Only recently, James Bullard, President of the St. Louis Federal Reserve, instructed the central financial institution would possibly have to make use of the “7% answer” — that means elevating charges to 7% to make sure the whole destruction of . As we have now mentioned beforehand, the worry is repeating the coverage errors of the late Nineteen Seventies that led to entrenched inflation.

Whereas the “7% answer” is supported by the likes of Larry Summers and others, there are huge variations between the financial system at the moment versus then. Attempting to extend the Fed funds price to 7%, 2.5% greater than they’re at the moment, dangers triggering a catastrophically deep recession.

The reason being the 2020 inflation was the results of one-time synthetic influences versus the Nineteen Seventies. As we famous beforehand in “”

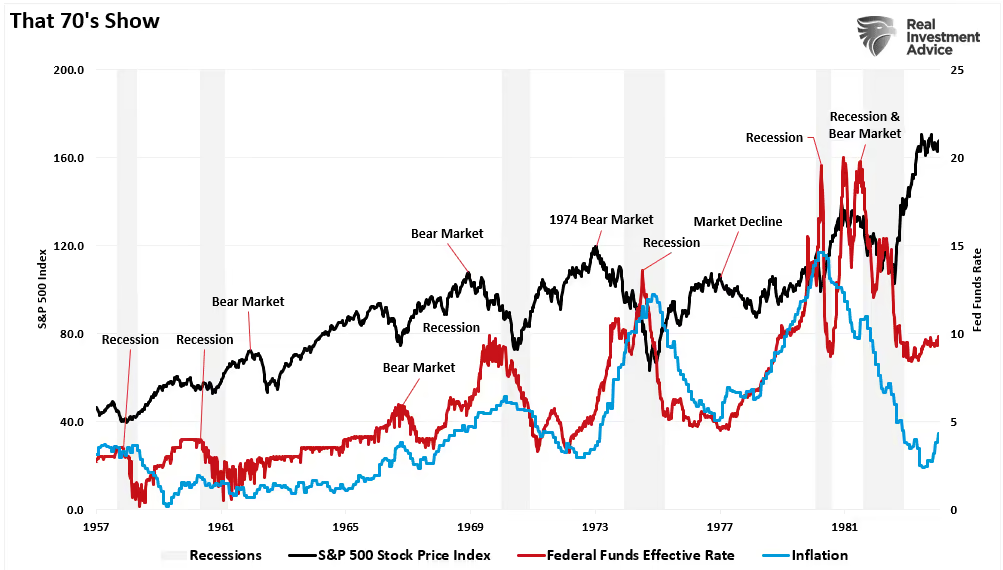

“The buildup of inflation was within the works lengthy earlier than the Arab Oil Embargo. Financial progress, wages, and financial savings charges catalyzed ‘demand push’ inflation. In different phrases, as financial progress elevated, financial demand led to greater costs and wages.”

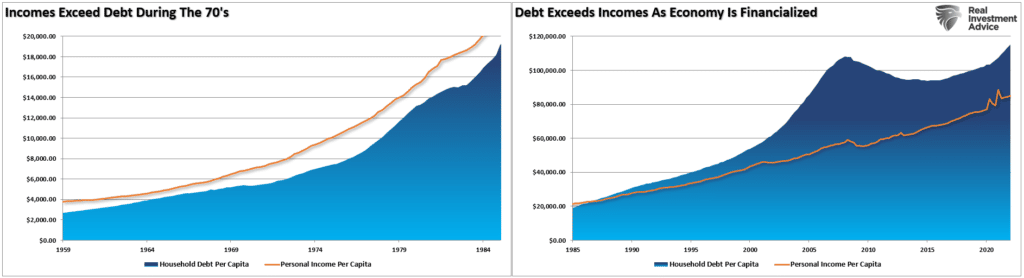

“Moreover, the Authorities ran no deficit, and family debt to web value was about 60%. So, whereas inflation was growing and rates of interest rose in tandem, the typical family may maintain their residing customary. The chart exhibits the distinction between family debt versus incomes within the pre-and post-financialization eras.”

