Torsten Asmus/iStock by way of Getty Photographs

Let me clarify the title first. Since 2015, Blackstone (NYSE:BX) has achieved, on a CAGR foundation, ~20% annual appreciation of its inventory regardless of the current drop. In the meantime, it’s buying and selling at a ~5.5% TTM dividend yield. I battle to call one other inventory with the same appreciation potential and excessive yield on the identical time. Usually buyers get both one or the opposite, however not each.

Does it imply that buyers can take pleasure in each excessive earnings and development sooner or later? Please learn on however remember that this submit assumes a sure familiarity with the corporate and business.

Accounting and structural complexities

GAAP accounting is deceptive as a result of BX has to consolidate loads of accounting knowledge which can be attributable to non-controlling pursuits (NCI). In a different way from another different asset managers, NCI contains not solely investees (principally owned by Blackstone funds equipped primarily by third events) but in addition the homeowners of the so-called Blackstone Holding Partnership Models.

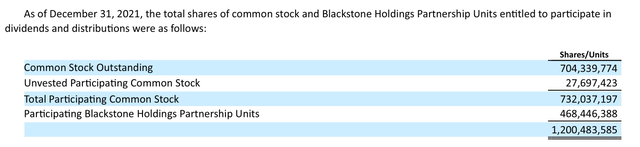

Blackstone operations are owned by each Blackstone, Inc. (the one buying and selling on NYSE) and the Blackstone Holding Partnership with models exchangeable on a one-to-one foundation to BX shares (each teams are equally eligible for dividends and distributions). The unitholders encompass administration, staff, and a few third events. Yearly (since 2019 when Blackstone was transformed into an organization from a partnership), some models are being transformed into shares however new models are being issued to sure newly employed and pre-existing senior managing administrators. This course of isn’t very clear, however at the moment, about 61% of homeowners encompass shareholders and 39% of unitholders. For higher understanding, right here is a picture from the final 10-Ok:

Firm

At any time when one critiques Blackstone’s outcomes, she has to separate them between clear shareholders and not-so-transparent unitholders. This image is additional sophisticated by the completely different tax statuses of each teams. I’ll skip the small print however briefly, it creates the so-called Tax Receivable Agreements (transferring funds from the company to unitholders) that BX often reviews along with taxes.

Even inside Blackstone, Inc., apart from frequent shares, there additionally exist Sequence I and Sequence II most well-liked shares. The one Sequence II most well-liked stockholder (so far as I perceive it’s the Founder aka Mr. Stephen A. Schwarzman performing via Blackstone Group Administration L.L.C.) elects the corporate’s administrators.

There are different privileges for insiders. Let me quote 10-Ok once more:

The Founder, senior managing administrators, staff and sure different associated events make investments on a discretionary foundation within the consolidated Blackstone Funds each straight and thru consolidated entities. These investments typically are topic to preferential administration payment and efficiency allocation or incentive payment preparations. As of December 31, 2021 and 2020, such investments aggregated $1.6 billion and $1.1 billion, respectively.

Summing up, Blackstone’s construction is archaic and favorable to insiders. Frequent shareholders are at drawback (although not at a substantial one). Consequently, regardless of its dimension, the corporate isn’t eligible for the S&P 500 inclusion (in distinction, for instance, with its peer Apollo (APO) because of the current simplification of its construction).

Due to the explanations talked about and a few extra elements, BX accounting is especially complicated. Nonetheless, any more, we will probably be discussing the corporate as if these issues didn’t exist in any respect.

Valuation complexities

Along with GAAP outcomes, Blackstone publishes its non-GAAP outcomes that filter out accounting and structural complexities. For all sensible functions, buyers use solely non-GAAP outcomes however their interpretation isn’t easy both.

On a non-GAAP foundation, Blackstone has three main sources of income and a smaller one:

- Administration charges characterize periodic charges assessed on third-party capital underneath Blackstone’s administration. They depend upon the scale of fee-generating property underneath administration (‘FGAUM’) and are probably the most secure supply of BX’s earnings. On non-GAAP statements, they’re often grouped with advisory charges that are transactional reasonably than periodic. Nonetheless, since advisory charges are a lot smaller than administration charges (maybe, by the order of magnitude), this grouping isn’t materials.

