Up to date on October 4th, 2024 by Bob Ciura

Insurance coverage corporations typically produce a excessive degree of income every year, as a result of they earn money in two methods. First, insurance coverage corporations acquire premium earnings on the insurance policies they underwrite.

Second, they’re able to earn money by investing the big sums of gathered premiums that haven’t been paid out as claims.

As a result of this, insurance coverage corporations have been among the many most rewarding to personal over the previous a number of many years. The truth is, lots of the Dividend Aristocrats and Dividend Achievers are within the insurance coverage business.

You possibly can obtain our Excel spreadsheet listing of over 60 insurance coverage shares (with vital metrics that matter similar to P/E ratios and dividend yields) without spending a dime by clicking the hyperlink beneath:

Our insurance coverage shares listing is derived from the holdings of two exchange-traded funds:

- SPDR S&P Insurance coverage ETF (KIE)

- iShares U.S. Insurance coverage ETF (IAK)

The insurance coverage business has created many nice fortunes. That’s as a result of it’s sluggish altering and extremely worthwhile, if the enterprise is finished nicely. Investing in insurance coverage shares is how Shelby Davis made $900 million from $50,000 beginning in his late 30’s.

In recent times, the insurance coverage business (and different elements of the monetary sector like banks) have struggled from low rates of interest, which slim the unfold between what insurance coverage corporations can earn on their invested capital, versus what they pay out in claims.

In flip, increased rates of interest can be a constructive catalyst for insurance coverage shares, which might see their internet funding earnings rise.

Nonetheless, there are a selection of insurers that look attractively priced immediately which might be poised to ship robust complete annual returns over the following 5 years.

This text will rank the highest 5 insurance coverage shares now, so as of anticipated complete annual returns.

