Kseniia Kapris/iStock by way of Getty Photographs

With the inventory market maneuvering again to all-time highs, it is a good time for traders to do some portfolio re-orientation and rotate out massive winners for extra value-oriented shares. Particularly, there are a variety of shares that posted robust Q2 outcomes regardless of falling additional amid the broader market restoration, and The RealReal (NASDAQ:REAL) is one among these shares that deserves a tough re-evaluation.

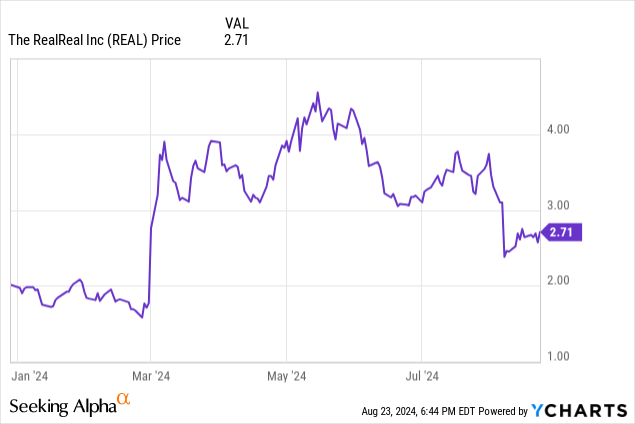

Shares of The RealReal have fallen practically 30% since reporting Q2 leads to early August, although the inventory does stay up practically 40% 12 months so far:

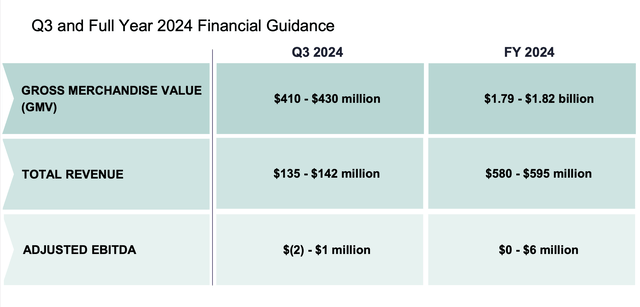

Within the briefest of nutshells, the core cause why the inventory fell is that the corporate ratcheted down its GMV and income expectations for the total 12 months, regardless of re-affirming that 2H’24 development would speed up versus 1H’24, and regardless of a powerful Q2 beat. To moreover offset the sting from a decrease full-year outlook, the corporate elevated its adjusted EBITDA expectations (to above breakeven at $0-$6 million, versus a previous viewpoint of simply $1 million on the midpoint), giving us a pleasant offset in boosted profitability.

The RealReal outlook replace (The RealReal Q2 earnings deck)

The corporate cited incorporating weaker macro knowledge into its second half outlook, though it famous that it has felt minimal impacts to date. I final wrote a bullish word on The RealReal in early June when the inventory was buying and selling within the mid-$3s. For my part, we should not overly punish The RealReal for being overly conservative in its steering, particularly if Q2 outcomes got here in properly forward of expectations, and I am reiterating my purchase opinion on this inventory.

This is a refresher on my full long-term bull case for The RealReal:

- Consignment poised for development in addition to affording the corporate with excessive gross margins. The corporate is ditching its direct-sales enterprise and dramatically shrinking down its stock ranges. Although general GMV is down y/y, consignment gross sales are up. As well as, the income combine shift towards consignment and away from direct gross sales has pushed The RealReal’s gross margin profile above 70%.

- Enhancing profitability. Due to its determination to shrink down its direct-sales stock and it concentrate on the higher-margin consignment enterprise, the corporate is now anticipating to be breakeven on an adjusted EBITDA foundation for everything of FY24.

- Luxurious alignment. The corporate distinguishes itself from different e-commerce gamers like Poshmark and Amazon.com (AMZN) by focusing particularly on luxurious manufacturers. Most of the objects listed on The RealReal checklist for $1,000+, giving the corporate a sure cachet that Amazon cannot replicate with its orientation towards worth.

- Debt restructuring. The corporate has additionally lately renewed all of its credit score agreements. The corporate’s convertible debt notes are actually not due till 2029, giving the corporate loads of respiratory room from a liquidity standpoint.

Keep lengthy right here and purchase the dip.

