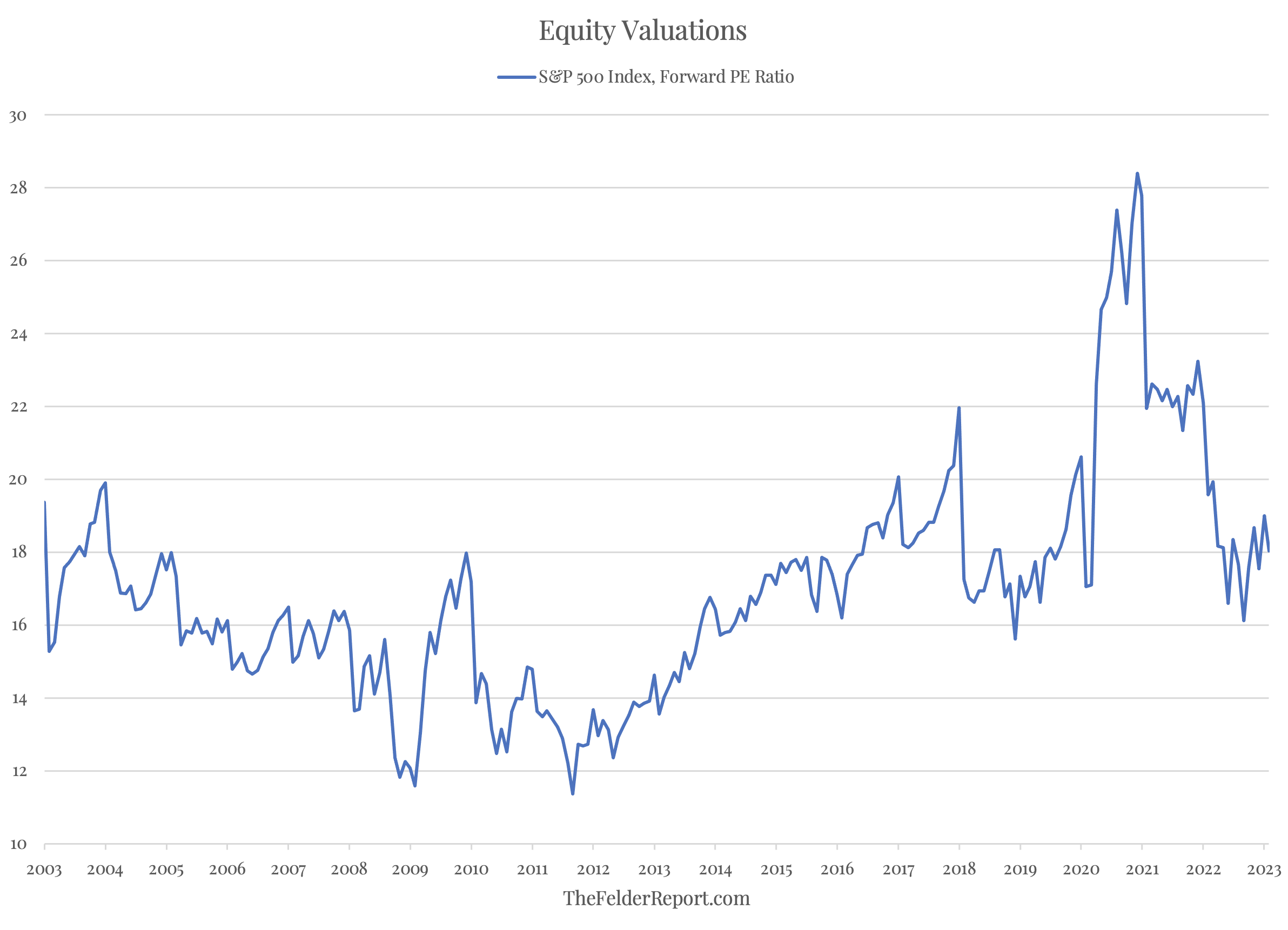

After the painful decline in inventory costs final 12 months, many traders have concluded that this now represents one other terrific shopping for alternative. And when you look simply at earnings-based valuation measures, you might be forgiven for pondering that, whereas they is probably not inordinately low-cost, fairness valuations are now not excessive.

The ahead price-to-earnings ratio exhibits the trades at a a number of of round 17, close to its common over the previous 20 years.

