Michael King/iStock by way of Getty Photographs

Analysis Abstract

Immediately I will be ranking The Hartford Monetary (NYSE:HIG), within the financials sector, insurance coverage subsector.

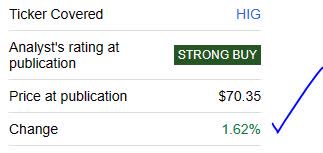

I final rated this inventory in June after I rated it a robust purchase. Since then, it had its Q2 earnings end result on July twenty seventh and I’ll do a deep dive into a few of that information to see if my prior ranking stands but additionally to elaborate extra on some key information factors.

Since my final ranking, the share value has risen by 1.62%:

Hartford – efficiency since final ranking (Searching for Alpha)

For readers much less acquainted with this firm, listed below are related factors from their web site: roots return to 1810, headquartered in Connecticut US, diversified enterprise segments together with private / enterprise insurance coverage in addition to worker advantages and exchange-traded funds.

Two key friends of this firm are AIG (AIG), and Assurant (AIZ).

Ranking Methodology

Utilizing a course of much like 5 mission phases in mission administration, I break down my general holistic ranking of this inventory into 5 classes I rank individually and of equal weight: dividends, valuation, share value, earnings progress, monetary well being.

If I like to recommend this inventory on at the very least 3 of 5 classes, it will get a maintain ranking. 4 of 5 will get a purchase, and fewer than 3 will get a promote ranking. Then I evaluate my ranking to the consensus from analysts, Wall Road, and the quant system.

Dividends

On this class, I’ll analyze the dividends of this inventory and whether or not I believe they current a possibility for dividend-income buyers. The information comes from official Searching for Alpha dividend data.

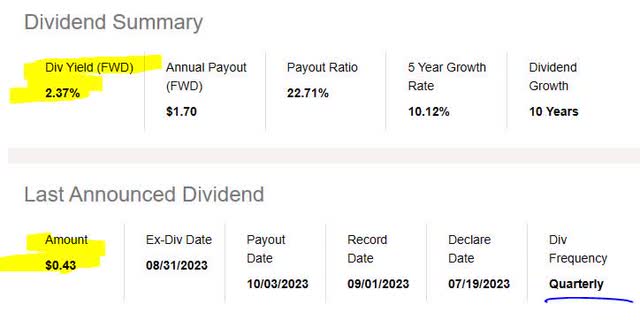

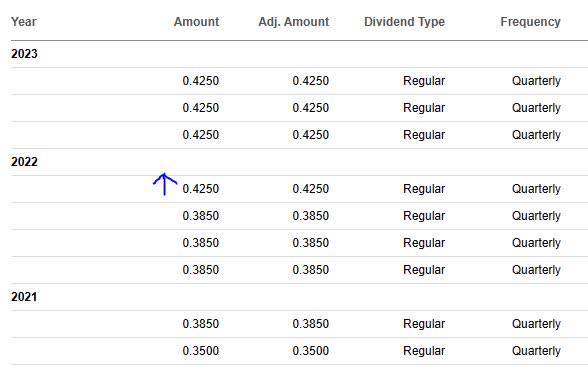

As of the writing of this evaluation, the ahead dividend yield is 2.37%, with a payout of $0.43 per share on a quarterly foundation, with the newest ex date being Aug. thirty first.

Hartford – dividend yield (Searching for Alpha)

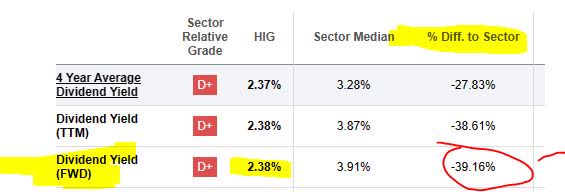

When evaluating to its sector common, this dividend yield is 39% beneath its sector common. I consider this can be a reasonably unfavorable level to contemplate for dividend buyers who’re evaluating a number of shares by which to take a position. I’d think about a yield of three% – 5% extra cheap in relation to the common, so on this case in my view it’s low.

