Printed on December thirty first, 2022 by Nikolaos Sismanis

Dividend Aristocrats comprise an elite group of 65 S&P 500 shares with 25+ years of consecutive dividend will increase. These shares are celebrated amongst dividend progress buyers, as they’re thought of dependable automobiles for rising one’s earnings in a extra predictable method.

Nonetheless, it’s necessary to notice that not all Dividend Aristocrats are created equal. Whereas most shares within the group have a tendency to extend their payouts meaningfully, others achieve this solely marginally as a technique to retain their Dividend Aristocrat standing. In some circumstances, this can be a manner for a Dividend Aristocrat to protect liquidity or enhance their monetary place earlier than extra noteworthy dividend hikes resume.

That mentioned, it’s value contemplating whether or not decelerating dividend will increase may very well be a signaling monetary pressure and whether or not it raises the danger of a dividend reduce sooner or later. As such, these Dividend Aristocrats ought to be evaluated twice earlier than making any funding selections.

We now have compiled an inventory of all 65 Dividend Aristocrats, together with related monetary metrics like dividend yield and P/E ratios. You may obtain the total record of Dividend Aristocrats by clicking on the hyperlink beneath:

Desk of Contents

Examples of Dividend Cuts Following a Declining Dividend Progress Tempo

Whereas it’s not a certain signal of monetary pressure, a Dividend Aristocrat slowing its tempo of dividend will increase might be an indication that the corporate is dealing with monetary challenges. This might doubtlessly result in a reduce in dividends. Listed here are some such examples which have beforehand occurred:

Pitney Bowes Inc. (PBI)

Pitney Bowes had grown its dividend yearly between 1983 and 2013, boasting 30 years of consecutive annual dividend will increase. In 2013, the corporate was compelled to chop its dividend after monetary misery, ending its multi-decade streak. Right here’s how Pitney Bowes’ dividend progress tempo appeared previous to the reduce:

- 1993 – 1998 DPS CAGR: 14.9%

- 1998 – 2003 DPS CAGR: 5.9%

- 2007 – 2012 DPS CAGR: 2.6%

AT&T Inc. (T)

Earnings-oriented buyers’ darling AT&T was compelled to chop its dividend by the top of 2021 after 37 years of consecutive annual dividend will increase. With its indebtedness reaching unsustainable ranges, a dividend reduce was the one manner for the corporate to begin deleveraging meaningfully and pursue recent progress initiatives. Right here’s how AT&T’s dividend progress tempo appeared previous to the reduce:

- 2003 – 2008 DPS CAGR: 6.8%

- 2008 – 2013 DPS CAGR: 2.4%

- 2016 – 2021 DPS CAGR: 1.5%

Mercury Normal Company (MCY)

Small-cap insurer Mercury Normal in the end needed to finish its 35-year dividend progress streak in 2022 after years of over-distributing its earnings. The corporate’s payout ratio would typically exceed 100%. Right here’s how Mercury Normal’s dividend progress tempo appeared previous to the reduce:

- 2002 – 2007 DPS CAGR: 11.6%

- 2007 – 2012 DPS CAGR: 3.3%

- 2016 – 2021 DPS CAGR: 0.4%

The 8 Dividend Aristocrats With The Smallest Dividend Will increase

Apart from AT&T’s unlucky reduce, Dividend Aristocrats continued to develop their dividends at slightly passable charges. The common dividend hike in 2022 by all 64 Dividend Aristocrats was 6.5%. Notably, 11 Dividend Aristocrats delivered double-digit hikes, whereas 28 Aristocrats grew their dividends by lower than 5% for the 12 months.

That mentioned, eight corporations, specifically, grew their dividends by a fee equal to or beneath 1%. May their decelerating tempo of dividend will increase sign a possible reduce shifting ahead?

#8: Dover Company (DOV)

- Years of dividend progress: 67

- Dividend yield: 1.5%

- 2005 – 2011 DPS CAGR: 10.7%

- 2011 – 2016 DPS CAGR: 7.8%

- 2016 – 2021 DPS CAGR: 3.0%

- Newest DPS enhance: 1.0%

Dover Company is a diversified world industrial producer with annual revenues of almost $9 billion. Dover’s 5 reporting segments embrace Engineered Methods, Clear Power & Fueling, Pumps & Course of Options, Imaging & Identification, and Local weather & Sustainability Applied sciences.

The corporate is a Dividend King with greater than six many years of dividend will increase. The truth is, with 2022’s dividend enhance marking 67 consecutive years of dividend progress, Dover boasts the second-longest dividend progress streak amongst U.S. corporations.

