Updated on September 13th, 2022 by Bob Ciura

Water is one of the basic necessities of human life. Life as we know it cannot exist without water. For this simple reason, water may be the most valuable commodity on Earth.

It is only natural for investors to consider purchasing water stocks. There are many different companies that can give investors exposure to the water business, such as water utilities. Some other companies are engaged in water purification.

In all, we have compiled a list of over 50 stocks that are in the business of water. The list was derived from five of the top water industry exchange-traded funds:

- Invesco Water Resources ETF (PHO)

- Invesco S&P Global Water ETF (CGW)

- Invesco Global Water ETF (PIO)

- First Trust ISE Water Index Fund (FIW)

- Ecofin Global Water ESG Fund (EBLU)

You can download a spreadsheet with all 56 water stocks (along with metrics that matter like price-to-earnings ratios and dividend yields) by clicking on the link below:

In addition to the Excel spreadsheet above, this article covers our top 7 water stocks today, that we cover in the Sure Analysis Research Database.

This article will discuss the top 7 water stocks according to their expected returns over the next five years, ranked in order of lowest to highest.

Table of Contents

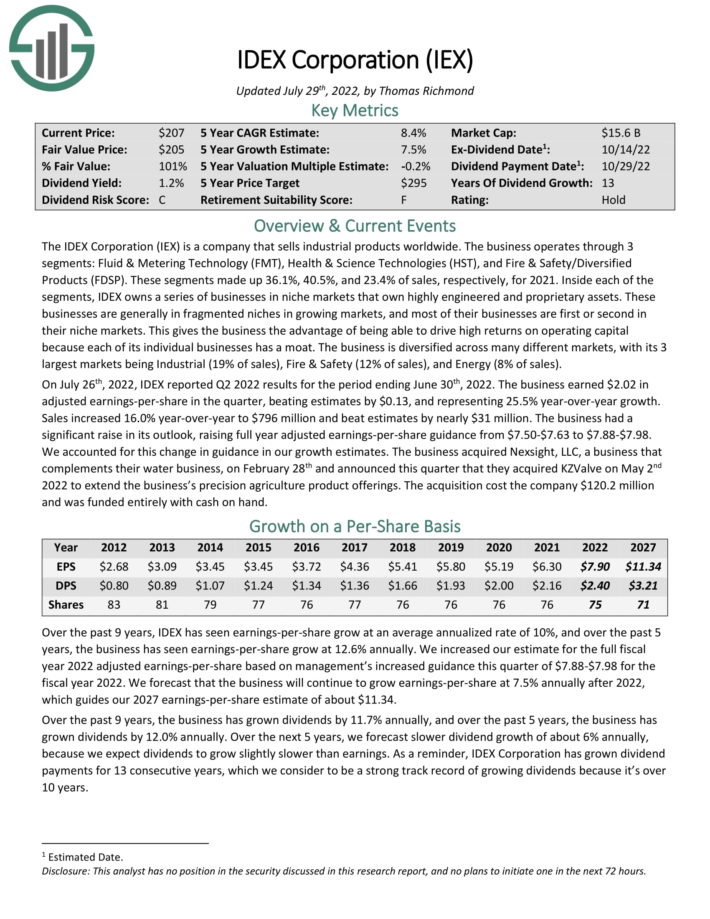

Water Stock #7: IDEX Corporation (IEX)

- 5-year expected annual returns: 7.9%

The IDEX Corporation sells industrial products worldwide. The business operates through 3 segments: Fluid & Metering Technology (FMT), Health & Science Technologies (HST), and Fire & Safety/Diversified Products (FDSP). These segments made up 36.1%, 40.5%, and 23.4% of sales, respectively, for 2021.

These businesses are generally in fragmented niches in growing markets, and most of their businesses are first or second in their niche markets. This gives the business the advantage of being able to drive high returns on operating capital because each of its individual businesses has a moat. The business is diversified across many different markets, with its 3 largest markets being Industrial (19% of sales), Fire & Safety (12% of sales), and Energy (8% of sales).

Source: Investor Presentation

On July 26th, 2022, IDEX reported Q2 2022 results for the period ending June 30th, 2022. The business earned $2.02 in adjusted earnings-per-share in the quarter, beating estimates by $0.13, and representing 25.5% year-over-year growth. Sales increased 16.0% year-over-year to $796 million and beat estimates by nearly $31 million. The business had a significant raise in its outlook, raising full year adjusted earnings-per-share guidance from $7.50-$7.63 to $7.88-$7.98.

The business acquired Nexsight, LLC, which complements their water business, and announced this quarter that they acquired KZValve on May 2nd 2022 to extend the business’s precision agriculture product offerings. The acquisition cost the company $120.2 million and was funded entirely with cash on hand.