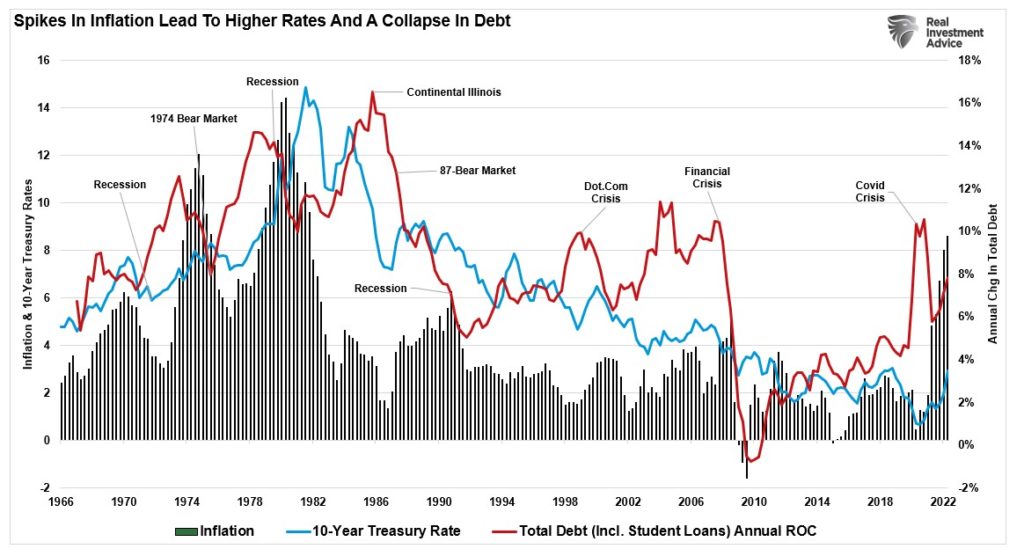

What was most notable is the Fed’s inflation combat didn’t begin in 1980 however continued by way of the whole lot of the 60s and 70s. As proven, as financial progress expanded, growing wages and financial savings, your complete interval was marked by inflation surges. Repeatedly, the Fed took motion to sluggish inflationary pressures, which resulted in repeated market and financial downturns.

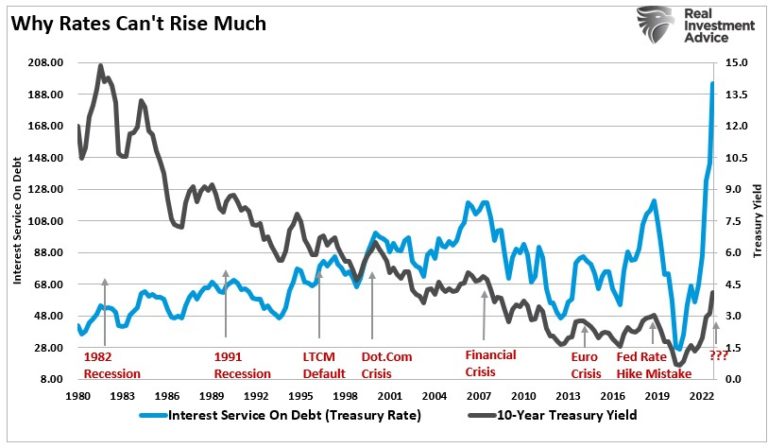

The large debt load is essentially the most essential distinction between making use of the “7% answer” at the moment and within the 70s. Right now, customers, companies, and even the Authorities rely upon low-interest debt to maintain an ongoing spending spree.

A “7% answer” may pop the huge “debt bubble,” resulting in extreme financial penalties.

The Debt Downside

The huge debt ranges present the only most vital threat and problem to the Federal Reserve. It’s also why the Fed is determined to return inflation to low ranges, even when it means weaker financial progress. Jerome Powell lately said the identical.

“We have to act now, forthrightly, strongly as we have now been doing. It is rather vital that inflation expectations stay anchored. What we hope to attain is a interval of progress beneath pattern.”

That final sentence is an important.

There are some vital monetary implications for below-trend financial progress. As we mentioned in “The Coming Reversion To The Imply Of Financial Progress:”

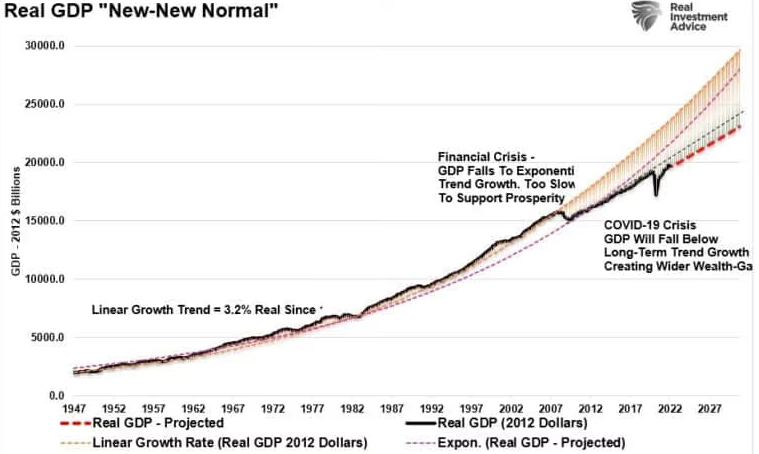

“After the ‘Monetary Disaster,’ the media buzzword grew to become the ‘New Regular’ for what the post-crisis financial system would really like. It was a interval of slower financial progress, weaker wages, and a decade of financial interventions to maintain the financial system from slipping again right into a recession.

Submit the ‘Covid Disaster,’ we are going to start to debate the ‘New New Regular’ of continued stagnant wage progress, a weaker financial system, and an ever-widening wealth hole. Social unrest is a direct byproduct of this “New New Regular,” as injustices between the wealthy and poor turn out to be more and more evident.

If we’re right in assuming that PCE will revert to the imply as stimulus fades from the financial system, then the ‘New New Regular’ of financial progress can be a brand new decrease pattern that fails to create widespread prosperity.”

As proven, financial progress traits are already falling in need of each earlier long-term progress traits. The Fed is now speaking about slowing financial exercise additional in its inflation combat.