Dover’s earnings-per-share have compounded at 6% yearly over the past decade. Progress, in truth, accelerated in the latest years, with earnings-per-share progress rising at an annual fee of greater than 14% over the previous 5 years. Dover did undergo some setbacks throughout the worst of the COVID-19 pandemic, however the firm shortly rebounded.

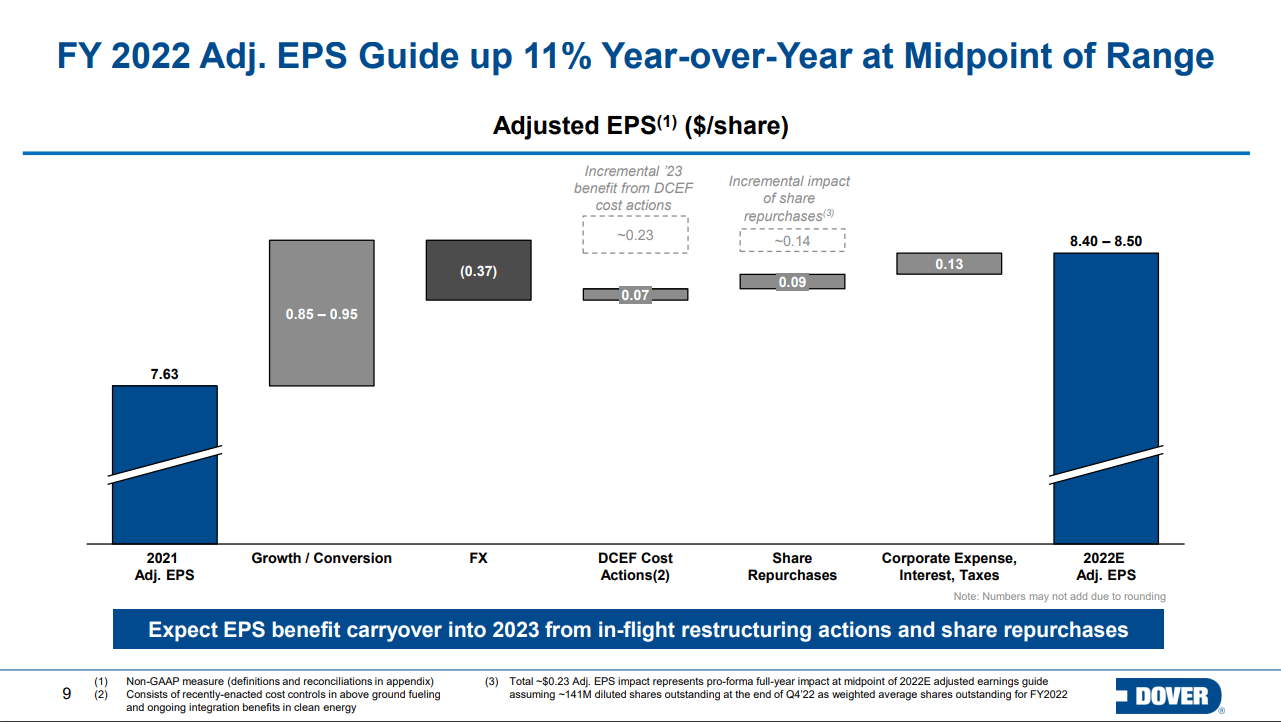

Supply: Investor Presentation

Is Dover Corp Prone to Lower its Dividend?

Regardless of Dover’s dividend progress fee decelerating considerably over the previous few years, we don’t imagine the corporate is headed towards a dividend reduce. Whereas Dover is a cyclical inventory, with its revenues topic to wild fluctuations throughout unfavorable market durations, the corporate has managed to maintain its earnings at stable ranges and even develop then notably over time. Final 12 months, the corporate’s internet earnings hit a brand new all-time whereas following earnings progress surpassing dividend progress over the 12 months, the inventory’s payout ratio stands at a really wholesome 24%

Click on right here to obtain our most up-to-date Certain Evaluation report on Dover Company (preview of web page 1 of three proven beneath):

#7 Cardinal Well being, Inc. (CAH)

- Years of dividend progress: 35

- Dividend yield: 2.5%

- 2005 – 2011 DPS CAGR: 24.3%

- 2011 – 2016 DPS CAGR: 15.0%

- 2016 – 2021 DPS CAGR: 3.9%

- Newest DPS enhance: 1.0%

Dublin, Ohio-based Cardinal Well being is among the “Huge 3” drug distribution corporations together with McKesson (MKC) and AmerisourceBergen (ABC). Cardinal Well being serves over 24,000 United States pharmacies and greater than 85% of the nation’s hospitals. The corporate has operations in additional than 30 nations with roughly 46,000 staff.