Click here to download our most recent Sure Analysis report on IEX (preview of page 1 of 3 shown below):

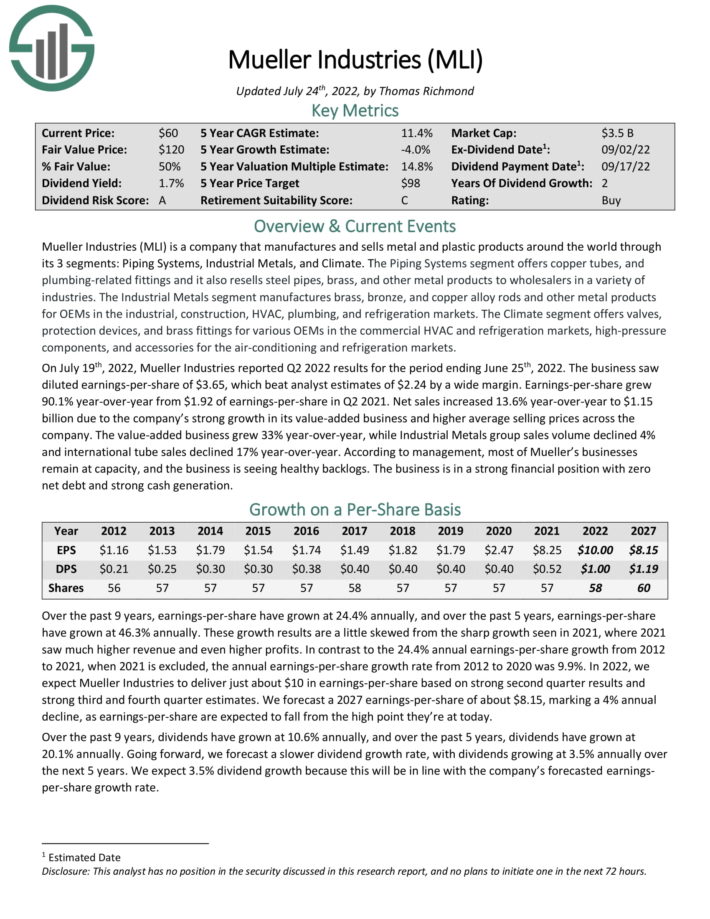

Water Stock #6: Mueller Industries (MLI)

- 5-year expected annual returns: 10.3%

Mueller Industries manufactures and sells metal and plastic products around the world through its 3 segments: Piping Systems, Industrial Metals, and Climate.

The Piping Systems segment offers copper tubes, and plumbing-related fittings and it also resells steel pipes, brass, and other metal products to wholesalers in a variety of industries. The Industrial Metals segment manufactures brass, bronze, and copper alloy rods and other metal products for OEMs in the industrial, construction, HVAC, plumbing, and refrigeration markets. The Climate segment offers valves, protection devices, and brass fittings for various OEMs in the commercial HVAC and refrigeration markets, high-pressure components, and accessories for the air-conditioning and refrigeration markets

On July 19th, 2022, Mueller Industries reported Q2 2022 results for the period ending June 25th, 2022. The business saw diluted earnings-per-share of $3.65, which beat analyst estimates of $2.24 by a wide margin. Earnings-per-share grew 90.1% year-over-year from $1.92 of earnings-per-share in Q2 2021.

Net sales increased 13.6% year-over-year to $1.15 billion due to the company’s strong growth in its value-added business and higher average selling prices across the company. The value-added business grew 33% year-over-year, while Industrial Metals group sales volume declined 4% and international tube sales declined 17% year-over-year.

According to management, most of Mueller’s businesses remain at capacity, and the business is seeing healthy backlogs. The business is in a strong financial position with zero net debt and strong cash generation.

Click here to download our most recent Sure Analysis report on MLI (preview of page 1 of 3 shown below):

