3alexd/iStock by way of Getty Pictures

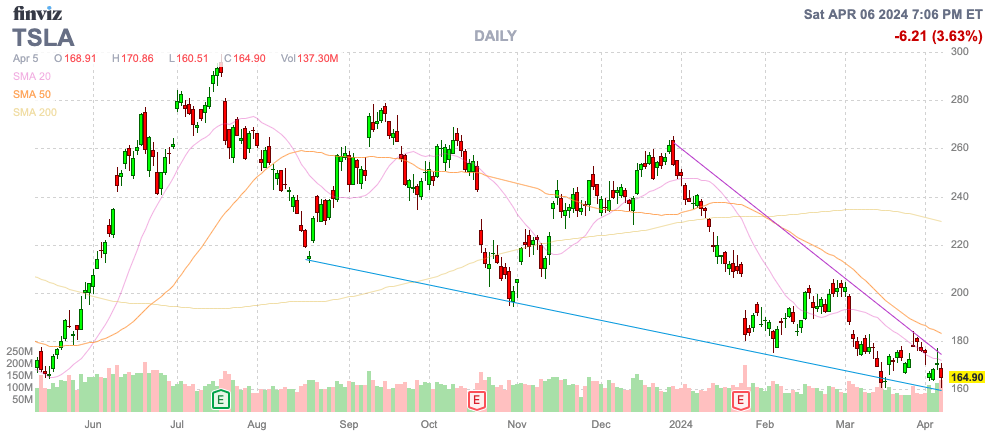

Tesla (NASDAQ:TSLA) has confronted a troublesome yr with slower EV demand within the U.S. and better competitors in China. The large hope for shareholders is that Elon Musk will fulfill the promise to show a fleet of Tesla’s into robotaxis permitting the corporate to earn giant charges. My funding thesis is mostly Bullish on the inventory, however the robotaxi catalyst might nonetheless be far-off.

Supply: Finviz

Robotaxi Launch

Elon Musk has promised Tesla would launch a robotaxi service going means again to 2016. The EV firm at the moment gives FSD (full-self driving) software program providing as much as a Degree 2 service, however a real robotaxi service would contain Degree 5 the place a driver would not exist and the automobile fully controls the driving capabilities.

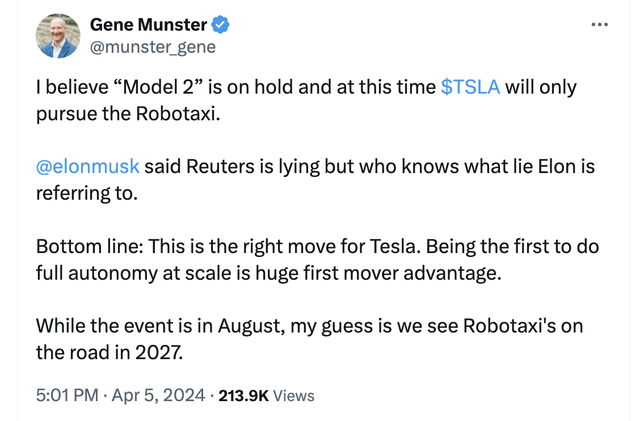

After a drama crammed day, Musk introduced on X that Tesla would unveil the robotaxi enterprise on August 8, or roughly 4 months from now. Although, the CEO did not truly listing the yr, however the assumption is clearly this yr.

Supply: Twitter/X

Tesla has already hosted a number of robotaxi occasions, so buyers in all probability should not get too enthusiastic about this information. Cruise Automation, owned by Normal Motors (GM) just lately shut down their robotaxi enterprise providing providers in a number of cities. The corporate had their license restricted in San Francisco after an accident brought on by a human driver and a pedestrian concerned the robotaxi service dragging a girl knocked into the Cruise automobile.

As Gene Munster from Deepwater Asset Administration discusses, even when Tesla has the know-how for a full Degree 5 robotaxi, the service is not prone to receive regulatory approval till 2027. The largest impediment might very properly be state approvals, not know-how.

