Up to date on April 1st, 2024

Spreadsheet knowledge up to date day by day

To ensure that retirees to generate dividend revenue that is still comparatively secure on a month-to-month foundation, it’s essential for them to know what shares pay dividends during which months.

That’s the place Positive Dividend is available in. We’ve created a database of each inventory that pays dividends in April (plus necessary metrics that matter to buyers), which you’ll obtain by clicking on the hyperlink under:

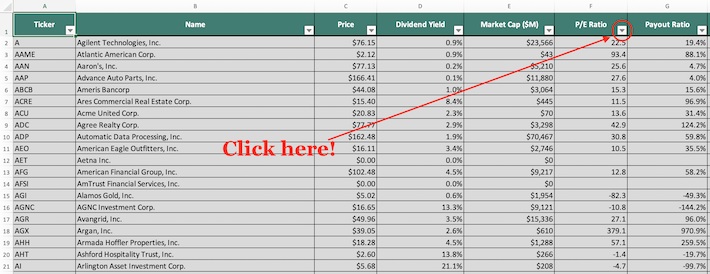

The database of shares that pay dividends in April obtainable for obtain above incorporates the next metrics for each safety within the record:

- Identify

- Ticker

- Inventory value

- Dividend yield

- Market capitalization

- P/E Ratio

- Payout Ratio

- Beta

Maintain studying this text to be taught extra about the right way to use our database of shares that pay dividends in April to seek out funding concepts.

Word: Constituents for the spreadsheet and desk above are from the Wilshire 5000 index, with knowledge supplied by Ycharts and up to date yearly. Securities outdoors the Wilshire 5000 index should not included within the spreadsheet and desk.

How To Use The April Dividend Shares Checklist To Discover Funding Concepts

Having an Excel database that incorporates the identify, ticker, and price-to-earnings ratio of each inventory that pays a dividend within the month of April may be tremendously helpful.

This doc turns into much more highly effective when mixed with a working data of spreadsheet instruments like Microsoft Excel.

With this in thoughts, the next tutorial will display the right way to apply to extra investing screens to the shares inside the April dividend shares database.

The primary display screen that we’ll display is for shares that commerce with market capitalizations above $15 billion and betas under 1.

Display 1: Market Capitalization Above $15 Billion, Beta Beneath 1

Step 1: Obtain your free record of shares that pay dividends in April by clicking right here. Apply Excel’s filter perform to each column within the spreadsheet.

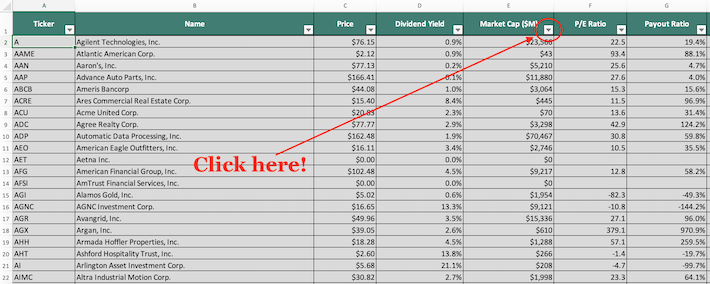

Step 2: Click on the filter icon on the prime of the market capitalization column, as proven under.

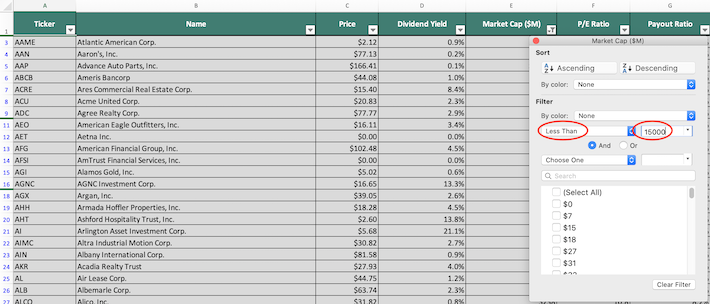

Step 3: Change the filter setting to “Larger Than” and enter 15000 into the sphere beside it, as proven under. Since market capitalization is measured in tens of millions, screening for market capitalizations above “15000” is equal for screening for market capitalizations above $15 billion.

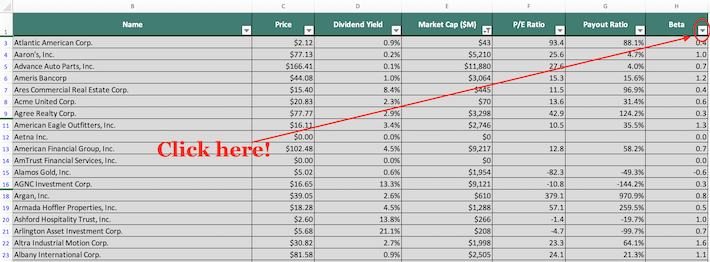

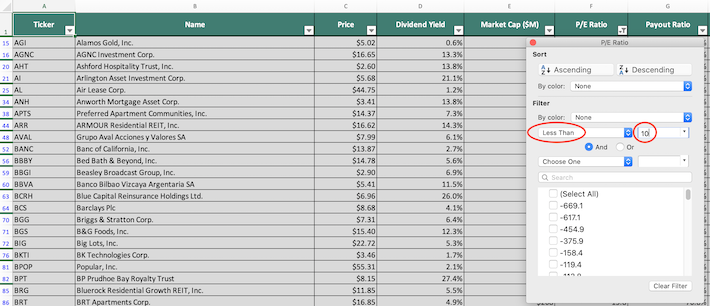

Step 4: Shut out of the filter window (by clicking the exit button, not by clicking the “Clear Filter” button within the backside proper nook). Subsequent, click on on the filter icon on the prime of the beta column, as proven under.