With 35 years of dividend will increase, the $20.4 billion market cap firm is a member of the Dividend Aristocrats Index.

Between 2011 and 2021, Cardinal Well being grew its earnings-per-share by a median compound fee of seven.6% per 12 months, whereas the dividend grew at greater than 9% yearly. Shifting ahead, we don’t anticipate this form of progress, particularly contemplating the slowdown in earnings enchancment in the previous few years.

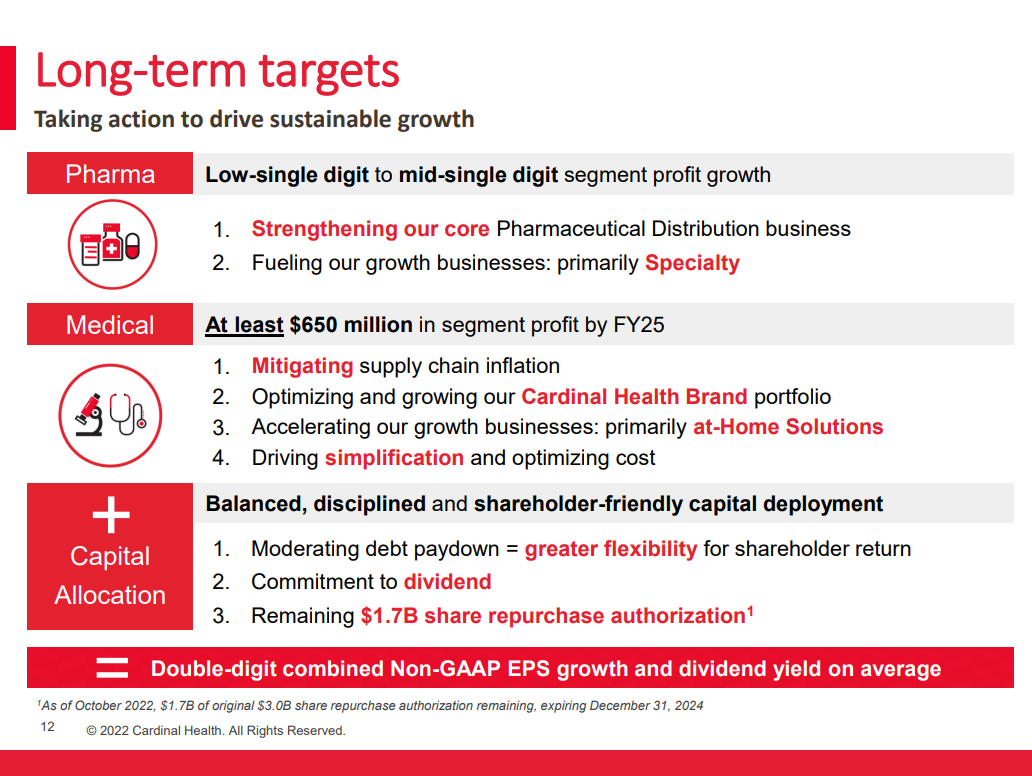

Supply: Investor Presentation

Is Cardinal Well being Prone to Lower its Dividend?

Certainly, Cardinal Well being’s dividend progress tempo has decelerated dramatically over the previous decade, whereas its most up-to-date 1% dividend enhance was actually underwhelming. However, we don’t imagine the corporate plans to chop its dividend anytime quickly.

It’s because the corporate’s earnings are more likely to stay strong as medication are likely to generate constant gross sales as their important pharmaceutical merchandise. Additional, the corporate’s payout ratio stands at a snug 38%, whereas Cardinal’s total monetary well being has been bettering.

Particularly, Cardinal’s long-term debt has declined from $9.0 billion in 2017 to $4.7 billion as of its most up-to-date Q3 2022 report. Lastly, the corporate is more likely to droop its inventory repurchases earlier than touching the dividend, and inventory repurchases have remained robust all year long.

