ChristianChan

Funding thesis

The Jap Firm (NASDAQ:EML) is an organization with a excessive cyclical element because of the nature of the industries for which it operates, and present instances marked by inflationary pressures, provide chain points, and recessionary considerations are impacting the corporate’s operations attributable to a discount in volumes and a contraction in revenue margins. These headwinds have taken place in the midst of a restructuring course of so, past elevated revenues, it is rather tough to evaluate how the corporate’s profitability shall be in the long run because the macroeconomic context is at the moment fairly complicated. Additionally, the corporate has elevated its debt ranges considerably on account of the restructuring course of, which is producing curiosity bills.

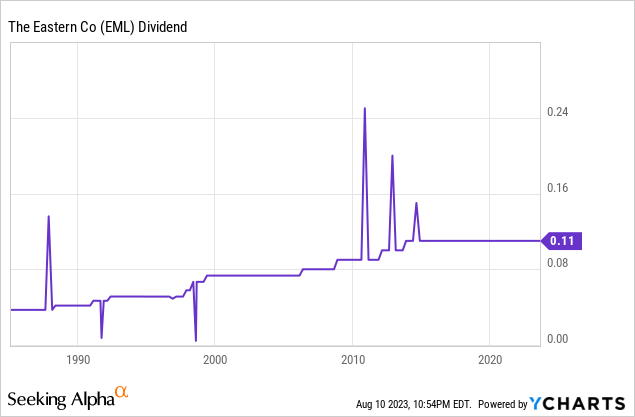

Regardless of this, web gross sales have doubled since 2016 and revenue margins have lately began bettering as the corporate is performing product worth raises to offset elevated manufacturing prices. Additionally, the administration has emptied a part of the inventories in current quarters, which has enabled robust money from operations with which to scale back the debt contracted through the restructuring. Moreover, the corporate has paid dividends for 332 consecutive quarters, and pessimism amongst traders has induced a major improve within the dividend yield to 2.36% because the share worth decreased by 45% from all-time highs, with which I think about the current fall within the share worth represents an excellent alternative for each long-term dividend traders (because the money payout ratio has traditionally been very low), in addition to for these traders all for acquiring comparatively excessive returns within the medium time period, as soon as the corporate’s prospects enhance.

A short overview of the corporate

The Jap Firm is a designer and producer of engineered options for industrial markets. The corporate was based in 1858 and its market cap at the moment stands at $116 million, using over 1,000 staff. As a result of nature of the businesses for which it operates, the corporate has a excessive cyclical element, so it’s particularly essential to make the most of instances of excessive pessimism (and thus decrease share costs) and keep away from investing when optimism reigns amongst traders. This enables for larger dividend yields on price and doubtlessly larger returns within the type of capital positive aspects as soon as operations enhance and optimism returns.

The Jap Firm (Easterncompany.com/)

The corporate has undergone a drastic transformation in recent times and at the moment operates three important companies: Large 3 Precision, Velvac, and Eberhard Manufacturing, that are main companies of their fields. Large 3 Precision manufactures returnable packaging options used within the meeting processes of automobiles, plane, and sturdy items and within the manufacturing processes of plastic packaging merchandise, packaged shopper items, and prescription drugs. Velvac designs and manufactures proprietary imaginative and prescient know-how for OEMs and aftermarket functions, and is a number one supplier of aftermarket elements to the heavy-duty truck market in North America. And Eberhard is a worldwide chief within the engineering and manufacturing of entry and safety {hardware}.

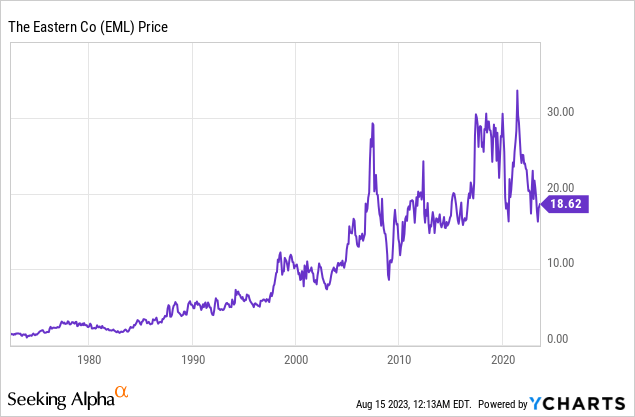

At the moment, shares are buying and selling at $18.62, which represents a forty five.17% decline from all-time highs of $33.96 on June 9, 2021. This displays rising pessimism amongst traders, regardless of rising revenues, as inflationary pressures and provide chain points are inflicting important margin contraction as it’s at the moment not attainable to evaluate the affect on profitability that the restructuring of current years will herald the long run.