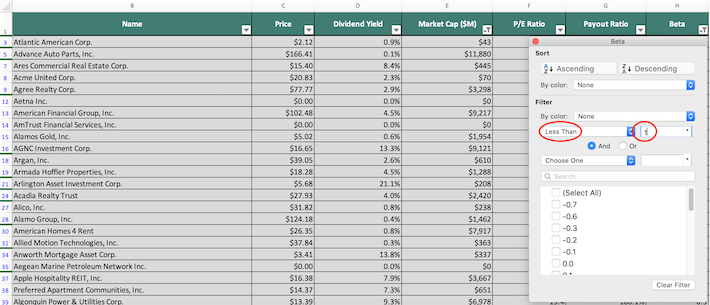

Step 5: Change the filter setting to “Much less Than” and enter 1 into the sphere beside it, as proven under. It will filter for April dividend shares with betas under 1.

The remaining shares on this database are shares that pay dividends in April which have market capitalizations above $15 billion and betas under 1.

The following display screen that we’ll display the right way to implement is for shares that pay dividends in April with price-to-earnings ratios under 10 and dividend yields above 5%.

Display 2: Worth-to-Earnings Ratios Beneath 10, Dividend Yields Above 5%

Step 1: Obtain your free record of shares that pay dividends in April by clicking right here. Apply Excel’s filter perform to each column within the spreadsheet.

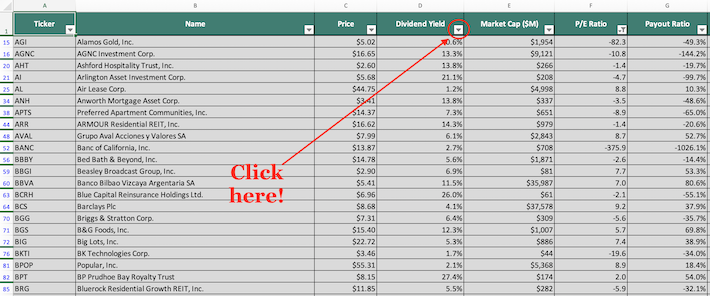

Step 2: Click on on the filter icon on the prime of the price-to-earnings ratio column, as proven under.

Step 3: Change the filter setting to “Much less Than” and enter 10 into the sphere beside it, as proven under. It will filter for shares that pay dividends in April with price-to-earnings ratios lower than 10.

Step 4: Shut out of the filter window (by clicking the exit button, not by clicking the “Clear Filter” button within the backside proper nook). Then, click on the filter icon on the prime of the dividend yield column, as proven under.

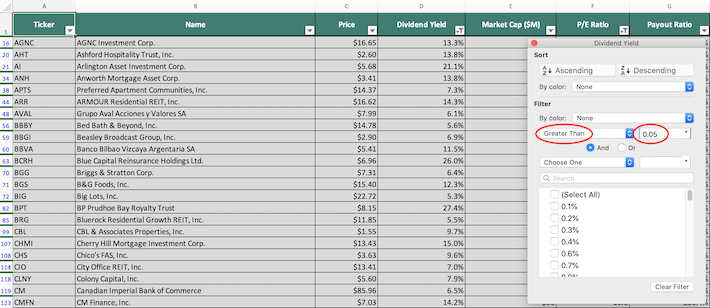

Step 5: Change the filter setting to “Larger Than” and enter 0.05 into the sphere beside it. It will filter for shares that pay dividends in April with dividend yields above 5%.

The remaining shares on this spreadsheet are shares that pay dividends in April with price-to-earnings ratios under 10 and dividend yields above 5%.

You now have a broad understanding of the right way to harness the facility of Microsoft Excel to seek out funding concepts inside our database of shares that pay dividends in April.

To conclude this text, we’ll share different funding databases that you should utilize to seek out compelling dividend funding alternatives.

Last Ideas: Different Helpful Investing Assets

Having an Excel doc that incorporates the identify, tickers, and monetary info for all shares that pay dividends in April is kind of helpful – but it surely turns into much more helpful when mixed with different databases for the non-April months of the calendar 12 months.

Thankfully, Positive Dividend additionally maintains related databases for the opposite 11 months of the 12 months. You possibly can entry these databases under:

Our analysis at Positive Dividend means that shares with steadily rising dividend funds have outperformed the broader market with much less volatility. With that in thoughts, the next databases of shares are helpful sources for locating funding concepts:

- The Dividend Aristocrats: a gaggle of S&P 500 shares with 25+ years of consecutive dividend will increase.

- The Dividend Achievers: a gaggle of dividend shares with 10+ years of consecutive dividend will increase.

- The Dividend Kings: thought of to be the best-of-the-best in relation to dividend development shares, the Dividend Kings are an unique group of shares with 50+ years of consecutive dividend will increase.

You may additionally be on the lookout for shares with sure dividend traits so that you could create a really personalized revenue stream. With this in thoughts, the next Positive Dividend databases will come in useful:

Particular person sectors of the inventory market will also be fruitful floor in your hunt for brand new funding concepts. Positive Dividend gives 10 databases of the shares in every sector of the inventory market. You possibly can entry these databases under:

Thanks for studying this text. Please ship any suggestions, corrections, or inquiries to [email protected].