Hartford – dividend yield vs sector (Searching for Alpha)

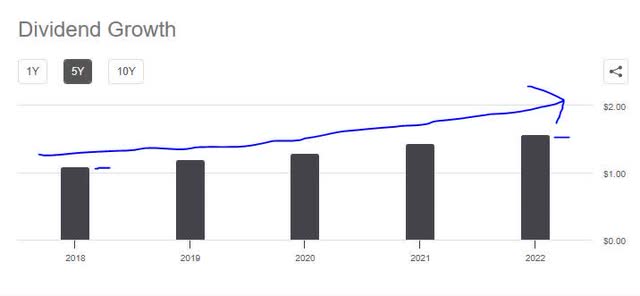

In trying on the 5 12 months dividend progress for this inventory, it has proven a optimistic upward pattern. That is, in my view, a optimistic level for dividend buyers and an indication of this agency’s capability to return capital again to shareholders, but additionally offsets the prior level of the yield being beneath common.

Hartford – dividend 5 12 months progress (Searching for Alpha)

Moreover, I’m in search of stability with dividend payouts, and this inventory has proven common dividend cost historical past currently, which is one other optimistic level to consider.

Hartford – dividend historical past (Searching for Alpha)

On the entire, I’d advocate this firm on the class of dividends. Nonetheless, later within the part on share value, I’ll present how this dividend yield can be utilized in an funding concept for this inventory.

Valuation

On this class, I’ll analyze the valuation of this inventory. The information comes from official valuation data on Searching for Alpha, particularly the ahead P/E ratio and ahead P/B ratio, the important thing metrics I take a look at.

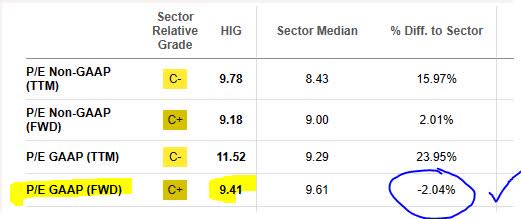

This inventory has a ahead P/E ratio of 9.41, which is about 2% beneath its sector common. I believe {that a} cheap value to earnings for this inventory can be between 8x earnings and 10x earnings, to remain inside an affordable 2 level vary of the common. On this case, on this metric the inventory seems to me to be fairly undervalued vs its general sector.

To begin a dialogue on this matter in feedback, why do you assume the price-to-earnings is or is just not a significant valuation metric to contemplate for this inventory?

Hartford – P/E Ratio (Searching for Alpha)

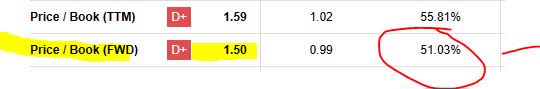

This inventory additionally has a ahead P/B ratio of 1.50, which is 51% above its sector common. I believe {that a} cheap price-to-book worth for this inventory can be between 0.50x ebook worth and 1.5x ebook worth, to remain inside a 2 level vary of the common. On this scenario, this inventory seems simply barely overvalued vs its general sector, so not a significant concern.

Hartford – P/B ratio (Searching for Alpha)

Let’s check out considered one of its friends talked about earlier: AIG. If evaluating the 2, AIG has a ahead price-to-earnings that’s 6% above the sector common and a price-to-book that’s virtually according to the common. So, it appears extra overvalued than Hartford on value to earnings however not on value to ebook.

It helps to do aspect by aspect comparisons like that when I’m contemplating whether or not to place capital into one or one other inventory in the identical sector.

Primarily based on the examples I gave, I’d advocate Hartford on the premise of valuation.

Share Value

On this class, I’ll use a quite simple funding concept to find out if the present share value presents a price shopping for alternative proper now or not, based mostly on potential beneficial properties & potential losses by monitoring the long-term shifting common.