A significant restructuring course of that right now kinds what we all know as The Jap Firm

In recent times, the corporate has undergone a restructuring course of that has resulted within the firm we all know right now as The Jap Firm, which at the moment has greater than double the revenues in comparison with 2016, however whose profitability we nonetheless can not know because of the disruptions attributable to the coronavirus pandemic in 2020 and the following provide chain points and inflationary pressures within the firm’s operations.

In April 2017, the corporate acquired Velvac, a number one designer and producer of proprietary imaginative and prescient know-how for business automobiles, for $39.5 million. Later, in June 2018, the corporate acquired sure property of Load N Lock Techniques, a frontrunner in modern truck cap and tonneau cowl locks that hold truck contents secure and safe, together with merchandise and mental property, for $5 million.

The acquisition spree continued in September 2019 when the corporate acquired Large 3 Precision Merchandise, a number one supplier of turnkey packaging options, for $81.7 million, and in June 2020, the corporate offered its Canadian Business Autos Company, which is a designer and producer of composite panels.

In August 2020, the corporate acquired sure property of Hallink RSB, a frontrunner in modern injection blow mould tooling and a number one provider of blow molds and alter components to the meals, beverage, healthcare, and chemical industries, and a bit later, in November 2020, the corporate offered its Sesamee Mexicana enterprise, which designs and manufactures composite panels and distributes industrial {hardware}.

In October 2022, the corporate offered its Argo EMS enterprise, a provider of printed circuit boards and different digital assemblies to authentic tools producers. Later, in November 2022, it offered its Greenwald Industries division, an authentic tools producer of fee options from coin-vending merchandise to good card techniques and fee functions, and through the identical month, it additionally offered its Frazer & Jones Firm division, a high-quality ductile and malleable iron foundry situated in Syracuse, NY. The divestitures of those three companies occurred after the administration decided they now not match with the corporate’s long-term technique.

Lastly, in Could 2023, the corporate additionally introduced the divestiture of Related Software Makers because of the low added-value of its merchandise and, in June 2023, the corporate acquired the enterprise and sure property of Sureflex, a producer of tractor-trailer electrical connection cable assemblies.

Web gross sales are considerably larger after the restructuring

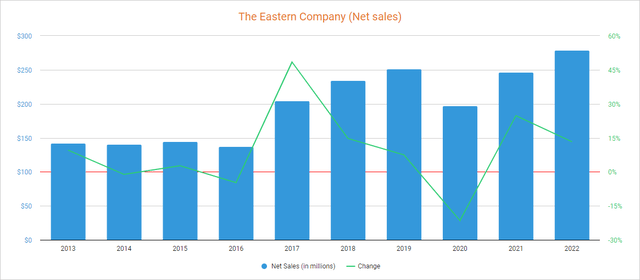

The corporate managed to extend its web gross sales through the years as they elevated by 77% from 2013 to 2019 (and by 83% from 2016 to 2019), and though the coronavirus pandemic induced a 21.50% discount in gross sales in 2020, they marked an all-time excessive in 2022 as they elevated by 24.75% in 2021 and by an extra 13.28% in 2022.

The Jap Firm web gross sales (In search of Alpha)

As for 2023, web gross sales elevated by 5.04% yr over yr through the first quarter, however declined by 1.73% yr over yr (and by 5.79% sequentially) through the second quarter, regardless of worth raises, because the backlog declined by 9% yr over yr to $75.3 million attributable to decrease demand for returnable transport packaging merchandise as OEMs are delaying some purchases attributable to recessionary considerations. However, I ought to word that 2022 was an exceptionally robust yr and the corporate retains launching new merchandise to the market because it lately launched new truck mirror assemblies, rotary latches, D-rings, and mirror cams.

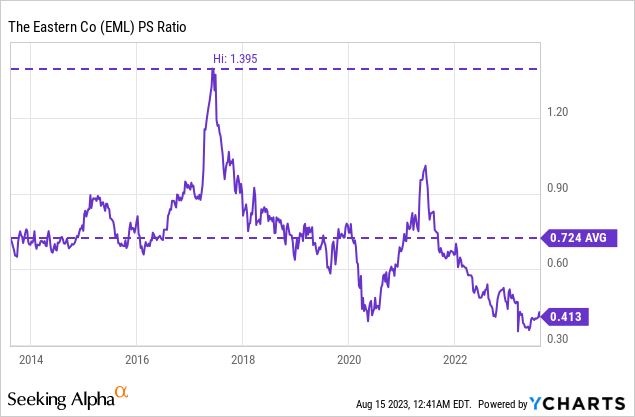

The corporate lacks geographic diversification as 97% of its web gross sales occurred in america in 2022, and the current decline within the share worth coupled with larger revenues has induced a steep decline within the P/S ratio to 0.413, which suggests the corporate generates annual revenues of $2.42 for every greenback held in shares by traders.

