As of immediately, Jerome “Nero” Powell and The Gang at The Federal Reserve haven’t trimmed the Fed’s steadiness sheet and have solely raised their goal fee as soon as beneath President Biden.

Right here is the Hindenburg Omen, named for the catastrophic explosion on Might 6, 1937 at Lakehurst Naval Air Station in New Jersey. The Hindenburg Omen was flashing purple earlier than the inventory market correction of late 2007-2009. However, the Hindenburg Omen has flashed purple repeatedly for the reason that monetary disaster, but the S&P 500 index has saved rising. The explanation? Repeated coverage errors by The Fed leaving financial stimulus in place for too lengthy resulting in a bubble forming within the inventory market.

The Shiller CAPE (Cyclically-adjust price-earnings) ratio is on the second highest stage for the reason that 1800s. The very best level was the notorious Dot.com bubble and bust in 2000/2001.

Since The Fed continues to say “We’ve got a plan!” to sluggish/shrink The Fed’s steadiness sheet and lift their goal fee … it has not finished something but (aside from a 25 foundation level bump on the March assembly).

I’m not advocating technical evaluation for shares, however the Bollinger Band evaluation for the S&P500 index is exhibiting the S&P 500 index close to the highest band indicating {that a} decline in doubtless.

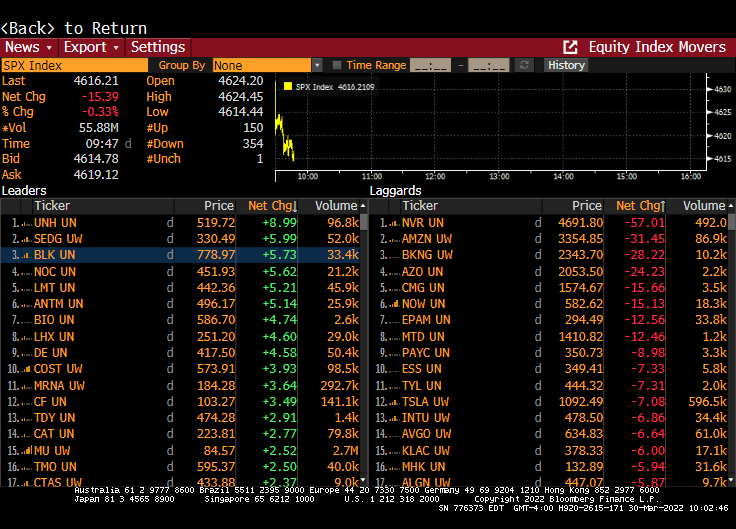

Immediately, the US fairness market in basically flat given the huge uncertainty concerning the Russia/Ukraine scenario and whether or not the US economic system is slipping into darkness. However this morning, Federal authorities blessed corporations (healthcare, photo voltaic power and Blackrock) are doing fairly effectively, whereas homebuider NVR is taking it on the chin because of hints that The Fed will elevating charges.

Now, NVR (Northern Virginia Properties, Ryan Properties) had explosive earnings progress of their February 1, 2022 report.

However the market is pricing within the crushing Fed fee hikes which are anticipated.

So, will Foul Powell pull a Volcker and lift charges and crush the economic system (and shares)? Or will Foul Powell And The Fed gang let inflation burn uncontrolled, however protect the huge asset bubbles?