Desk Of Contents

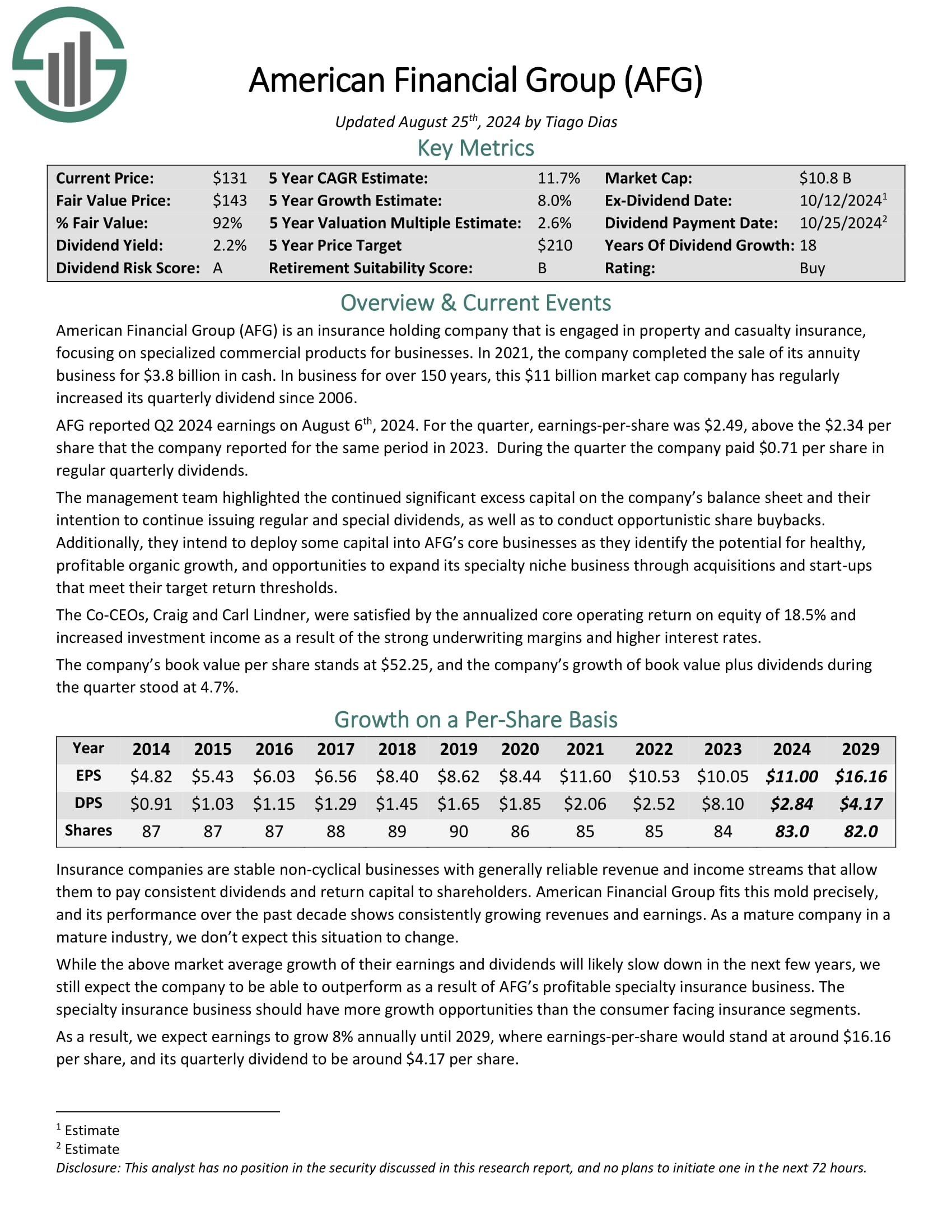

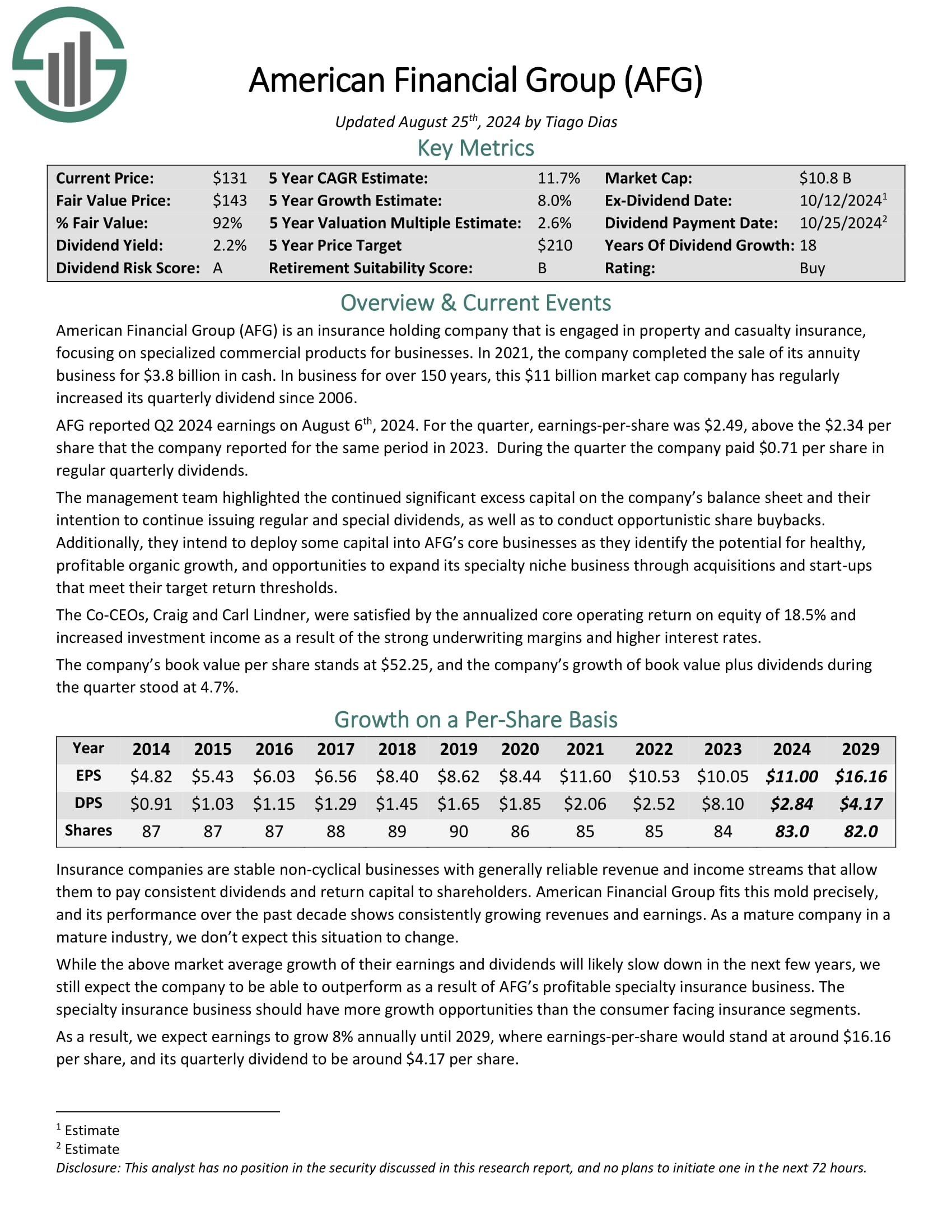

Finest Insurance coverage Inventory #5: American Monetary Group (AFG)

- 5-year anticipated annual returns: 11.1%

American Monetary Group is an insurance coverage holding firm that’s engaged in property and casualty insurance coverage, specializing in specialised industrial merchandise for companies. In 2021, the corporate accomplished the sale of its annuity enterprise for $3.8 billion in money.

AFG reported Q2 2024 earnings on August sixth, 2024. For the quarter, earnings-per-share was $2.49, above the $2.34 per share that the corporate reported for a similar interval in 2023. Through the quarter the corporate paid $0.71 per share in common quarterly dividends.

Annualized core working return on fairness was 18.5% for the second quarter, and elevated funding earnings on account of the robust underwriting margins and better rates of interest. The corporate’s e book worth per share stands at $52.25, and the corporate’s development of e book worth plus dividends throughout the quarter stood at 4.7%.

Click on right here to obtain our most up-to-date Positive Evaluation report on AFG (preview of web page 1 of three proven beneath):

Finest Insurance coverage Inventory #4: The Hanover Insurance coverage Group (THG)

- 5-year anticipated annual returns: 11.3%

The Hanover Insurance coverage Group is a holding firm whose main enterprise is providing property and casualty insurance coverage services. The corporate markets itself by unbiased brokers and brokers in the US.

In 2023, Private Strains accounted for about 42% of segmented revenues; Industrial Strains, 36%; Different Property & Casualty, 22%. The corporate operates an funding portfolio that’s primarily uncovered to fixed-income securities.

On July thirty first, 2024, The Hanover Insurance coverage Group reported its monetary outcomes for the second quarter for the interval ending June thirtieth, 2024. The corporate introduced internet earnings of $40.5 million, or $1.12 per diluted share, a big enchancment from a internet lack of $69.2 million, or $1.94 per primary share, in the identical interval the earlier 12 months.

Working earnings for the quarter was $68.1 million, or $1.88 per diluted share, in comparison with an working lack of $68.3 million, or $1.91 per diluted share, within the prior-year quarter.

The mixed ratio for the second quarter, excluding catastrophes, was 88.5%, reflecting continued efficient pricing and margin recapture initiatives throughout its three segments.

Click on right here to obtain our most up-to-date Positive Evaluation report on THG (preview of web page 1 of three proven beneath):

Finest Insurance coverage Inventory #3: Lincoln Nationwide (LNC)

- 5-year anticipated annual returns: 14.8%

Lincoln Nationwide Company gives life insurance coverage, annuities, retirement plan providers and group safety. The company was based in 1905.