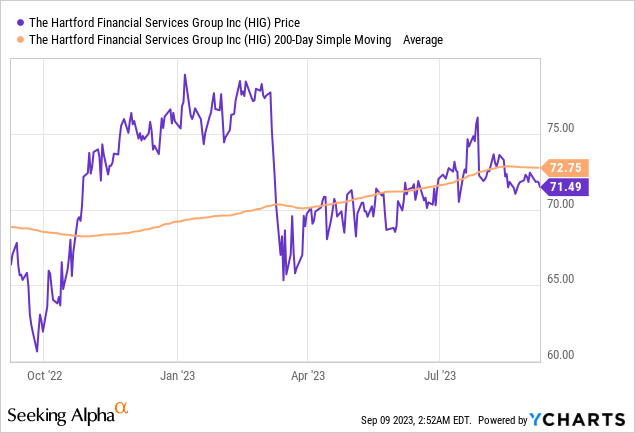

First, I pulled the yChart (as of the writing of this text, so the value proven is just not actual time!) which exhibits a share value of $71.49, in comparison with its 200-day easy shifting common “SMA” of $72.75, during the last 1 12 months interval.

Second, I decide what my objective is for return on capital and what my danger tolerance is for capital loss, if I purchase 10 shares on the present share value and maintain for 1 12 months to additionally earn a full 12 months of dividend revenue.

My objective is optimistic +10% return on capital, and my danger tolerance is a -10% unfavorable return on capital.

After holding for 1 12 months, I plan to promote the ten shares. The next simulation checks what occurs if the share value I promote at in Aug. 2024 is +10% above the present SMA, and what occurs if it has dropped to -10% beneath the present SMA:

Hartford – investing concept (writer evaluation)

Within the above instance, if the share value goes as much as $80.03 I exceed my revenue objective by +4.34% and if the share value drops to $65.48 I additionally keep inside my loss restrict by 4%.

With that mentioned, the present share value presents a purchase alternative and in my view I’d advocate it.

Nonetheless, readers ought to nonetheless run their very own simulations based mostly on their particular person portfolio targets which I can’t advise on right here, as their danger tolerance and revenue targets my differ from this concept above. It’s merely a framework with which to consider potential beneficial properties & losses if shopping for on the present value.

Additionally, be aware that the above concept can create two potential tax occasions: dividend revenue and capital beneficial properties. This must be mentioned additional together with your tax professional for session on this matter.

Earnings Progress

On this class, I study the earnings traits evaluating the newest quarterly outcomes to the identical quarter a 12 months in the past, together with each top-line and bottom-line revenue, and different related matters to earnings I believe must be mentioned for my readers.

On a YoY foundation, this agency confirmed optimistic progress in its two key income drivers: premiums on insurance coverage insurance policies, and curiosity revenue on its funding portfolio. For my part, this exhibits not solely that the agency is benefiting from the elevated rate of interest setting of the final 12 months but additionally is rising its core enterprise which is insurance coverage.

I forecast that it’ll at the very least proceed displaying robust outcomes from curiosity revenue contemplating that charges should not happening anytime quickly. In actual fact, CME Fedwatch predicts a 92% probability the Fed retains charges the identical after its Sept. twentieth assembly.

Hartford – income YoY (Searching for Alpha)

On a YoY foundation, the agency confirmed optimistic progress in internet revenue and EPS as properly, in accordance with its revenue assertion, with a primary earnings per share of $1.75 in Q2, one other optimistic signal I can point out.

Hartford – internet revenue YoY progress (Searching for Alpha)

To assist me perceive what was the driving force behind a few of these outcomes, I turned to the Q2 earnings commentary and presentation which gave fascinating insights.

In accordance with the corporate, its core insurance coverage enterprise is displaying optimistic traits, which makes me need to be bullish on this inventory much more:

P&C internet written premium progress of 11%, together with 12% in Business Traces with double-digit will increase from every enterprise.

Hartford CFO Beth Costello additionally reiterated this optimistic sentiment:

Business Traces had an impressive quarter with written premium progress of 12 p.c…

Group Advantages continued robust momentum from first quarter pushed by 7 p.c progress…

Primarily based on this proof and breakdown, I’d advocate on this class of YoY earnings progress, and anticipate extra optimistic outcomes for Q3 because the agency already has the tailwind to make it potential.

Monetary Well being

On this class, I’ll talk about whether or not this firm exhibits robust monetary fundamentals within the realm of capital, liquidity, and general stability sheet & cashflow matters.

