Denis Shevchuk/iStock by way of Getty Photographs

Funding Thesis

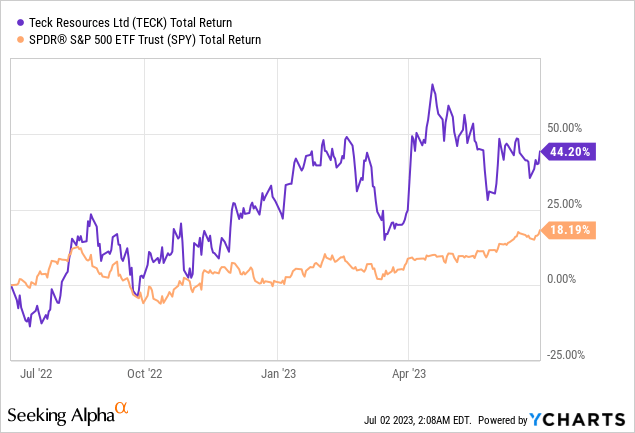

Teck Sources (NYSE:TECK) is up over 40% previously yr, vastly outperforming different commodities corporations and the S&P 500 Index (SPY), regardless of going through easing inflation and a slowing world financial system.

The corporate has invaluable property and a powerful pipeline that’s well-positioned to learn from the rising demand for copper, because the adoption of fresh vitality applied sciences proceed to extend. After the spin-off of its coal section, the corporate may even turn out to be a pure copper and zinc firm, which presents large potential for valuation re-rating.

Why Teck Sources?

Teck Sources is a number one Canadian mining firm that makes a speciality of copper, zinc, and steelmaking coal. The Vancouver-based firm at present owns 4 main working property positioned throughout the US, Chile, Peru, and Canada. QB2, its flagship copper mine in Northern Chile, lastly began manufacturing this yr and is ready to double the corporate’s copper manufacturing from 320 kt (kiloton) in 2022 to 640 kt in 2024. The ramping manufacturing in QB2 ought to be an enormous development driver for manufacturing within the close to and medium time period.

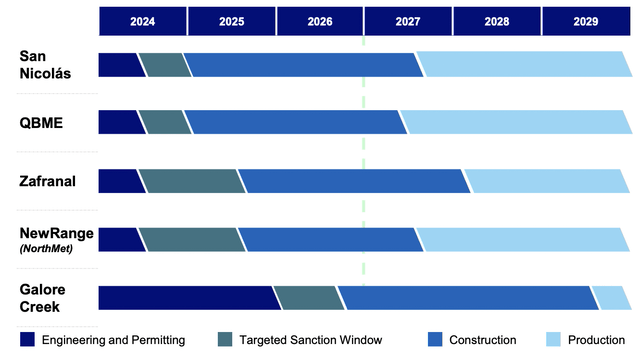

Teck Sources has a considerable aggressive benefit in copper manufacturing on account of its robust mission pipeline. The corporate acknowledged the alternatives in copper nearly a decade in the past and began its investments early. Moreover the lately commenced QB2, it at present has 5 different initiatives within the pipeline with 3 of them estimated to start manufacturing in 2027, as proven within the chart beneath. These initiatives when all commenced will additional improve the corporate’s annual manufacturing by round 590 kt.

It is going to be exhausting for different corporations to catch up within the brief time period even when they ramp up their CAPEX, as copper has one of many longest mission lead instances. As an illustration, main copper mines take round 16 years on common to develop from discovery to first manufacturing (lithium takes solely 5 to six years). The development planning and building phases alone price round 4 to five years. That is the explanation why opponents at the moment are making an attempt to extend their presence by way of acquisitions slightly than natural investments.

Teck Sources

Favorable Tailwinds

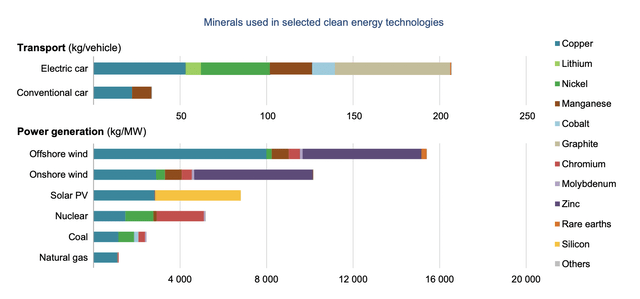

Copper and zinc current large development alternatives as the continuing vitality transition is driving up the demand for essential minerals. As you may see within the chart beneath by the IEA (Worldwide Power Company), most clear vitality applied sciences require a big quantity of minerals, particularly copper. Within the transport section, every EV (electrical automobile) makes use of round 53kg of copper, 140% greater in comparison with simply 22kg from typical automobiles.

The identical is seen within the energy technology section. Wind technology makes use of numerous zinc and copper, whereas photo voltaic PV (photovoltaic) makes use of numerous copper. In accordance with IEA, the 2 applied sciences are anticipated to turn out to be the most important vitality technology sources inside renewables, accounting for 67% mixed. The quickly rising adoption and recognition of fresh vitality applied sciences ought to be a powerful long-term tailwind for Teck Sources shifting ahead.