Supply: Twitter/X

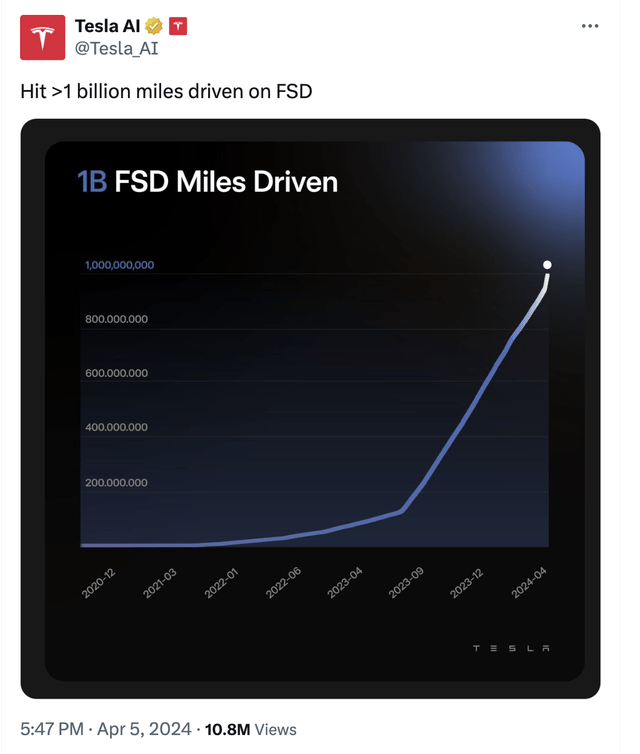

Whereas Tesla has lengthy mentioned full autonomy, the FSD service is barely Degree 2 as a result of necessities for driver supervision. The corporate introduced the FSD service has now pushed 1 billion miles with an enormous uptick within the final yr and a hockey stick transfer after just lately providing 1-month free trial.

Supply: Twitter/X

FSD prices $12/Okay or a customs can begin a subscription for $199/month and seems extremely over valued contemplating the service is barely Degree 2. The issue with these FSD miles is that regulators will not rely them as autonomous for testing functions as a result of drivers are supposed to maintain palms and eyes on the automobile.

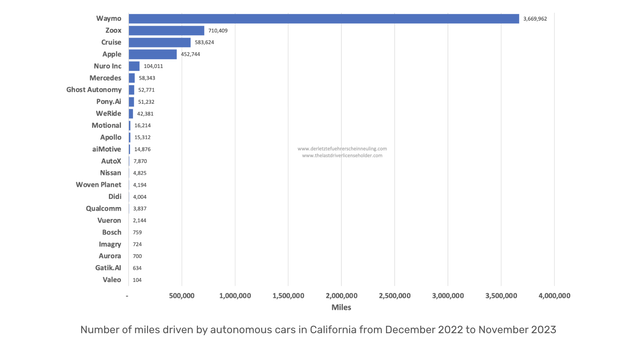

The FSD miles undoubtedly assist Tesla construct the platform and replace the service, however a robotaxi service would require regulatory approvals for a license to not have a driver within the automobile and every metropolis/state has their very own rules. In keeping with the California DMV, Tesla has 0 recorded check miles whereas Waymo had 3.7 million final yr.

Supply: The Final Driver License Holder

Huge Funding Projections

ARK Make investments (ARKK) purchased into the robotaxi idea and projected Tesla might have a $2,000 anticipated worth in 2027 based mostly on the launch of the service. The bottom line is taking the EV firm from an EV producer to an autonomous service supplier.

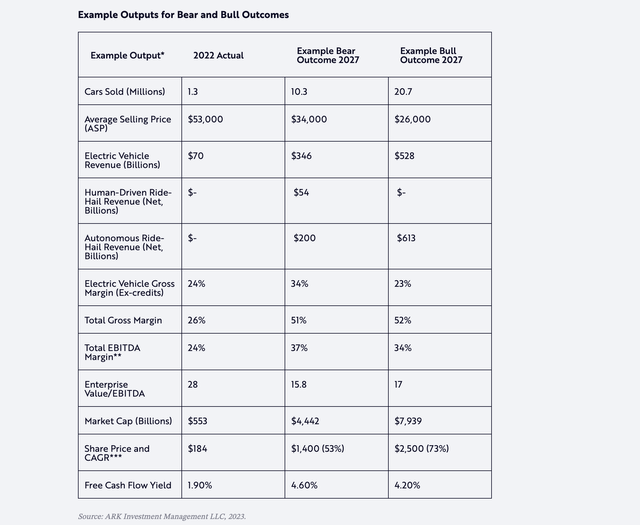

Tesla was projected to half the automobile ASP to solely $26,000 whereas dramatically boosting the models bought from just one.3 million in 2022 to twenty.7 million in 2027. EV revenues would nonetheless surge from $70 billion to $528 billion in the course of the interval, however the firm would greater than double revenues with a robotaxi enterprise producing $613 billion in revenues alone.