Listed here are some factors I discovered that I believe are related to readers.

In accordance with the corporate,

In 2Q23, the corporate returned $484MM to stockholders together with $350MM in share repurchases and $134MM in frequent stockholder dividends paid.

Additional, the stability sheet on the finish of Q2 continues to indicate optimistic whole fairness of $14.1B, with belongings far exceeding liabilities, regardless of the worth of debt securities the agency holds being considerably decrease YoY and on a downtrend since Dec. 2021:

Hartford – debt securities at finish of Q2 (Searching for Alpha)

Moreover, I need to level out one other optimistic, and that’s optimistic free cashflow (levered and unlevered) in each of the final two quarterly outcomes, which I consider is one other signal of this agency’s environment friendly administration. For instance, finish of Q2 unlevered free cashflow was simply over $2B.

Hartford – cashflow (Searching for Alpha)

Primarily based on the info, I’d advocate on this class, and I stay up for continued optimistic outcomes on this house for Q3.

Ranking Rating

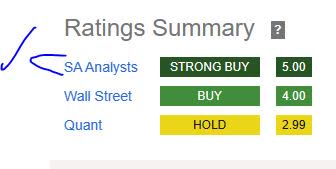

Immediately, this inventory was advisable in 5 of my ranking classes, as soon as once more incomes a robust purchase ranking from me immediately which reaffirms my June ranking. That is according to the consensus from analysts and extra bullish than the consensus from the SA quant system.

Hartford – ranking consensus (Searching for Alpha)

My Ranking vs Draw back Threat

My bullish ranking can face a draw back danger as follows:

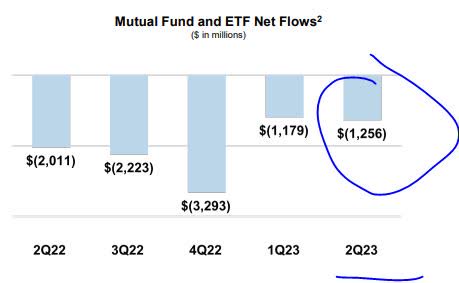

Apart from insurance coverage options, one other main enterprise section this agency has is Hartford Funds, which manages their very own mutual funds and exchange-traded funds. These readers who know this business additionally know that the extra money flows into these funds the extra money is made in charges to handle them.

The alternative can happen, and there have been internet outflows at Hartford Funds, which might presumably be of concern to some buyers and analysts who take a bearish sentiment on this agency.

Hartford Funds – internet outflows (firm q2 presentation)

My counterargument and why I believe to stay bullish proper now’s that the online outflows are enhancing at Hartford Funds as of Q2, because the chart above exhibits. As well as, they handle many forms of funds so one must differentiate between fairness and bond funds.

For instance, a Reuters story on Sept. eighth highlighted the overall outflows from fairness funds however elevated demand for money-market funds.

In accordance with the story:

Buyers withdrew from U.S. fairness funds for a sixth successive week within the seven days to Sept. 6, within the wake of downbeat financial information from China and Europe, and a surge in U.S Treasury yields.

Cash market funds drew $32.18B price of inflows, the most important quantity in three weeks.

Evaluation Wrapup

To wrap up immediately’s dialogue, listed below are the important thing factors we went over:

This inventory bought a robust purchase ranking immediately, reiterating my June ranking once more.

Its optimistic factors are: dividends, valuation, share value, earnings YoY progress, monetary well being.

Draw back dangers of fund outflows have been addressed.

In closing, I proceed to advocate maintaining this inventory in a watchlist of economic sector shares, and as an SA analyst I usually hidden gems like this among the many insurance coverage subsector, which regularly occasions is just not closely coated, however in my view presents an fascinating alternative.

The important thing to recollect concerning the insurance coverage enterprise is that it’s merely a switch of danger to a third-party, to keep away from consuming it on the total value of a possible disaster to particular person or property. This sector acknowledged this enterprise alternative a very long time in the past, and for probably the most half has confirmed to be resilient by many many years of market turbulence.