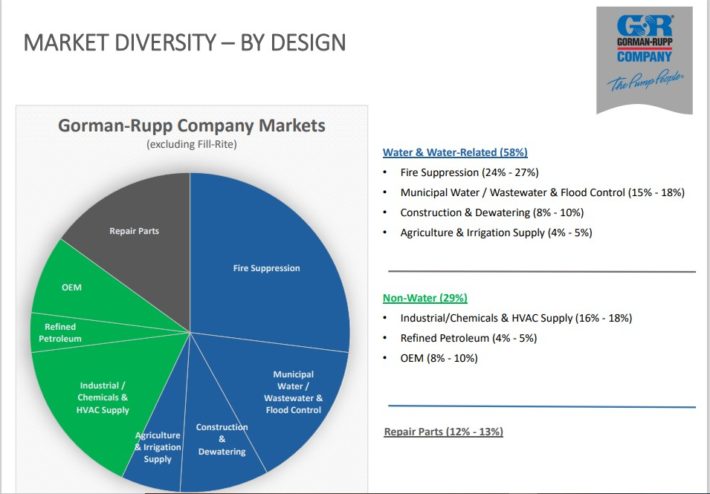

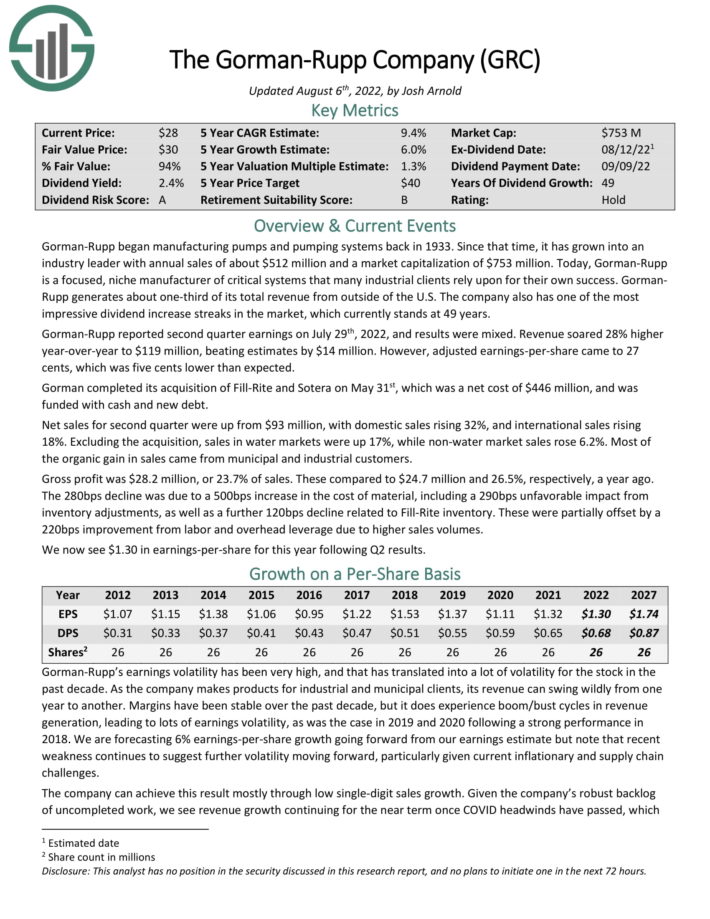

Water Stock #5: Gorman-Rupp Co. (GRC)

- 5-year expected annual returns: 10.5%

Gorman-Rupp began manufacturing pumps and pumping systems back in 1933. Since that time, it has grown into an

industry leader with annual sales of about $405 million. Today, Gorman-Rupp is a focused, niche manufacturer of critical systems that many industrial clients rely upon for their own success.

Source: Investor Presentation

GormanRupp generates about one-third of its total revenue from outside of the U.S. The company also has one of the most impressive dividend increase streaks in the market, which currently stands at 49 years.

Gorman-Rupp reported second quarter earnings on July 29th, 2022, and results were mixed. Revenue soared 28% higher year-over-year to $119 million, beating estimates by $14 million. However, adjusted earnings-per-share came to 27 cents, which was five cents lower than expected. Gorman completed its acquisition of Fill-Rite and Sotera on May 31st, which was a net cost of $446 million, and was funded with cash and new debt.

Net sales for second quarter were up from $93 million, with domestic sales rising 32%, and international sales rising 18%. Excluding the acquisition, sales in water markets were up 17%, while non-water market sales rose 6.2%. Most of the organic gain in sales came from municipal and industrial customers.

Click here to download our most recent Sure Analysis report on GRC (preview of page 1 of 3 shown below):