This ratio is 42.96% decrease than the typical of the previous 10 years and represents a 70.39% decline from decade-highs of 1.395 reached in 2017, which displays excessive pessimism amongst traders as they’re putting considerably much less worth on the corporate’s gross sales because of the current contraction in margins and its larger debt load.

Revenue margins are bettering, however decreased volumes stay a problem

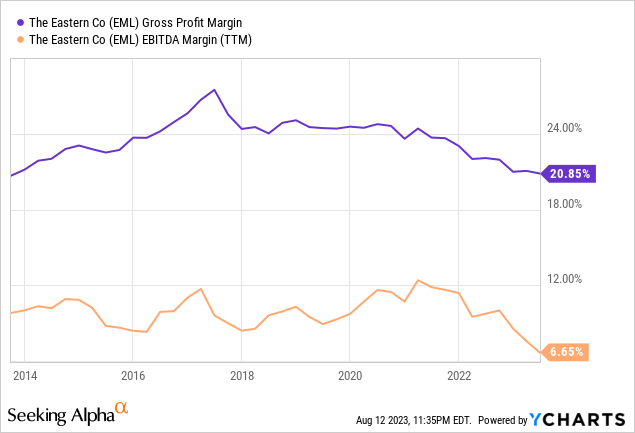

After the coronavirus pandemic disaster again in 2020, the reopening of the world’s economies induced provide chain points and elevated freight and materials prices in 2021 and 2022 that induced a margin contraction that has continued to this present day because the trailing twelve months’ gross revenue margin at the moment stands at 20.85% (in comparison with over 24% earlier than the coronavirus pandemic), and the EBITDA margin at 6.65% (in comparison with ~10% earlier than the coronavirus). This has induced a decline within the firm’s money technology capability because it reported money from operations of -$2.0 million in 2021, and $10.5 million in 2022.

However, the gross revenue margin improved throughout two consecutive quarters to 22.17% within the second quarter of 2023 because the administration is performing product worth raises to offset larger uncooked materials and freight prices, though the EBITDA margin remained weak at 6.56%. Additionally, provide chain points and inflationary pressures are beginning to present indicators of easing, and revenue margins are anticipated to maintain bettering as 20% of the overall backlog nonetheless doesn’t replicate new costs. Nonetheless, decrease volumes derived from rising recessionary considerations stay a problem because the absorption capability of the corporate’s workforce is at the moment impacted by decrease demand, though which means that margins nonetheless have some room for enchancment.

Web debt is beginning to decline boosted by stock destocking

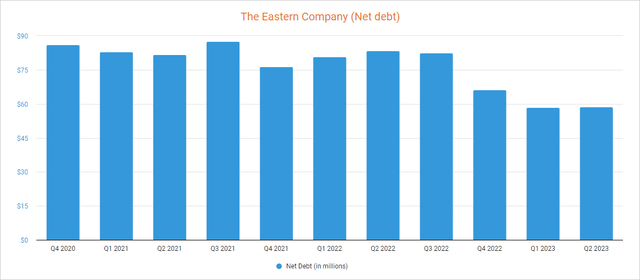

As a consequence of the restructuring course of, the corporate’s web debt elevated from -$20.9 million in 2016 to $12.9 million in 2017, $14.7 million in 2018, and $93.1 million in 2019, however the firm has managed to scale back its web debt to $58.8 million as it’s at the moment making use of its inventories to transform them into precise money.