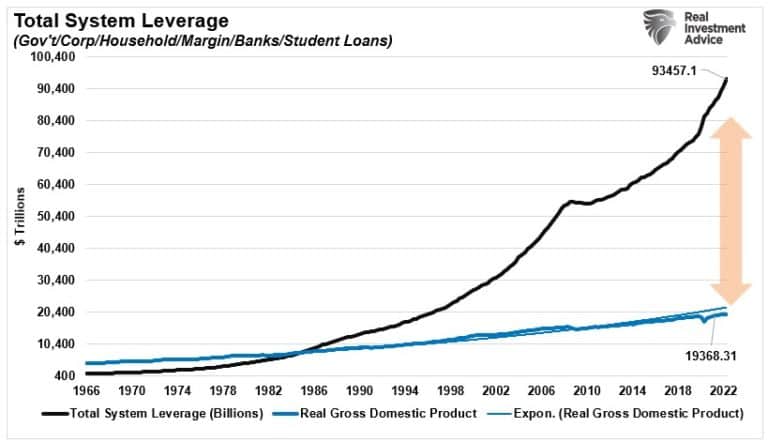

The rationale that slowing financial progress, and killing inflation, is important for the Fed is as a result of large quantity of leverage within the financial system. The chart beneath exhibits the overall financial system leverage versus GDP. It at the moment requires $4.82 of debt for every greenback of inflation-adjusted financial progress.

The issue comes if inflation stays elevated and rates of interest alter to greater ranges. Such would set off a debt disaster as servicing necessities enhance and defaults rise. Traditionally, such occasions led to a recession at greatest and a monetary disaster at worst.

As Ron Insana lately said;

“[Bullard’s] ‘7% answer’ is, in my opinion, fully and completely absurd. Elevating charges by as much as three full share factors from the Fed’s present goal vary of three.75% to 4% would guarantee a really deep recession. It might be certain that one thing someplace breaks, risking a systemic market or financial occasion that can shake the monetary markets or the financial system to their very core.”

Historical past means that such would certainly be the case.

Wash, Rinse & Repeat

The rise and fall of inventory costs have little to do with the typical American and their participation within the home financial system. Rates of interest are a wholly completely different matter. Since rates of interest have an effect on “funds,” will increase in charges shortly negatively impression consumption, housing, and funding, which finally deters financial progress.

Given the already large ranges of excellent debt and customers now piling into bank card debt to offset spikes in residing prices, the surge in charges will trigger a reversion in consumption. Such will inevitably result in a reversal of financial coverage, as seen repeatedly over the past decade, to offset the deflation of asset markets.

In fact, such results in the repetitive cycle of Federal Reserve interventions.

- Financial coverage drags ahead future consumption leaving a void sooner or later.

- Since financial coverage doesn’t create self-sustaining financial progress, ever-larger quantities of liquidity are wanted to take care of the identical exercise stage.

- The filling of the “hole” between fundamentals and actuality results in financial contraction.

- Job losses rise, the wealth impact diminishes, and actual wealth reduces.

- The center class shrinks additional.

- Central banks act to offer extra liquidity to offset recessionary drag and restart financial progress by dragging ahead future consumption.

- Wash, Rinse, Repeat.

If you happen to don’t consider me, right here is the proof:

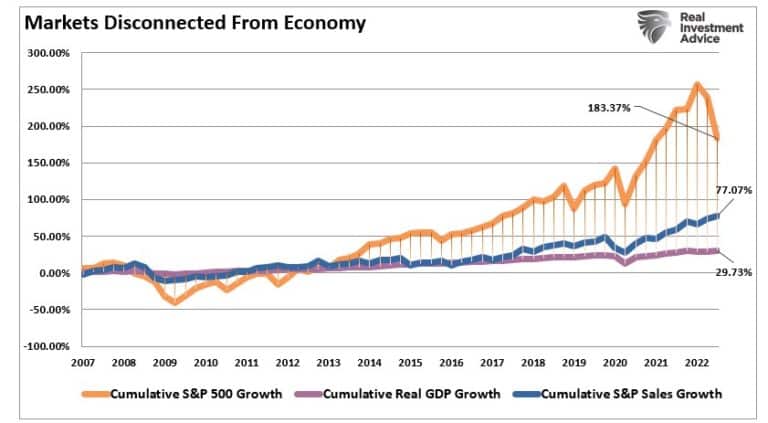

“By means of the top of Q3-2022, utilizing quarterly knowledge, the inventory market has returned nearly 184% from the 2007 peak. Such is greater than 6x GDP progress and a pair of.4x the rise in company income. (I’ve used SALES progress within the chart beneath as it’s what occurs on the prime line of revenue statements and isn’t AS topic to manipulation.)“

The important takeaway is that whereas the Fed’s coverage of low-interest charges pushed capital into the monetary markets, it did so on the expense of financial progress. The debt accumulation wanted to maintain a “residing customary” has left the lots depending on low charges to help financial exercise.

Most definitely, the Fed’s “7% answer” will clear up the inflation drawback attributable to the huge stimulus injections following the pandemic. Sadly, the medication will most probably kill the affected person within the course of.