- Realized efficiency earnings (generally generally known as carry) is a slice of funding good points/earnings obtained by Blackstone upon exit from investments supplied funding efficiency is above a sure hurdle fee. Carry is an enormous merchandise for BX however it’s lumpy. First, exits aren’t common and occur solely when the funding cycle is over and the funding may be disposed of. And secondly, it’s advantageous and simpler to exit investments throughout good markets.

- Price-related efficiency earnings is one thing within the center between administration charges and carry. Just like administration charges, they’re assessed periodically and don’t require funding exits. Just like carry, they’re assessed solely when sure milestones are reached equivalent to most well-liked returns or excessive watermark. Hedge funds’ 20% incentive charges are instance of fee-related efficiency earnings however Blackstone is sort of artistic in introducing them for various funding autos. Price-related efficiency earnings can also be massive and lumpy.

- Realized principal funding earnings represents realized returns on Blackstone’s personal capital. Blackstone is an asset-light funding supervisor and offers lower than 5% of the restricted accomplice commitments of any specific fund. Consequently, this merchandise is usually a lot smaller than the three others but in addition lumpy.

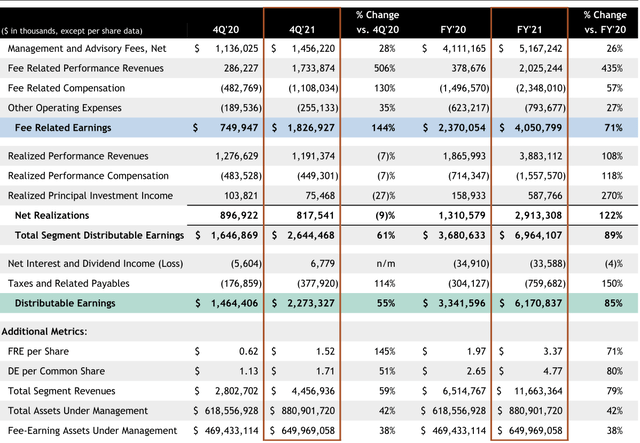

To raised perceive the atmosphere, allow us to take into account the most recent full-year non-GAAP outcomes under:

Firm

The Distributable Earnings (‘DE’) line (in daring) seems crucial as, per Blackstone’s coverage, 85% of DE in a specific quarter will probably be distributed to shareholders and unitholders in money the following quarter.

In its flip, DE represents a sum of 4 sources of earnings described above much less internet curiosity and taxes. We anticipate administration and advisory charges to develop from yr to yr in step with FGAUM. Nonetheless, fee-related efficiency revenues in 2021 had been ~6 instances increased than in 2020, and carry in 2021 was ~2 instances greater than in 2020. Realized principal in 2021 was ~4 instances greater than in 2020. The distinction is partially random, partially because of the development in FGAUM, however maybe, principally because of higher markets in 2021 vs 2020 (S&P 500 returns had been 28.7% and 18.4% respectively).

In yr like 2021, Blackstone’s revenues from the administration charges may be smaller than from the three different sources mixed. This makes Blackstone completely different from a few of its friends. However this isn’t the one distinction.

Price-related earnings (‘FRE’) are regularly rising for, say, Brookfield Asset Administration (BAM) and Apollo and may be reasonably simply valued. This isn’t the case for BX, as its FRE contains lumpy fee-related efficiency revenues that had been solely ~2.5 instances smaller in 2021 than the administration charges (BAM and APO have related sources of income however they’re small). So, Blackstone’s FRE is a very completely different beast than BAM’s or Apollo’s FRE and can’t be valued simply.

As a result of significance of lumpy objects, Blackstone’s DE, in addition to dividends derived from DE, doesn’t assist a lot to worth the corporate. DE in a single accounting interval is a poor predictor of what’s going to occur within the subsequent accounting interval. For sensible functions, the corporate’s present excessive dividend yield can’t be relied upon to make a purchase order choice.