Click on right here to obtain our most up-to-date Certain Evaluation report on Cardinal Well being, Inc.(preview of web page 1 of three proven beneath):

#6 Emerson Electrical Co. (EMR)

- Years of dividend progress: 66

- Dividend yield: 2.2%

- 2005 – 2011 DPS CAGR: 9.2%

- 2011 – 2016 DPS CAGR: 6.6%

- 2016 – 2021 DPS CAGR: 1.2%

- Newest DPS enhance: 1.0%

Emerson Electrical was based in Missouri in 1890. Since that point, it has advanced by means of natural progress, in addition to strategic acquisitions and divestitures, from a regional producer of electrical motors and followers right into a $56 billion diversified world chief in know-how and engineering.

Its world buyer base and various product and repair choices afford it about $20 billion in annual income. The corporate’s very spectacular 66-year dividend enhance streak lands it on the celebrated Dividend Kings record.

Supply: Investor Presentation

Emerson is present process a major shift in its technique, whereby it’s promoting off legacy items and focusing extra on automation and recurring income. We imagine that low single-digit progress in income and a tailwind from the buybacks would be the key drivers of earnings-per-share progress within the coming years. The corporate has lowered its share depend by about 37% since 1987.

Nonetheless, we word there may be more likely to be vital earnings weak spot whereas the transformation performs out, together with a gradual begin to fiscal 2023.

Is Emerson Electrical Prone to Lower its Dividend?

Regardless of Emerson Electrical having considerably slowed down the speed at which it grows its dividend, we don’t imagine this to be an indication of a near-term reduce. The dividend is well-covered.

The truth is, with earnings-per-share rising at a CAGR of seven.3% over the previous decade, Emerson’s payout ratio has relaxed considerably currently. It stood at 77% in 2016 however has now fallen to 51%. The deceleration in dividend hikes is almost definitely a part of Emerson’s transformation plan.

Click on right here to obtain our most up-to-date Certain Evaluation report on Emerson Electrical Co. (preview of web page 1 of three proven beneath):

#5 Federal Realty Funding Belief (FRT)

