toronto-Dominion Financial institution (TD), Truist Monetary (TFC), T. Rowe Value (TROW), Cohen & Steers Infrastructure Fund (UTF), Valero (VLO), Umpqua Holdings (UMPQ), Ventas (VTR), WestRock (WRK), Warner Bros. Discovery (WBD), and W. P. Carey (WPC).

Editor’s Observe: This text discusses a number of securities that don’t commerce on a significant U.S. change. Please concentrate on the dangers related to these shares.