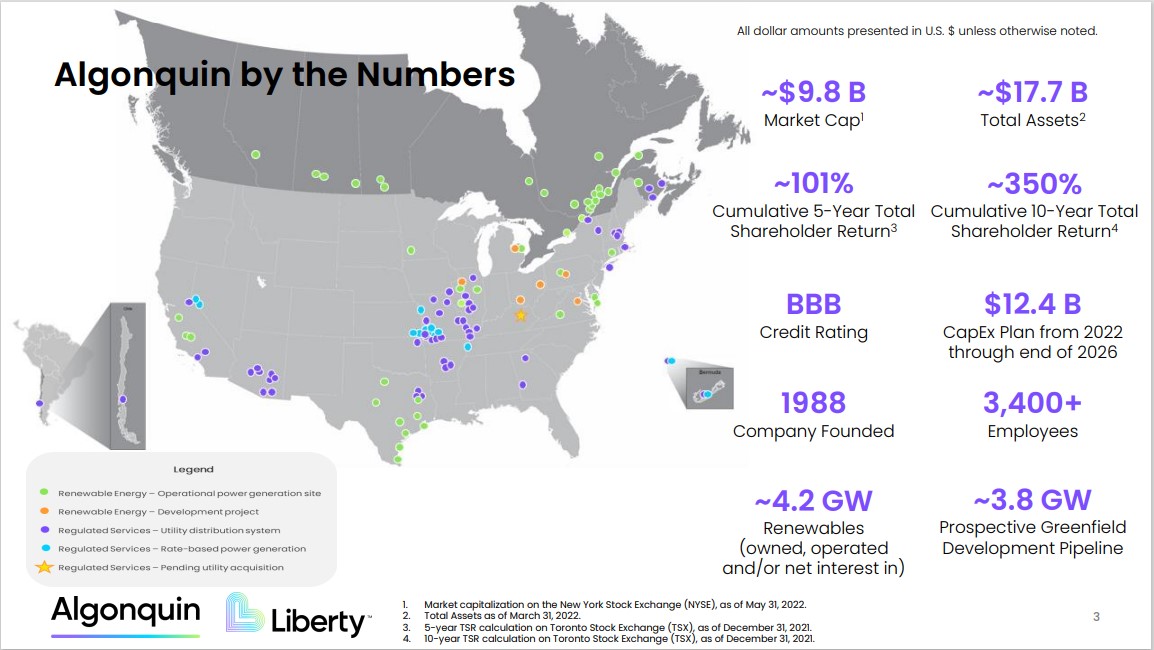

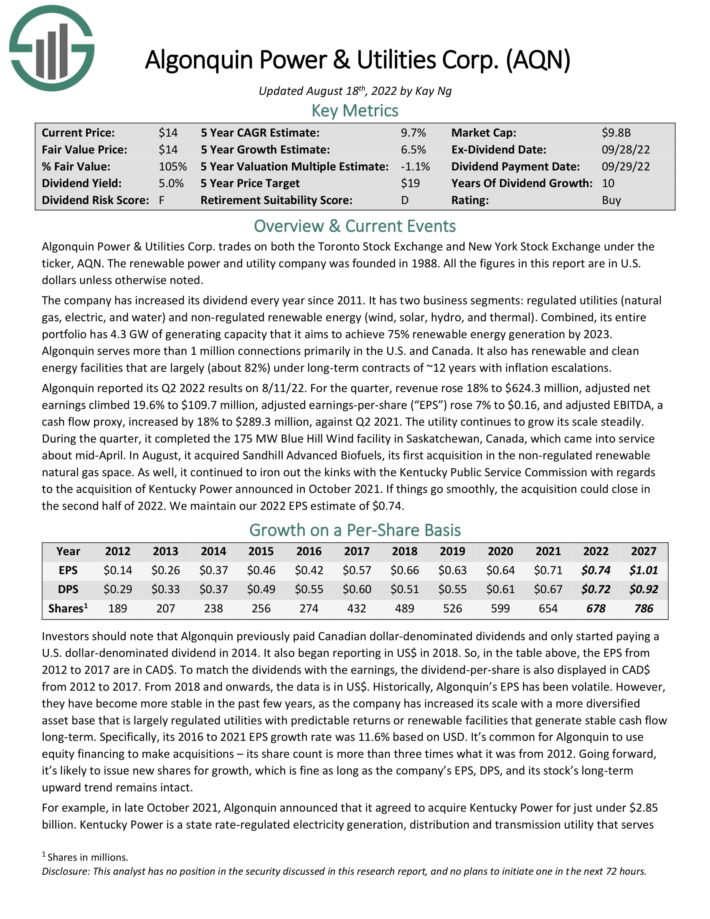

Water Stock #4: Algonquin Power & Utilities Corp. (AQN)

- 5-year expected annual returns: 10.9%

Algonquin Power & Utilities Corp. trades on both the Toronto Stock Exchange and New York Stock Exchange under the ticker, AQN. The renewable power and utility company was founded in 1988. The company has increased its dividend every year since 2011.

It has two business segments: regulated utilities (natural gas, electric, and water) and non-regulated renewable energy (wind, solar, hydro, and thermal). Combined, its entire portfolio has 4.3 GW of generating capacity that it aims to achieve 75% renewable energy generation by 2023.

Source: Investor Presentation

Algonquin serves more than 1 million connections primarily in the U.S. and Canada. It also has renewable and clean energy facilities that are largely (about 82%) under long-term contracts of ~12 years with inflation escalations.

Algonquin reported its Q2 2022 results on 8/11/22. For the quarter, revenue rose 18% to $624.3 million, adjusted net earnings climbed 19.6% to $109.7 million, adjusted earnings-per-share (“EPS”) rose 7% to $0.16, and adjusted EBITDA, a cash flow proxy, increased by 18% to $289.3 million, against Q2 2021. The utility continues to grow its scale steadily.

During the quarter, it completed the 175 MW Blue Hill Wind facility in Saskatchewan, Canada, which came into service about mid-April. In August, it acquired Sandhill Advanced Biofuels, its first acquisition in the non-regulated renewable natural gas space. As well, it continued to iron out the kinks with the Kentucky Public Service Commission with regards to the acquisition of Kentucky Power announced in October 2021. If things go smoothly, the acquisition could close in the second half of 2022.

