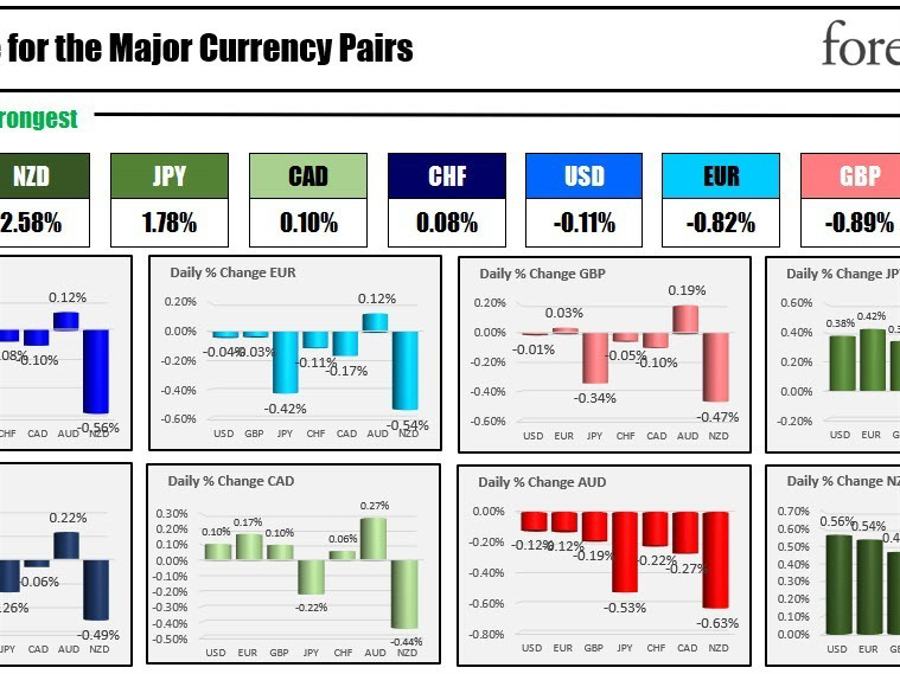

The strongest to the weakest of the key currencies

The NZD is the strongest and the AUD is the weakest because the NA session begins. The USD is blended with some modest corrective motion in markets. Yesterday, US shares tumbled and yields soared as inflation fears kicked increased. The S&P International PMI knowledge got here in stronger than anticipated. Fed’s Bullard reiterated his view that the Fed ought to transfer charges to five.25% to five.50% vary with the perfect path being the shortest (i.e., hike by 50 bps). The feedback are in keeping with his latest views.

US mortgage purposes fell -13.3% as we speak after a -7.7% decline final week. The 30 yr mortgage price surged to six.62% from 6.39% final week.

US 30 yr mortgage

In New Zealand, the Reserve Financial institution of New Zealand elevate charges by 50 foundation factors and was extra hawkish of their tilt:

- Too early to find out influence of Cyclone Gabrielle

- Costs for some items are more likely to spike within the weeks forward

- Nonetheless forecasting a recession 9 to 12 months interval

- Demand must sluggish considerably

- Little or no dialogue of a 25bp price hike, most focus was on 50bp

In the meantime in Australia, the AUD moved decrease after softer wage knowledge for the quarter. The AUDNZD fell -0.63% and is the most important mover thus far as we speak. Trying on the 4-hour chart of the pair, the value has moved again under its 100 hour MA at 1.0974. Final week, the pair examined that MA solely to search out keen consumers (see blue line on the chart under) in opposition to it. Keep under the 100 bar MA now would maintain the bears extra in management with the 200 bar MA at 1.09203 and the 100 day MA at 1.0886 as the subsequent draw back targets on extra promoting momentum.

AUDNZD falls under the 100 hour MA

In different markets:

- spot gold is buying and selling at $4.37 or 0.24% at $1839.19.

- Spot silver is buying and selling up three cents or 0.15% at $21.86.

- WTI crude oil is buying and selling down $0.45 at $75.91

- Pure fuel is buying and selling close to unchanged at $2.17 yesterday moved to the bottom stage since August 2020

- Bitcoin is buying and selling at $24,153 after buying and selling as little as $23,871 and as excessive as $24,474 as we speak

General US fairness costs are rebounding after yesterday’s rout to the draw back noticed the key indices have their worst day in 2023. The options are implying

- Dow Industrial Common up 70 factors after yesterday’s -697.10 level decline

- S&P index is 10.4 factors after yesterday’s -81.75 level decline

- NASDAQ index is up 44 factors after yesterday’s -294.97 level decline

Within the European inventory market, the key indices are decrease as a catch as much as the afternoon declines in US fairness costs

- German DAX down -0.14%

- France’s CAC down -0.28%

- UK’s FTSE 100 down -0.79%

- Spain’s Ibex down -0.81%

Within the Asian Pacific market as we speak:

-

Japan’s Nikkei 225 -1.34%

-

China’s Shanghai Composite -0.47%

-

Hong Kong’s Cling Seng -0.51%

-

Australia’s S&P/ASX 200 -0.3%

Within the US debt market, the yields are correcting a few of the good points from yesterday and are buying and selling decrease. The the run increased yesterday took a few of yields up double digits (5 yr yield was up 10.2 foundation factors whereas the ten yr yield was up 11.2 foundation factors). The U.S. Treasury will public sale off 5 yr notes at 1 PM ET:

US yields are decrease throughout the board

European 10 yr yields