Lincoln Nationwide reported second quarter 2024 outcomes on August 1st, 2024, for the interval ending June thirtieth, 2024. The corporate generated internet earnings of $5.11 per share within the quarter, which in contrast favorably to $2.94 within the second quarter of 2023. Adjusted earnings from operations equaled $1.84 per share in comparison with $2.02 in the identical prior 12 months interval.

Moreover, annuities common account balances rose by 6.8% to $158 billion and group safety insurance coverage premiums grew 2.8% to $1.3 billion.

Click on right here to obtain our most up-to-date Positive Evaluation report on LNC (preview of web page 1 of three proven beneath):

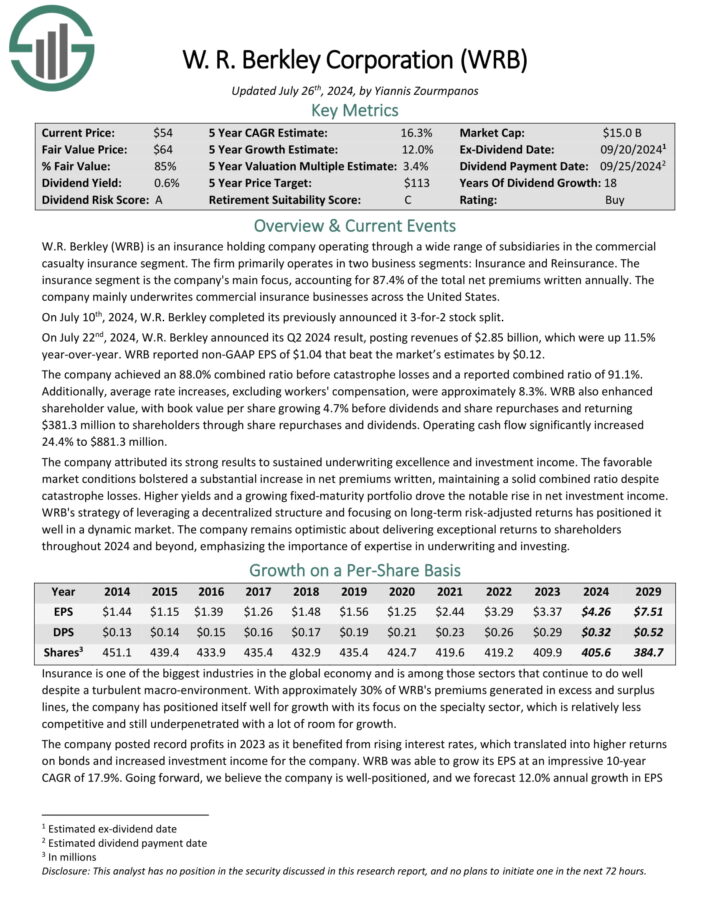

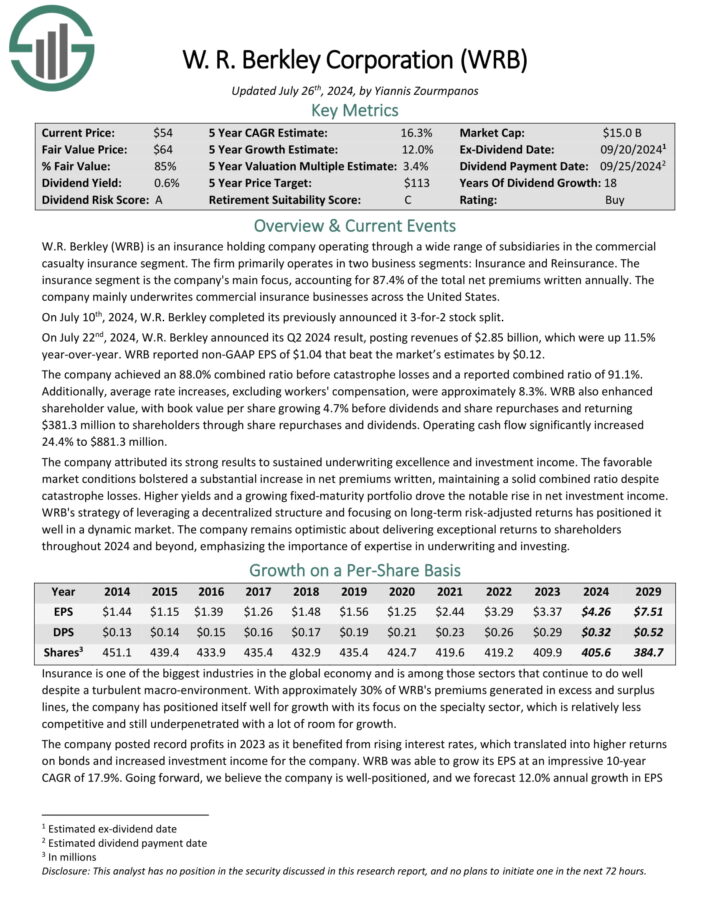

Finest Insurance coverage Inventory #2: W.R. Berkley (WRB)

- 5-year anticipated annual returns: 15.3%

W.R. Berkley is an insurance coverage holding firm working by a variety of subsidiaries within the industrial casualty insurance coverage phase. The agency primarily operates in two enterprise segments: Insurance coverage and Reinsurance.

On July twenty second, 2024, W.R. Berkley introduced its Q2 2024 outcome, posting revenues of $2.85 billion, which have been up 11.5% year-over-year. WRB reported non-GAAP EPS of $1.04 that beat the market’s estimates by $0.12.

The corporate achieved an 88.0% mixed ratio earlier than disaster losses and a reported mixed ratio of 91.1%. Moreover, common charge will increase, excluding staff’ compensation, have been roughly 8.3%.

WRB additionally enhanced shareholder worth, with e book worth per share rising 4.7% earlier than dividends and share repurchases and returning $381.3 million to shareholders by share repurchases and dividends. Working money stream considerably elevated 24.4% to $881.3 million.

Click on right here to obtain our most up-to-date Positive Evaluation report on WRB (preview of web page 1 of three proven beneath):

Finest Insurance coverage Inventory #1: Globe Life (GL)

- 5-year anticipated annual returns: 16.3%

Globe Life is an insurance coverage holding firm offering primarily life and supplemental medical health insurance through direct to shopper, unique brokers, and unbiased brokers. Based in 1979, Globe Life has raised its dividend yearly for the previous 19 years.