IEA

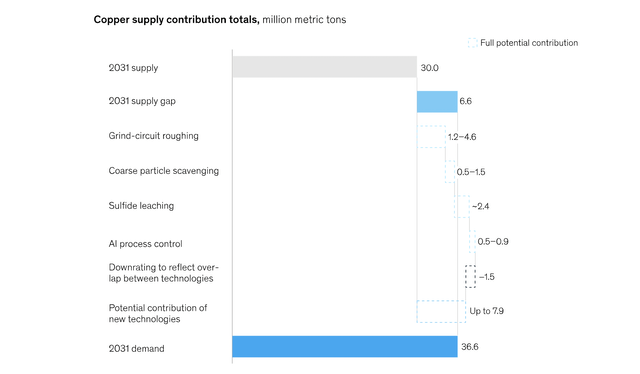

Moreover, the constraint on copper provide on account of lengthy lead instances also needs to be one other significant tailwind for the corporate. As talked about above, many mining corporations are under-invested in copper manufacturing previously decade and it is going to be exhausting for them to develop manufacturing in a brief time period.

Copper manufacturing will seemingly proceed to rise amid beforehand commenced initiatives however the tempo of improve is just too gradual, because the IEA estimates demand will outpace provide by 2025 or 2026. The identical outlook is famous by McKinsey, because the analysis agency forecasts a provide hole of 6.6 million tons (20% of provide) in 2031, as proven within the chart beneath. I imagine the widening mismatch between provide and demand will proceed to drive the value of copper.

McKinsey

Separation Of Coal Phase

Teck Sources can also be planning to spin off its steelmaking coal section into Elk Valley Sources, a standalone coal producer. It could even be separated by way of acquisition, with potential patrons equivalent to Glencore (OTCPK:GLNCY) valuing it at $8.2 billion. Both means, a profitable spin-off ought to considerably improve the corporate’s worth, because it turns into a pure play for copper and zinc. Moreover the massive proceeds, that is key to valuation because the multiples for pure-play corporations are usually a lot greater than the diversified ones.

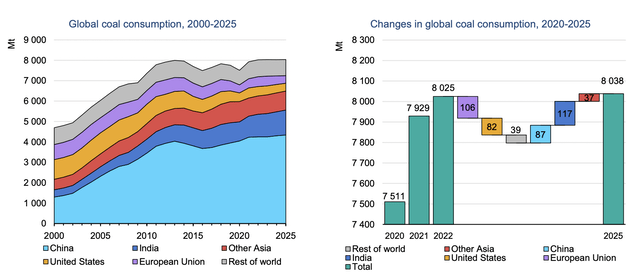

The standalone coal firm also needs to get stable bids as coal is displaying nice resilience. Because of the Europe vitality disaster, world coal consumption really reached a brand new excessive final yr, surpassing 8 billion tonnes. Regardless of the rising adoption of inexperienced vitality, its consumption is anticipated to carry up effectively at round 8 billion tonnes yearly from now until 2025, as proven within the chart beneath. Whereas consumption in Europe and the US is ready to say no, Asia international locations equivalent to India and China will seemingly offset the drop, as consumption continues to extend amid rising electrical energy wants.

IEA

Compelling Valuation

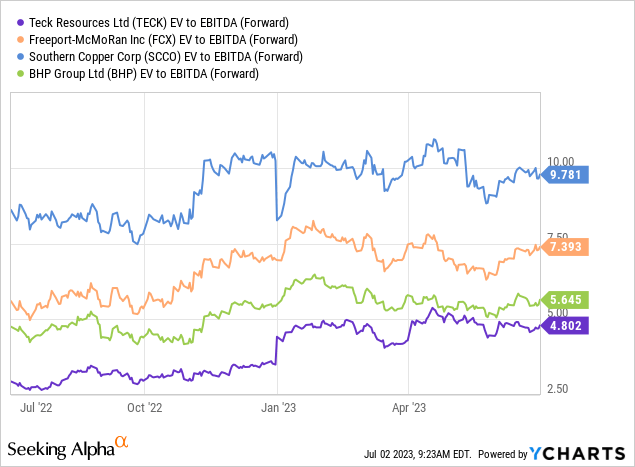

Regardless of the massive improve in share worth, Teck Sources’ valuation stays extraordinarily compelling in my view, particularly when contemplating the re-rating potential. The corporate is at present buying and selling at an fwd EV/EBITDA of 4.8x, which could be very low-cost in comparison with friends, as proven within the chart beneath. As an illustration, it’s buying and selling at a 14% low cost in comparison with different diversified mining corporations equivalent to BHP Group (BHP), which has an fwd EV/EBITDA of 5.6x.

Extra importantly, it’s at present priced at a considerable low cost of 44% in comparison with pure copper corporations together with Freeport-McMoRan (FCX) and Southern Copper (SCCO), which has a median fwd EV/EBITDA of 8.6x. Teck Sources ought to have vital upside potential because it transitions right into a pure-play.

Dangers

A notable threat concerning Teck Sources is the stunning slowdown in China’s financial system, because the momentum from the nation’s reopening wanes. As an illustration, its industrial manufacturing in Might was solely up 3.5% YoY (yr over yr), down meaningfully in comparison with the 5.6% reported in April. Its manufacturing manufacturing additionally decelerated from 6.5% in April to simply 4.1% in Might. China’s softening financial system could impression the general demand for copper within the close to time period because the nation accounted for round 55% of copper consumption in 2022, in keeping with Statista.

Buyers Takeaway

Teck Sources is without doubt one of the best-positioned commodity corporations for the approaching decade. The corporate has a deep mission pipeline that provides them a big benefit in opposition to different corporations. The accelerating pattern of inexperienced vitality transition can also be an enormous tailwind that can proceed to drive the demand for copper. Contemplating the favorable backdrop and the upcoming transition to a pure-play, the present valuation appears vastly discounted. I imagine the corporate ought to have ample upside in the long term and I charge it as a purchase.