Main inventory market indices in america closed blended on Tuesday, after the newest report on manufacturing unit orders within the nation confirmed a -2.1% m/m decline in July, the largest drop in 8 months however stronger than expectations of a -2.5% m/m decline.

Markets have been broadly weaker on Tuesday, as weaker-than-expected financial information from China and the Eurozone fuelled risk-off sentiment in asset markets. China’s providers sector skilled its slowest tempo of development this 12 months in August, and the August Eurozone S&P composite PMI was revised right down to its weakest degree in 2 years. As well as, increased world bond yields additionally weighed on shares.

The 10-year T-note yield rose to a 1-week excessive of 4.27% and settled at 4.26%. The ten-year Bund rose to a 1-week excessive of two.61% and settled at 2.61%. The 10-year UK gilt rose to a 1-week excessive of 4.53% and settled at 4.52%. With rising US yields and weaker financial knowledge from China and Europe, USD had one other sturdy session. The USDIndex on Tuesday rose +0.54% and recorded a 5-month excessive. Tuesday’s inventory weak point elevated liquidity demand for the US Greenback.

The USA30 fell -0.56% as Walgreens Boots Alliance Inc. slumped 2.99%. The USA500 fell -0.42%, with Penn Leisure Inc. plunging 6.70%. Then again, the USA100 rose 0.11% as Airbnb Inc. rocketed +7.23% and there was a +4.7% acquire in Tesla. Airbnb included its firm within the US500 Inventory Index earlier this month and Tesla rallied after its car deliveries to China in August elevated by greater than +30% m/m. The China Passenger Automotive Affiliation (CPCA) introduced the corporate’s electrical car (EV) gross sales within the nation noticed a month-to-month improve from 64,285 in July to 84,159 in August. In the meantime, knowledge analyst agency Kantar revealed an inventory of essentially the most priceless automotive manufacturers in 2023, topped by Tesla.

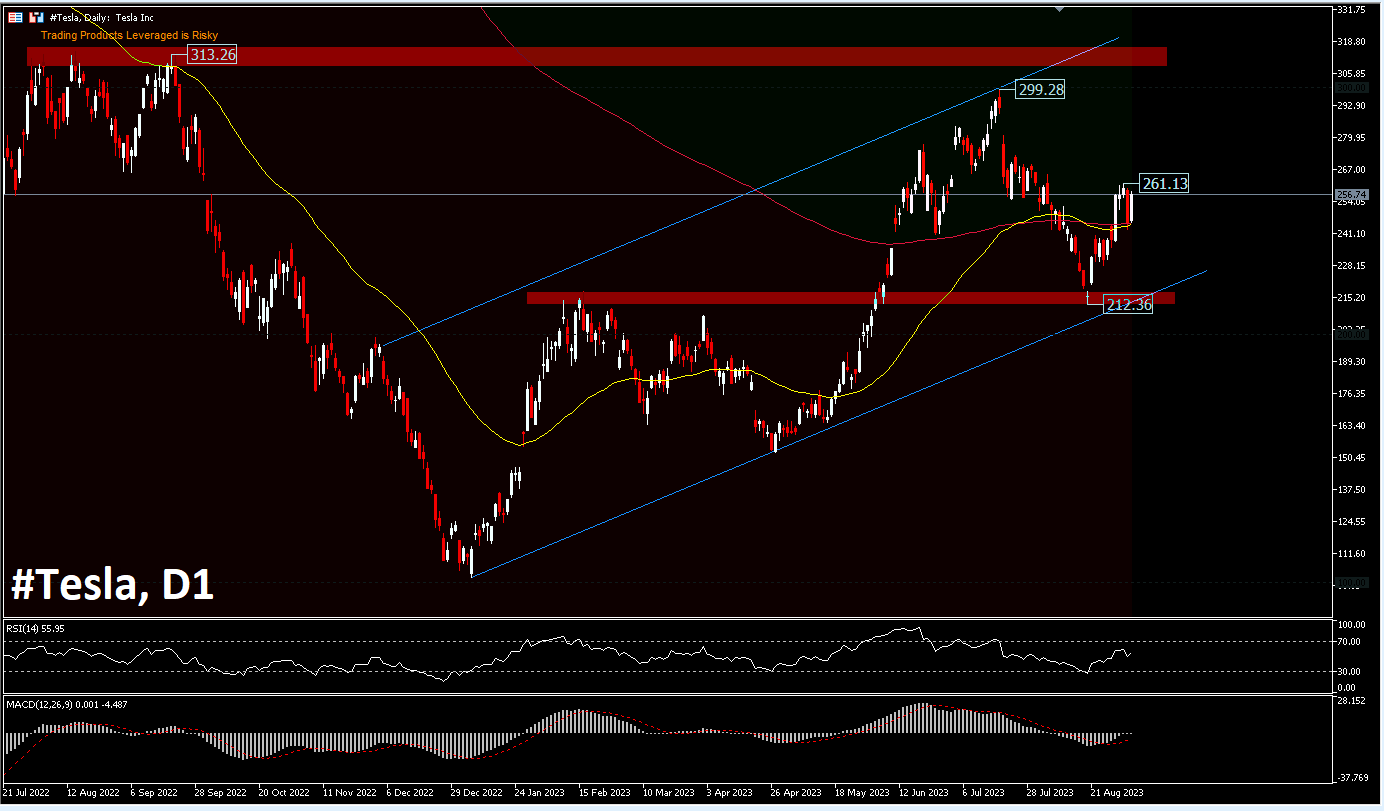

Shares of #Tesla bounced off the 52-day & 200-day exponential shifting averages with a 4.7% acquire to $256.74. Shares of #Tesla plunged -5.1% on Friday after Tesla launched Mannequin 3 upgrades in China but additionally lower costs of Mannequin S, Mannequin X and Full Self-Driving. Final week’s excessive was at $261.13, a break above this degree might transfer increased to check the $300.00 psychological worth. On the draw back, the low fashioned from the southern doji at $212.26 is a structural assist degree that buyers will take into consideration. RSI is above the growth line and MACD is thinning on the zero line.

Click on right here to entry our Financial Calendar

Ady Phangestu

Market Analyst – HF Instructional Workplace – Indonesia

Disclaimer: This materials is offered as a basic advertising and marketing communication for data functions solely and doesn’t represent an unbiased funding analysis. Nothing on this communication comprises, or must be thought-about as containing, an funding recommendation or an funding suggestion or a solicitation for the aim of shopping for or promoting of any monetary instrument. All data offered is gathered from respected sources and any data containing a sign of previous efficiency is just not a assure or dependable indicator of future efficiency. Customers acknowledge that any funding in Leveraged Merchandise is characterised by a sure diploma of uncertainty and that any funding of this nature entails a excessive degree of threat for which the customers are solely accountable and liable. We assume no legal responsibility for any loss arising from any funding made primarily based on the data offered on this communication. This communication should not be reproduced or additional distributed with out our prior written permission.