- Years of dividend progress: 55

- Dividend yield: 4.2%

- 2005 – 2011 DPS CAGR: 3.8%

- 2011 – 2016 DPS CAGR: 7.1%

- 2016 – 2021 DPS CAGR: 2.1%

- Newest DPS enhance: 0.9%

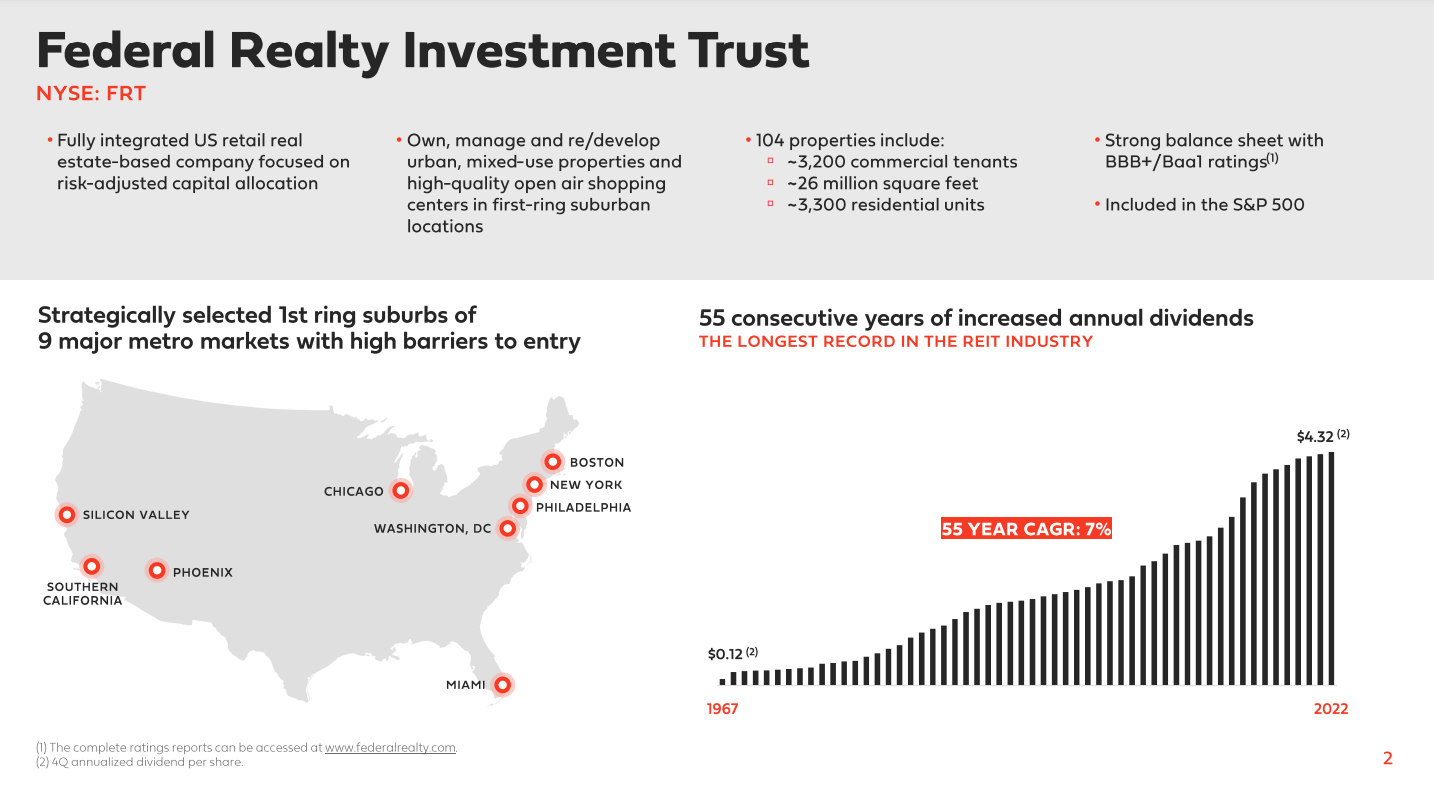

Federal Realty is among the bigger actual property funding trusts (REITs) in america. The belief was based in 1962 and concentrates on high-income, densely populated coastal markets within the US, permitting it to cost extra per sq. foot than its competitors. Federal Realty trades with a market capitalization of $8.3 billion at the moment.

Previous to 2020, Federal Realty’s funds-from-operations had not dipped year-over-year at any level previously decade, a tremendously spectacular feat on condition that the belief operates within the extremely cyclical actual property sector. The corporate’s efficiency has normalized since, and Federal Realty is predicted to attain near-record earnings in Fiscal 2022.

Shifting ahead, we anticipate that Federal Realty’s progress might be comprised of a continuation of upper hire charges on new leases and its spectacular growth pipeline fueling asset base growth. Margins are anticipated to proceed to rise barely because it redevelops items of its portfolio, and same-center income continues to maneuver increased.

Federal Realty options the longest dividend progress streak amongst REITs, boasting 55 years of successive annual dividend will increase.

Supply: Investor Presentation

Is Federal Realty Prone to Lower its Dividend?

Federal Realty’s newest dividend enhance of 0.9% was actually disappointing, however we don’t imagine it alerts a possible dividend reduce. The corporate is almost definitely simply being conservative within the face of a tricky actual property atmosphere amid rising rates of interest. Apart from, Federal Realty is predicted to file near-record FFO/share in Fiscal 2022.

Moreover, it’s not the primary time a marginal dividend enhance has occurred throughout a tricky market panorama. In 2009, Federal Realty elevated its dividend-per-share by only a cent (1.5%) to a quarterly fee of $0.66 earlier than dividend will increase re-accelerated as quickly as market situations normalized.

Federal Realty’s payout ratio stays fairly wholesome as nicely, presently standing beneath 70%.

Click on right here to obtain our most up-to-date Certain Evaluation report on Federal Realty Funding Belief (preview of web page 1 of three proven beneath):

#4 Realty Earnings Company (O)

- Years of dividend progress: 27

- Dividend yield: 4.7%

- 2005 – 2011 DPS CAGR: 3.7%

- 2011 – 2016 DPS CAGR: 6.7%

- 2016 – 2021 DPS CAGR: 3.4%

- Newest DPS enhance: 0.8%

Realty Earnings is a REIT that has turn into well-known for its profitable dividend progress historical past and month-to-month dividend funds. Right now, the belief owns greater than 4,000 properties that aren’t a part of a wider retail growth (reminiscent of a mall) however as an alternative are stand-alone properties. Because of this its places are viable for a lot of completely different tenants, together with authorities providers, healthcare providers, and leisure.

Realty Earnings has trademarked itself as “The Month-to-month Dividend Firm”, boasting 628 month-to-month dividends declared and 100 consecutive quarterly will increase.

Supply: Investor Presentation

Realty Earnings generates its progress by means of rising rents at present places, by way of contracted hire will increase or by leasing properties to new tenants at increased charges, but additionally by buying new properties. Administration invested about $2.1 billion in new properties in 2020 and one other $6.4 billion in 2021. Realty Earnings expects to extend its investments in worldwide markets throughout the subsequent couple of years.

Is Realty Earnings Prone to Lower its Dividend?