Click here to download our most recent Sure Analysis report on AQN (preview of page 1 of 3 shown below):

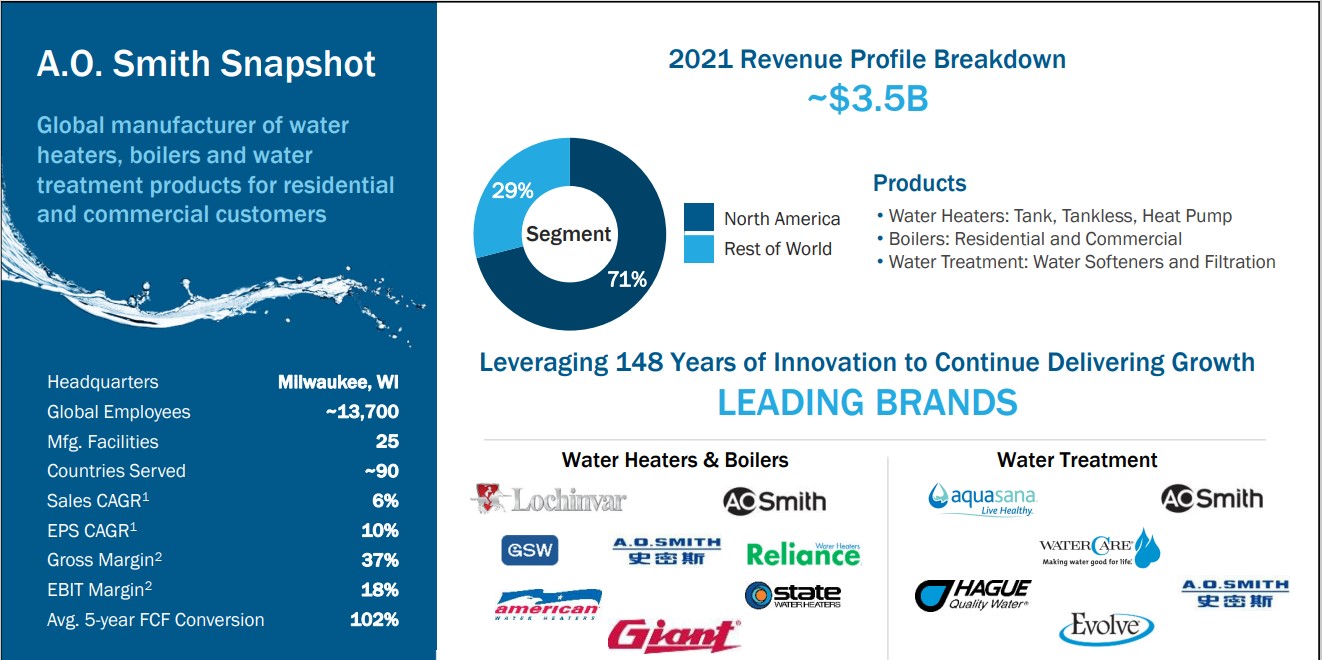

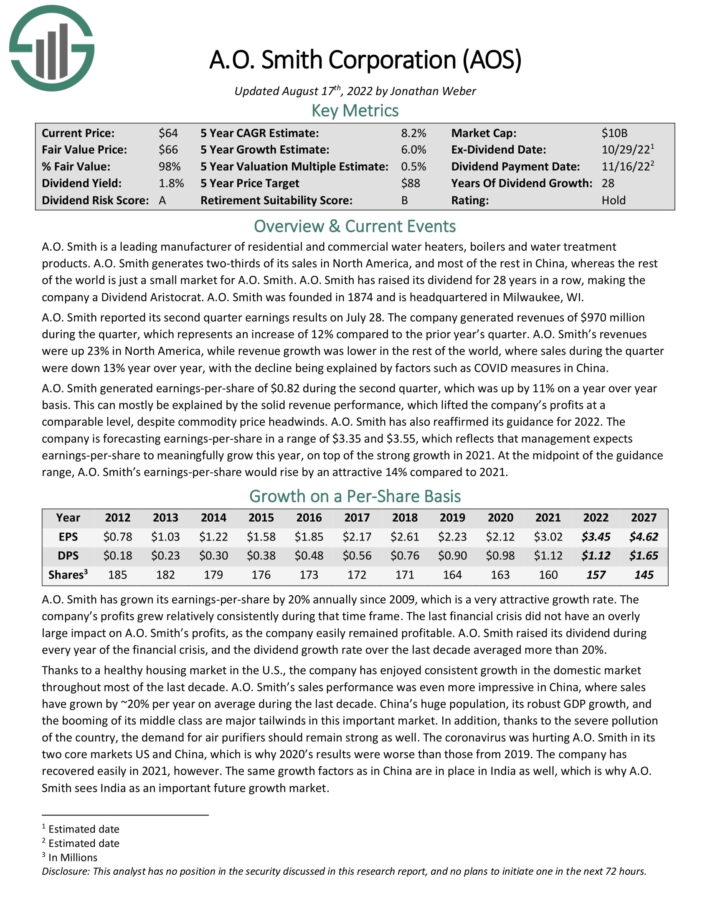

Water Stock #3: A.O. Smith (AOS)

- 5-year expected annual returns: 11.2%

A.O. Smith is a leading manufacturer of residential and commercial water heaters, boilers and water treatment products. A.O. Smith generates the majority of its sales in North America, with the remainder from the rest of the world. It has category-leading brands across its various geographic markets.