Blackstone and different funding firms

An funding firm has two main assets for earning profits at its disposal. It could possibly both ship returns on its capital or it may well extract charges from managing third-party capital. Nothing prevents an funding firm to mix each strategies.

Fairness is the first metric to measure the corporate’s capital. Our funding firm ought to attempt its finest to leverage its fairness with out dropping management of the dangers concerned. For instance, Berkshire Hathaway (BRK.B) (BRK.A) makes use of P&C insurance coverage float for this goal. Brookfield makes use of debt, and Apollo makes use of life insurance coverage liabilities.

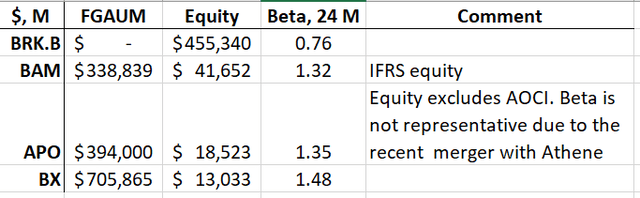

The power to extract charges, then again, is finest described by the FGAUM. Within the following desk, we’re crudely evaluating assets to earn a living for 4 massive and profitable buyers together with Blackstone:

Firms’ filings, SA, writer

The comparability within the desk isn’t easy. For instance, IFRS fairness for BAM could be very completely different from GAAP fairness for the three others, and so forth. Nonetheless, we’ll concentrate on the principle level solely: whereas BAM and APO are utilizing each assets, Berkshire and BX characterize excessive circumstances. Berkshire doesn’t have any FGAUM and Blackstone has the smallest fairness and the largest FGAUM out of the 4.

Since Berkshire may be reasonably moderately valued utilizing its fairness, we are able to attempt to worth Blackstone utilizing solely its FGAUM. We don’t need to go into particulars about how BX extracts earnings from FGAUM trusting the corporate to do it most effectively. Then FGAUM alone determines Blackstone’s incomes potential.

Blackstone’s valuations

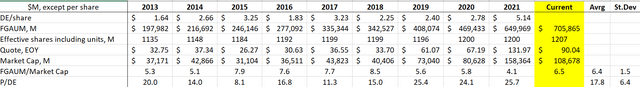

The desk under presents multi-year outcomes for FGAUM/Market Cap for Blackstone. For comparability, we additionally current the P/DE metric on a trailing foundation.

Firm, writer

First, the ratio of the common worth to its commonplace deviation is way increased for FGAUM/Market Cap than for P/DE. This is a sign that we’ve got reached some enchancment in valuing Blackstone.

Secondly, FGAUM/Market Cap has been fluctuating between 5.1 to eight.5 during the last 10 years with its common worth of 6.4. Coincidentally, Blackstone is buying and selling now very near its common.

Since 2013, Blackstone has been rising FGAUM at ~16% CAGR and we don’t see the explanation why this development can’t be repeated (there are a number of engines for it now, however we is not going to go into this dialogue). Assuming no enlargement/contraction of its FGAUM/Market Cap a number of, we are able to anticipate ahead returns to be the identical 16% plus a number of factors in dividends or ~19-20%. The inventory seems fairly enticing.

Conclusion

Posting about Brookfield and Apollo, I stored receiving questions on Blackstone that I attempted to deal with on this publication.

Please be aware that Blackstone has the next beta than its friends. Whereas the inventory appears enticing now, the prevailing volatility might current even higher shopping for factors.

I’m holding a reasonably small stake in BX initiated fairly lately. It’s a lot smaller than my stakes in BAM or APO just because I consider I do know the latter higher. All three greatest different asset managers appear reasonably enticing although I want Blackstone altered its company construction.

And eventually in regards to the conundrum I discussed firstly. Blackstone’s capital appreciation is because of the development of FGAUM whereas its often excessive yield is expounded to specific profitable years. Since 2015, the trailing yield has been fluctuating between 2.7 and 11%. Excessive yield isn’t essentially the explanation to purchase BX.