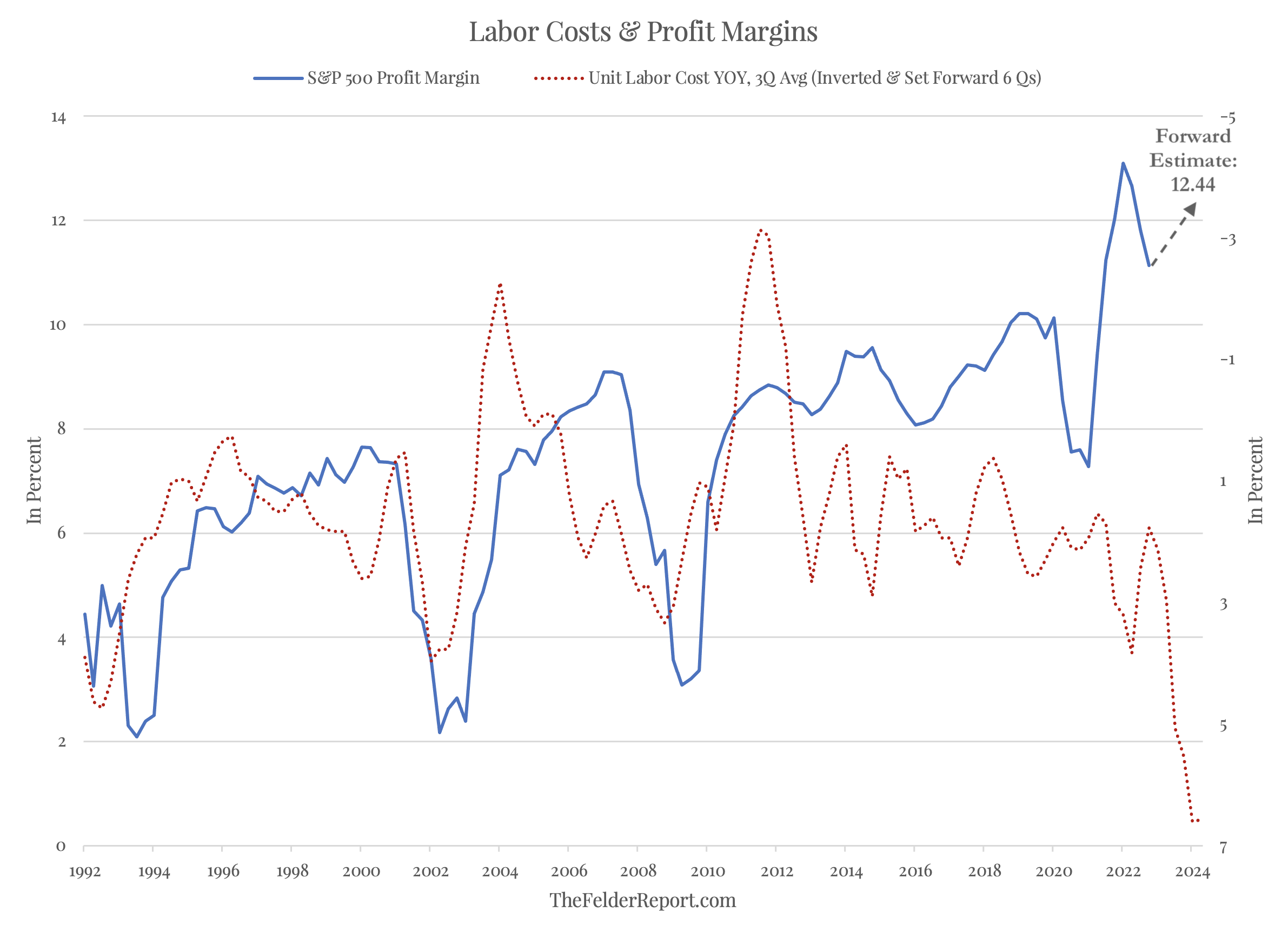

What this measure obscures, nevertheless, is the truth that the revenue margins supporting these earnings are nonetheless obscene. Furthermore, estimates assume the current decline in margins will quickly reverse and that they may return practically to document highs.

Definitely, there are at the very least a number of (just like the power within the , , and costs over the previous couple of years) to be skeptical of this optimistic evaluation. Quickly rising labor prices sometimes result in margin declines higher than that we have now already seen, and labor prices have already risen sooner than at any level previously thirty years.

If revenue margins proceed to fall over the course of this 12 months moderately than reverse greater as anticipated, the denominator in these ahead price-to-earnings ratios might decline dramatically, revealing the truth that fairness valuations have been by no means actually all that affordable within the first place.

They solely seem that means at the moment as the results of some specifically heroic on the a part of fairness analysts.