Source: Investor Presentation

A.O. Smith reported its second quarter earnings results on July 28. The company generated revenues of $970 million during the quarter, which represents an increase of 12% compared to the prior year’s quarter. A.O. Smith’s revenues were up 23% in North America, while revenue growth was lower in the rest of the world, where sales during the quarter were down 13% year over year, with the decline being explained by factors such as COVID measures in China.

A.O. Smith generated earnings-per-share of $0.82 during the second quarter, which was up by 11% on a year over year basis. This can mostly be explained by the solid revenue performance, which lifted the company’s profits at a comparable level, despite commodity price headwinds.

A.O. Smith has also reaffirmed its guidance for 2022. The company is forecasting earnings-per-share in a range of $3.35 and $3.55, which reflects that management expects earnings-per-share to meaningfully grow this year, on top of the strong growth in 2021. At the midpoint of the guidance range, A.O. Smith’s earnings-per-share would rise by an attractive 14% compared to 2021.

Click here to download our most recent Sure Analysis report on A.O. Smith (preview of page 1 of 3 shown below):

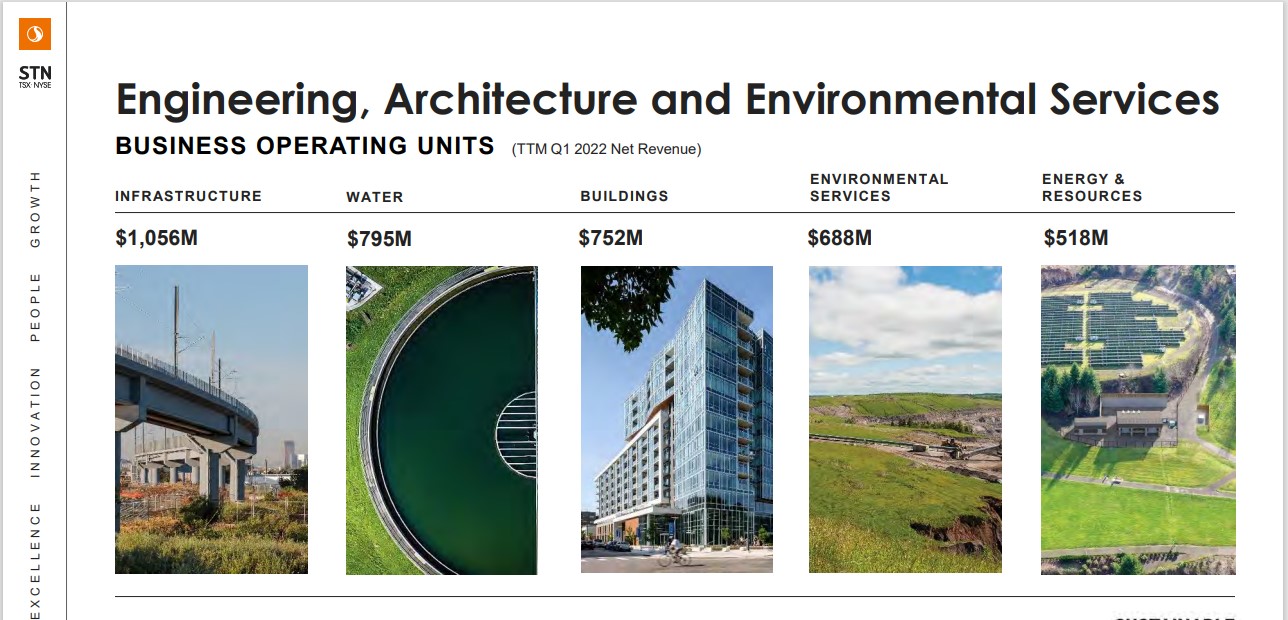

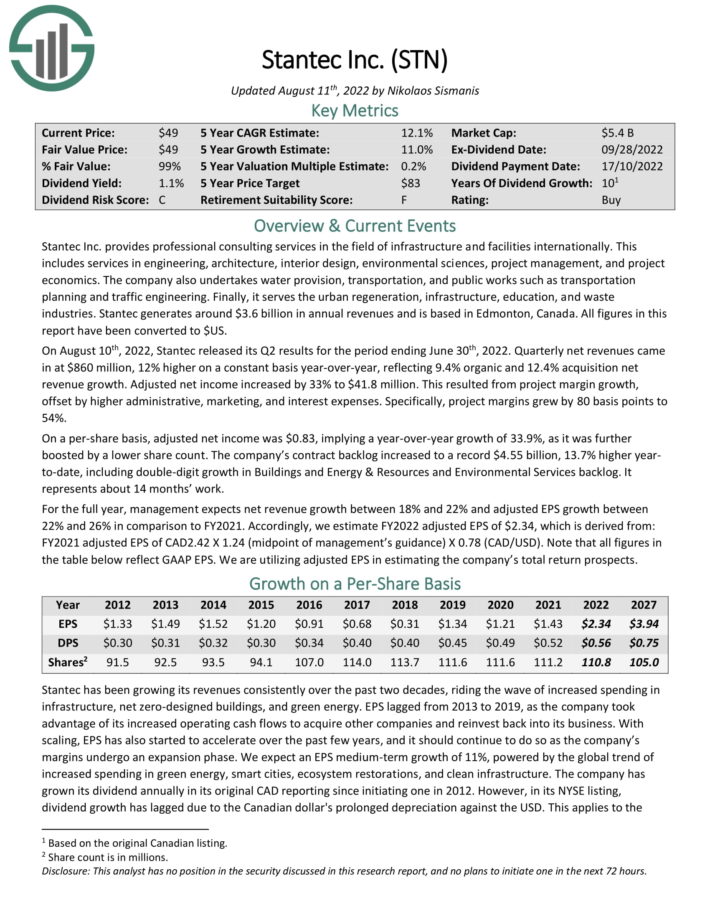

Water Stock #2: Stantec Inc. (STN)

- 5-year expected annual returns: 11.7%

Stantec Inc. provides professional consulting services in the field of infrastructure and facilities internationally. This includes services in engineering, architecture, interior design, environmental sciences, project management, and project economics.

The company also undertakes water provision, transportation, and public works such as transportation planning and traffic engineering.

Source: Investor Presentation

Finally, it serves the urban regeneration, infrastructure, education, and waste industries. Stantec generates around $3.6 billion in annual revenues and is based in Edmonton, Canada.

On August 10th, 2022, Stantec released its Q2 results for the period ending June 30th, 2022. Quarterly net revenues came in at $860 million, 12% higher on a constant basis year-over-year, reflecting 9.4% organic and 12.4% acquisition net revenue growth. Adjusted net income increased by 33% to $41.8 million. This resulted from project margin growth, offset by higher administrative, marketing, and interest expenses. Specifically, project margins grew by 80 basis points to 54%.

On a per-share basis, adjusted net income was $0.83, implying a year-over-year growth of 33.9%, as it was further boosted by a lower share count. The company’s contract backlog increased to a record $4.55 billion, 13.7% higher yearto-date, including double-digit growth in Buildings and Energy & Resources and Environmental Services backlog.

For the full year, management expects net revenue growth between 18% and 22% and adjusted EPS growth between

22% and 26% in comparison to FY2021.

Click here to download our most recent Sure Analysis report on STN (preview of page 1 of 3 shown below):