The Jap Firm web debt (In search of Alpha)

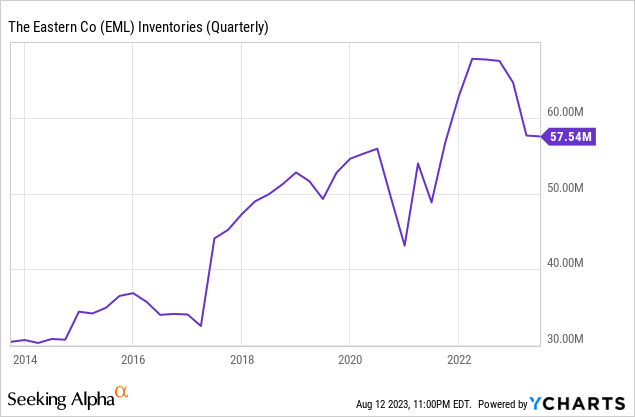

On this regard, the corporate paid down an extra $5 million in debt through the second quarter of 2023 (and the debt discount was $10 million in complete through the first half of 2023) as money from operations is bettering boosted by margin enlargement and stock destocking, and the corporate nonetheless has inventories of $57.54 million and money and equivalents of $13.2 million, which considerably reduces the danger of curiosity bills persevering with growing as the corporate mustn’t want to extend its debt publicity within the brief time period.

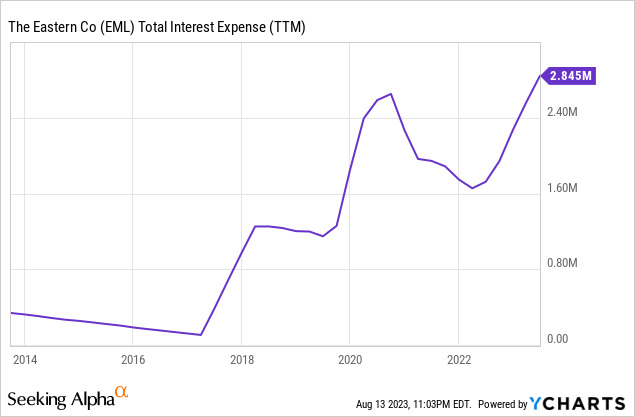

Regardless of a major discount in long-term debt from $93.6 million in 2019 to $51.4 million at the moment, the price of debt continues to rise attributable to larger rates of interest as trailing-twelve months’ curiosity bills at the moment stand at $2.85 million. Moreover, curiosity bills had been $0.78 million through the second quarter of 2023, so the corporate is anticipated to pay round $3.12 million a yr at present charges.

Regardless of this, curiosity bills are anticipated to start reducing within the foreseeable future as the corporate is at the moment producing sufficient money from operations to cowl the dividend and curiosity bills whereas capital expenditures are comparatively low, which ought to ultimately enhance the corporate’s long-term prospects.

The dividend is sustainable

The corporate has paid 332 consecutive quarterly dividends, and the current margin enlargement coupled with elevated revenues make it, for my part, a secure dividend. Moreover, the current share worth decline has induced a rise within the dividend yield to 2.36%, which I’d charge as beneficiant (regardless of lack of progress) attributable to a really low historic money payout ratio (of round 30%) that permits for operational progress initiatives such because the current restructuring course of and the following deleveraging part.

Within the following desk, I’ve calculated the money payout ratio of the previous few years by calculating what share of the money from operations the corporate has allotted annually to cowl curiosity bills and the dividend as on this method we are able to assess its sustainability by precise operations.

| 12 months | 2014 | 2015 | 2016 |

2017 |

2018 | 2019 | 2020 | 2021 | 2022 |

| Money from operations (in tens of millions) | $9.3 | $9.1 | $12.4 | $11.2 | $12.9 | $23.0 | $20.7 | -$2.0 | $10.5 |

| Dividends paid (in tens of millions) | $2.7 | $2.7 | $2.8 | $2.8 | $2.8 | $2.7 | $2.8 | $2.8 | $2.7 |

| Curiosity expense (in million) | $0.3 | $0.2 | $0.1 | $1.0 | $1.2 | $1.9 | $2.1 | $1.7 | $2.3 |

| Money payout ratio | 32% | 32% | 23% | 34% | 31% | 20% | 24% | – | 48% |

As could be seen within the desk, the money payout ratio has been traditionally low, besides in 2021 attributable to unfavourable money from operations. Throughout 2022, money from operations improved to $10.5 million (from -$2.0 million in 2022), and the state of affairs has continued to enhance as trailing twelve months’ money from operations at the moment stands at $27.2 million boosted by some stock destocking.

Through the second quarter of 2023, the corporate reported money from operations of $6.7 million, inventories declined by $0.2 million and accounts receivable declined by $2.5 million whereas accounts payable elevated by simply $0.4 million. This must be sufficient to cowl the annual dividend expense of $2.7 million and curiosity bills of $2.3 million as the corporate reported a optimistic web revenue of $1.4 million, which continues to be effectively under the $4.0 million reported throughout the identical quarter of 2022, however represents a major enchancment from $0.4 million through the fourth quarter of 2022 and $0.6 million through the first quarter of 2023. This displays the current enchancment in revenue margins which, if present developments proceed, ought to permit the corporate to speed up the deleveraging part.