Much like Federal Realty, Realty Earnings’s newest dividend enhance was below-average as administration is being conservative within the face of a tricky actual property atmosphere amid rising rates of interest. We don’t imagine that Realty Earnings’s dividend security is threatened for a number of causes.

Firstly, at 76%, its payout ratio is definitely the bottom it has been in over a decade. Secondly, administration continues to develop the dividend a number of instances a 12 months (often quarterly), which additional cements their confidence within the dividend. Lastly, Realty Earnings’s properties are in excessive demand and can probably stay so. The occupancy fee throughout the portfolio is round 99%, and tenants typically report excessive hire protection ratios.

Click on right here to obtain our most up-to-date Certain Evaluation report on Realty Earnings Company (preview of web page 1 of three proven beneath):

#3 3M Firm (MMM)

- Years of dividend progress: 64

- Dividend yield: 5.0%

- 2005 – 2011 DPS CAGR: 3.5%

- 2011 – 2016 DPS CAGR: 15.0%

- 2016 – 2021 DPS CAGR: 5.9%

- Newest DPS enhance: 0.7%

3M sells greater than 60,000 merchandise which might be used day-after-day in properties, hospitals, workplace buildings, and colleges around the globe. It has about 95,000 staff and serves prospects in additional than 200 nations. 3M consists of 4 separate divisions.

The Security & Industrial division produces tapes, abrasives, adhesives, and provide chain administration software program, in addition to manufactures private protecting gear and safety merchandise. The Healthcare section provides medical and surgical merchandise in addition to drug supply programs.

The Transportation & Electronics division produces fibers and circuits with the purpose of utilizing renewable vitality sources whereas lowering prices. The Shopper division sells workplace provides, residence enchancment merchandise, protecting supplies, and stationery provides.

3M has grown earnings at a fee of 5.4% per 12 months over the past decade. Easing uncooked materials/logistics/labor inflation and a stabilizing world provide chain atmosphere are more likely to be optimistic earnings progress catalysts in 2023, in response to administration.

Supply: Investor Presentation

Is 3M Prone to Lower its Dividend?

3M is dealing with a number of lawsuits, together with almost 300,000 claims that its earplugs utilized by U.S. fight troops and produced by a subsidiary have been faulty. On December twenty second, a U.S. choose blocked 3M from attempting to dodge legal responsibility for accidents from its allegedly faulty earplugs by diverting blame to a subsidiary. The continuing state of affairs probably explains administration’s resolution to decelerate dividend will increase.

That mentioned, we imagine that 3M’s dividend ought to stay secure. Whereas dividend progress has outpaced earnings progress lately, the payout ratio stays beneath 60%. Additional, the corporate’s diversified portfolio of mission-critical merchandise ought to proceed to generate strong money flows no matter non permanent headwinds within the financial system.

Click on right here to obtain our most up-to-date Certain Evaluation report on 3M Firm (preview of web page 1 of three proven beneath):

#2 Worldwide Enterprise Machines Company (IBM)

