metamorworks

Abstract

Telia Firm AB (OTCPK:TLSNF) gives telecommunication companies. The Firm gives cell communications companies in addition to operates fastened networks all through Eurasia. I’m recommending a maintain ranking as I see the inventory pretty valued on the present valuation, and there may be a threat that turnaround efforts won’t succeed.

Financials / Valuation

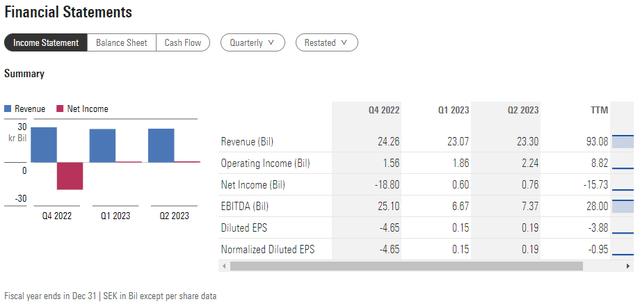

Morningstar

With web gross sales of SEK23.3 billion in 2Q23, TLSNF was barely forward of consensus. Natural income development amounted to 2.2%. Whereas one-off objects decreased reported EBITDA by 1.8% to SEK7.37billion, adjusting for these revealed underlying EBITDA of SEK7.77billion. General, Service income appeared wholesome at SEK19.91 billion, whereas TV & Media income was low because of declining promoting.

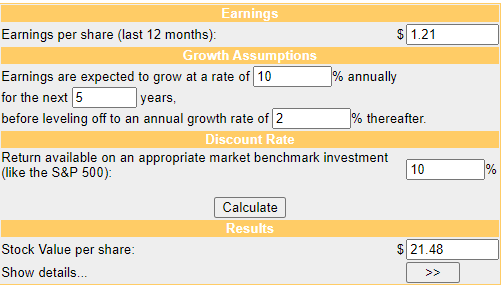

Based mostly on my view of the enterprise, if TLSNF can efficiently restructure and develop as per historic pattern, it ought to be capable of develop topline within the low single digits, which mixed with some margin growth might result in EPS development within the 10% vary (much like the consensus estimate). I assumed a ten% low cost price, which is increased than the S&P earnings yield, as I see some threat within the restructuring efforts. My DCF mannequin suggests a worth goal of SEK 21.48, implying the inventory is kind of pretty valued.

Moneychimp

Feedback

Q2 revenues have been down 14% year-over-year because the promoting setting in 1H23 continued to deteriorate. Nevertheless, increased paytv costs contributed to a development in Pay TV income. Given my perception that the promoting market will keep powerful all year long, except the macro financial system improves, I count on this phase to proceed to be sluggish. Even when the financial system reveals indications of enchancment, it could be a while earlier than corporations are keen to spend a lot on promoting once more. Nevertheless, pricing within the TV sector ought to assist mitigate the destructive affect of the promoting downturn, so I anticipate that top-line outcomes can be much less unaffected.

The issue comes on the EBITDA line the place I count on prices to stay excessive this 12 months, particularly as regards to labour. Consequently, TLSNF is slicing 10-20% of its workforce and trying to cut back content material prices as a part of a large restructure of the enterprise. Administration additionally made it plain that they don’t seem to be taken with doubling down in TV media right now. Whereas that is encouraging information as a result of it reveals that Telia’s administration is targeted on sustaining a wholesome revenue margin, the chance that Telia might lose these rights raises doubts in regards to the firm’s future development. For my part, TLSNF ought to submit a proposal that’s considerably decrease than what they’re at present paying.

Provided that the restructuring efforts are nonetheless ongoing, I count on to see the complete affect in 2024, particularly as FY24 can have a straightforward FY23 comp. Particularly, administration goals for EBITDA and money stream to be above SEK1 billion in 2025.

For FY23, administration expects a money stream acceleration within the second half, per their steerage. Compared to the low finish of the really helpful SEK 7-9 billion, the structural aspect of the operational money stream was simply SEK 1.4bn in 1H23. Assuming the steerage’s midpoint (SEK 8 billion), TLSNF might want to generate SEK 6.6 billion in money stream in 2H23, indicating a big improve over 1H23. Given the elevated probability of TLSNF lacking steerage, I count on some traders to change into extra threat averse consequently. On the decision, although, administration expressed optimism about assembly the goal. Administration anticipates a rise in EBITDA because of growth in Sweden and reducing vitality prices. H2 CAPEX may even be a lot decrease in comparison with the identical time final 12 months, and significantly in This autumn. I stay cautiously optimistic on this steerage and can keep on the side-lines for now.

Threat & Conclusion

The principle threat I see for TLSNF is the failure of its turnaround initiatives. For the reason that anticipated earnings development is closely depending on the success of this, any mis-execution in turnaround efforts would damage the creditability of administration, resulting in traders shunning the inventory, which is able to strain the inventory worth. In conclusion, I like to recommend a maintain ranking for TLSNF till its turnaround efforts present extra optimistic traction. Whereas the inventory seems to be pretty valued on the present worth, the success of its restructuring initiatives is vital for future earnings development. Q2 revenues have been impacted by a troublesome promoting setting, however the firm’s concentrate on cost-cutting and margin upkeep is encouraging. Nevertheless, the chance of mis-execution within the turnaround plan might result in investor skepticism and inventory worth strain. Till there may be extra proof of profitable progress, it is prudent to stay cautious and look ahead to additional developments earlier than making any funding selections.

Editor’s Notice: This text discusses a number of securities that don’t commerce on a serious U.S. trade. Please pay attention to the dangers related to these shares.