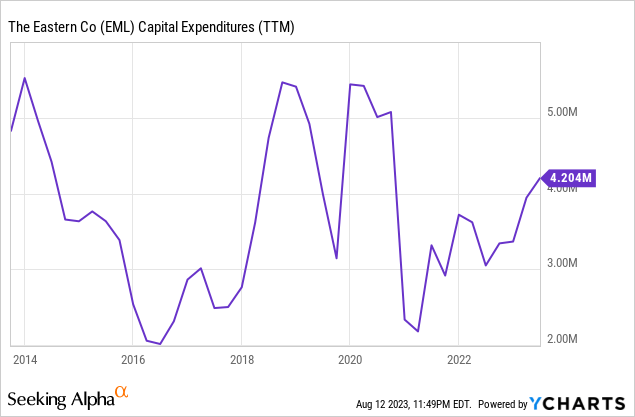

Additionally, the corporate ought to be capable to cowl its capital expenditures (even at present money from operations), which elevated to $4.20 million (TTM) through the previous quarter as the corporate is growing new merchandise for Eberhard and Velvac divisions.

On this regard, I strongly think about that the dividend is at the moment secure because the money from operations reported through the second quarter of 2023 is sufficient to cowl greater than 1 / 4 of the annual bills for the dividend, curiosity bills, and capital expenditures, which also needs to allow the corporate to maintain up with the deleveraging course of, and thus, begin lowering the fee on the debt.

Dangers value mentioning

Total, I think about The Jap Firm’s danger profile as comparatively low over the long run because of optimistic money from operations and pretty conservative debt publicity. Even so, under I want to spotlight these dangers that I imagine traders ought to concentrate on within the brief and medium phrases as the corporate has a powerful cyclical nature.

- If inflationary pressures don’t ease on the anticipated charge, revenue margins might proceed to say no as materials and freight prices might improve once more.

- Latest rate of interest hikes carried out to scale back excessive inflation charges might trigger a recession, which might result in a sustained discount in volumes. This may have a unfavourable affect on each the corporate’s gross sales and revenue margins attributable to unabsorbed labor as the corporate’s cyclical nature is powerful, and this danger could be lowered by the potential investor with a cost-dollar averaging technique.

- If revenue margins decline attributable to stronger headwinds or a recession lastly materializes, the corporate could possibly be compelled to extend its debt publicity, which might lead to elevated curiosity bills.

- As a result of the present headwinds have taken place within the midst of the corporate’s restructuring course of, it isn’t but identified what the potential revenue margins are and the corporate’s money from operations technology capability.

Conclusion

In the long run, I don’t imagine that The Jap Firm’s operations are in a (too) delicate state of affairs because the money technology capability reached through the second quarter of 2023 is sufficient to cowl the dividend, curiosity bills, and capital expenditures, however brief and medium time period dangers are preserving traders on the sidelines. It stays to be seen what the corporate’s potential revenue margins shall be in a much less complicated macroeconomic context than the present one, and the present debt pile is producing curiosity bills which, regardless of being the corporate capable of cowl, are larger than the dividend attributable to elevated rates of interest. Additionally, the current backlog decline attributable to clients’ rising recessionary considerations poses an issue for gross sales, however particularly for revenue margins attributable to unabsorbed labor.

Regardless of this, the current headwinds (elevated manufacturing and transportation prices and declining volumes attributable to recessionary considerations) are, for my part, of a short lived nature as they’re immediately linked to the present macroeconomic panorama, and the corporate ought to be capable to ultimately attain larger revenue margins ranges because it manages to go a part of the rise in manufacturing prices to clients whereas volumes normalize. Additionally, excessive money and equivalents and inventories ought to permit for additional declines within the firm’s debt publicity, which ought to finally result in decrease curiosity bills. For these causes, I think about that the current decline of 45% within the share worth represents an excellent alternative for long-term traders all for the next dividend yield on price or potential larger returns within the type of capital positive aspects as soon as the corporate’s prospects enhance. However, I think about it a really sensible concept to maintain a bullet within the chamber (common down) as a way to add some shares to the place at decrease costs in case the present headwinds intensify or a possible recession lastly materializes as the corporate is very cyclical and the present instances are marked by robust volatility.