- Years of dividend progress: 27

- Dividend yield: 4.7%

- 2005 – 2011 DPS CAGR: 21.4%

- 2011 – 2016 DPS CAGR: 13.7%

- 2016 – 2021 DPS CAGR: 3.6%

- Newest DPS enhance: 0.6%

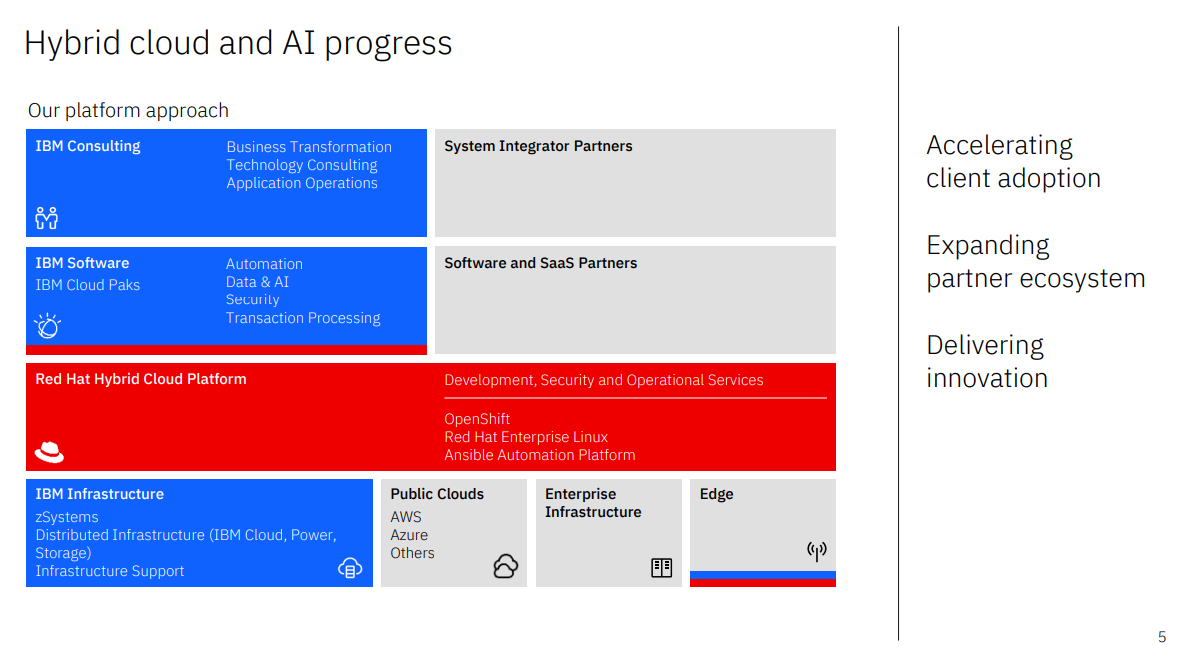

IBM is a worldwide data know-how firm that gives built-in enterprise options for software program, {hardware}, and providers. IBM’s focus is operating mission-critical programs for giant, multi-national prospects and governments.

Final 12 months, IBM spun off Kyndryl, its managed infrastructure enterprise, however it’s nonetheless one of many largest IT providers corporations on the earth. The corporate now has 4 enterprise segments: Software program, Consulting, Infrastructure, and Financing. IBM had annual income of ~$57.4 billion in 2021 (not together with Kyndryl).

IBM’s core operations are worthwhile. However IBM had problem producing progress previously a number of years because of the transition to cloud and SaaS within the IT business and IBM’s late emphasis on this market. Nonetheless, IBM is now specializing in cloud and SaaS and intends to be a significant participant within the hybrid cloud, as illustrated by the Crimson Hat and plenty of smaller acquisitions.

Supply: Investor Presentation

Is IBM Prone to Lower its Dividend?

IBM’s dividend progress has slowed down considerably currently. This is smart, contemplating that the corporate is producing the identical free money circulation per share because it did 15 years in the past following years of declining revenues. We wouldn’t kill the opportunity of a dividend reduce within the medium time period if IBM’s revenues and earnings have been to proceed to say no, because the payout ratio has already climbed to 67%. That mentioned, optimistic catalysts are in place that ought to maintain payouts, together with rising cloud revenues and continued deleveraging.

Click on right here to obtain our most up-to-date Certain Evaluation report on Worldwide Enterprise Machines Company(preview of web page 1 of three proven beneath):