Supply: ARK Make investments

The mannequin steered Tesla had a 63% likelihood of beginning robotaxi service in 2024 or 2025. ARK Make investments gave little or no odds to the service beginning after 2025.

The entire worth is derived from turning a fleet of cheaper automobiles estimated to value $25K to fabricate into cash incomes robotaxis. Lots of the market drama on Friday was whether or not Tesla nonetheless plans to supply the Mannequin 2.

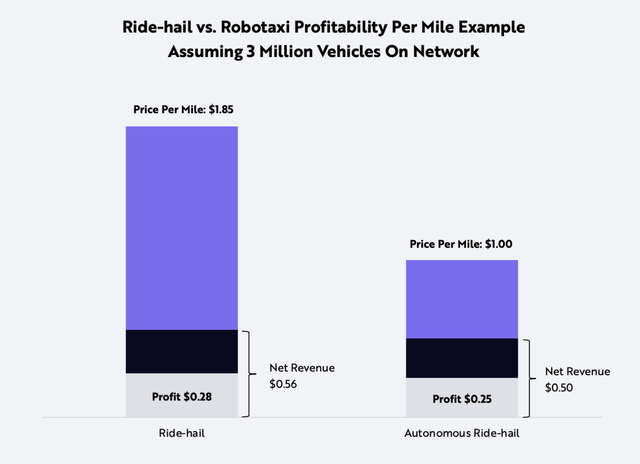

The pre-Covid fashions had objectives of Tesla lowering the journey prices from ride-hail providers like Uber (UBER) by 50% to ~$1 per mile. The quantity of journeys would improve with the decrease value and lowered have to personal a automobile with robotaxis.

Supply: ARK Make investments

A giant a part of the prices of ride-hailing providers is the motive force. A holy grail of the sector is eradicating this value from the construction whereas Tesla has truly projected the power to supply a automobile with further AV know-how at a really low value whereas numerous fears have been the automobile value would skyrocket.

Beneath Ark Make investments’s mannequin, Tesla would generate ~$0.50 in income per mile and generate a revenue of $0.25. Lots of the monetary particulars must be labored out based mostly on the timing of the service and the power of the EV firm to supply the low costing EVs with robotaxi service able to working as much as 90K miles a yr and 1 million lifetime miles. As well as, huge questions encompass whether or not Tesla remains to be targeted on promoting the automobiles to asset homeowners that be a part of the robotaxi service. Tesla would acquire revenues from purchases of the FSD service at $12K now and share within the platform revenues presumably 50/50 based mostly on the above mannequin.

If something, ride-hailing prices have solely risen within the final 4 years. In keeping with a AAA research, ride-hailing providers prices $2+ per mile in main cities whereas proudly owning a automobile solely prices round $1 per mile.

Traders ought to undoubtedly tune into the robotaxi unveiling occasion on August 8 with open ears. The inventory is intriguing having fallen practically 60% from the highs from over 2 years in the past. Musk at all times has one thing within the works that might add worth to Tesla and his decided management might assist push previous a few of the rules that hit Cruise’s service.

With the slowdown within the EV market, the inventory is not precisely low cost now at 40x 2025 EPS targets of $4 and over 4x gross sales targets. Robotaxis are undoubtedly the holy grail for the auto sector and Musk appears extra decided than others making Tesla interesting from this angle, although the enterprise is not prone to launch anytime quickly.

Takeaway

The important thing investor takeaway is that buyers do not normally fare properly investing towards Elon Musk. Tesla launching a robotaxi service might present the following huge leg up for the inventory with ARK Make investments projecting upside to $2,000 from the present value of solely $165, over an 1,100% achieve. The issue is that Musk has lengthy promised full-self driving providers and Tesla has but to ship something shut. To not point out, the EV firm seems to have carried out nothing to permit regulators to license a robotaxi service in any state.

The inventory is intriguing on the large dip right here, however buyers want to know the complete launch of the robotaxi service is very unlikely for a number of extra years. Purchase Tesla, however do not buy the inventory for AVs.