Globe Life reported Q2 2024 earnings on July twenty fourth, 2024. For the quarter, earnings-per-share have been $2.83, above the $2.24 the corporate reported in the identical quarter of 2023. The outcomes replicate the adoption of latest accounting requirements, which resulted within the restating of prior 12 months’s figures.

Return on fairness (ROE) was 20.8% for the three months ended June thirtieth, 2024, and internet gross sales for all times and well being elevated over the year-ago quarters by 16% and seven% respectively. In complete, Globe Life’s internet funding earnings grew by 9% in comparison with the year-ago quarter.

The corporate continued its share buyback program and repurchased 3.8 million shares throughout the quarter for a complete of $314 million in capital returned to shareholders at a mean worth of $81.87 per share. The corporate has additionally introduced a brand new dividend to be paid on the primary of August.

The corporate raised its EPS steering to between $11.80 and $12.10 per share for the 2024 fiscal 12 months.

Click on right here to obtain our most up-to-date Positive Evaluation report on GL (preview of web page 1 of three proven beneath):

Closing Ideas

Insurance coverage is usually thought of to be a boring business, however buyers in search of strong annual returns and dividend earnings ought to take into account insurance coverage shares.

Many insurance coverage shares have elevated dividends for no less than a decade. Some have completed so for a number of many years.

Not solely has almost each firm on this listing exhibited a sample of regular dividend development for a few years, all have an above-market common dividend yield as nicely.

In consequence, many insurance coverage shares are interesting for earnings buyers.

Traders in search of publicity to this business may see robust returns from these high 5 insurance coverage shares.

The next articles include shares with very lengthy dividend or company histories, ripe for choice for dividend development buyers.

Thanks for studying this text. Please ship any suggestions, corrections, or inquiries to [email protected].