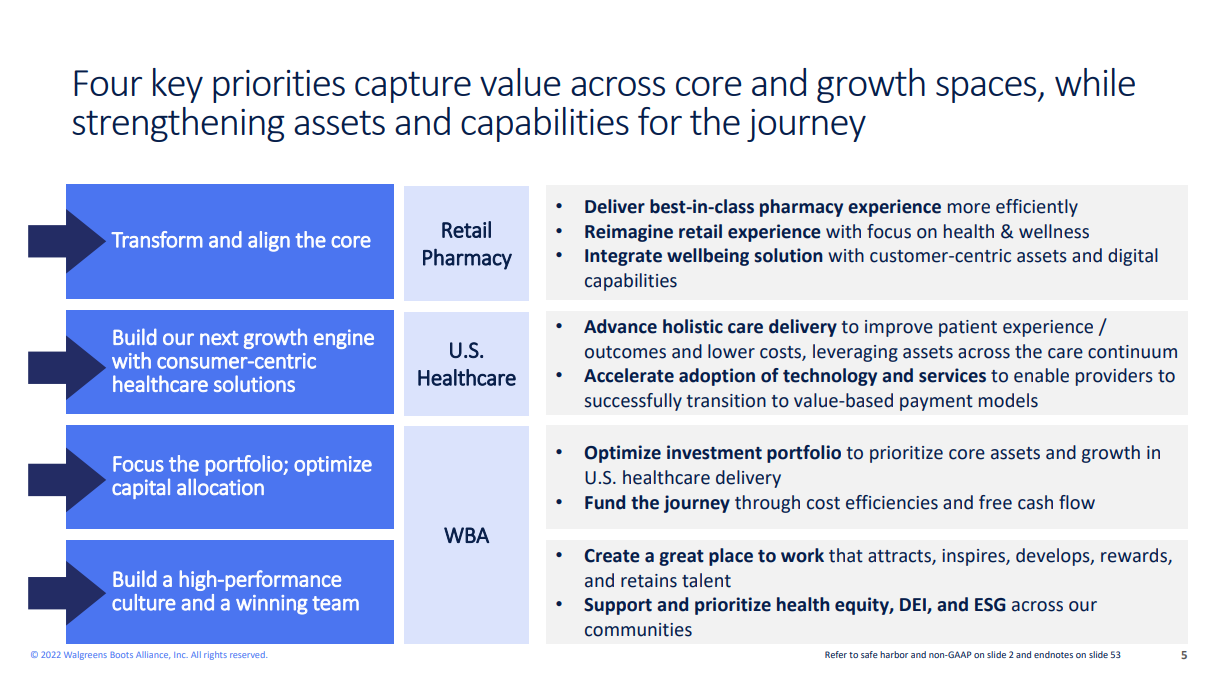

#1 Walgreens Boots Alliance (WBA)

- Years of dividend progress: 47

- Dividend yield: 5.1%

- 2005 – 2011 DPS CAGR: 22.4%

- 2011 – 2016 DPS CAGR: 14.7%

- 2016 – 2021 DPS CAGR: 5.3%

- Newest DPS enhance: 0.5%

Walgreens Boots Alliance is the most important retail pharmacy in america and Europe. The $32.1 billion market cap firm has a presence in additional than 9 nations by means of its flagship Walgreens enterprise and different enterprise ventures.

Walgreens’ earnings-per-share grew at a CAGR of seven.6% over the previous decade, powered by rising revenues and a declining share depend. This was pushed by a mixture of things, together with stable top-line progress ($72 billion to $133 billion), a gradual internet revenue margin, and a discount within the variety of excellent shares.

Supply: Investor Presentation

Is Walgreens Boots Alliance Prone to Lower its Dividend?

Walgreens has been rising its dividend by smaller and smaller quantities over time. That mentioned, we don’t imagine its 47-year dividend progress is about to return to an finish anytime quickly. With earnings-per-share rising considerably sooner than the dividend over the previous decade, the inventory’s payout ratio presently stands at 42%, decrease than 44% in 2012. On account of promoting essential drugs and different prescribed drugs, we imagine the corporate will proceed producing stable money flows. They need to proceed to guard the dividend and even for additional dividend will increase forward, no matter their progress fee.

Click on right here to obtain our most up-to-date Certain Evaluation report on Walgreens Boots Alliance (preview of web page 1 of three proven beneath):

Ultimate Ideas

Analyzing an organization’s dividend progress fee development could be a useful indicator for buyers trying to assessment its monetary well being and dividend progress prospects. A protracted slowdown within the tempo at which dividends are rising might sign that the corporate is experiencing monetary hurdles.

In that case, the corporate might doubtlessly be vulnerable to a dividend reduce sooner or later, no matter how spectacular its dividend progress streak is. We now have seen this occur greater than as soon as, with Pitney Bowes Inc. (PBI), AT&T Inc. (T), and Mercury Normal Company (MCY) ending their multi-decade dividend progress observe data as their financials couldn’t maintain their payouts additional. In all three circumstances, a dividend reduce was adopted by a steady deceleration in dividend progress.

The eight Dividend Aristocrats mentioned on this article all noticed dividend progress of lower than or equal to 1% in 2022, and plenty of have additionally proven a development of slowing dividend progress over the long run. Whereas we can not utterly kill the opportunity of a dividend reduce for any of those corporations, we imagine that almost all, if not all of those Dividend Aristocrats, are presently not vulnerable to slicing their dividends.

Whether or not it’s a scientific danger, like rising rates of interest within the case of Federal Realty Belief and Realty Earnings, or a systemic danger, like the continued lawsuit within the case of 3M, the comparatively tiny dividend will increase seen this 12 months amongst these Dividend Aristocrats can probably be attributed to the warning exercised by their administration groups.

If you’re interested by discovering extra high-quality dividend progress shares appropriate for long-term funding, the next Certain Dividend databases might be helpful:

The main home inventory market indices are one other stable useful resource for locating funding concepts. Certain Dividend compiles the next inventory market databases and updates them month-to-month:

Thanks for studying this text. Please ship any suggestions, corrections, or inquiries to [email protected].