Q2 obtain

Let’s now undergo The RealReal’s newest quarterly leads to better element. The Q2 earnings abstract is proven under:

The RealReal Q2 outcomes (The RealReal Q2 earnings deck)

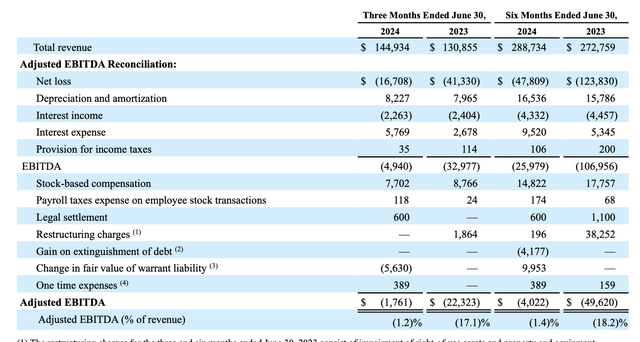

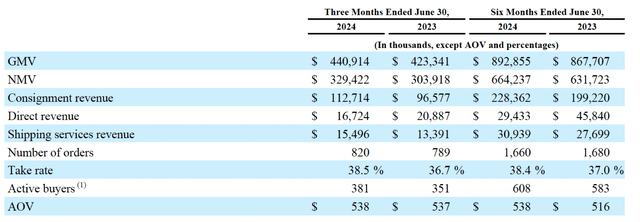

We word that regardless of the corporate’s GMV and income steering lower, Q2 income of $144.9 million truly grew 11% y/y and beat Wall Avenue’s expectations of $139.9 billion (+7% y/y) by a significant four-point margin. GMV additionally grew 4% y/y to $440.9 million, whereas take charges expanded 180bps y/y to 36.7% (as proven within the chart under). Progress additionally accelerated sharply, by 9 factors relative to Q1’s high line development fee of simply 2% y/y.

The RealReal core metrics (The RealReal Q2 earnings deck)

The corporate emphasised that whereas it is taking weaker macro expectations into its outlook, the it hasn’t but felt significant impacts to the enterprise, and it nonetheless expects GMV developments to speed up transferring forward. Per CFO Ajay Gopal’s remarks on the Q2 earnings name:

First, let’s discuss GMV. We count on our GMV development within the second half to speed up versus our first half, and that is as we head into the seasonal peak of our enterprise quantity in This autumn.

To your query, I’d characterize our outlook on the second half as being prudent a couple of potential slowdown in shopper spending. To be clear, we’re solely seeing modest stress right now. We noticed some compression in costs pushed by a desire in the direction of extra discounted merchandise. This began late in Q2 and has continued into July.

In Q2, our ASP, common promoting value, was down 3%. This was offset by a comparable improve in objects per order, which resulted in AOE being flat versus prior 12 months. So, our steering for the remainder of the 12 months displays a balanced view on how this dynamic goes to play out within the second half of 2024.”

What I discover equally vital is the truth that energetic patrons are persevering with to extend, enhancing 9% y/y to 381k. This can be a clear sign to me that The RealReal’s model is resonating and never fading right into a fad: which is the case for some friends like Sew Repair (SFIX), which has been bleeding energetic prospects because the peak of the pandemic.

Moreover, we must always word that adjusted EBITDA margins are making main leaps, enhancing from -17.1% within the year-ago Q2 to a near-breakeven -1.2% in the latest quarter. Steerage implies roughly breakeven in Q3 after which full adjusted EBITDA profitability in This autumn, which is the corporate’s seasonal peak.

Dangers, valuation and key takeaways

At present share costs just below $3, The RealReal trades at a market cap of $295.1 million. After we web off the $150.7 million of money and $434.0 million of debt on the corporate’s newest steadiness sheet, the corporate’s ensuing enterprise worth is $578.4 million.

As such, the corporate trades at only a 1.0x EV/FY24 income a number of – which, for a corporation that’s simply beginning to count on significant adjusted EBITDA constructed on high of 70%+ professional forma gross margins represents an opportunistic entry level.

Dangers abound, in fact. The corporate’s change into the consignment enterprise is comparatively new, and macro headwinds might throw off its current progress in gross sales (although it is apparently already included into the corporate’s newest outlook). The corporate additionally bears appreciable debt relative to its present profitability, although it has prolonged its debt maturity till 2029.

All in all, nevertheless, I view The RealReal as a comparatively unknown firm that touts extra benefits than dangers because it recovers its core enterprise and emphasizes profitability. Keep lengthy right here and purchase the dip.