Article up to date on December sixth, 2022 by Bob Ciura

Spreadsheet knowledge up to date each day

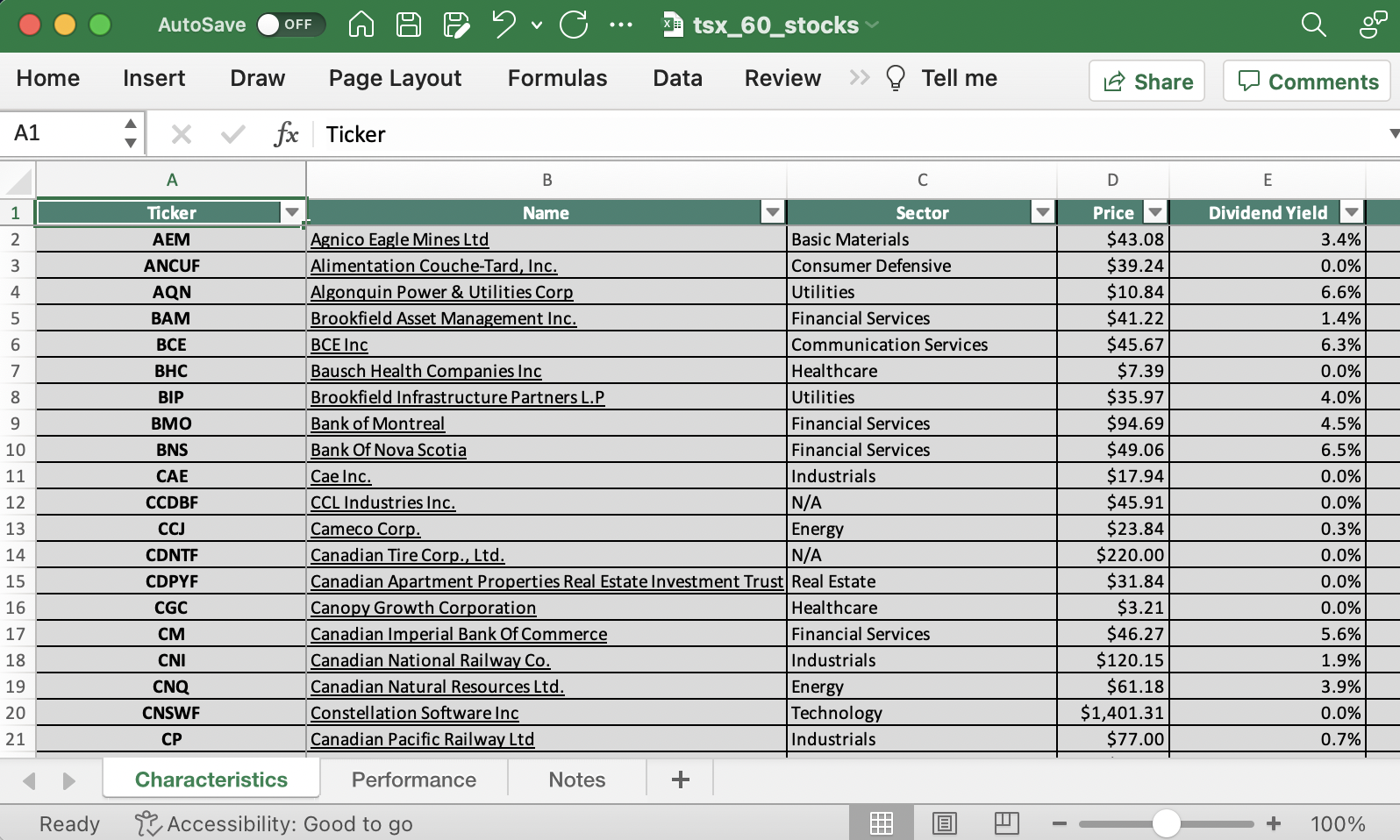

The TSX 60 Index is a inventory market index of the 60 largest firms that commerce on the Toronto Inventory Alternate.

As a result of the Canadian inventory market is closely weighted in the direction of massive monetary establishments and vitality firms, the TSX is an inexpensive benchmark for Canadian equities efficiency. Additionally it is an awesome place to search for funding concepts.

You possibly can obtain a database of the businesses inside the TSX 60 (together with related monetary metrics akin to dividend yields and price-to-earnings ratios) by clicking on the hyperlink beneath:

The TSX 60 Shares Record obtainable for obtain above incorporates the next info for each safety inside the index:

- Inventory Value

- Dividend Yield

- Market Capitalization

- Value-to-Earnings Ratio

All the monetary knowledge within the database are listed in Canadian {dollars}. Maintain studying this text to be taught extra about maximizing the facility of the TSX 60 Shares Record.

How To Use The TSX 60 Shares Record To Discover Funding Concepts

Having an Excel doc that incorporates the names, tickers, and monetary knowledge for each inventory inside the TSX 60 Index might be extraordinarily helpful.

This doc turns into much more highly effective when mixed with a basic data of find out how to use Microsoft Excel to implement rudimentary investing screens.

With that in thoughts, the next tutorial will present you find out how to implement a helpful investing display screen for the TSX 60 Shares Record.

Excel Spreadsheet Display screen Tutorial: TSX 60 Shares With P/Es < 20 and Dividend Yields > 2%

Step 1: Obtain the TSX 60 Shares Record by clicking right here.

Step 2: Set the spreadsheet’s columns to filter.

Step 3: Change the filter setting for P/E Ratio to seek out securities with P/E ratios between 0 and 20. This can display screen out destructive P/E’ ratio shares which might be a results of destructive earnings, in addition to shares with P/E ratios of 20 or extra.

Step 4: Change the filter setting for Dividend Yield to seek out securities with dividend yields higher than 2%.

The remaining shares on this spreadsheet are TSX 60 Index constituents with price-to-earnings ratios beneath 20 and dividend yields above 2%.

To conclude this text, we’ll share different Positive Dividend assets that you should use to reinforce the standard of your investing due diligence.

Remaining Ideas: Different Dividend Development Investing Sources

The TSX 60 Index incorporates the 60 largest firms that commerce on the Toronto Inventory Alternate. Due to its exclusivity, it doesn’t include all of the Canadian shares.

For traders concerned with attaining some Canadian publicity inside their funding portfolios, we really useful sifting via the broader S&P/TSX Composite Index.

As well as, we have now coated a number of completely different features of investing within the Canadian market within the articles beneath:

Alternatively, chances are you’ll search via these databases and decide that investing in worldwide shares is just not for you.

Positive Dividend has additionally created databases of home shares by sector, which we replace weekly. These sector-specific inventory market assets might be accessed beneath:

Our final group of inventory market databases incorporates securities that meet sure necessities relating to dividend payout schedules, dividend yields, company historical past, or authorized construction. Take into account this a catch-all for the Positive Dividend databases that don’t group properly with our different assets:

Thanks for studying this text. Please ship any suggestions, corrections, or inquiries to assist@suredividend.com.