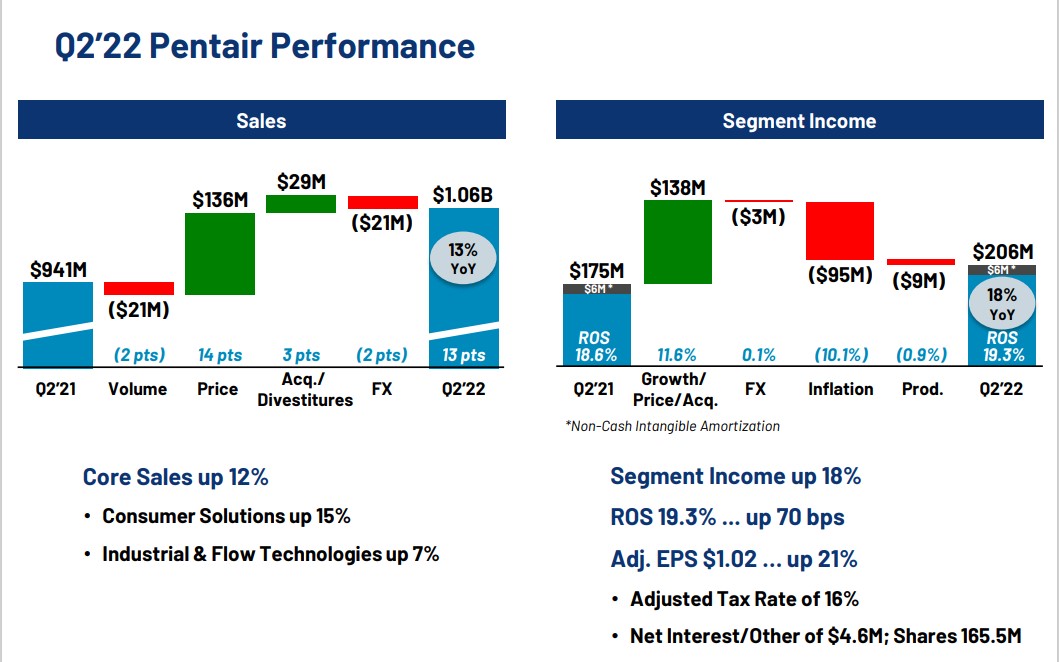

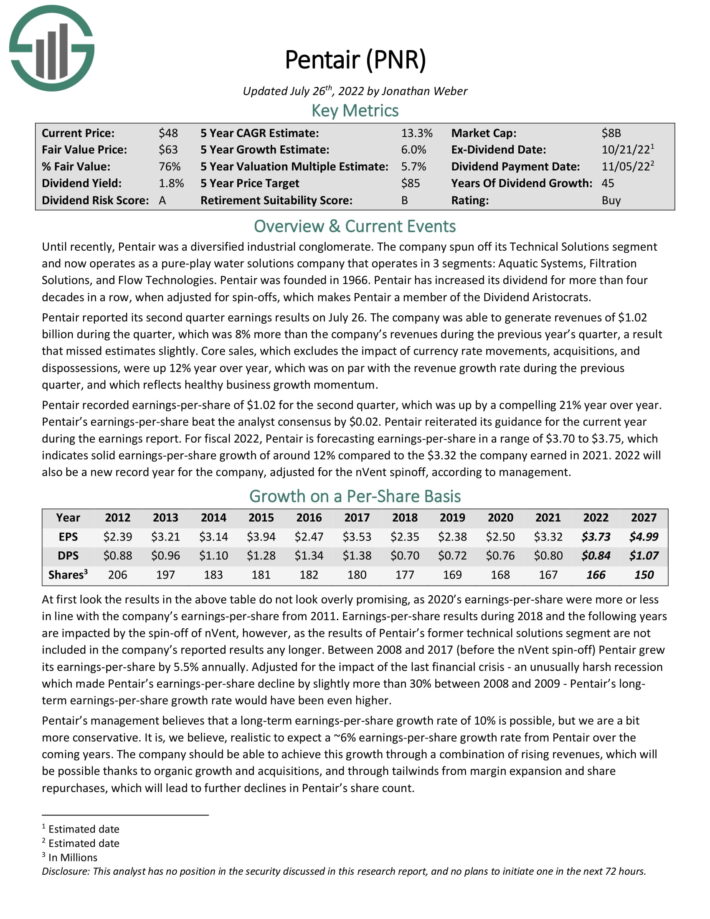

Water Stock #1: Pentair plc (PNR)

- 5-year expected annual returns: 13.4%

Pentair operates as a pure–play water solutions company with 3 segments: Aquatic Systems, Filtration Solutions, and Flow Technologies. Pentair was founded in 1966. Pentair has increased its dividend for more than four decades in a row, when adjusted for spin–offs.

Pentair reported its second quarter earnings results on July 26. The company was able to generate revenues of $1.02 billion during the quarter, which was 8% more than the company’s revenues during the previous year’s quarter, a result that missed estimates slightly.

Source: Investor Presentation

Core sales, which excludes the impact of currency rate movements, acquisitions, and dispossessions, were up 12% year over year, which was on par with the revenue growth rate during the previous quarter, and which reflects healthy business growth momentum.

Pentair recorded earnings-per-share of $1.02 for the second quarter, which was up by a compelling 21% year over year. Pentair’s earnings-per-share beat the analyst consensus by $0.02. Pentair reiterated its guidance for the current year during the earnings report.

For fiscal 2022, Pentair is forecasting earnings-per-share in a range of $3.70 to $3.75, which indicates solid earnings-per-share growth of around 12% compared to the $3.32 the company earned in 2021. 2022 will also be a new record year for the company, adjusted for the nVent spinoff, according to management.

Total returns are expected to reach 13.4% over the next five years.

Click here to download our most recent Sure Analysis report on Pentair (preview of page 1 of 3 shown below):

Final Thoughts

Water could be one of the biggest investing themes over the next several decades. An increasing global population is only going to cause demand for water to rise in the future.

And, given the fact that water is a necessity of human life, demand for water should hold up extremely well, even during the worst recessions.

Therefore, young investors with a longer time horizon such as Millennials should consider water stocks.

These factors make water stocks appealing for risk-averse investors looking for stability from their stock investments.

Not all the water stocks on this list receive buy recommendations at this time, as some appear to be overvalued today. But all the water stocks on this list pay dividends and are likely to increase their dividends for many years in the future.

Additional Resources

At Sure Dividend, we often advocate for investing in companies with a high probability of increasing their dividends each and every year.

If that strategy appeals to you, it may be useful to browse through the following databases of dividend growth stocks:

The major domestic stock market indices are another solid resource for finding investment ideas. Sure Dividend compiles the following stock market databases and updates them monthly:

Thanks for reading this article. Please send any feedback, corrections, or questions to [email protected].